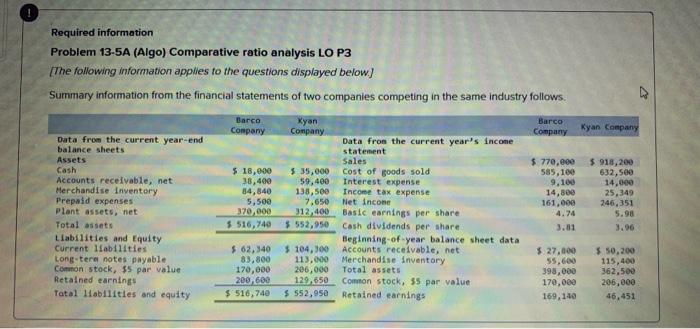

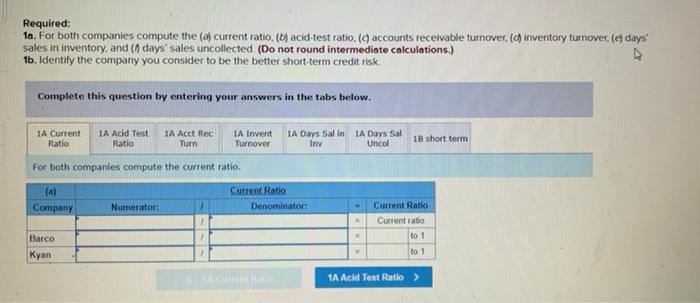

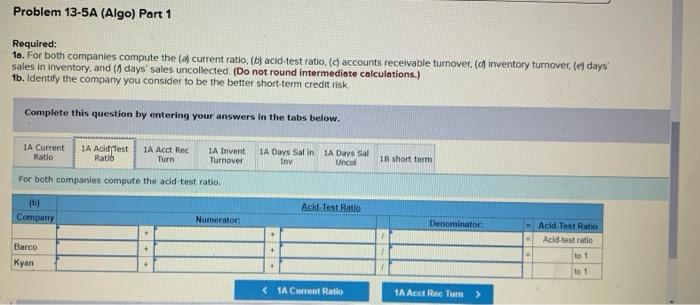

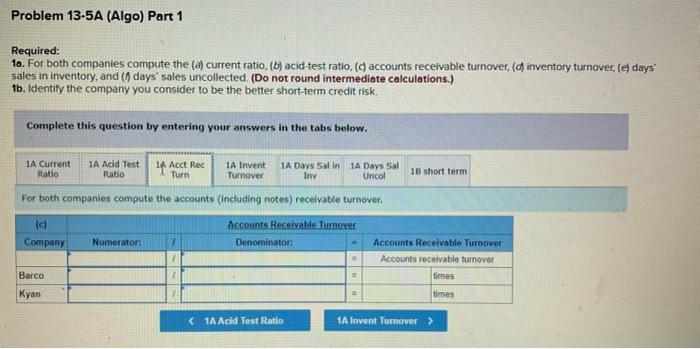

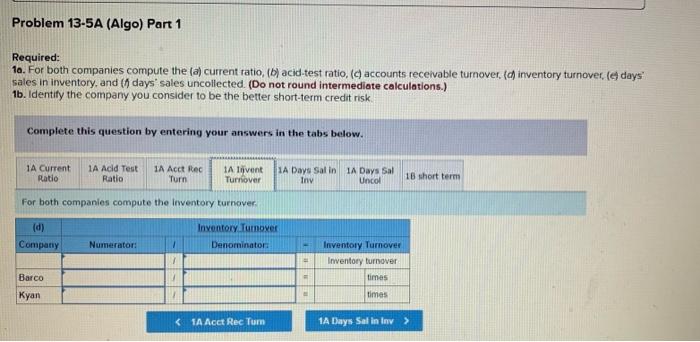

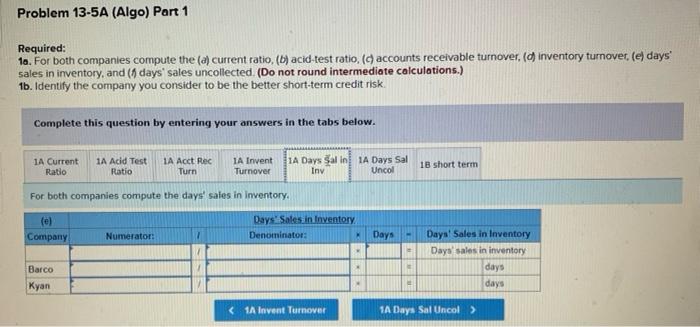

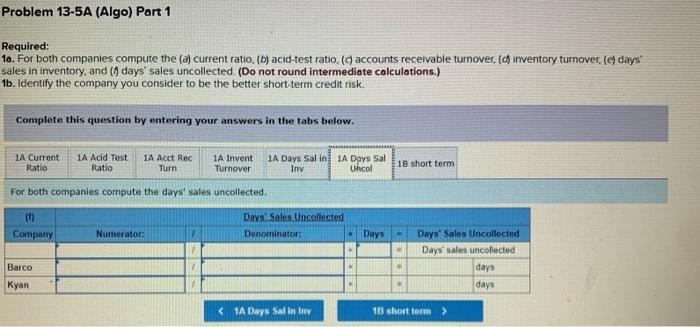

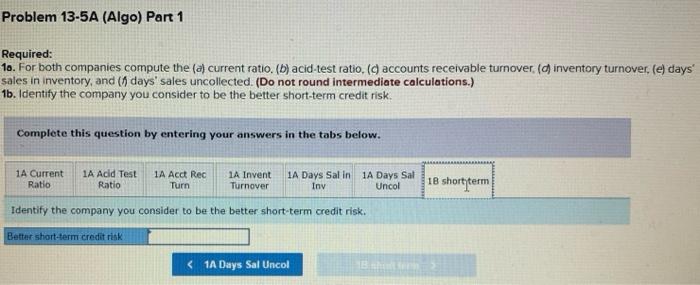

Required information Problem 13-5A (Algo) Comparative ratio analysis LO P3 [The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows Barco Company Xyan Company Barco Company Kyan Company Data from the current year-end balance sheets Assets Cash Accounts receivable, net Merchandise Inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Current liabilities Long-tere notes payable Common stock, 35 par value Retained earnings Tatal liabilities and equity $ 18,000 38,400 84,840 5,500 370,000 $ 516,740 $ 35,000 59,400 138,500 7.650 312 400 $ 552,950 $918,200 632,500 14,900 25,349 246,351 Data from the current year's income statement Sales Cost of goods sold Interest expense Income tax expense Net Income Basic earnings per share Cash dividends per share Beginning of year balance sheet data Accounts receivable, net Merchandise Inventory Total assets Common stock, 35 par value Retained earnings $ 770.000 585,100 9.100 14,800 161,000 4.74 3.81 3.96 $ 62,340 $ 104,300 83,800 113,000 170,000 206,000 200.600 129,650 $ 516,740 $ 552,950 $ 27,000 55,600 398,000 170,000 169,140 $ 50,200 115,400 362,500 206,000 46,451 Required: 10. For both companies compute the current ratio, (b) acid-test ratio. (accounts receivable turnover (chinventory turnover (e) days sales in inventory, and (7 days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover IA Days Sal in 1A Days Sal Inv Uncol 1B short term For both companies compute the current ratio, (a) Company Current Ratio Denominator: Numerator Current Ratio Current ratio to 1 Barco Kyan to 1 1A Acid Test Ratio >> Problem 13-5A (Algo) Part 1 Required: 1o. For both companies compute the current ratio, (b) acid-test ratio, accounts receivable turnover (inventory turnover le days sales in inventory, and (7 days' sales uncollected (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratib 1A Acct Rec Turn 1A Invent Turnover 1A Days Salin 1A Days Sal Iny Uncol 13 short term For both companies compute the acld test ratio. (b) Company Acid Test Ratio Numerator Denominator Acid. Test Ratio Acid-test ratio tot Barco Kyan +++ 101 Problem 13-5A (Algo) Part 1 Required: 