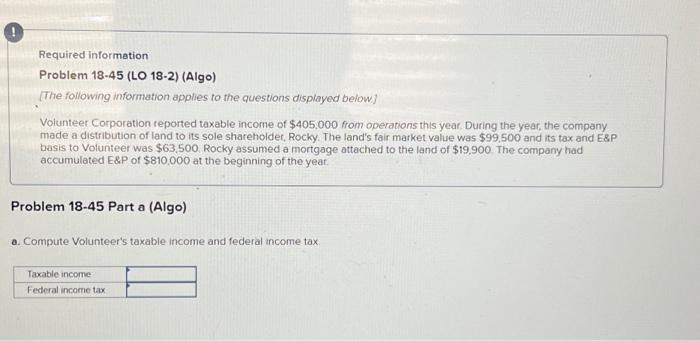

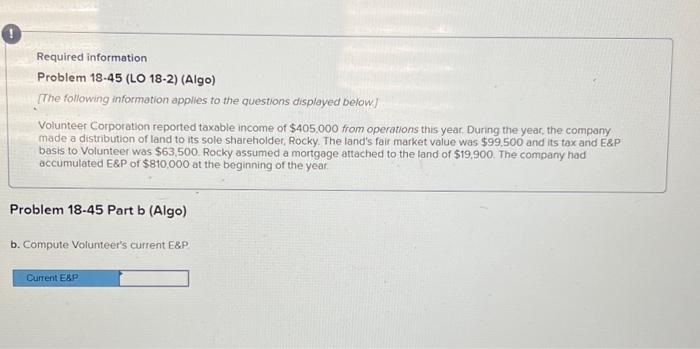

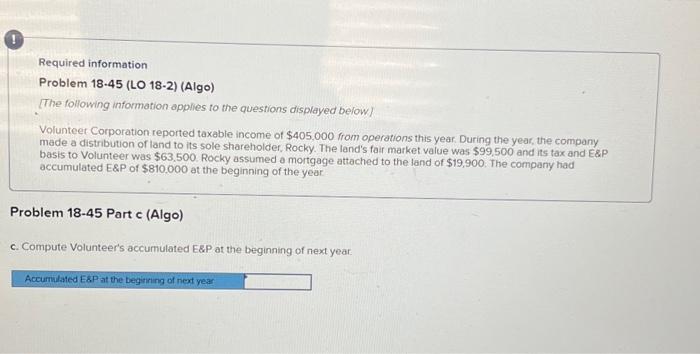

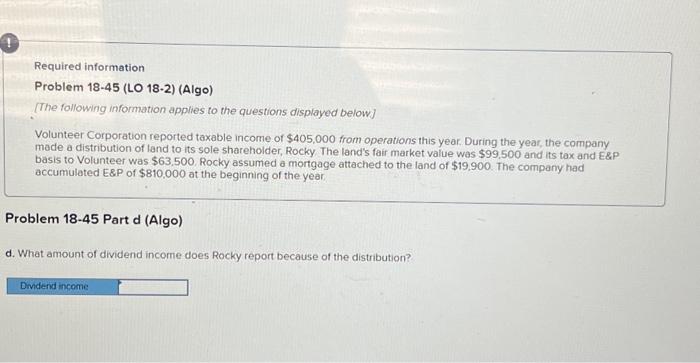

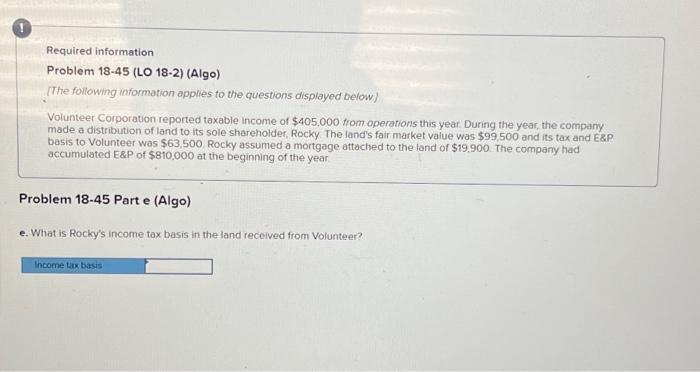

Required information Problem 18.45 (LO 18-2) (Algo) [The following information applies to the questions displayed below] Volunteet Corporation reported taxable income of $405,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky. The land's fair market value was $99,500 and its tax and E\&P basis to Volunteer was $63,500. Rocky assumed a mortgage attached to the land of $19,900. The company had accumutated E\&P of $810.000 at the beginning of the year Problem 18-45 Part c (Algo) c. Compute Volunteer's accumulated E\&P at the beginning of next year- Required information Problem 18-45 (LO 18-2) (Algo) [The following information applies to the questions displayed below] Volunteer Corporation reported taxable income of $405,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky. The land's fair market value was $99,500 and its tax and ERP basis to Volunteer was $63,500 Rocky assumed a mortgage attached to the land of $19,900. The company had accumutated E\&P of $810.000 at the beginning of the year. Problem 18-45 Part e (Algo) e. What is Rocky's income tax basis in the land received from Volunteer? Required information Problem 18.45 (LO 18-2) (Algo) [The following information applies to the questions displayed below] Volunteer Corporation reported taxable income of $405,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky. The land's fair market value was $99,500 and its tax and E\&P basis to Volunteer was $63.500. Rocky assumed a mortgage attached to the land of $19,900. The company had accumulated E\&P of $810,000 at the beginning of the year. Problem 18-45 Part b (Algo) b. Compute Volunteer's current E\&P Required information Problem 18-45 (LO 18-2) (Algo) [The following information applies to the questions displayed below] Volunteer Corporation reported taxable income of $405,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky. The land's fair market value was $99,500 and its tax and E\&P basis to Volunteer was $63,500. Rocky assumed a mortgage attached to the land of $19,900 The company had accumulated E\&P of $810,000 at the beginning of the year. Problem 18-45 Part a (Algo) a. Compute Volunteer's taxable income and federal income tax Required information Problem 18-45 (LO 18-2) (Algo) [The following information applies to the questions displayed below] Volunteer Corporation reported taxable income of $405,000 from operations this year. During the year, the company made a distribution of land to its sole shareholder, Rocky The land's fair market value was $99,500 and its tax and E\&P basis to Volunteer was $63,500. Rocky assumed a mortgage attached to the land of $19,900. The company had accumulated EBP of $810,000 at the beginning of the year. Problem 18-45 Part d (Algo) d. What amount of dividend income does Rocky report because of the distribution