Answered step by step

Verified Expert Solution

Question

1 Approved Answer

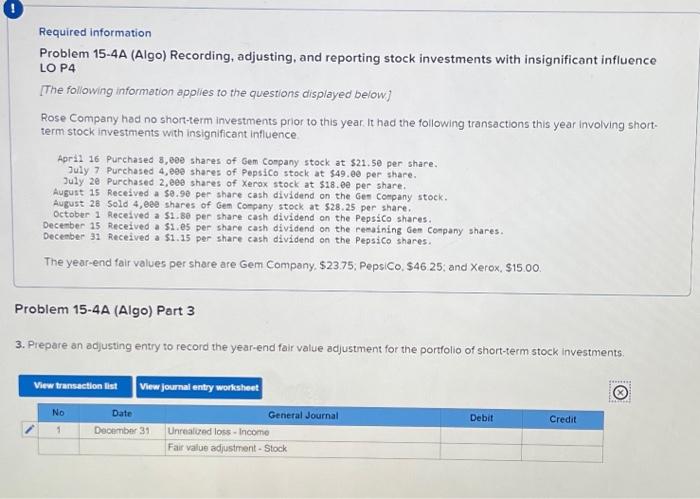

Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applies to the questions displayed below] Rose

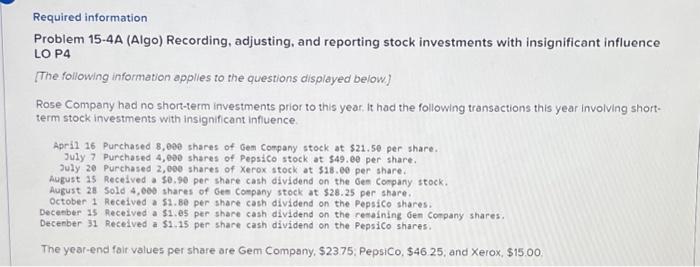

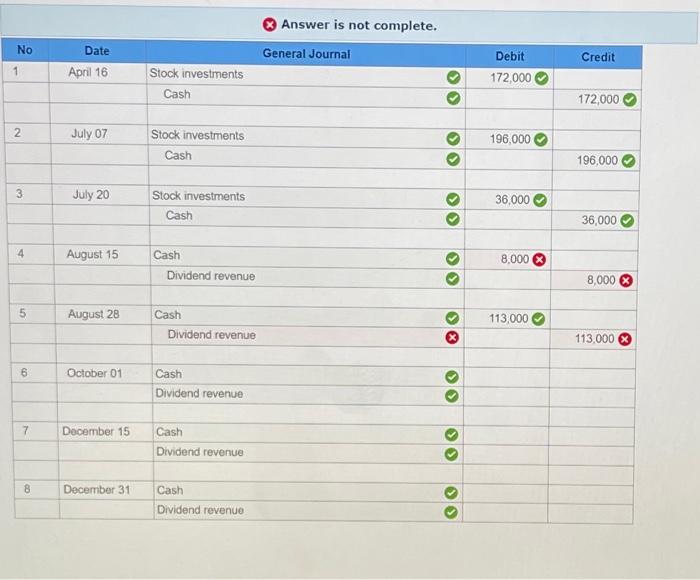

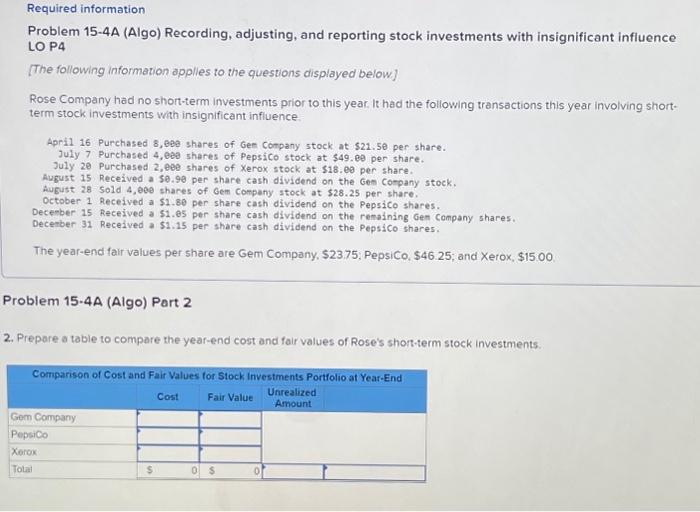

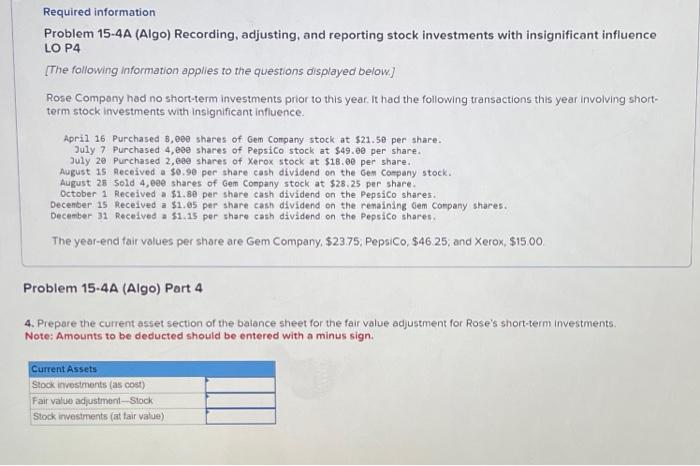

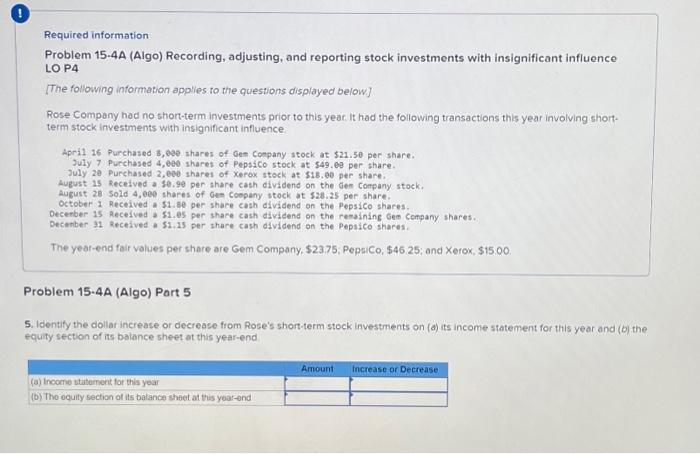

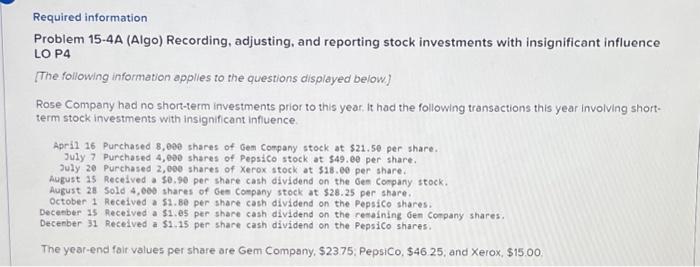

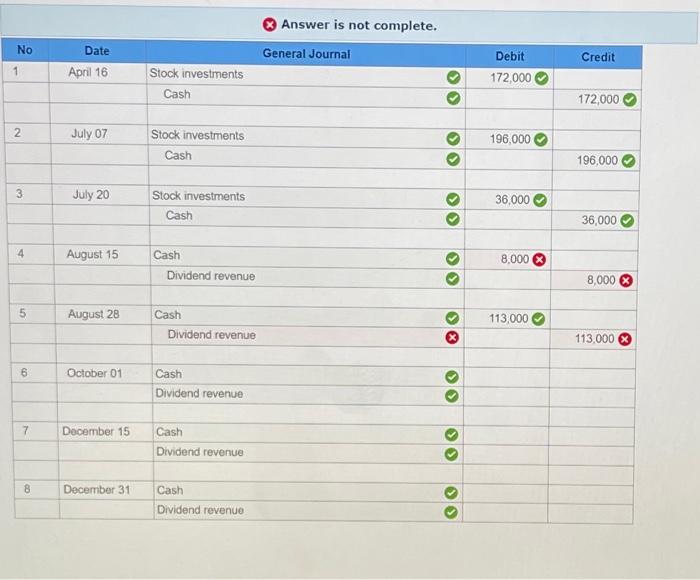

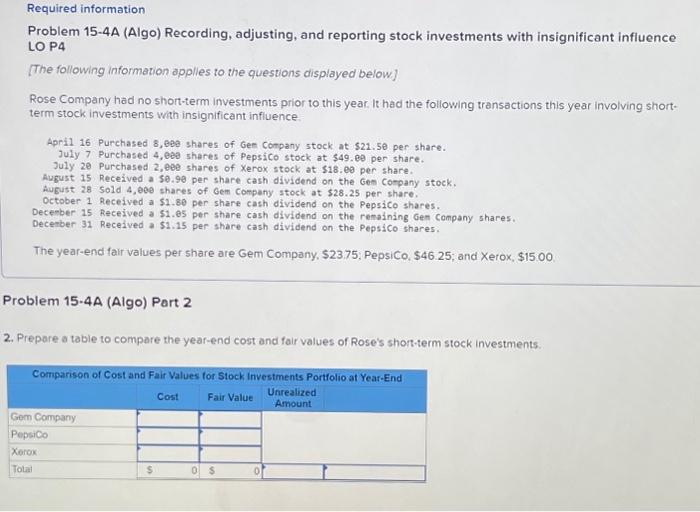

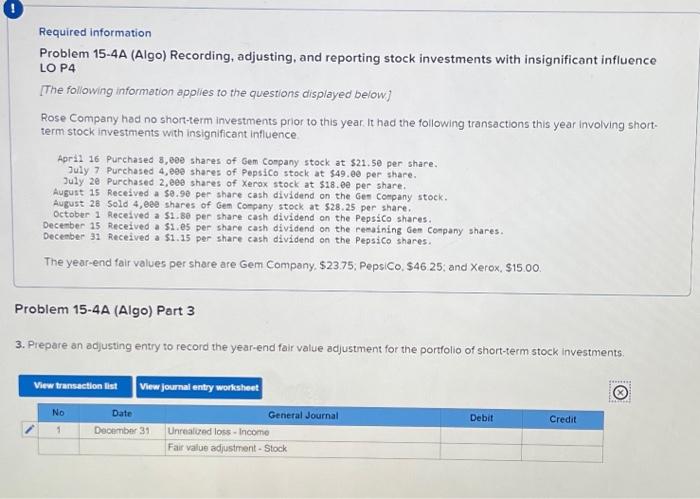

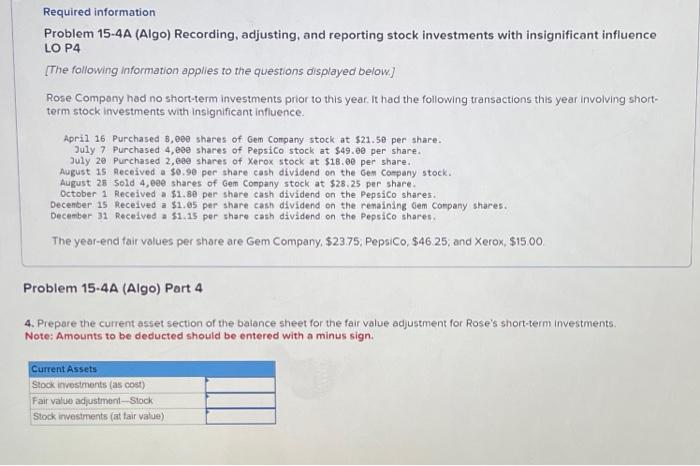

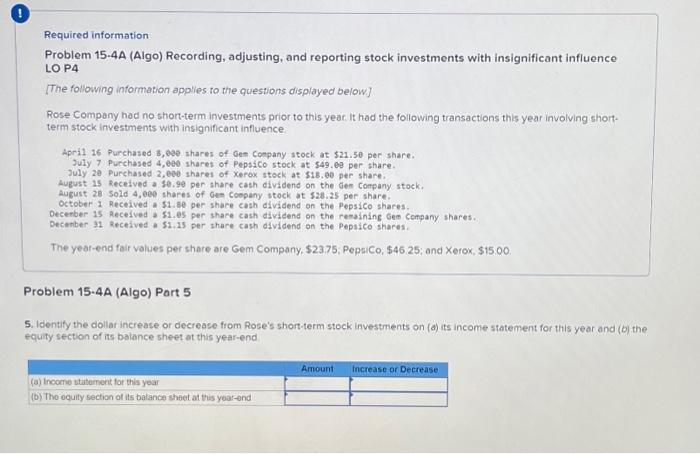

Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applies to the questions displayed below] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving shortterm stock investments with insignificant influence Apri1 16 Purchased 8 , 600 shares of Gem Company stock at $21,50 per share. July 7 Purchased 4 , eee shares of Pepsico stock at $49.00 per share. July 2e Purchased 2, eee shares of Xerox stock at $18.ee per share. August 15 Recelved a se.90 per share cash dividend on the Ges company stock. August 28 Sold 4 , eee shares of Gem company stock at $28.25 per share. October 1 Received a 51 . Be per share cash dividend on the Pepsico shares. Decenber 15 Received a $1. 05 per share cash dividend on the reeaining Gen Conpany shares. Deceaber 31 Received a $1.