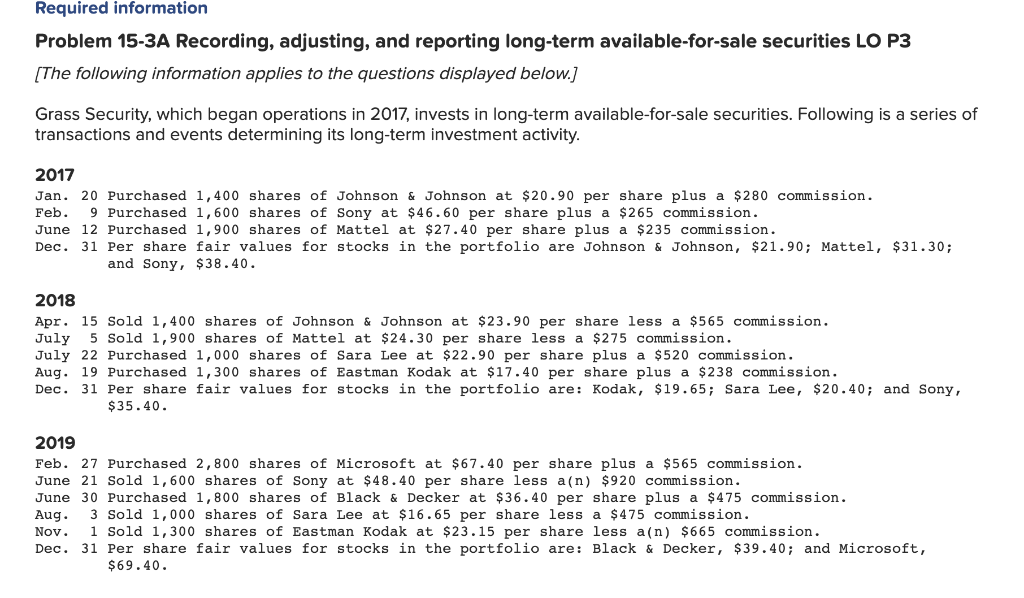

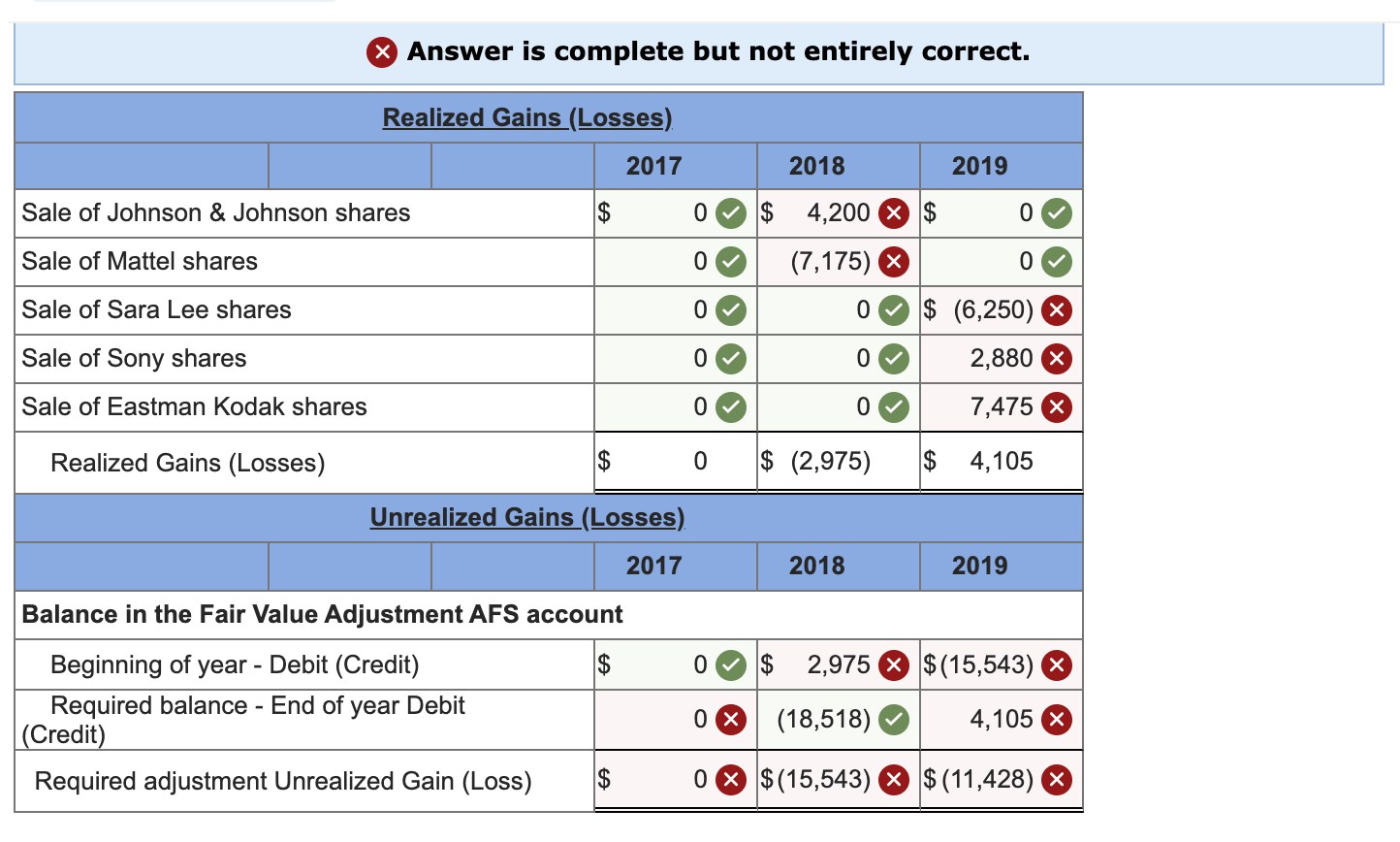

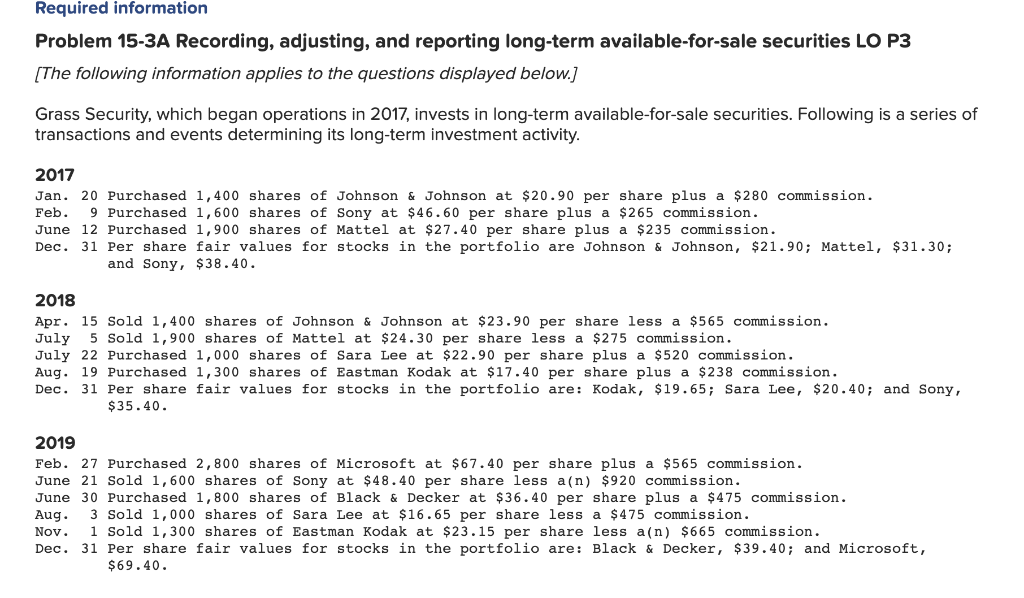

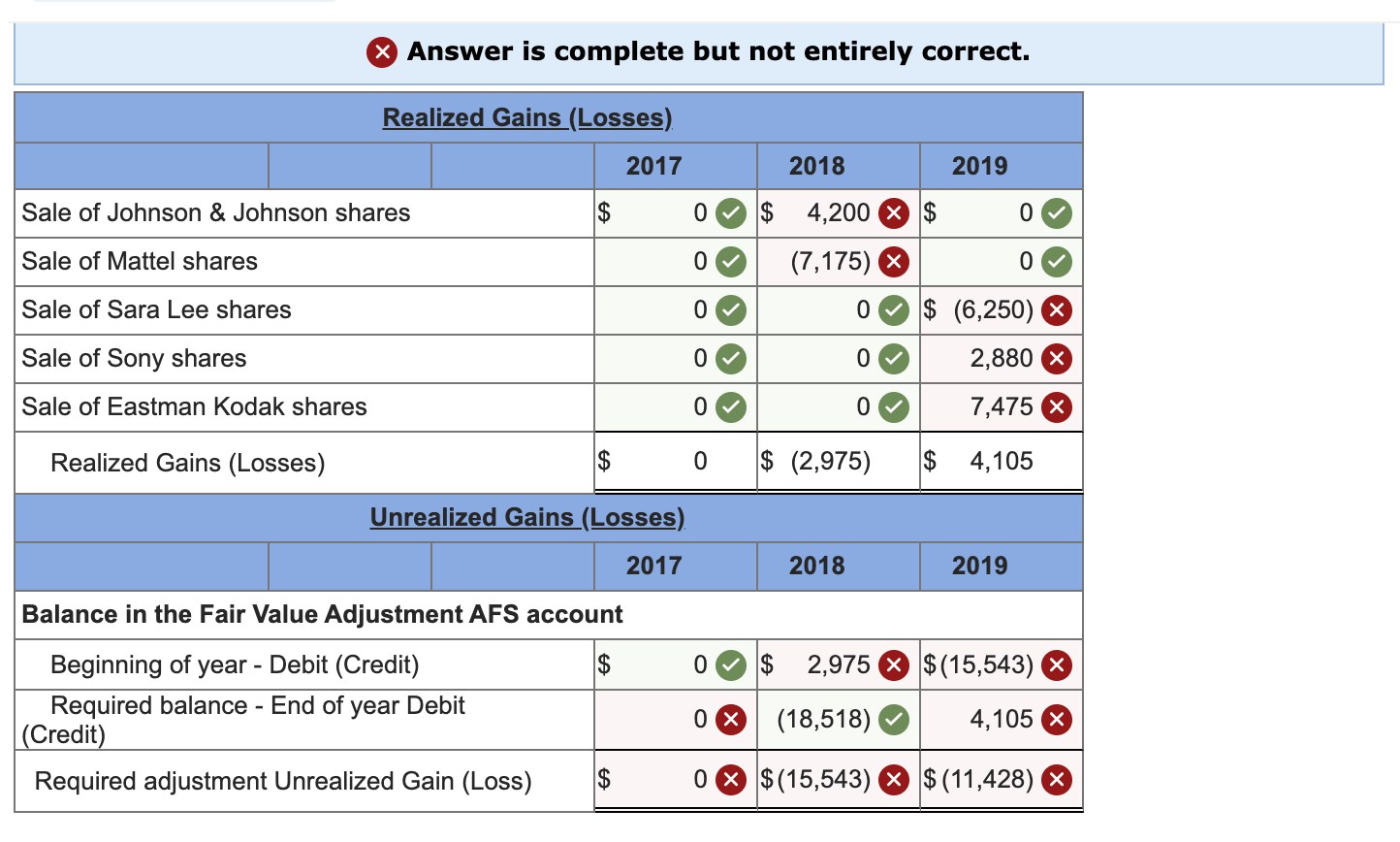

Required information Problem 15-3A Recording, adjusting, and reporting long-term available-for-sale securities LO P3 [The following information applies to the questions displayed below.] Grass Security, which began operations in 2017, invests in long-term available-for-sale securities. Following is a series of transactions and events determining its long-term investment activity. 2017 Jan. 20 Purchased 1,400 shares of Johnson & Johnson at $20.90 per share plus a $280 commission. Feb. 9 Purchased 1,600 shares of Sony at $46.60 per share plus a $265 commission. June 12 Purchased 1,900 shares of Mattel at $27.40 per share plus a $235 commission. Dec. 31 Per share fair values for stocks in the portfolio are Johnson & Johnson, $21.90; Mattel, $31.30; and Sony, $38.40. 