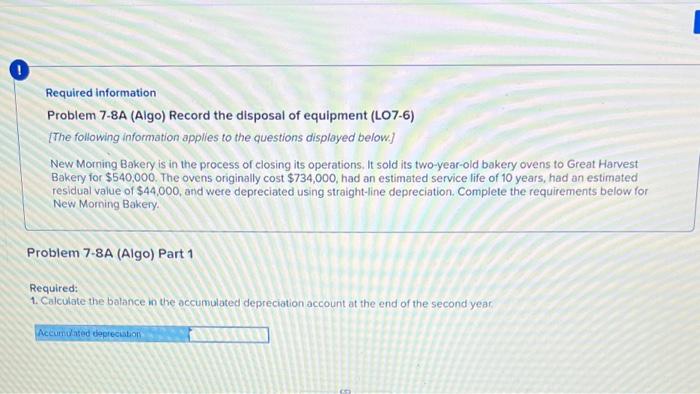

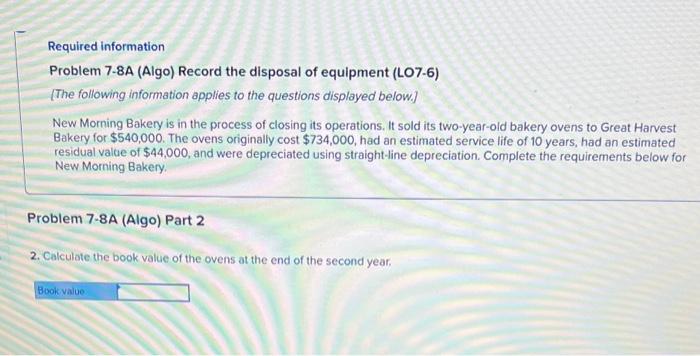

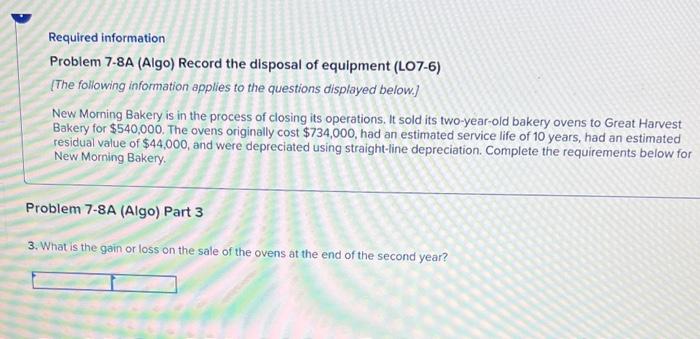

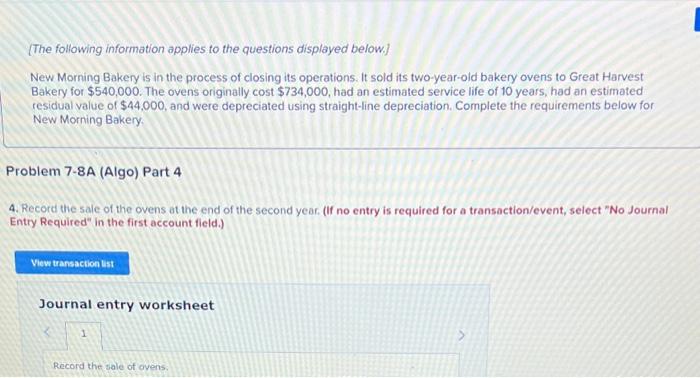

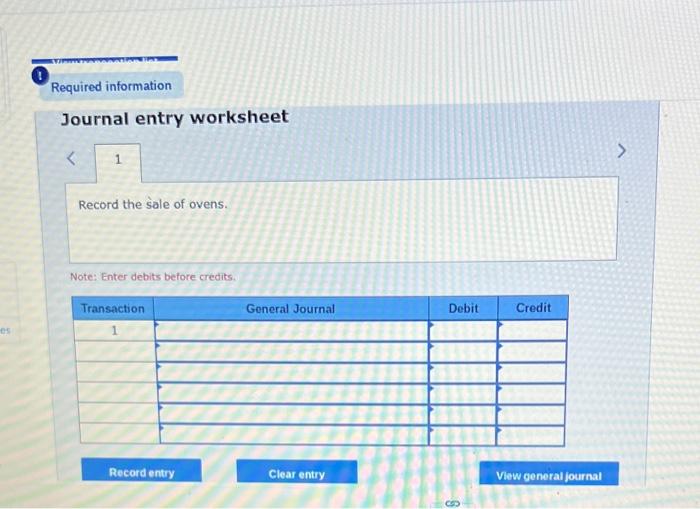

Required information Problem 7-8A (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations, It sold its two-year-old bakery ovens to Great Harvest Bakery for $540,000. The ovens originally cost $734,000, had an estimated service life of 10 years, had an estimated residual value of $44,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 1 Required: 1. Calculate the balance in the accumulated depreciation account at the end of the second year: Required information Problem 7-8A (Algo) Record the disposal of equipment (LO7-6) [The foliowing information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $540,000. The ovens originally cost $734,000, had an estimated service life of 10 years, had an estimated residual value of $44,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 2 2. Calculate the book value of the ovens at the end of the second year, Problem 7-8A (Algo) Record the disposal of equipment (LO7-6) [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $540,000. The ovens originally cost $734,000, had an estimated service life of 10 years, had an estimated residual value of $44,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 3 3. What is the gain or loss on the sale of the ovens at the end of the second year? [The following information applies to the questions displayed below.] New Morning Bakery is in the process of closing its operations. It sold its two-year-old bakery ovens to Great Harvest Bakery for $540,000. The ovens originally cost $734,000, had an estimated service life of 10 years, had an estimated residual value of $44,000, and were depreciated using straight-line depreciation. Complete the requirements below for New Morning Bakery. Problem 7-8A (Algo) Part 4 4. Record the sale of the ovens at the end of the second year. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Note: Enter debits before credits