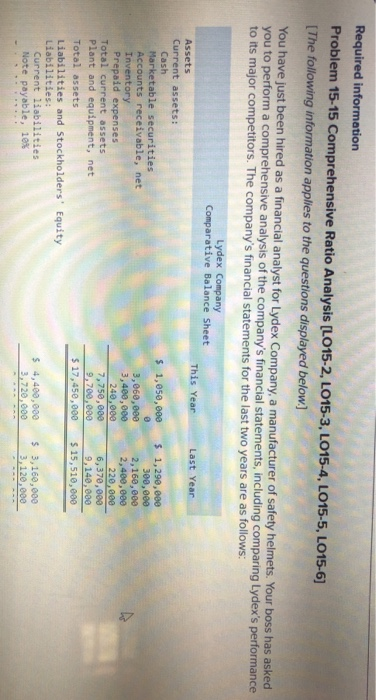

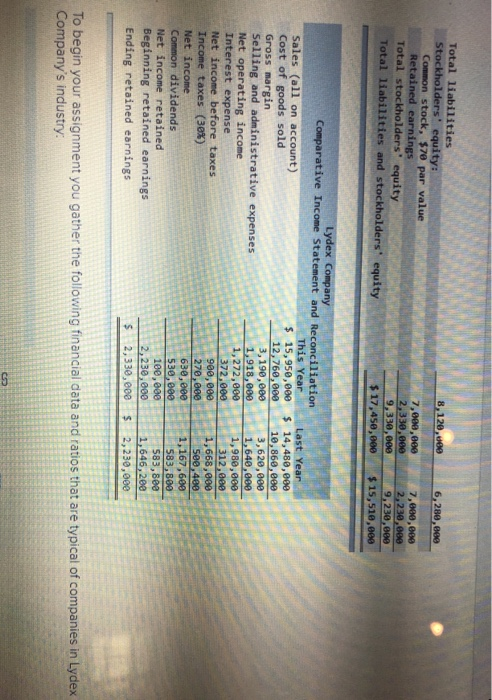

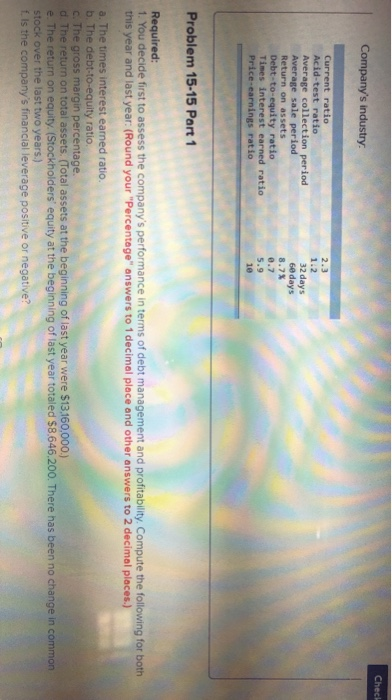

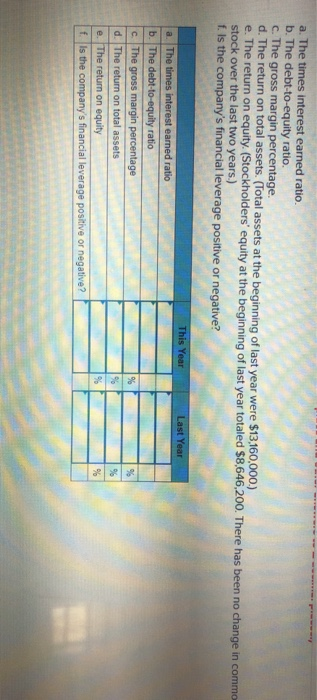

Required information Problem 15-15 Comprehensive Ratio Analysis [L015-2, LO15-3, LO15-4, LO15-5, LO15-6) [The following information applies to the questions displayed below You have just been hired as a financial analyst for Lydex Company, a manufacturer of safety helmets. Your you to perform a comprehensive analysis of the company's financial statements, including compa to its major competitors. The company's financial statements for the last two years are as follows: boss has asked ring Lydex's performance Lydex Company Comparative Balance Sheet This Year Last Year Assets Current assets: s 1,050,000 1,298,00e 300,000 2,160,000 2,400,eee Cash Marketable securities Accounts receivable, net 3,060,00e 3,400,000 240,000 7,750,e00 6,370,000 9,140,080 s 17,450,000 $15,510,00e Total current assets Total assets Liabilities and Stockholders' Equity Liabilities: s 4,400,000 3,160,000 3,120,000 Current liabilities Note payable, 108% 3,720,000 Common stock, $70 Retained Cost of goods sold Net operating income (38%) Income taxes 583,800 583,800 1,646,20e 100,000 To begin your assignment you gather the following financial data and ratios that are typical of companies in Lydex Company's industry 2.3 1.2 32 days 60 days 8.7% ratio Acid-test ratio Average collection period Return on assets Debt-to-equity ratio Times interest earned ratio 5.9 1e Problem 15-15 Part 1 1. You decide first to assess the company's performance in terms of debt management and profitability. Compute the following for both this year and last year: (Round your "Percentage" answers to 1 decimal place and other answers to 2 decimal places.) ratio C. The gross margin percentage. d. The return on total assets. (Total assets at the beginning of last year were $13,160,000.) e. The return on equity. (Stockholders' equity at the beginning of last year totaled $8.646,200. There has been no change in common stock over the last two years.) Is the company's financial leverage positive or negative? b. The debt-to-equity ratio. C. The gross margin d. The return on total assets. (Total assets at the beginning of last year were $13,160,000) e. The return on equity. ( stock over the last two years.) f Is the c otaled $8,646,200. There has been no change in commo equity at the beginning of last year t