10. For both companies compute the (a) current ratio. (b) acid-test ratio. (accounts receivable turnover, () inventory turnover (e) days' sales in inventory, and ( days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test 1 Acct Rec Ratio Turn 1A Invent Turnover 1A Days Salin 1A Days Sal Inv Uncol 18 short term For both companies compute the accounts (including notes) receivable turnover. (c) Company Accounts Receivable Tumover Denominator: Numerator: = Accounts Receivable Turnover Accounts receivable turnover times times Barco Kyan = Problem 13-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (d) accounts receivable turnover (c) inventory turnover (@days' sales in inventory, and (1 days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1 lijvent Turnover 1A Days Salin IA Days Sal Iny Uncol 18 short term For both companies compute the inventory turnover (d) Company Inventory Turnover Denominator Numerator: 1 Inventory Turnover Inventory turnover times 1 Barco Kyan times Problem 13-5A (Algo) Part 1 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( accounts receivable turnover, () inventory turnover (e) days sales in inventory, and (6 days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Salin 1A Days Sal Iny Uncol IB short term For both companies compute the days' sales in Inventory. (e) Company Days Sales in Inventory Denominator: Numerator: Days Days' Sales in Inventory Daya sales in inventory days days 1 Barco Kyan Problem 13-5A (Algo) Part 1 Required: 10. For both companies compute the (a) current ratio. (b) acid-test ratio. ( accounts receivable turnover. (d) inventory turnover (e) days sales in inventory, and (1 days' sales uncollected (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio IA Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uhcol 18 short term For both companies compute the days' sales uncollected. (1) Company Days Sales Uncollected Denominator: Numerator: Days Days' Sales Uncollected Days' sales uncollected days days Barco Kyan Problem 13-5A (Algo) Part 1 Required: 10. For both companies compute the (a) current ratio. (b) acid-test ratio, ( accounts receivable turnover. (a) inventory turnover. (e) days sales in inventory, and (1) days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be the better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol 18 short term Identify the company you consider to be the better short-term credit risk. Better short-term credit risk