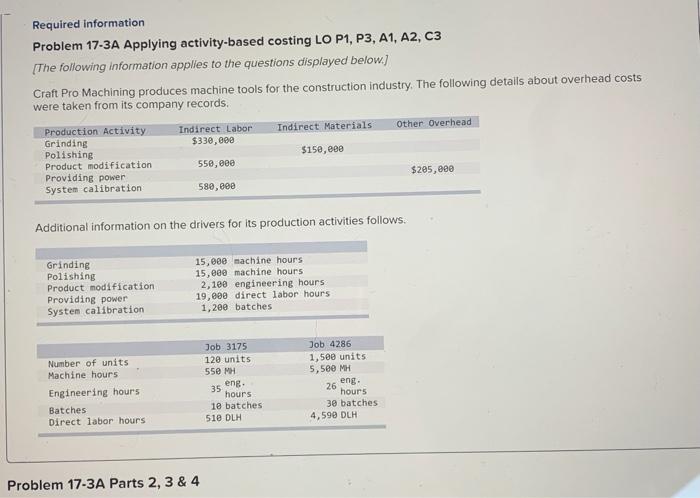

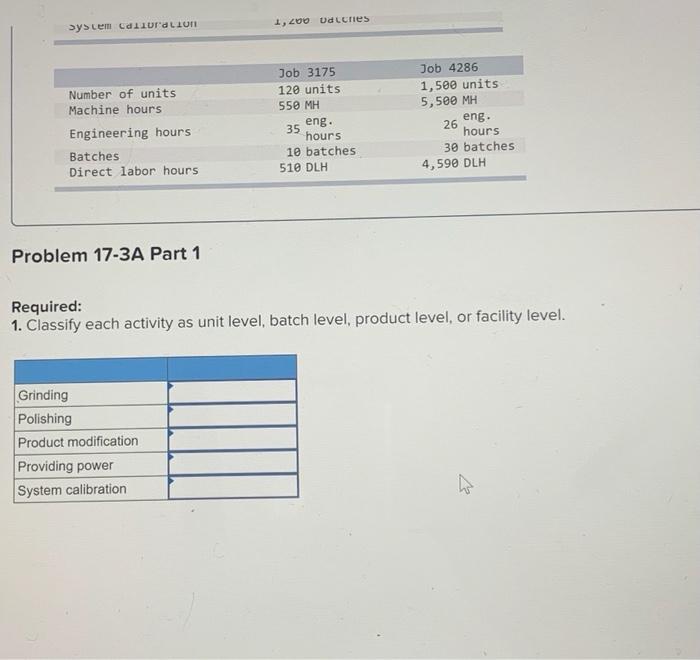

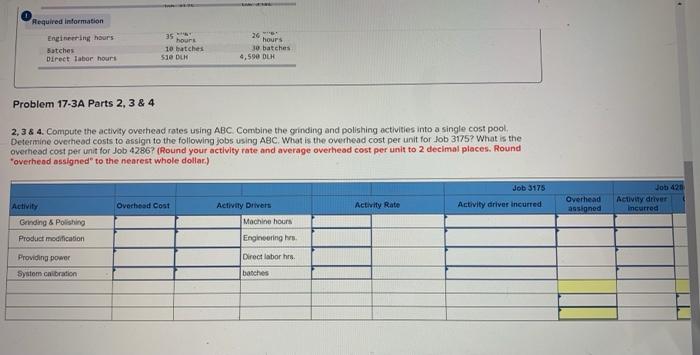

Required information Problem 17-3A Applying activity-based costing LO P1, P3, A1, A2, C3 [The following information applies to the questions displayed below) Craft Pro Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records. Production Activity Indirect Labor Indirect Materials Other Overhead Grinding $330, eee Polishing $150,000 Product modification 550,000 Providing power $205, eee System calibration 580,000 Additional information on the drivers for its production activities follows. Grinding Polishing Product modification Providing power Systen calibration 15,000 machine hours 15,eee machine hours 2,100 engineering hours 19,000 direct labor hours 1,200 batches Number of units Machine hours Engineering hours Batches Direct labor hours Job 3175 120 units 550 MH eng. hours 10 batches 510 DLH Job 4286 1,500 units 5,500 MH eng 26 hours 30 batches 4,599 DLH 35 Problem 17-3A Parts 2, 3 & 4 1,200 Udleries System Cdluralium Number of units Machine hours Engineering hours Batches Direct labor hours Job 3175 120 units 550 MH eng. 35 hours 10 batches 510 DLH Job 4286 1,500 units 5,500 MH eng 26 hours 30 batches 4,590 DLH Problem 17-3A Part 1 Required: 1. Classify each activity as unit level, batch level, product level, or facility level. Grinding Polishing Product modification Providing power System calibration . Required information Engineering hours Batches Direct Tabor hours 35 hours 10 butches 510 DLK 26 hours 30 batches 4,590 DLH Problem 17-3A Parts 2, 3 & 4 2,3 & 4. Compute the activity overhead rates using ABC. Combine the grinding and polishing activities into a single cost pool Determine overhead costs to assign to the following jobs using ABC. What is the overhead cost per unit for Job 3175? What is the overhead cost per unit for Job 4286? (Round your activity rate and average overhead cost per unit to 2 decimal places. Round "overhead assigned to the nearest whole dollar) Job 3175 Activity driver incurred Job 420 Activity driver Incurred Overhead Cost Activity Rate Overhead assigned Activity Gending & Polishing Product modification Activity Drivers Machine hours Engineering Direct labor hrs. Providing power System calibration batches 11