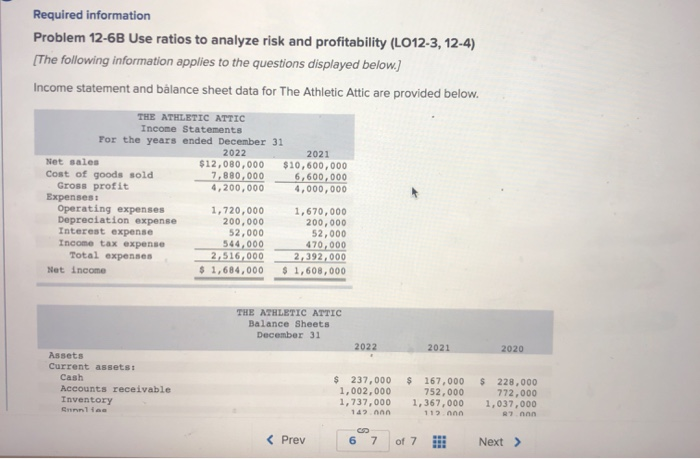

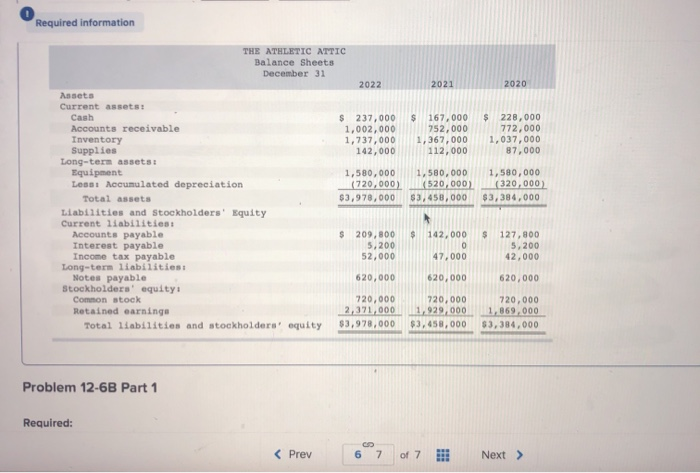

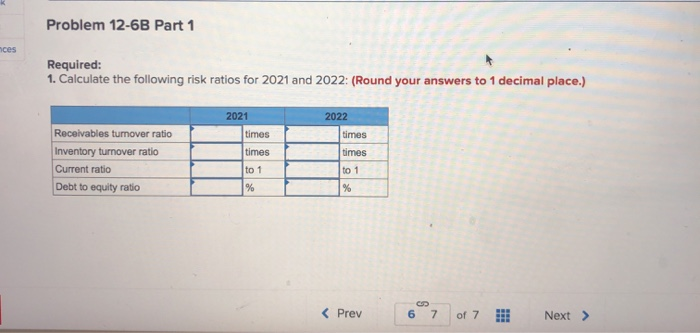

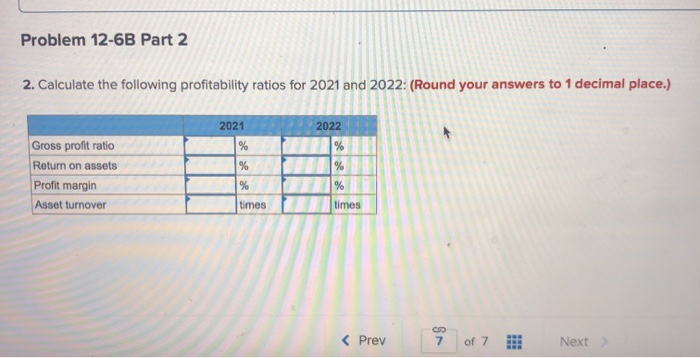

Required information Problem 12-68 Use ratios to analyze risk and profitability (LO12-3, 12-4) [The following information applies to the questions displayed below.] Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 2021 Net sales $12,080,000 $10,600,000 Cost of goods sold 7,880,000 6,600,000 Gross profit 4,200,000 4,000,000 Expenses: Operating expenses 1,720,000 1,670,000 Depreciation expense 200,000 200,000 Interest expense 52,000 52,000 Income tax expense 544,000 470,000 Total expenses 2,516,000 2,392,000 Net Income $ 1,684,000 $ 1,600,000 THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 Assets Current assets Cash Accounts receivable Inventory Sunline $ 237,000 1,002,000 1,737,000 147 on $ 167,000 752,000 1,367,000 112 nnn $ 228,000 772,000 1,037,000 R7 non Required information THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 237,000 1,002,000 1,737,000 142,000 $ 167,000 752,000 1,367,000 112,000 $ 228,000 772,000 1,037,000 87,000 1,580,000 (720,000) $3,978,000 1,580,000 520,000) $3,450,000 1,580,000 (320,000) $3,384,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Lesni Accumulated depreciation Total assets Liabilities and stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity Common stock Retained earnings Total liabilities and stockholders' equity S $ 209,800 5,200 52,000 142,000 0 47,000 $ 127,800 5,200 42.000 620,000 620,000 620,000 720,000 2,371,000 $3,978,000 720,000 1,929,000 $3,458,000 720,000 1,869,000 $3,384,000 Problem 12-6B Part 1 Required: Problem 12-6B Part 1 ces Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 times times 2022 times times Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio to 1 % to 1 % Problem 12-6B Part 2 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 % % % % Gross profit ratio Return on assets Profit margin Asset turnover % % times times