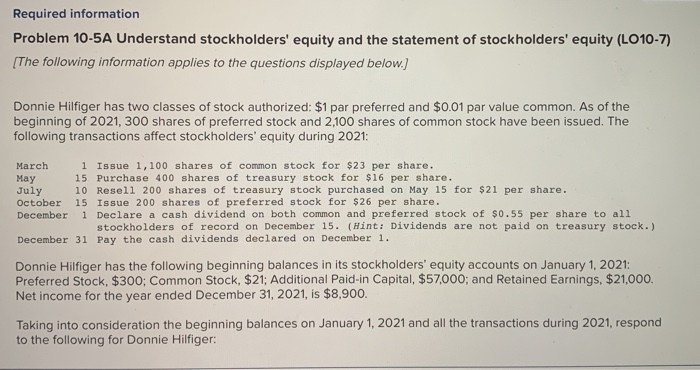

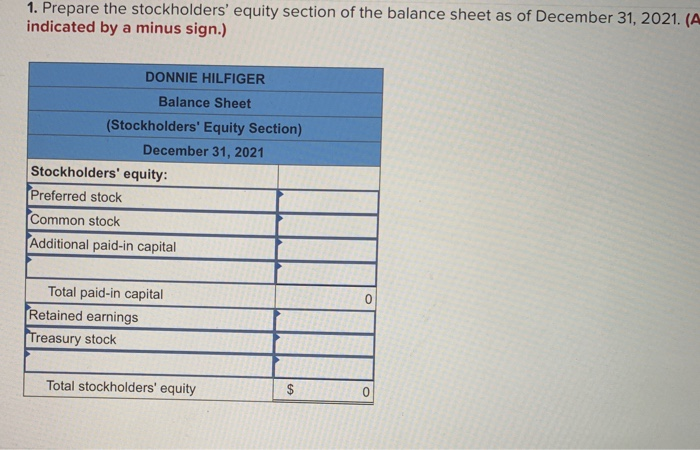

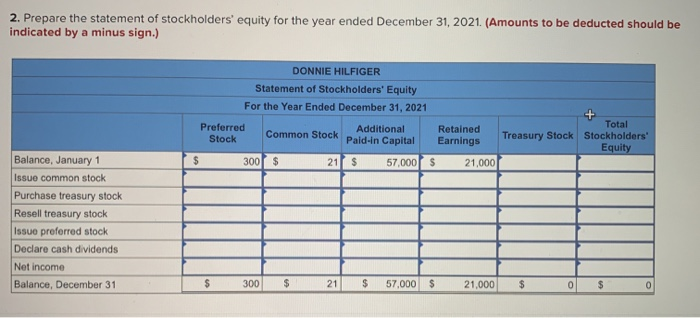

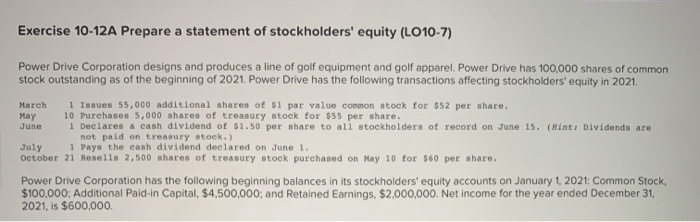

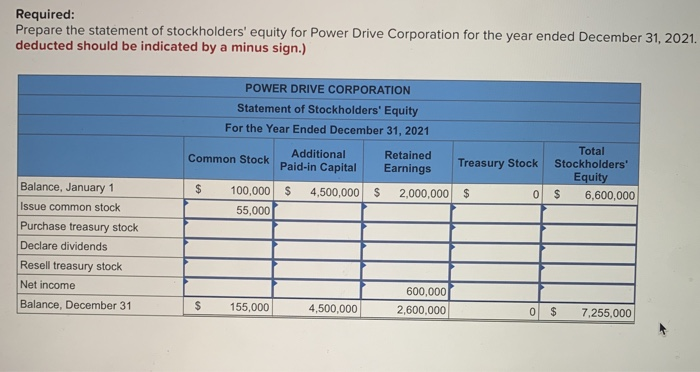

Required information Problem 10-5A Understand stockholders' equity and the statement of stockholders' equity (LO10-7) [The following information applies to the questions displayed below.) Donnie Hilfiger has two classes of stock authorized: $1 par preferred and $0.01 par value common. As of the beginning of 2021, 300 shares of preferred stock and 2,100 shares of common stock have been issued. The following transactions affect stockholders' equity during 2021: March 1 Issue 1,100 shares of common stock for $23 per share. May 15 Purchase 400 shares of treasury stock for $16 per share. July 10 Resell 200 shares of treasury stock purchased on May 15 for $21 per share. October 15 Issue 200 shares of preferred stock for $26 per share. December 1 Declare a cash dividend on both common and preferred stock of $0.55 per share to all stockholders of record on December 15. (Hint: Dividends are not paid on treasury stock.) December 31 Pay the cash dividends declared on December 1. Donnie Hilfiger has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Preferred Stock, $300; Common Stock, $21; Additional Paid-in Capital, $57,000; and Retained Earnings, $21,000. Net income for the year ended December 31, 2021, is $8,900. Taking into consideration the beginning balances on January 1, 2021 and all the transactions during 2021, respond to the following for Donnie Hilfiger: 1. Prepare the stockholders' equity section of the balance sheet as of December 31, 2021. (A indicated by a minus sign.) DONNIE HILFIGER Balance Sheet (Stockholders' Equity Section) December 31, 2021 Stockholders' equity: Preferred stock Common stock Additional paid-in capital Total paid-in capital Retained earnings Treasury stock Total stockholders' equity $ 2. Prepare the statement of stockholders' equity for the year ended December 31, 2021. (Amounts to be deducted should be indicated