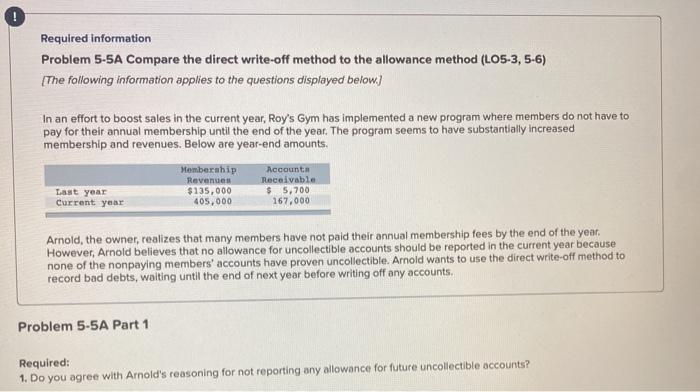

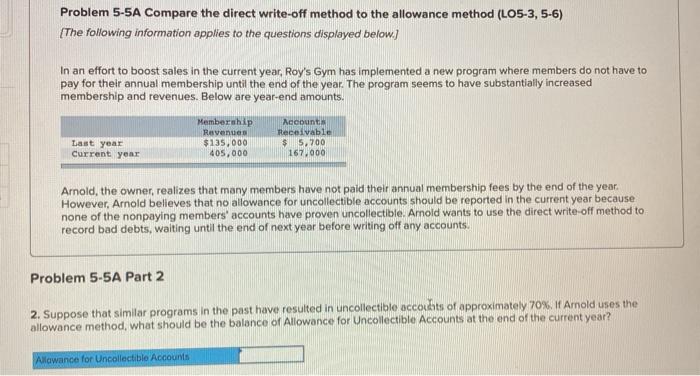

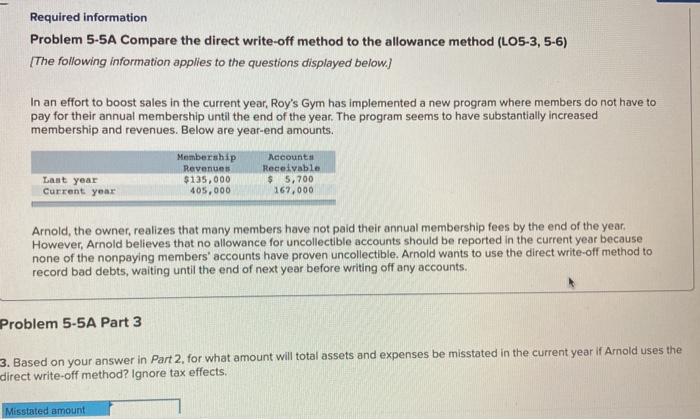

! Required information Problem 5-5A Compare the direct write-off method to the allowance method (L05-3,5-6) [The following information applies to the questions displayed below.) In an effort to boost sales in the current year, Roy's Gym has implemented a new program where members do not have to pay for their annual membership until the end of the year. The program seems to have substantially increased membership and revenues. Below are year-end amounts. Membership Revenue $135,000 405,000 Last year Current year Account Receivable $ 5,700 167,000 Arnold, the owner, realizes that many members have not paid their annual membership fees by the end of the year. However, Arnold believes that no allowance for uncollectible accounts should be reported in the current year because none of the nonpaying members' accounts have proven uncollectible. Arnold wants to use the direct write-off method to record bad debts, waiting until the end of next year before writing off any accounts. Problem 5-5A Part 1 Required: 1. Do you agree with Arnold's reasoning for not reporting any allowance for future uncollectible accounts? Problem 5-5A Compare the direct write-off method to the allowance method (LO5-3,5-6) [The following information applies to the questions displayed below) In an effort to boost sales in the current year, Roy's Gym has implemented a new program where members do not have to pay for their annual membership until the end of the year. The program seems to have substantially increased membership and revenues. Below are year-end amounts. Membership Ravenues $135,000 405,000 Last year Current year Account Receivable $ 5.700 167.000 Arnold, the owner, realizes that many members have not paid their annual membership fees by the end of the year. However, Arnold believes that no allowance for uncollectible accounts should be reported in the current year because none of the nonpaying members' accounts have proven uncollectible. Arnold wants to use the direct write-off method to record bad debts, waiting until the end of next year before writing off any accounts. Problem 5-5A Part 2 2. Suppose that similar programs in the past have resulted in uncollectible accoubts of approximately 70%, I Amold uses the allowance method, what should be the balance of Allowance for Uncollectible Accounts at the end of the current year? Allowance for Uncollectible Accounts Required information Problem 5-5A Compare the direct write-off method to the allowance method (LO5-3,5-6) The following information applies to the questions displayed below.) In an effort to boost sales in the current year, Roy's Gym has implemented a new program where members do not have to pay for their annual membership until the end of the year. The program seems to have substantially increased membership and revenues. Below are year-end amounts. Last year Current year Membership Revenues $135,000 405,000 Accounts Receivable $ 5,700 167,000 Arnold, the owner, realizes that many members have not paid their annual membership fees by the end of the year, However, Arnold believes that no allowance for uncollectible accounts should be reported in the current year because none of the nonpaying members' accounts have proven uncollectible. Arnold wants to use the direct write-off method to record bad debts, waiting until the end of next year before writing off any accounts. Problem 5-5A Part 3 3. Based on your answer in Part 2, for what amount will total assets and expenses be misstated in the current year if Arnold uses the direct write-off method? Ignore tax effects, Misstated amount