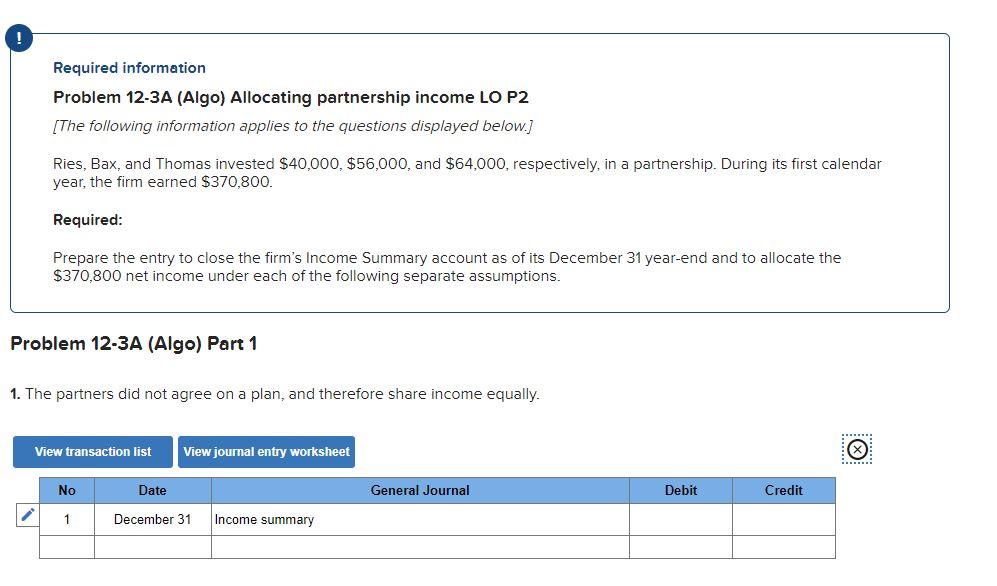

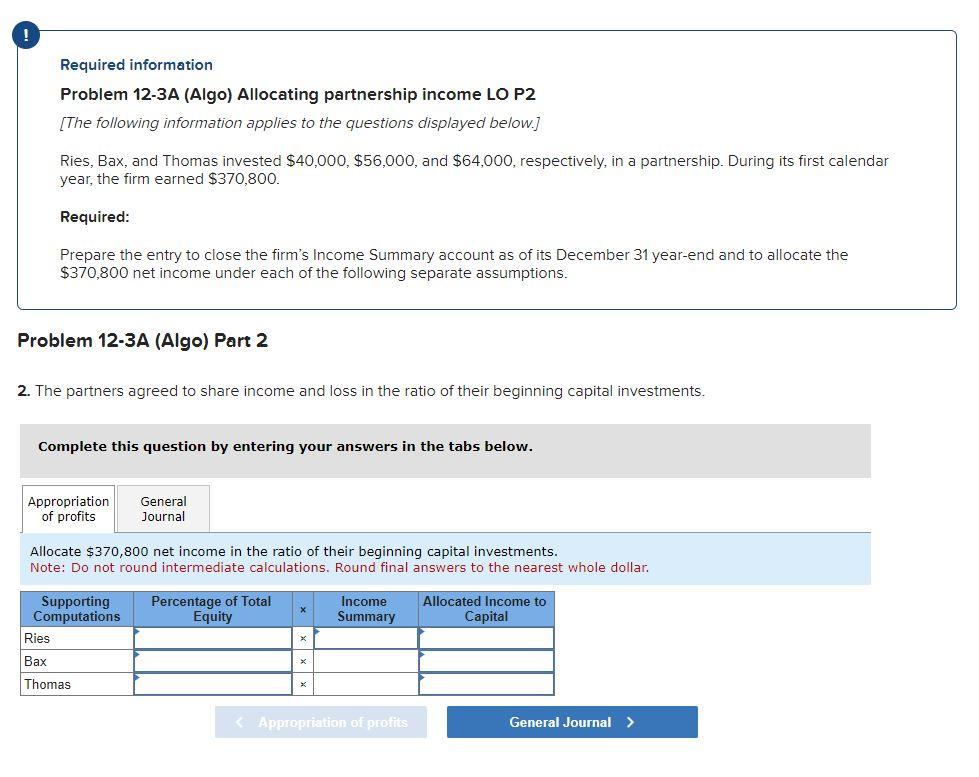

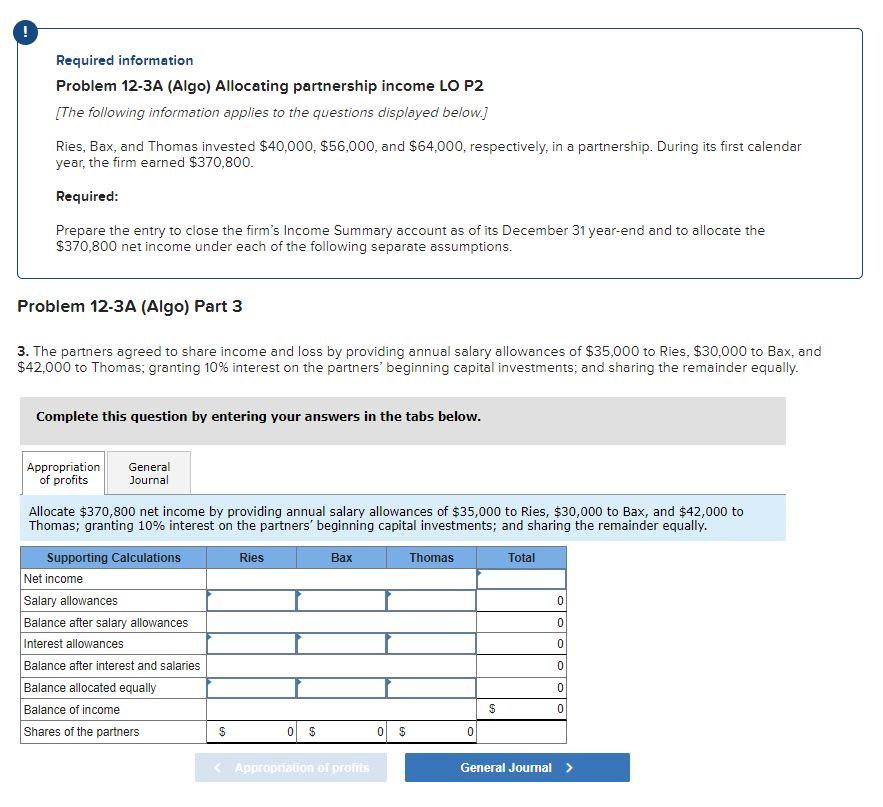

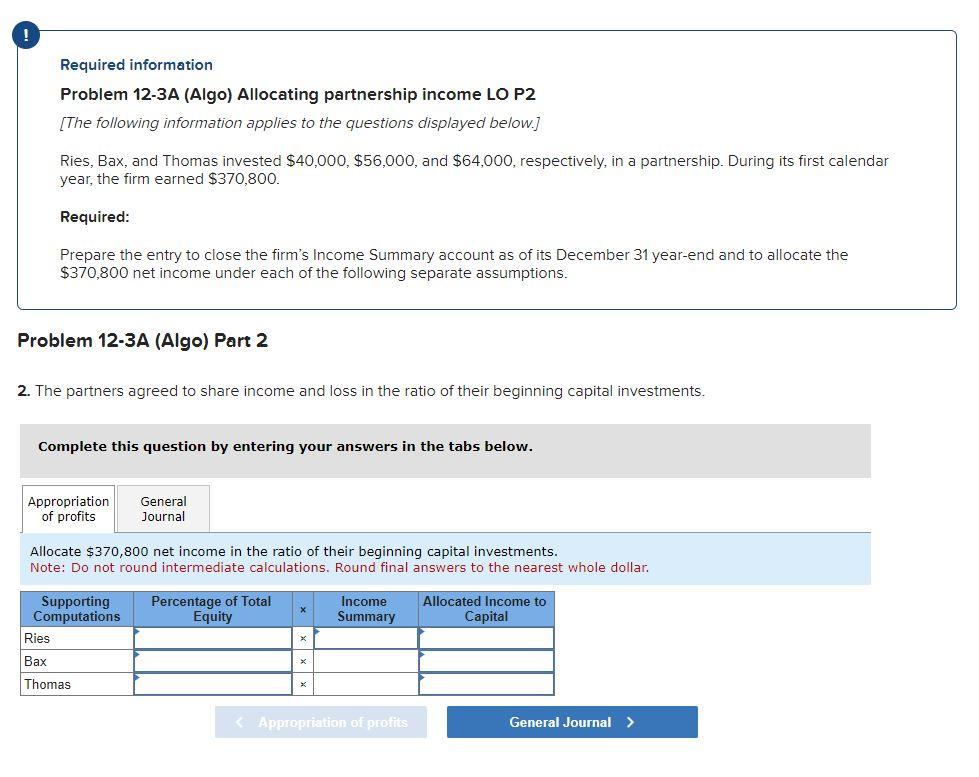

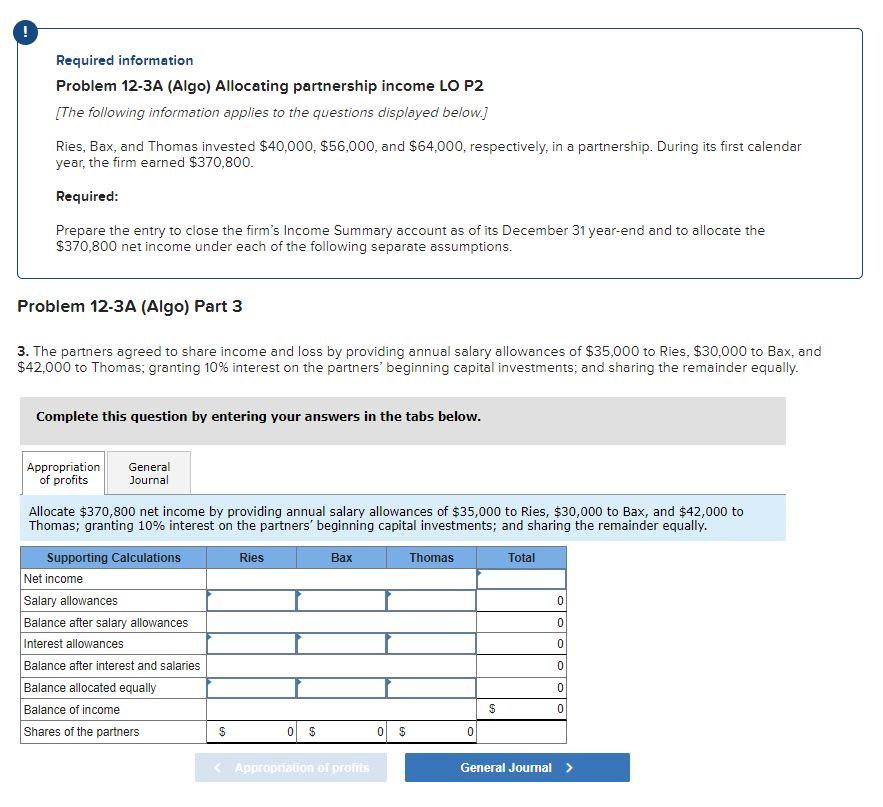

Required information Problem 12-3A (Algo) Allocating partnership income LO P2 [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $40,000,$56,000, and $64,000, respectively, in a partnership. During its first calendar year, the firm earned $370,800. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $370,800 net income under each of the following separate assumptions. Problem 12-3A (Algo) Part 1 1. The partners did not agree on a plan, and therefore share income equally. Required information Problem 12-3A (Algo) Allocating partnership income LO P2 [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $40,000,$56,000, and $64,000, respectively, in a partnership. During its first calendar year, the firm earned $370,800. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $370,800 net income under each of the following separate assumptions. Problem 12-3A (Algo) Part 2 2. The partners agreed to share income and loss in the ratio of their beginning capital investments. Complete this question by entering your answers in the tabs below. Allocate $370,800 net income in the ratio of their beginning capital investments. Note: Do not round intermediate calculations. Round final answers to the nearest whole dollar. Required information Problem 12-3A (Algo) Allocating partnership income LO P2 [The following information applies to the questions displayed below.] Ries, Bax, and Thomas invested $40,000,$56,000, and $64,000, respectively, in a partnership. During its first calendar year, the firm earned $370,800. Required: Prepare the entry to close the firm's Income Summary account as of its December 31 year-end and to allocate the $370,800 net income under each of the following separate assumptions. Problem 12-3A (Algo) Part 3 3. The partners agreed to share income and loss by providing annual salary allowances of $35,000 to Ries, $30,000 to Bax, and $42,000 to Thomas; granting 10% interest on the partners' beginning capital investments; and sharing the remainder equally. Complete this question by entering your answers in the tabs below. Allocate $370,800 net income by providing annual salary allowances of $35,000 to Ries, $30,000 to Bax, and $42,000 to Thomas; granting 10% interest on the partners' beginning capital investments; and sharing the remainder equally