2018 Apr. 15 Sold 1,400 shares of Johnson & Johnson at $23.90 per share less a $565 commission. July 5 Sold 1,900 shares of Mattel at $24.30 per share less a $275 commission. July 22 Purchased 1,000 shares of Sara Lee at $22.90 per share plus a $520 commission. Aug. 19 Purchased 1,300 shares of Eastman Kodak at $17.40 per share plus a $238 commission. Dec. 31 Per share fair values for stocks in the portfolio are: Kodak, $19.65; Sara Lee, $20.40; and Sony, $35.40. 2019 Feb. 27 Purchased 2,800 shares of Microsoft at $67.40 per share plus a $565 commission June 21 Sold 1,600 shares of Sony at $48.40 per share less a(n) $920 commission. June 30 Purchased 1,800 shares of Black & Decker at $36.40 per share plus a $475 commission. Aug. 3 Sold 1,000 shares of Sara Lee at $16.65 per share less a $475 commission. Nov. 1 Sold 1,300 shares of Eastman Kodak at $23.15 per share less a(n) $665 commission. Dec. 31 Per share fair values for stocks in the portfolio are: Black & Decker, $39.40; and Microsoft, $69.40. X Answer is complete but not entirely correct. Realized Gains (Losses) 2017 2018 2019 Sale of Johnson & Johnson shares $ 0$ 4,200 X $ 0 Sale of Mattel shares 0 (7,175) X 0 Sale of Sara Lee shares 0 0 $ (6,250) Sale of Sony shares 0 0 2,880 X Sale of Eastman Kodak shares 0 0 7,475 X Realized Gains (Losses) $ 0 $ (2,975) $ 4,105 Unrealized Gains (Losses) 2017 2018 2019 0 $ 2,975 $(15,543) Balance in the Fair Value Adjustment AFS account Beginning of year - Debit (Credit) $ Required balance - End of year Debit (Credit) Required adjustment Unrealized Gain (Loss) $ 0% (18,518) 4,105 X 0X $ (15,543) $ (11,428) X