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$23.75; PepsiCo, \$46.25; and Xerox, \$15.00. roblem 15-4A (Algo) Part 3 Prepare an adjusting entry to record the year-end fair value adjustment for the portfolio of short-term stock investments. Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving shortterm stock investments with insignificant influence. April 16 Purchased 8 , 000 shares of Gem Company stock at $21.50 per share. July 7 Purchased 4,000 shares of Pepsico stock at $49.00 per share. July 20 Purchased 2, e00 shares of Xerox stock at $18.00 per share. August 15 Received a $0.90 per share cash dividend on the Gem Company stock. August 28 5old 4 ,eee shares of Gem Conpany stock at $28.25 per share. October 1 Received a $1.80 per share cash dividend on the Pepsico shares. Decenter 15 Received a $1.05 per share cash dividend on the renaining Gem company shares. Decentber 31 Received a $1.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$23.75; PepsiCo, \$46.25; and Xerox, \$15.00. Problem 15-4A (Algo) Part 4 4. Prepare the current asset section of the balance sheet for the fair value adjustment for Rose's short-term investments. Note: Amounts to be deducted should be entered with a minus sign. Required information Problem 15.4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applies to the questions displayed below] Rose Company had no short-term investments prior to this year, It had the following transactions this year involving shortterm stock investments with insignificant influence. April 16 Purchased 8, eve shares of Gen Company stock at \$21.5e per share. July 7 Purchased 4 , eve shares of Pepsico stock at $49.ee per share. July 20 Purchased 2 , 00e shares of Xerox stock at $18.00 per share. August is Received a $0,90 per share cash dividend on the Ges Company stock. August 28 sold 4 ,ees shares of Ges company stock at $28.25 per share. October 1 Recelved a 51 .80 per share cash dividend on the Pepsico shares. Decenber is Received a $1.05 per share cash dividend on the renaining Gen Company shares. Decerber 31 Received a $1,15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$2375: PepsiCo, \$46.25, and Xerox, \$15.00. Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below] Rose Company had no short-term investments prior to this year, It had the following transactions this year involving short. term stock investments with insignificant influence Apri1 16 Purchased s, eee shares of Gee Conpany stock at $21.50 per share. July 7 Purchased 4 , eed shares of Pepsico stock at 549 , e9 per share. July 20 Purchased 2 , eve shares of Xerox stock at $18.ee per share. August is Recefved a 30.90 per share cash dividend on the Gen Company stock. August 28 sold 4 , eee shares of Ges Conpany stock at 528.25 per share. October 1 Received a $1.se per shace cash dividend on the Pepsico shares. Decerber 15 Received a 51 .0s per share cash dividend on the remaining Geo company shares. Decenber il keceived a 51.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$2.75; PepsiCo, \$46 25; and Xerox, $15.00. Problem 15.4A (Algo) Part 5 5. Identify the dollar increase or decrease from Rose's short-term stock investments on ( 0 ) its income statement for this year and (b) the equity section of its balance sheet ot this year-end Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applles to the questions displayed below] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving shortterm stock investments with insignificant influence April 16 Purchased 8 , epe shares of Gee Company stock at $21.50 per share. July 7 Purchased 4 ,eee shares of Pepsico stock at $49. ee per share. July 20 Purchased 2 ,eee shares of Xerox stock at $18.00 per share. August 15 Received a 50.90 per share cash dividend on the Gen Company stock. August 28 Sold 4 , eee shares of Gem Company stock at $28.25 per share. October 1 Recelved a $1.80 per share cash dividend on the Pepsico shares. December 15 Received a $1.es per share cash dividend on the remaining Gen company shares. December 31 Received a $1.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$23.75; PepsiCo, \$46 25; and Xerox, \$1500 Problem 15.4A (Algo) Port 2 2. Prepare a table to compare the year-end cost and fair values of Rose's short-term stock investments

Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applies to the questions displayed below] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving shortterm stock investments with insignificant influence Apri1 16 Purchased 8 , 600 shares of Gem Company stock at $21,50 per share. July 7 Purchased 4 , eee shares of Pepsico stock at $49.00 per share. July 2e Purchased 2, eee shares of Xerox stock at $18.ee per share. August 15 Recelved a se.90 per share cash dividend on the Ges company stock. August 28 Sold 4 , eee shares of Gem company stock at $28.25 per share. October 1 Received a 51 . Be per share cash dividend on the Pepsico shares. Decenber 15 Received a $1. 05 per share cash dividend on the reeaining Gen Conpany shares. Deceaber 31 Received a $1.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$23.75; PepsiCo, \$46.25; and Xerox, \$15.00. roblem 15-4A (Algo) Part 3 Prepare an adjusting entry to record the year-end fair value adjustment for the portfolio of short-term stock investments. Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below.] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving shortterm stock investments with insignificant influence. April 16 Purchased 8 , 000 shares of Gem Company stock at $21.50 per share. July 7 Purchased 4,000 shares of Pepsico stock at $49.00 per share. July 20 Purchased 2, e00 shares of Xerox stock at $18.00 per share. August 15 Received a $0.90 per share cash dividend on the Gem Company stock. August 28 5old 4 ,eee shares of Gem Conpany stock at $28.25 per share. October 1 Received a $1.80 per share cash dividend on the Pepsico shares. Decenter 15 Received a $1.05 per share cash dividend on the renaining Gem company shares. Decentber 31 Received a $1.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$23.75; PepsiCo, \$46.25; and Xerox, \$15.00. Problem 15-4A (Algo) Part 4 4. Prepare the current asset section of the balance sheet for the fair value adjustment for Rose's short-term investments. Note: Amounts to be deducted should be entered with a minus sign. Required information Problem 15.4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applies to the questions displayed below] Rose Company had no short-term investments prior to this year, It had the following transactions this year involving shortterm stock investments with insignificant influence. April 16 Purchased 8, eve shares of Gen Company stock at \$21.5e per share. July 7 Purchased 4 , eve shares of Pepsico stock at $49.ee per share. July 20 Purchased 2 , 00e shares of Xerox stock at $18.00 per share. August is Received a $0,90 per share cash dividend on the Ges Company stock. August 28 sold 4 ,ees shares of Ges company stock at $28.25 per share. October 1 Recelved a 51 .80 per share cash dividend on the Pepsico shares. Decenber is Received a $1.05 per share cash dividend on the renaining Gen Company shares. Decerber 31 Received a $1,15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$2375: PepsiCo, \$46.25, and Xerox, \$15.00. Required information Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LO P4 [The following information applies to the questions displayed below] Rose Company had no short-term investments prior to this year, It had the following transactions this year involving short. term stock investments with insignificant influence Apri1 16 Purchased s, eee shares of Gee Conpany stock at $21.50 per share. July 7 Purchased 4 , eed shares of Pepsico stock at 549 , e9 per share. July 20 Purchased 2 , eve shares of Xerox stock at $18.ee per share. August is Recefved a 30.90 per share cash dividend on the Gen Company stock. August 28 sold 4 , eee shares of Ges Conpany stock at 528.25 per share. October 1 Received a $1.se per shace cash dividend on the Pepsico shares. Decerber 15 Received a 51 .0s per share cash dividend on the remaining Geo company shares. Decenber il keceived a 51.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$2.75; PepsiCo, \$46 25; and Xerox, $15.00. Problem 15.4A (Algo) Part 5 5. Identify the dollar increase or decrease from Rose's short-term stock investments on ( 0 ) its income statement for this year and (b) the equity section of its balance sheet ot this year-end Problem 15-4A (Algo) Recording, adjusting, and reporting stock investments with insignificant influence LOP4 [The following information applles to the questions displayed below] Rose Company had no short-term investments prior to this year. It had the following transactions this year involving shortterm stock investments with insignificant influence April 16 Purchased 8 , epe shares of Gee Company stock at $21.50 per share. July 7 Purchased 4 ,eee shares of Pepsico stock at $49. ee per share. July 20 Purchased 2 ,eee shares of Xerox stock at $18.00 per share. August 15 Received a 50.90 per share cash dividend on the Gen Company stock. August 28 Sold 4 , eee shares of Gem Company stock at $28.25 per share. October 1 Recelved a $1.80 per share cash dividend on the Pepsico shares. December 15 Received a $1.es per share cash dividend on the remaining Gen company shares. December 31 Received a $1.15 per share cash dividend on the Pepsico shares. The year-end fair values per share are Gem Company, \$23.75; PepsiCo, \$46 25; and Xerox, \$1500 Problem 15.4A (Algo) Port 2 2. Prepare a table to compare the year-end cost and fair values of Rose's short-term stock investments

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started