by a minus sign.) DONNIE HILFIGER Statement of Stockholders' Equity For the Year Ended December 31, 2021 Preferred Additional Retained Stock Common Stock Pald-in Capital Earnings 300 $ 21 $ 57,000 $ 21,000 Treasury Stock Total Stockholders' Equity Balance, January 1 Issue common stock Purchase treasury stock Resell treasury stock Issue preferred stock Declare cash dividends Net income Balance, December 31 300 $ $ 57.000 21,000 $ 0 $ Exercise 10-12A Prepare a statement of stockholders' equity (LO10-7) Power Drive Corporation designs and produces a line of golf equipment and golf apparel. Power Drive has 100,000 shares of common stock outstanding as of the beginning of 2021. Power Drive has the following transactions affecting stockholders' equity in 2021. March 1 Issues 55,000 additional shares of $1 par value common stock for $52 per share. May 10 Purchases 5,000 shares of treasury stock for $55 per share. June Declares a cash dividend of $1.50 per share to all stockholders of record on June 15. (Hint: Dividends are not paid on treasury stock.) July 1 Pays the cash dividend declared on June 1. October 21 Resells 2,500 shares of treasury stock purchased on May 10 for $60 per share. Power Drive Corporation has the following beginning balances in its stockholders' equity accounts on January 1, 2021: Common Stock $100,000; Additional Paid-in Capital, $4,500,000; and Retained Earnings. $2,000,000. Net Income for the year ended December 31. 2021, is $600,000 Required: Prepare the statement of stockholders' equity for Power Drive Corporation for the year ended December 31, 2021. deducted should be indicated by a minus sign.) POWER DRIVE CORPORATION Statement of Stockholders' Equity For the Year Ended December 31, 2021 Additional Common Stock Paid-in Capital Retained Earnings Treasury Stock Total Stockholders' Equity $ 6,600,000 $ $ 4,500,000 $ 2,000,000 $ 0 100,000 55,000 Balance, January 1 Issue common stock Purchase treasury stock Declare dividends Resell treasury stock Net income Balance, December 31 600,000 2,600,000 $ 155,000 4,500,000 0 $ 7,255,000