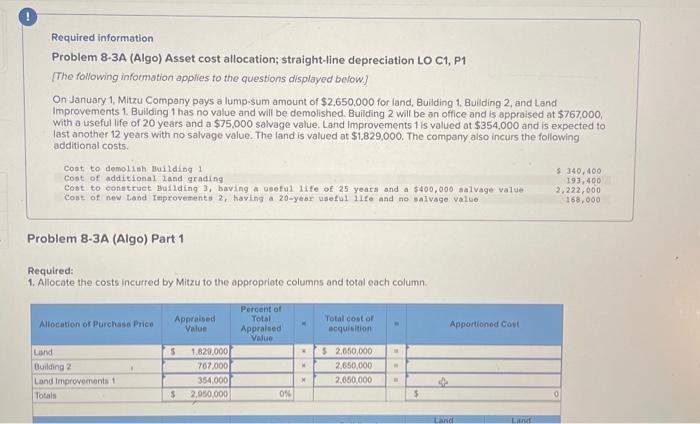

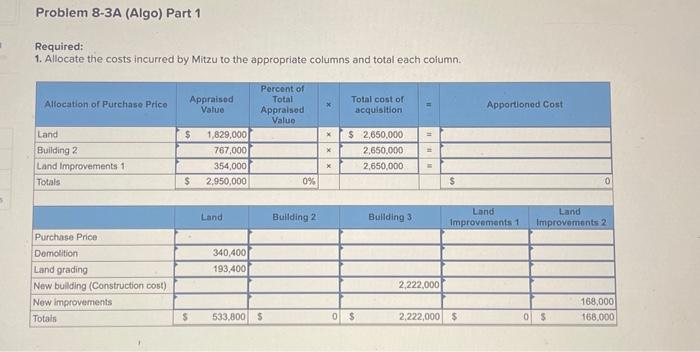

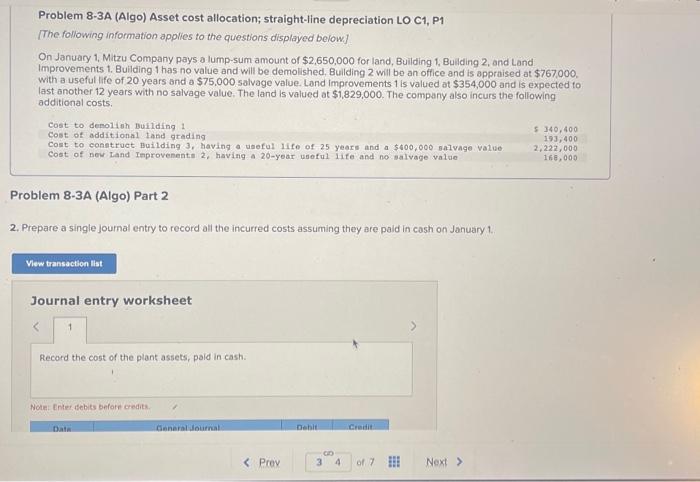

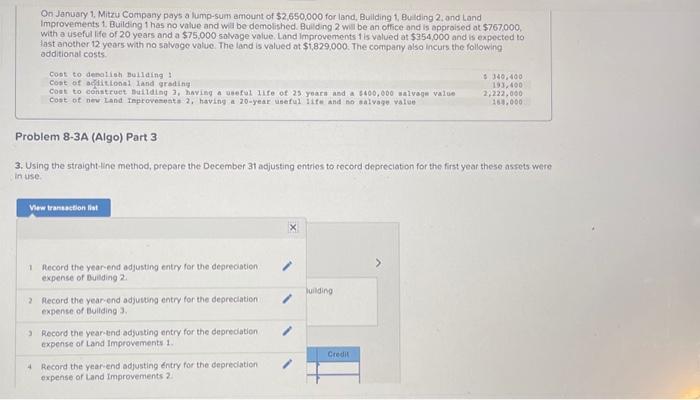

Required information Problem 8-3A (Algo) Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below.] On January 1, Mitzu Company pays a lump-sum amount of $2,650,000 for land, Building 1, Builing 2, and Land Improvements 1. Bullding 1 has no value and will be demolished. Building 2 will be an office and is appraised at $767,000, with a useful life of 20 years and a $75,000 salvage value. Land Improvements 1 is valued at $354,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,829,000. The company also incurs the following additional costs. Cost to demolish Builing 1 Cont of additional land grading Cost to construct Building 3, baving a usetul life of 25 years and a $400,000 salvage value 2,222,000 Cost of new tand Improversents 2 , having a 20-year useful ilfe and no saIvage value. Cont 2,222,000 168,000 Problem 8-3A (Algo) Part 1 Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each column. Required: 1. Allocate the costs incurred by Mitzu to the appropriate columns and total each coiumn. Problem 8-3A (Algo) Asset cost allocation; straight-line depreciation LO C1, P1 [The following information applies to the questions displayed below] On January 1, Mitzu Company pays a lump-sum amount of $2,650,000 for land, Building 1, Building 2, and Land Improvements 1. Buliding 1 has no value and will be demolished, Building 2 will be an office and is appraised at $767,000, with a useful life of 20 years and a $75,000 salvage value. Land improvements 1 is valued at $354,000 and is expected to last another 12 years with no salvage value. The land is valued at $1,829,000. The company also incurs the following additional costs. Cost to depollish building 1 Cost of additional tand grading Cost to construet Building 3, having a useful lifo of 25 year and a $400,000 salvage value Cost of new Land improvenents 2, having a 20 -year useful life and no salvage value 5140,400 193,400 2,222,000 166,000 Problem 8-3A (Algo) Part 2 2. Prepare a single joumal entry to record all the incurred costs assuming they are paid in cash on January 1. On January 1, Mitzu Company pays a lump-surm amount of $2,650,000 for land, Bullding 1, Bulding 2, and Land Improvements 1. Building 1 has no value and wia be demolished. Building 2 wil be an office and is approised at $767000 with a useful life of 20 years and a $75,000 salvoge volue. Lond improvements 1 is valued at $354,000 and is expected to fast another 12 years with no salvage value. The land is valued at $1,829,000. The corppany also incurs the following odditional costs Cost to-denolish Builaing : Cost of acFitionsl land grading cost of nee Land inprove=pata 2, having a 20-year useful lite and no natvage vatue 290,000 Problem 8-3A (Algo) Part 3 3. Using the straight-line method, prepare the December 3t adjusting entries to record depreciation for the first year these assets were in use. 1 Record the yearend edjusting entry for the depreoation expense of Bulding 2 2 Aecord the year end adjuuing entry for the depreciation expense of Bullding 3 . 3 Record the yearitend adjusting entry for the depreciation expense of Land Improvements 1 . 4 Record the yeariend adjusting entry for the depreciation expense of Land improvements