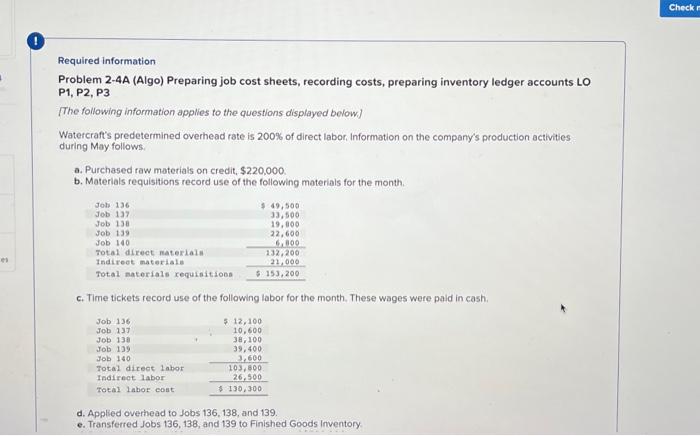

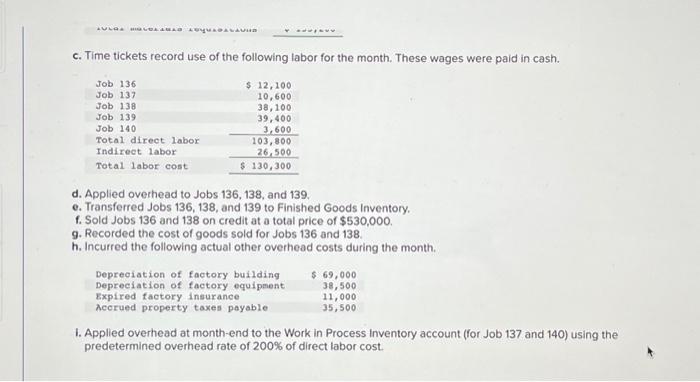

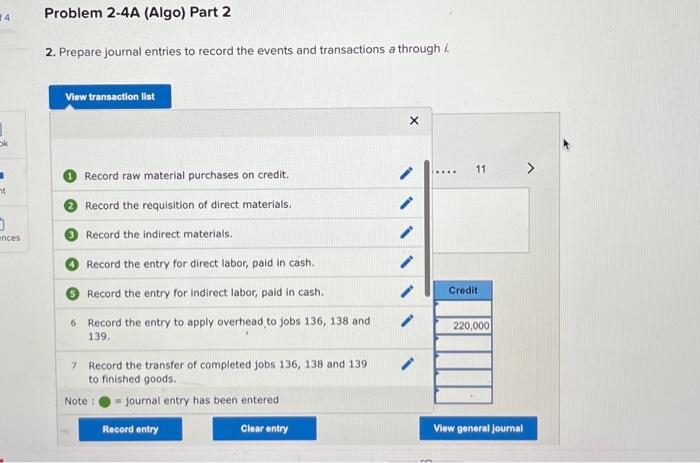

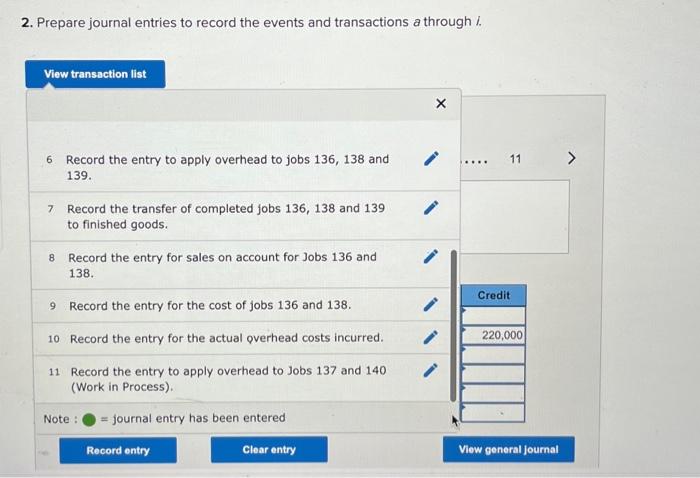

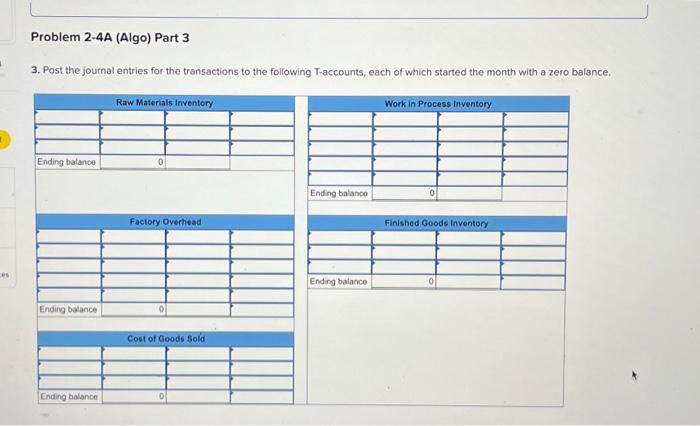

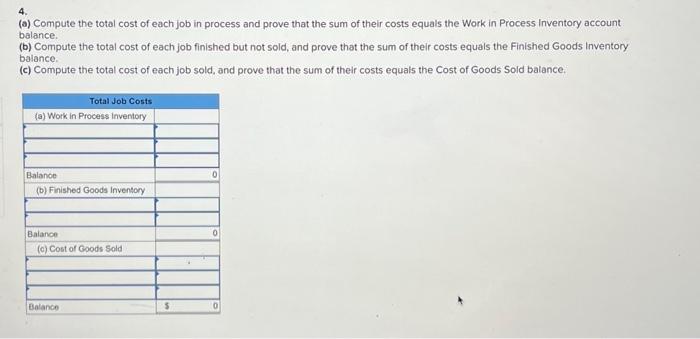

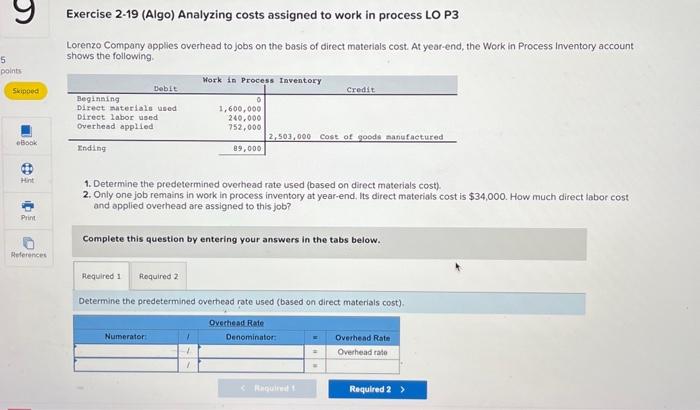

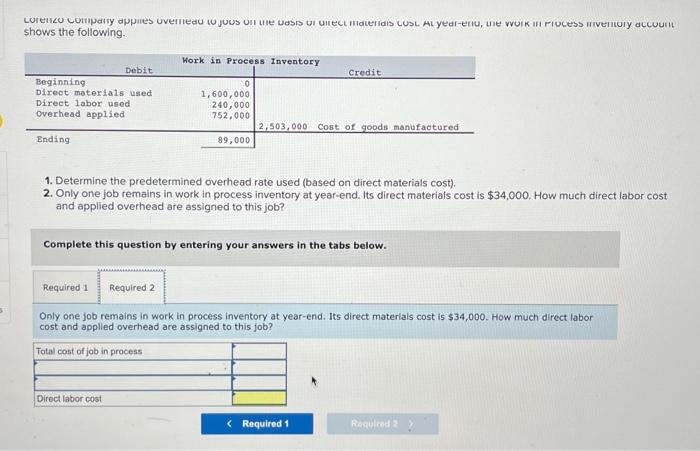

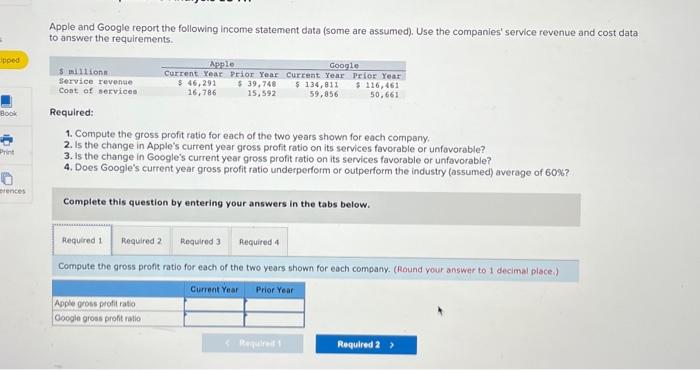

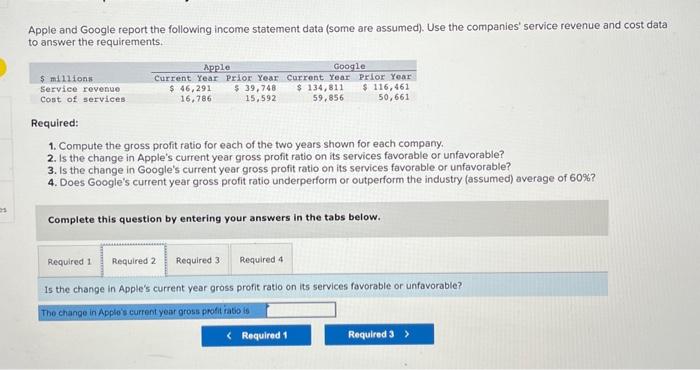

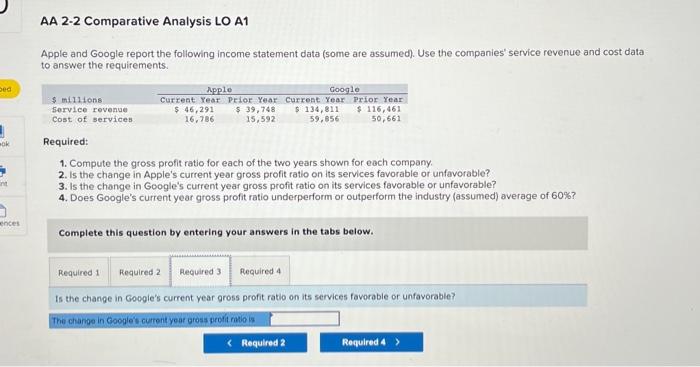

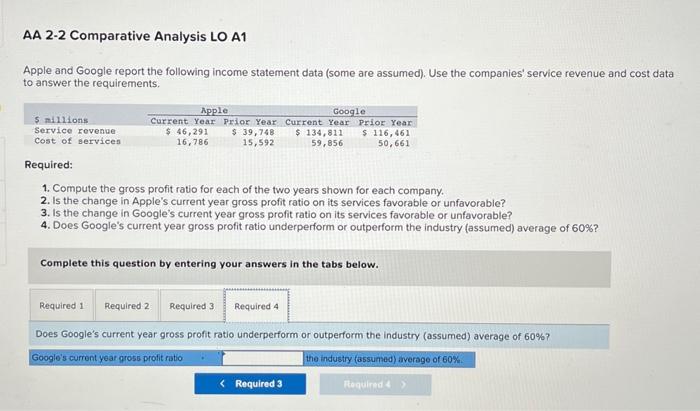

Required information Problem 2-4A (Algo) Preparing job cost sheets, recording costs, preparing inventory ledger accounts LO P1, P2, P3 [The following information applies to the questions displayed bolow] Watercraft's predetermined overhead rate is 200% of direct labor. Information on the company's production activities during May follows. a. Purchased raw materials on credit, $220,000 b. Materials requisitions record use of the following materials for the month. c. Time tickets record use of the following labor for the month. These wages were paid in cash. d. Applied overhead to Jobs 136, 138, and 139. e. Transferred Jobs 136,138 , and 139 to Finished Goods Inventory c. Time tickets record use of the following labor for the month. These wages were paid in cash. d. Applied overhead to Jobs 136,138 , and 139. e. Transferred Jobs 136, 138, and 139 to Finished Goods Inventory. f. Sold Jobs 136 and 138 on credit at a total price of $530,000. g. Recorded the cost of goods sold for Jobs 136 and 138. h. Incurred the following actual other overhead costs during the month. 