Answered step by step

Verified Expert Solution

Question

1 Approved Answer

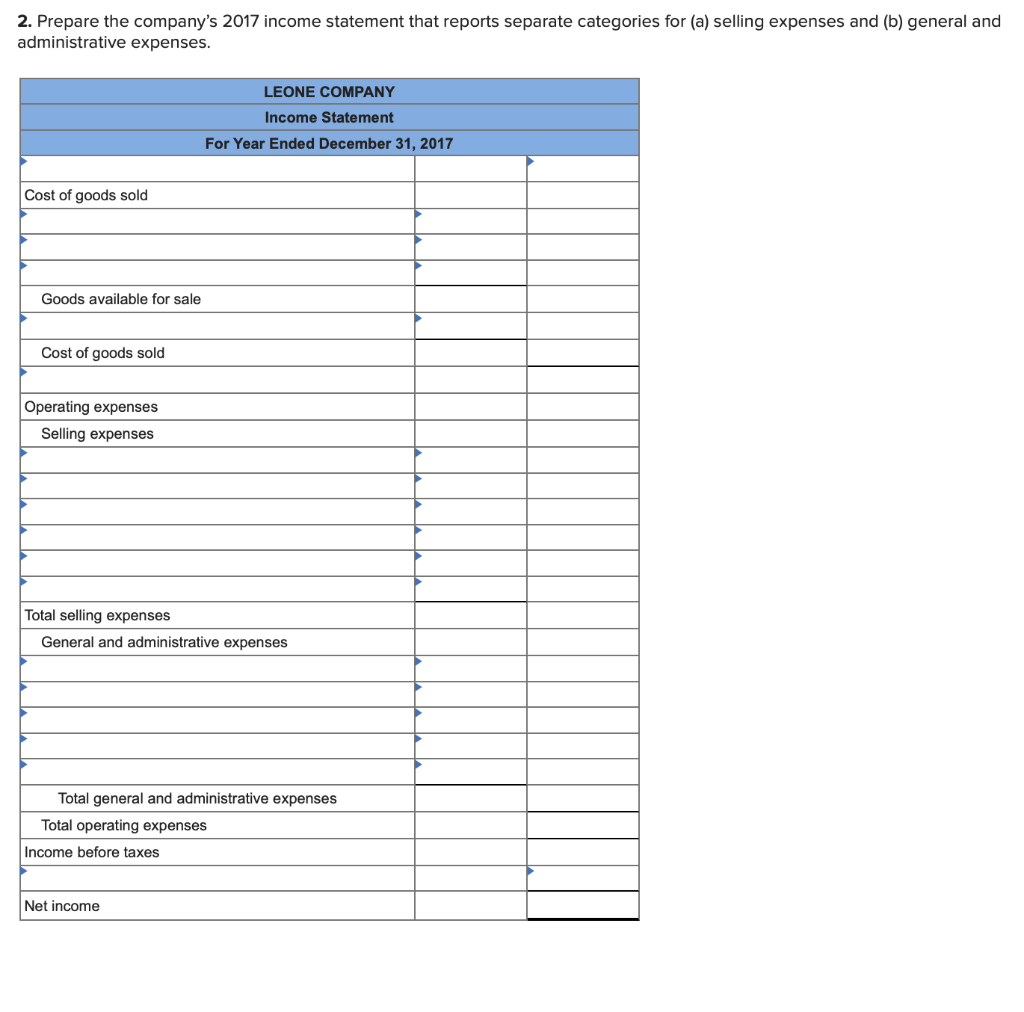

Required information Problem 14-3A Schedule of cost of goods manufactured and income statement; inventory analysis LO P2, A1 [The following information applies to the questions

Required information

Problem 14-3A Schedule of cost of goods manufactured and income statement; inventory analysis LO P2, A1

[The following information applies to the questions displayed below.]

The following calendar year-end information is taken from the December 31, 2017, adjusted trial balance and other records of Leone Company.

| Advertising expense | $ | 29,900 | Direct labor | $ | 679,200 | ||

| Depreciation expenseOffice equipment | 11,000 | Income taxes expense | 237,700 | ||||

| Depreciation expenseSelling equipment | 9,700 | Indirect labor | 59,900 | ||||

| Depreciation expenseFactory equipment | 34,900 | Miscellaneous production costs | 9,600 | ||||

| Factory supervision | 111,300 | Office salaries expense | 68,000 | ||||

| Factory supplies used | 9,500 | Raw materials purchases | 972,000 | ||||

| Factory utilities | 41,000 | Rent expenseOffice space | 28,000 | ||||

| Inventories | Rent expenseSelling space | 27,800 | |||||

| Raw materials, December 31, 2016 | 155,600 | Rent expenseFactory building | 78,300 | ||||

| Raw materials, December 31, 2017 | 192,000 | Maintenance expenseFactory equipment | 37,000 | ||||

| Work in process, December 31, 2016 | 16,300 | Sales | 4,535,300 | ||||

| Work in process, December 31, 2017 | 24,100 | Sales salaries expense | 390,200 | ||||

| Finished goods, December 31, 2016 | 169,200 | ||||||

| Finished goods, December 31, 2017 | 143,100 | ||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started