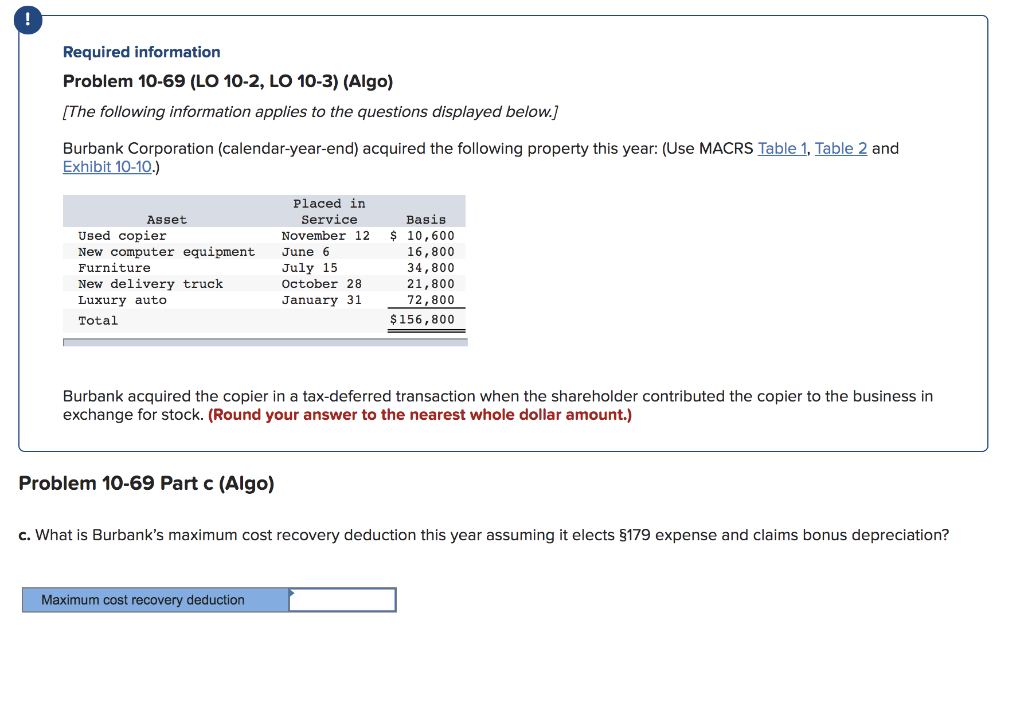

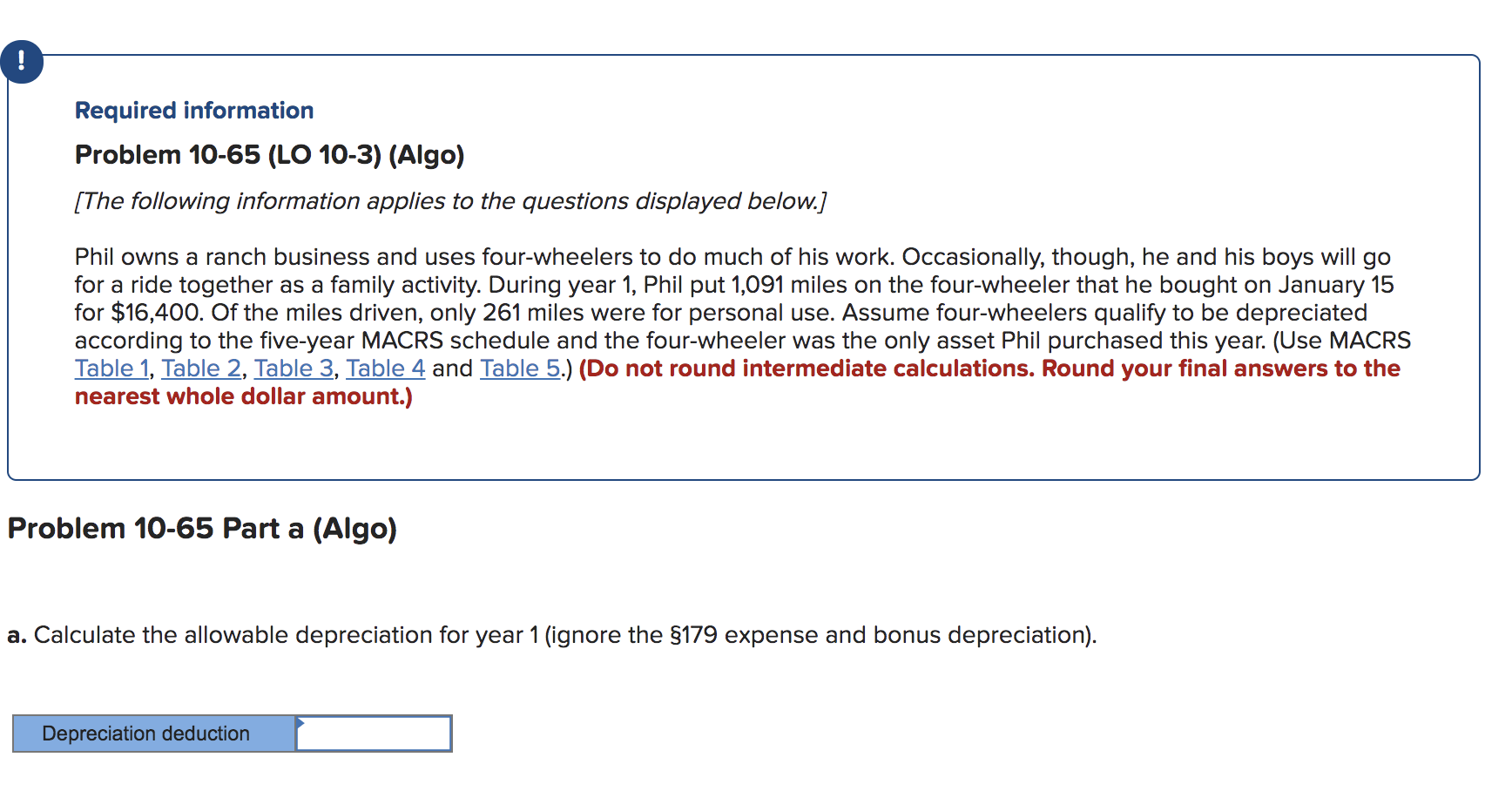

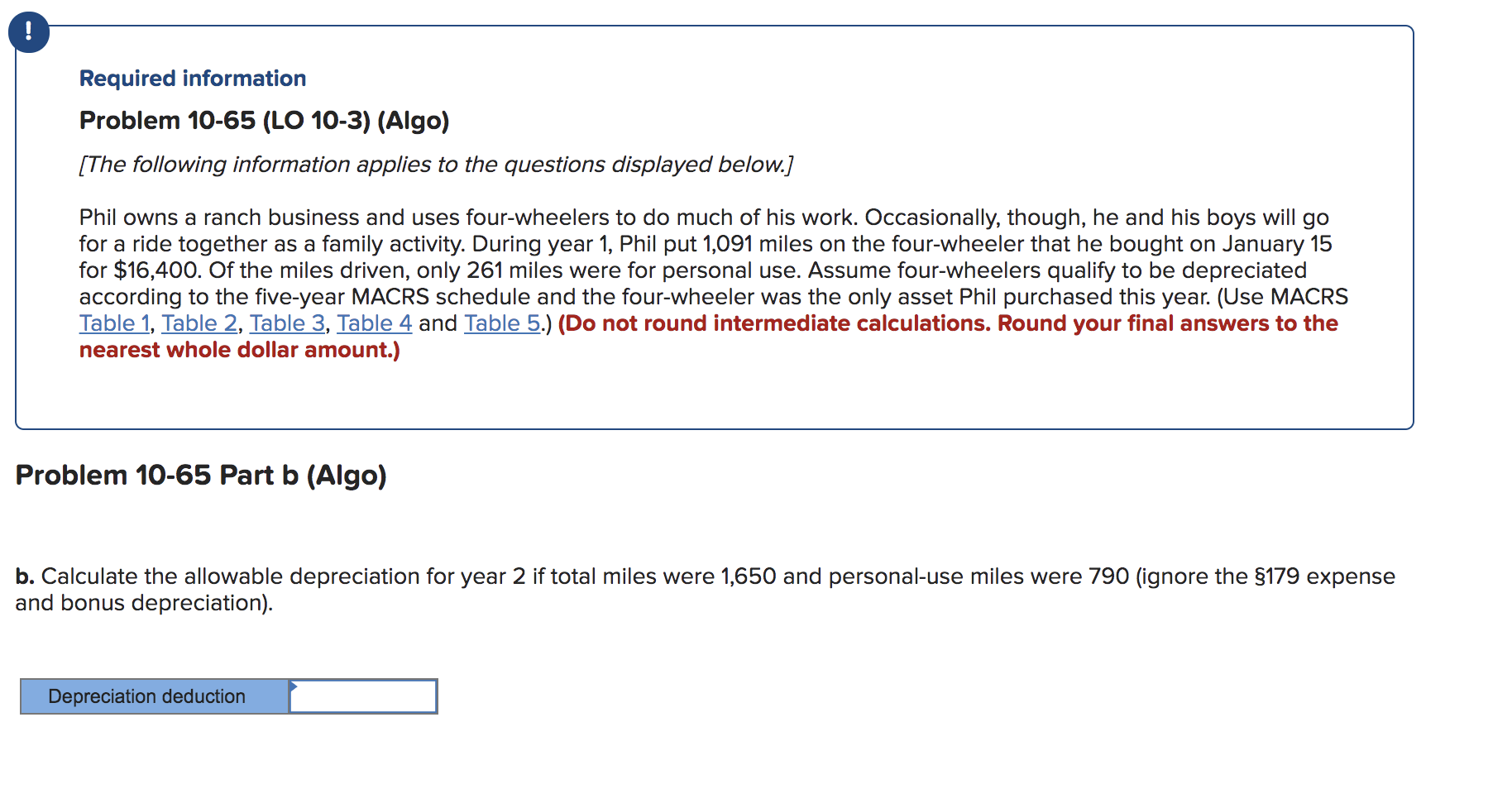

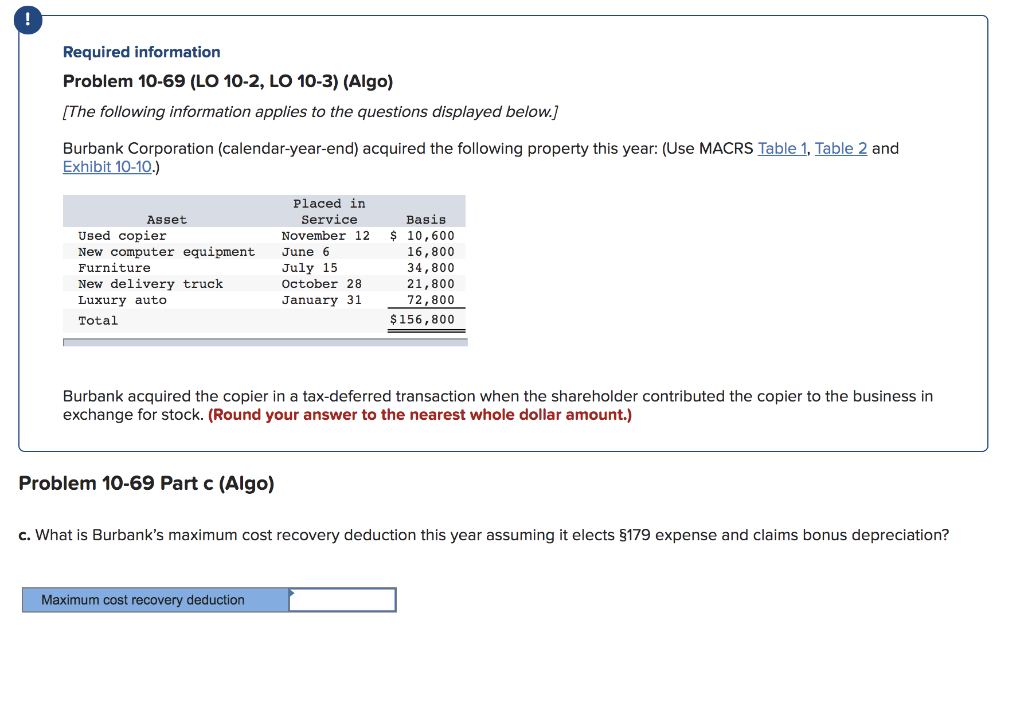

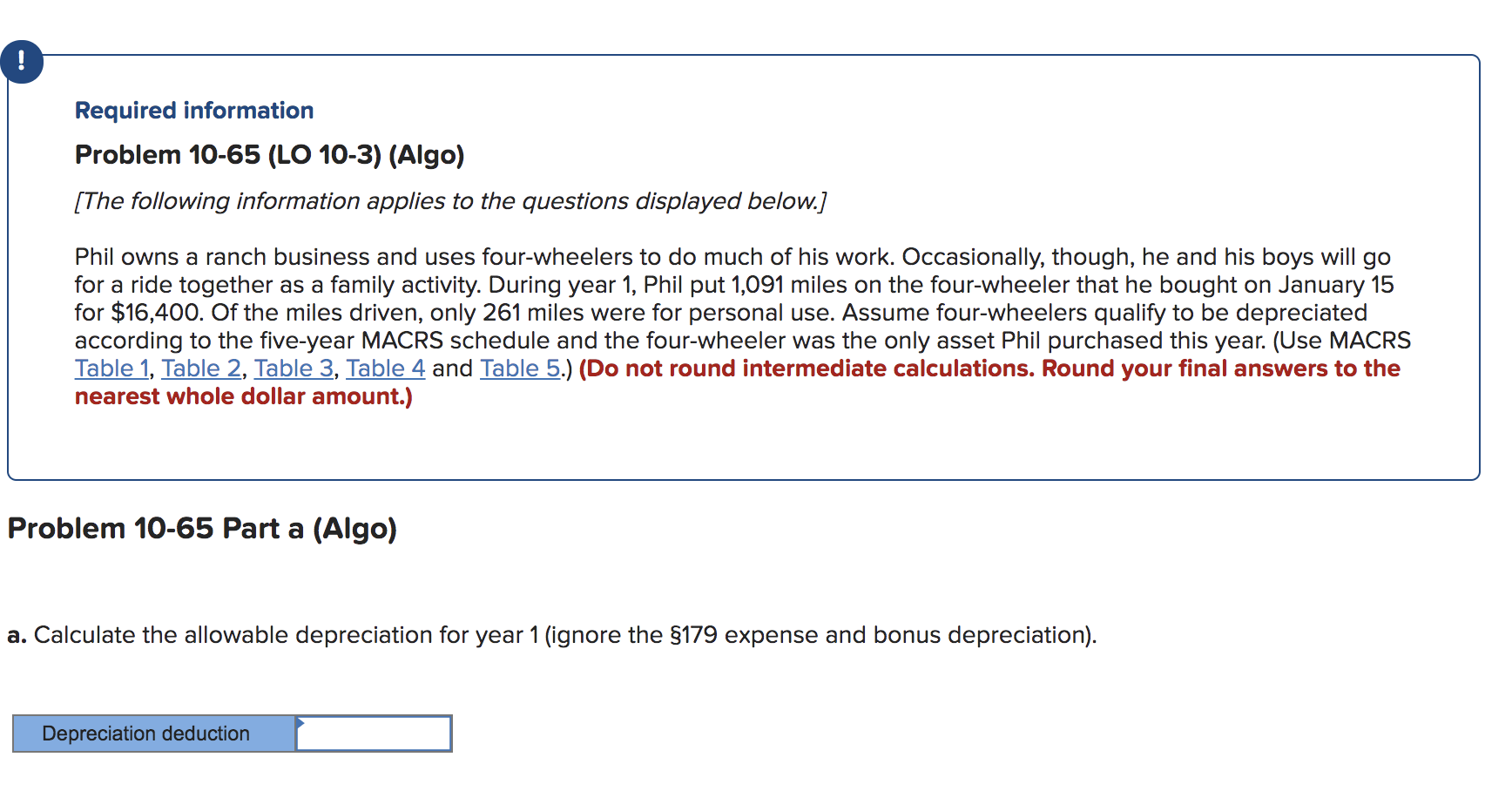

! Required information Problem 10-69 (LO 10-2, LO 10-3) (Algo) [The following information applies to the questions displayed below.] Burbank Corporation (calendar-year-end) acquired the following property this year: (Use MACRS Table 1, Table 2 and Exhibit 10-10.) Asset Used copier New computer equipment Furniture New delivery truck Luxury auto Total Placed in Service November 12 June 6 July 15 October 28 January 31 Basis $ 10,600 16,800 34,800 21,800 72,800 $ 156,800 Burbank acquired