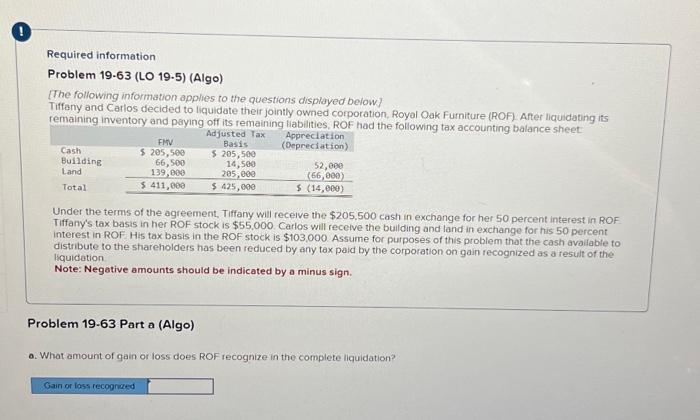

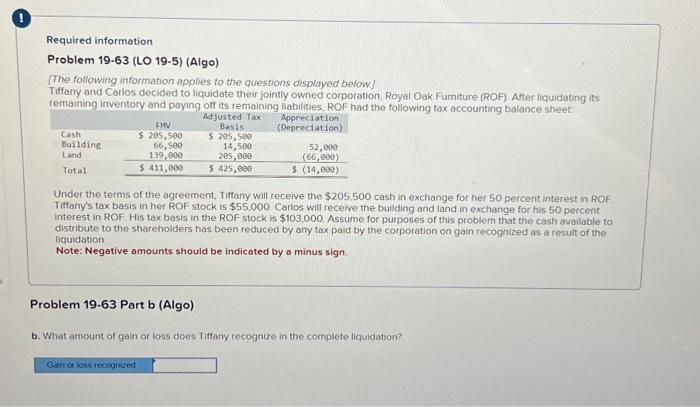

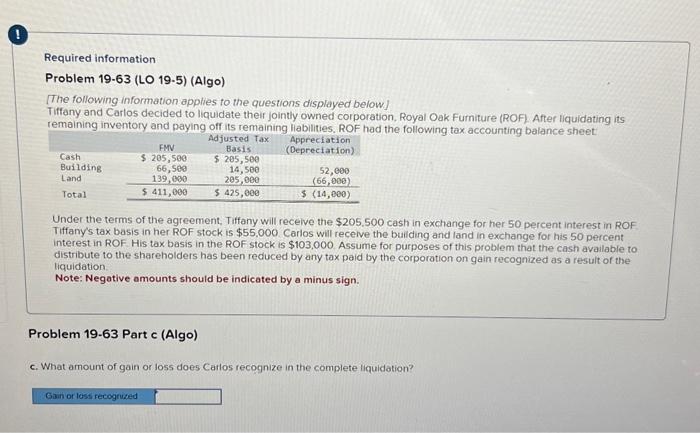

Required information Problem 19.63 (LO 19.5) (Algo) The following information applies to the questions displayed below] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF) After liquidating its remaining inventory and Daving off its remaininn fiatulitise Dne had the following tax accounting balance sheet: Under the terms of the agreement, Tiffaryy will recelve the $205.500 cash in exchange for her 50 percent interest in ROF Tiffany's tax basis in her ROF stock is $55,000. Carlos will recetve the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $103,000. Assume for purposes of this problem thot the cash avalable to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation liquidation. Note: Negative amounts should be indicated by a minus sign. Problem 19.63 Part a (Algo) a. What amount of gain or loss does ROF recognize in the complete liquidation? Problem 19.63 (LO 19.5) (Algo) [The following information applies to the questions displayed below] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF) After liquidating its temaining inventory and paying off its remaining liabilities. ROF had the following tax accounting balance sheet: Under the terms of the agreement, Tiffany will receive the $205,500 cash in exchange for her 50 percent interest in ROF Titfany's tax basis in her ROF stock is $55,000 Carlos will recelve the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $103,000. Assume for purposes of this problem that the cash available to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation Note: Negative amounts should be indicated by a minus sign. Problem 19.63 Part b (Algo) b. What amount of gain or loss does Titfany recognize in the complete liquidation? Required information Problem 19-63 (LO 19-5) (Algo) [The following information applies to the questions displayed below] Tiffany and Carlos decided to liquidate their jointly owned corporation. Royal Oak Furniture (ROF). After liquidating its remaining inventory and paying off its remainina liabilities. ROF had the following tax accounting balance sheet: Under the terms of the agreement, Tiffany will recelve the $205.500 cash in exchange for her 50 percent interest in ROF Tiffany's tax basis in her ROF stock is $55.000. Carlos will recelve the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $103,000. Assume for purposes of this problem that the cash avallable to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation. Note: Negative amounts should be indicated by a minus sign. Problem 19.63 Part c (Algo) c. What amount of gain or loss does Carlos recognize in the complete liquidation? Problem 19.63 (LO 19.5) (Algo) [The following information applies to the questions dispiayed below) Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF). After liquidating its remaining inventorv and Davina off its remainina liahilitise onf had the following tax accounting balance sheet: Under the terms of the agreement, Tiffony will receive the $205,500 cosh in exchange for her 50 percent interest in Rof Tiffany's tax basis in her ROF stock is $55,000 Carlos will receive the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $103,000. Assume for purposes of this problem that the cash avaitable to distribute to the shoreholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation Note: Negative amounts should be indicated by a minus sign. Problem 19.63 Part d (Algo) d. What is Carlos's adjusted tax basis in the building and land after the comptete liquidation? Problem 19.63 (LO 19.5) (Algo) [The following information applies to the questions displayed below] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Fumiture (ROF) After liquidating its remaining inventory and pavina off its remainina liabilities. ROF had the following tax accounting balance sheet. Under the terms of the agreement, Tiffany will recelve the $205,500 cash in exchange for her 50 percent interest in ROF