1. Applied overhead at month-end to the Work in Process Inventory account (for Job 137 and 140) using the predetermined overhead rate of 200% of direct labor cost. 2. Prepare journal entries to record the events and transactions a through i. Record raw material purchases on credit. Record the requisition of direct materials. Record the indirect materials. Record the entry for direct labor, paid in cash. Record the entry for indirect labor, paid in cash. 6. Record the entry to apply overhead to jobs 136,138 and 139. 7 Record the transfer of completed jobs 136,138 and 139 to finished goods. Note : C= journal entry has been entered 2. Prepare journal entries to record the events and transactions a through /. 6. Record the entry to apply overhead to jobs 136,138 and 139. 7 Record the transfer of completed jobs 136,138 and 139 to finished goods. 8 Record the entry for sales on account for Jobs 136 and 138. 9 Record the entry for the cost of jobs 136 and 138. 10 Record the entry for the actual qverhead costs incurred. 11 Record the entry to apply overhead to Jobs 137 and 140 (Work in Process). Note : O= journal entry has been entered 3. Post the journal entries for the transactions to the following T-accounts, each of which started the month with a zero balance. 4. (a) Compute the total cost of each job in process and prove that the sum of their costs equals the Work in Process Inventory account balance. (b) Compute the total cost of each job finished but not sold, and prove that the sum of their costs equals the Finished Goods Inventory balance. (c) Compute the total cost of each job sold, and prove that the sum of their costs equals the Cost of Goods Sold balance. Exercise 2-19 (Algo) Analyzing costs assigned to work in process LO P3 Lorenzo Company opplies overhead to jobs on the basis of direct materials cost. At year-end, the Work in Process Inventory account shows the following. 1. Determine the predetermined overhead rate used (based on direct materials cost). 