the copier in a tax-deferred transaction when the shareholder contributed the copier to the business in exchange for stock. (Round your answer to the nearest whole dollar amount.) Problem 10-69 Part c (Algo) c. What is Burbank's maximum cost recovery deduction this year assuming it elects $179 expense and claims bonus depreciation? Maximum cost recovery deduction Required information Problem 10-65 (LO 10-3) (Algo) [The following information applies to the questions displayed below.] Phil owns a ranch business and uses four-wheelers to do much of his work. Occasionally, though, he and his boys will go for a ride together as a family activity. During year 1, Phil put 1,091 miles on the four-wheeler that he bought on January 15 for $16,400. Of the miles driven, only 261 miles were for personal use. Assume four-wheelers qualify to be depreciated according to the five-year MACRS schedule and the four-wheeler was the only asset Phil purchased this year. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Problem 10-65 Part a (Algo) a. Calculate the allowable depreciation for year 1 (ignore the $179 expense and bonus depreciation). Depreciation deduction Required information Problem 10-65 (LO 10-3) (Algo) [The following information applies to the questions displayed below.] Phil owns a ranch business and uses four-wheelers to do much of his work. Occasionally, though, he and his boys will go for a ride together as a family activity. During year 1, Phil put 1,091 miles on the four-wheeler that he bought on January 15 for $16,400. Of the miles driven, only 261 miles were for personal use. Assume four-wheelers qualify to be depreciated according to the five-year MACRS schedule and the four-wheeler was the only asset Phil purchased this year. (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) (Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) Problem 10-65 Part b (Algo) b. Calculate the allowable depreciation for year 2 if total miles were 1,650 and personal-use miles were 790 (ignore the $179 expense and bonus depreciation). Depreciation deduction