Tiffany's tax basis in her ROF stock is $55,000. Carlos will receive the building and land in exchange for his 50 percent interest in ROF His tax basis in the ROF stock is $103.000. Assume for purposes of this probiem that the cash avaitable to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation. Note: Negotive amounts should be indicated by a minus sign. Problem 19-63 Part e (Algo) Assume Tiffany owns 40 percent of the ROF stock and Carlos owns 60 percent. Tiffany will receive $164.400 in the bquidation and Carlos will receive the land and bulding plus $41,100 e. What omount of gain of loss does ROF tecognize in the complete liquidation? Required information Problem 19.63 (LO 19.5) (Algo) [The following information applies to the questions displayed below] Tiffary and Carlos decided to liquidate their jointly owned corporation. Royal Oak. Furniture (ROF). After liquidating its remaining inventory and Davina off its remainina liahilitioe bnf had the following tax accounting balance sheet: Under the terms of the agreement, Tiffany will receive the $205,500 cash in exchange for her 50 percent interest in ROF Tiffany's tax basis in her ROF stock is $55,000 Carlos will receive the bulding and land in exchange for his 50 percent. interest in ROF. His tax basis in the ROF stock is $103,000. Assume for purposes of this problem that the cash avalfable to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a result of the liquidation Note: Negative amounts should be indicated by a minus sign. Problem 19.63 Part f (Algo) Assume Tiffamy owns 40 percent of the ROF stock and Carlos owns 60 percent. Tiffany will receive $164.400 in the liquidation and Corlos with receive the land and building plus $41,100 f. Whet amount of gain of loss does Tiffany recognize in the complete liquidation? Required information Problem 19.63 (LO 19.5) (Algo) [The following information applies to the questions displayed below] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Furniture (ROF). After liquidating its Under the termis or the agreement, Tiffary will receive the $205.500 cash in exchange for her 50 percent interest in RoF Tiffany's tox basis in her ROF stock is $55,000. Corlos will receive the building and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $103,000 Assume for purposes of this problem that the cash avalable to distribute to the shareholders has beon rediced by any lax paid by the corporotion on gain recognized as a result of the liquidation Note: Negative amounts should be indicated by a minus sign. Problem 19-63 Part g (Algo) Assume Tiffony owns 40 percent of the ROF stock and Corlos owns 60 percent. Inffany will receme $164,400 in the liquidation and Carios will receive the land and bulding plus $41,100 g. What amount of gain or loss does Cartos recognize in the complete liquidation? Problem 19.63 (LO 19.5) (Algo) [The following information applies to the questions displayed befow] Tiffany and Carlos decided to liquidate their jointly owned corporation, Royal Oak Fumiture (ROF). After liquidating its remaining inventorv and Daving off its remaininn liahilities Dof had the following tax accounting balance sheet. Under the terms of the agreement, Tiffany will receive the $205,500 cash in exchange for her 50 percent interest in ROF Tiffany's tax basis in her ROF stock is $55.000 Carlos will receive the bullding and land in exchange for his 50 percent interest in ROF. His tax basis in the ROF stock is $103,000 Assume for purposes of this problem that the cash avallable to distribute to the shareholders has been reduced by any tax paid by the corporation on gain recognized as a fesult of the liquidation. Note: Negative amounts should be indicated by a minus sign. Problem 19-63 Part h (Algo) Assume Tiffany owns 40 percent of the ROF stock and Carlos owns 60 percent. Tiffany will receive $164.400 in the liquidation and Carlos will recelve the land and building plus $41,100. h. What is Carlos's adjusted tax basis in the bullding and land after the complete liquidation