Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information Problem 16-15 (Static) Comprehensive Ratio Analysis [LO16-2, L016-3, L016-4, LO16-5, L016-6] [The following information applies to the questions displayed below.] Lydex Company's financial

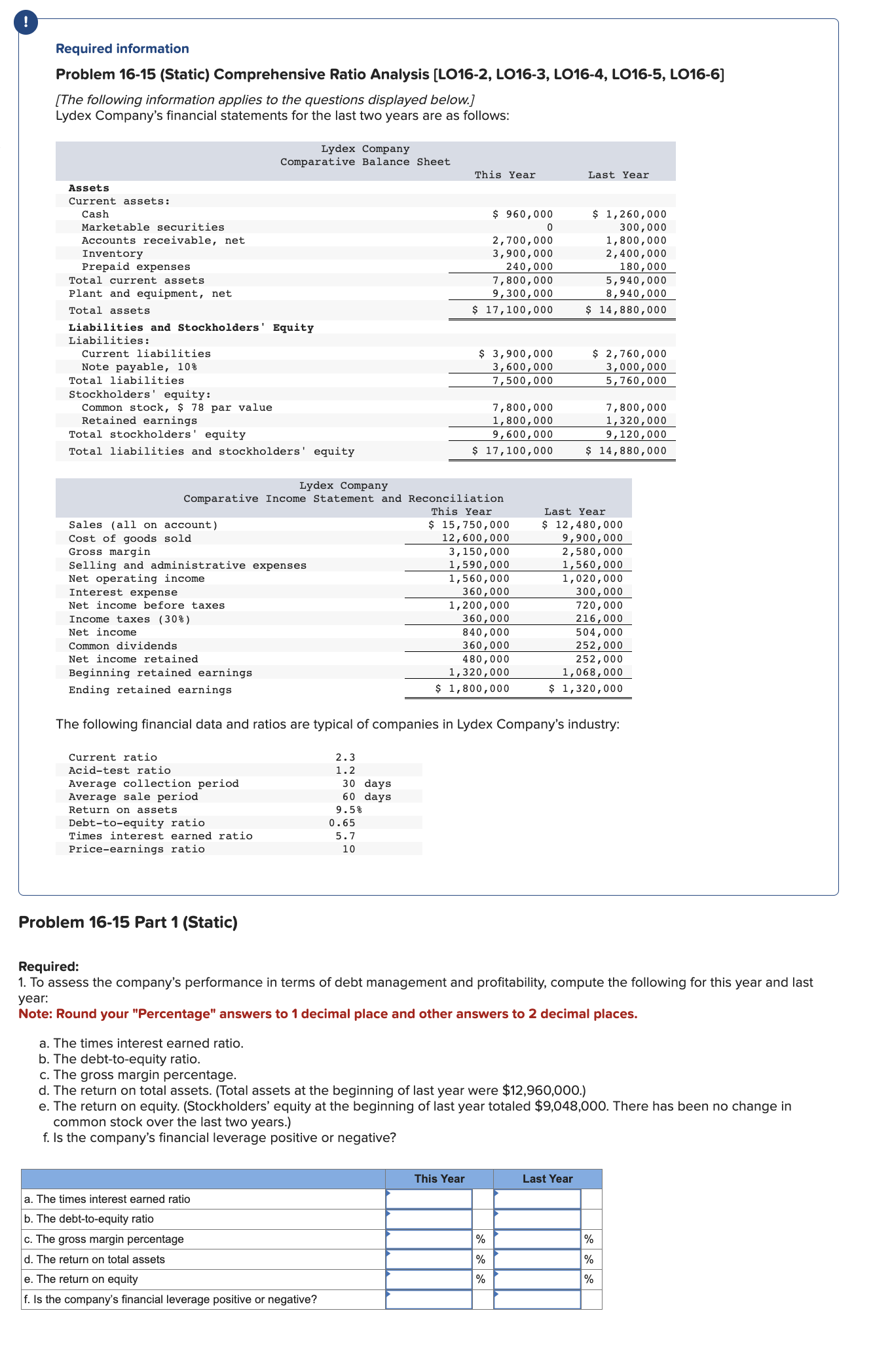

Required information Problem 16-15 (Static) Comprehensive Ratio Analysis [LO16-2, L016-3, L016-4, LO16-5, L016-6] [The following information applies to the questions displayed below.] Lydex Company's financial statements for the last two years are as follows: The following financial data and ratios are typical of companies in Lydex Company's industry: Problem 16-15 Part 1 (Static) Required: 1. To assess the company's performance in terms of debt management and profitability, compute the following for this year and last year: Note: Round your "Percentage" answers to 1 decimal place and other answers to 2 decimal places. a. The times interest earned ratio. b. The debt-to-equity ratio. c. The gross margin percentage. d. The return on total assets. (Total assets at the beginning of last year were $12,960,000.) e. The return on equity. (Stockholders' equity at the beginning of last year totaled $9,048,000. There has been no change in common stock over the last two years.) f. Is the company's financial leverage positive or negative

Required information Problem 16-15 (Static) Comprehensive Ratio Analysis [LO16-2, L016-3, L016-4, LO16-5, L016-6] [The following information applies to the questions displayed below.] Lydex Company's financial statements for the last two years are as follows: The following financial data and ratios are typical of companies in Lydex Company's industry: Problem 16-15 Part 1 (Static) Required: 1. To assess the company's performance in terms of debt management and profitability, compute the following for this year and last year: Note: Round your "Percentage" answers to 1 decimal place and other answers to 2 decimal places. a. The times interest earned ratio. b. The debt-to-equity ratio. c. The gross margin percentage. d. The return on total assets. (Total assets at the beginning of last year were $12,960,000.) e. The return on equity. (Stockholders' equity at the beginning of last year totaled $9,048,000. There has been no change in common stock over the last two years.) f. Is the company's financial leverage positive or negative Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started