2. Only one job remains in work in process inventory at year-end, its direct materials cost is $34,000. How much direct labor cost and applied overhead are assigned to this job? Complete this question by entering your answers in the tabs below. Determine the predetermined overhead rate used (based on direct materials cost). shows the following. 1. Determine the predetermined overhead rate used (based on direct materials cost). 2. Only one job remains in work in process inventory at year-end. Its direct materiais cost is $34,000. How much direct labor cost and applied overhead are assigned to this job? Complete this question by entering your answers in the tabs below. Only one job remains in work in process inventory at year-end. Its direct materlals cost is $34,000. How much direct labor cost and applied overhead are assigned to this job? Apple and Google report the following income statement data (some are assumed). Use the companies' service revenue and cost data answer the requirements. Required: 1. Compute the gross profit ratio for each of the fwo years shown for each company. 2. Is the change in Apple's current year gross profit ratio on its services favorable or unfovorable? 3. Is the change in Google's current year gross profit ratio on its services favorable or unfavorable? 4. Does Google's current year gross profit ratio underperform or outperform the industry (assumed) average of 60% ? Complete this question by entering your answers in the tabs below. Compute the gross proft ratio for each of the two years shown for each company. (Round your answer to 1 decimal place.) Apple and Google report the following income statement data (some are assumed). Use the companies' service revenue and cost data to answer the requirements. Required: 1. Compute the gross profit ratio for each of the two years shown for each company. 