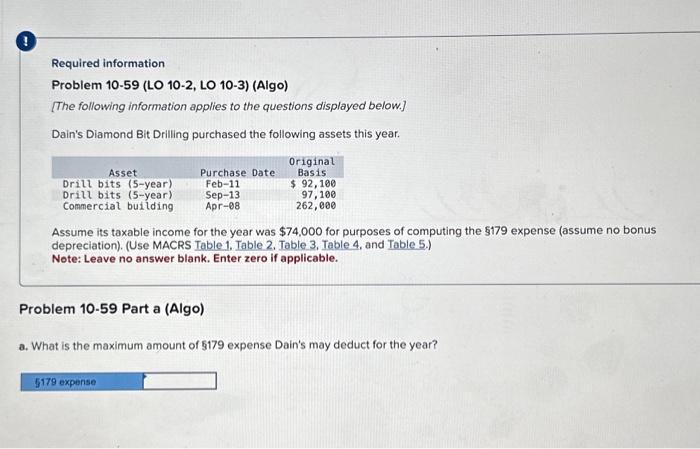

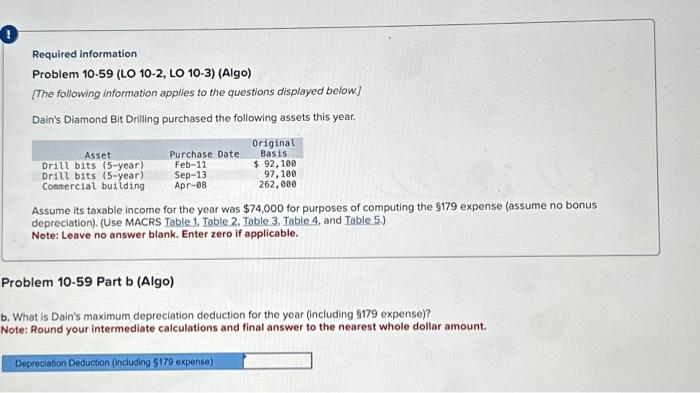

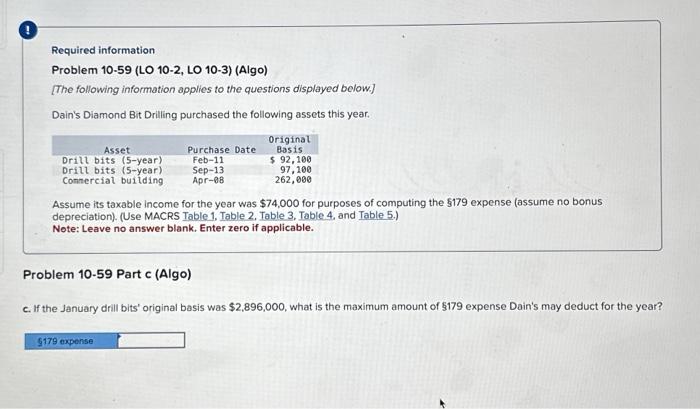

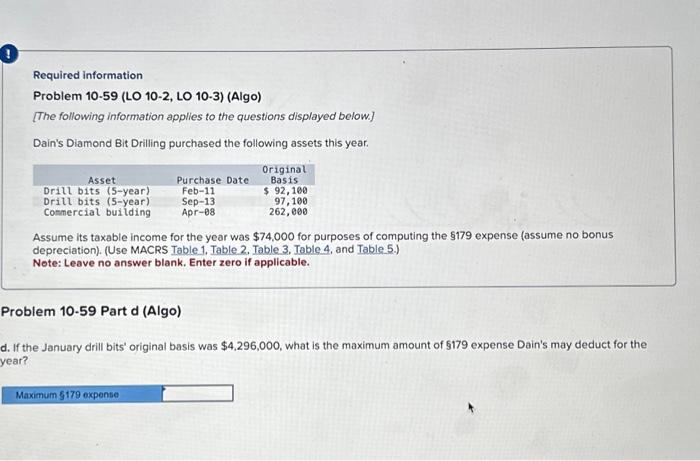

Required information Problem 10-59 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] Dain's Dlamond Bit Drilling purchased the following assets this year. Assume its taxable income for the year was $74,000 for purposes of computing the $179 expense (assume no bonus depreciation). (Use MACRS Table 1, Table 2. Table 3, Table 4, and Table 5.) Note: Leave no answer blank. Enter zero if applicable. Problem 10-59 Part a (Algo) a. What is the maximum amount of 5179 expense Dain's may deduct for the year? Required information Problem 10-59 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] Dain's Diamond Bit Drilling purchased the following assets this year. Assume its taxable income for the year was $74,000 for purposes of computing the $179 expense (assume no bonus depreciation). (Use MACRS Table 1, Table 2, Table 3, Table 4, and Table 5.) Note: Leave no answer blank. Enter zero if applicable. Problem 10-59 Part b (Algo) b. What is Dain's maximum depreciation deduction for the year (including 5179 expense)? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Required information Problem 10-59 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below] Dain's Diamond Bit Drilling purchased the following assets this year. Assume its taxable income for the year was $74,000 for purposes of computing the $179 expense (assume no bonus depreciation). (Use MACRS Table 1, Table 2. Table 3, Table 4, and Table 5.) Note: Leave no answer blank. Enter zero if applicable. roblem 10-59 Part c (Algo) If the January drill bits' original basis was $2,896,000, what is the maximum amount of $179 expense Dain's may deduct for the year? Required information Problem 10-59 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below] Dain's Diamond Bit Drilling purchased the following assets this year. Assume its taxable income for the year was $74,000 for purposes of computing the $179 expense (assume no bonus depreciation). (Use MACRS Table 1. Table 2. Table 3. Table 4, and Table 5.) Note: Leave no answer blank. Enter zero if applicable. oblem 10-59 Part d (Algo) If the January drill bits' original basis was $4,296,000, what is the maximum amount of $179 expense Dain's may deduct for the