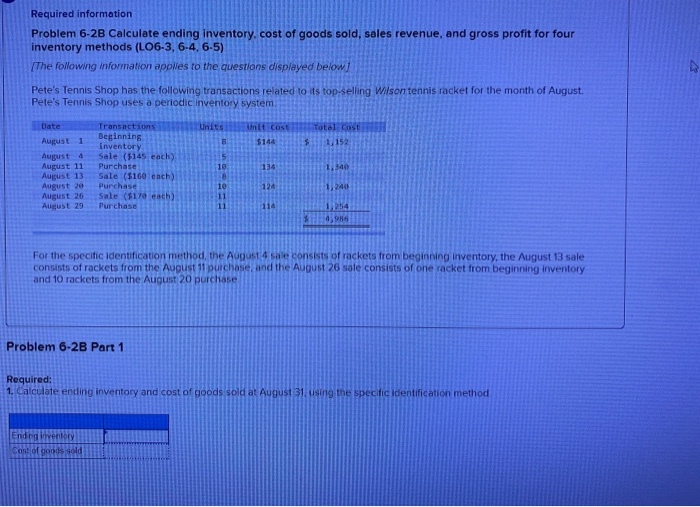

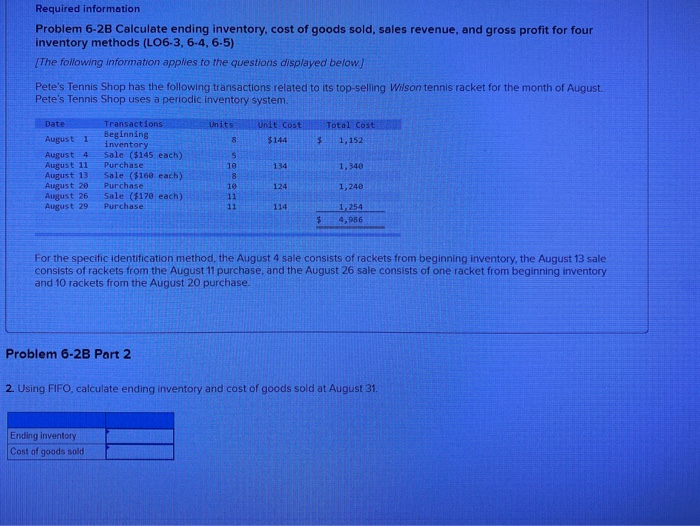

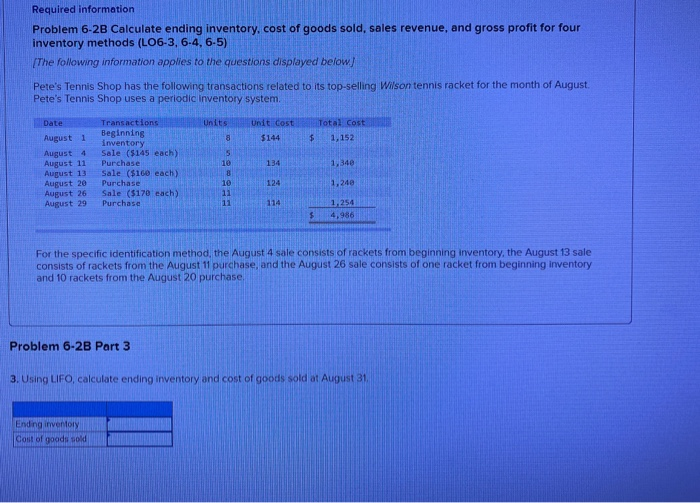

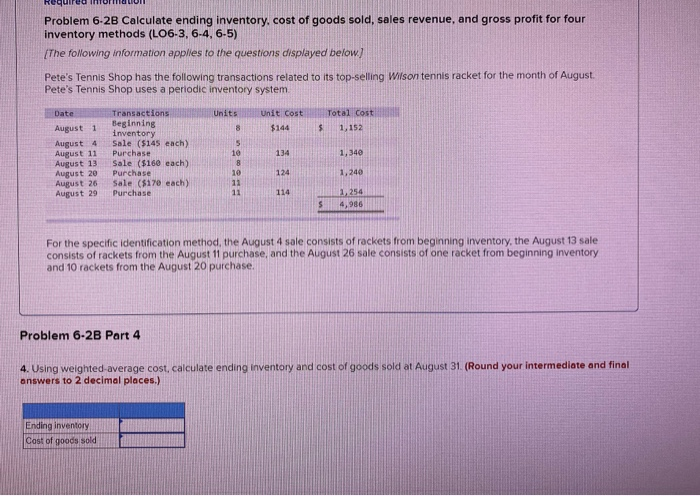

Required information Problem 6-2B Calculate ending inventory cost of goods sold, sales revenue, and gross profit for four inventory methods (L06-3, 6-4, 6-5) The following information apples to the questions displayed below! Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete's Tennis Shop uses a periodic inventory system Units Unit Cost $144 Totel Cost 1/152 8 $ Date August 1 August 4 August 11 August 13 August 20 August 26 August 29 Transactions Beginning inventory Sale ($145 each) Purchase Sale ($160 each) Purchase Sale $170 each) Purchase 10 134 1,340 10 124 1240 11 114 1254 4,99 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sole consists of one racket from beginning inventory and 10 rackets from the August 20 purchase Problem 6-2B Part 1 Required: 1. Calculate ending inventory and cost of goods sold at August 31, using the specific identification method Ending inventory Cost of goods old Required information Problem 6-2B Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4, 6-5) (The following information applies to the questions displayed below) Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete's Tennis Shop uses a periodic inventory system Date Units Unit Cost $144 Total Cost 1,152 8 $ 4 Transactions Beginning inventory Sale ($145 each) Purchase Sale (5160 each) Purchase Sale ($170 each) Purchase 134 August 1 August August 11 August 13 August 20 August 26 August 29 1,340 5 10 8 10 11 11 124 1,240 114 1.254 4,986 $ For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. Problem 6-2B Part 2 2. Using FIFO, calculate ending inventory and cost of goods sold at August 31. Ending inventory Cost of goods sold Required information Problem 6-2B Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4, 6-5) The following information applies to the questions displayed below.) Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete's Tennis Shop uses a periodic inventory system, Date Units Unit cost $144 Total Cost 1,152 8 $ Transactions Beginning inventory Sale ($145 each) Purchase Sale ($160 each) Purchase Sale $170 each) Purchase 134 August 1 August 4 August 11 August 13 August 20 August 26 August 29 1,340 5 110 8 10 11 11 1,240 114 1,254 4,986 $ For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase Problem 6-2B Part 3 3. Using LIFO, calculate ending inventory and cost of goods sold at August 31, Ending inventory Cont of goods sold Problem 6-2B Calculate ending inventory, cost of goods sold, sales revenue, and gross profit for four inventory methods (LO6-3, 6-4, 6-5) The following information applies to the questions displayed below) Pete's Tennis Shop has the following transactions related to its top-selling Wilson tennis racket for the month of August. Pete's Tennis Shop uses a periodic inventory system Units Unit Cost $144 Total Cost 1,152 8 $ Date August 1 August 4 August 11 August 13 August 20 August 26 August 29 Transactions Beginning inventory Sale ($145 each) Purchase Sale ($160 each) Purchase Sale ($170 each) Purchase 134 1,340 5 10 8 10 11 11 124 1,240 114 1.254 $ 4,986 For the specific identification method, the August 4 sale consists of rackets from beginning inventory, the August 13 sale consists of rackets from the August 11 purchase, and the August 26 sale consists of one racket from beginning inventory and 10 rackets from the August 20 purchase. Problem 6-2B Part 4 4. Using weighted average cost, calculate ending inventory and cost of goods sold at August 31. (Round your intermediate and final answers to 2 decimal places.) Ending inventory Cost of goods sold