2. Is the change in Apple's current year gross profit ratio on its services favorable or unfavorable? 3. Is the change in Google's current year gross profit ratio on its services favorable or unfavorable? 4. Does Google's current year gross profit ratio underperform or outperform the industry (assumed) average of 60% ? Complete this question by entering your answers in the tabs below. Is the change in Apple's current year gross profit ratio on its services favorable or unfavorable? Apple and Google report the following income statement data (some are assumed). Use the companies' service revenue and cost data to answer the requirements. Required: 1. Compute the gross profit ratio for each of the two years shown for each company. 2. Is the change in Apple's current year gross profit ratio on its services favorable or unfavorable? 3. Is the change in Google's current year gross profit ratio on its services favorable or unfavorable? 4. Does Google's current year gross profit ratio underperform or outperform the industry (assumed) average of 60% ? Complete this question by entering your answers in the tabs below. Is the change in Google's current year gross profit ratio on its services favorable or unfavorable? Apple and Google report the following income statement data (some are assumed). Use the companies' service revenue and cost data to answer the requirements. Required: 1. Compute the gross profit ratio for each of the two years shown for each company. 2. Is the change in Apple's current year gross profit ratio on its services favorable or unfavorable? 3. Is the change in Google's current year gross profit ratio on its services favorable or unfavorable? 4. Does Google's current year gross profit ratio underperform or outperform the industry (assumed) average of 60% ? Complete this question by entering your answers in the tabs below