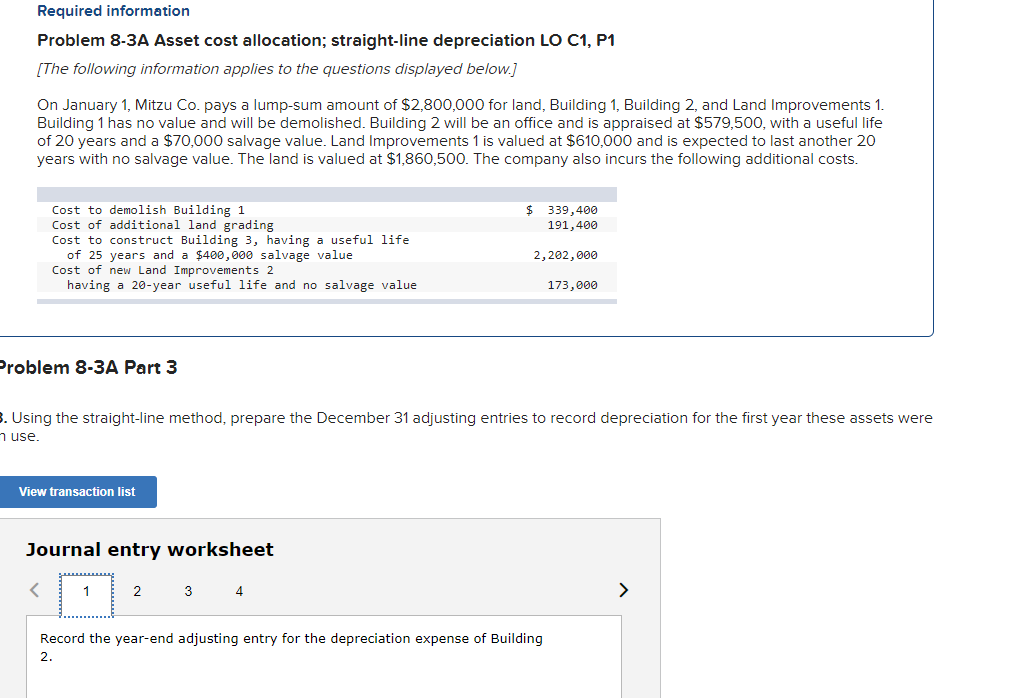

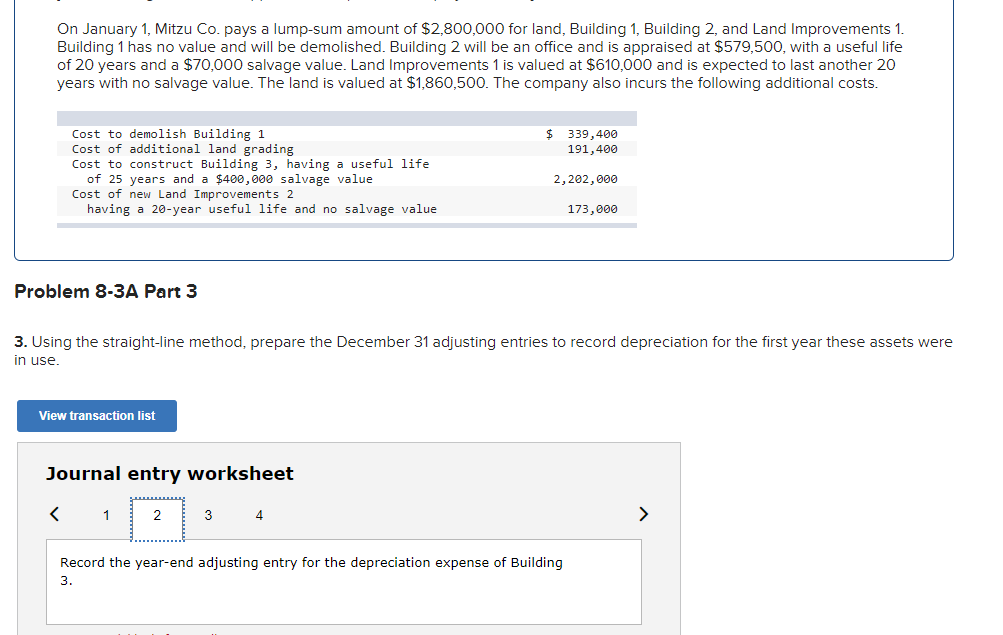

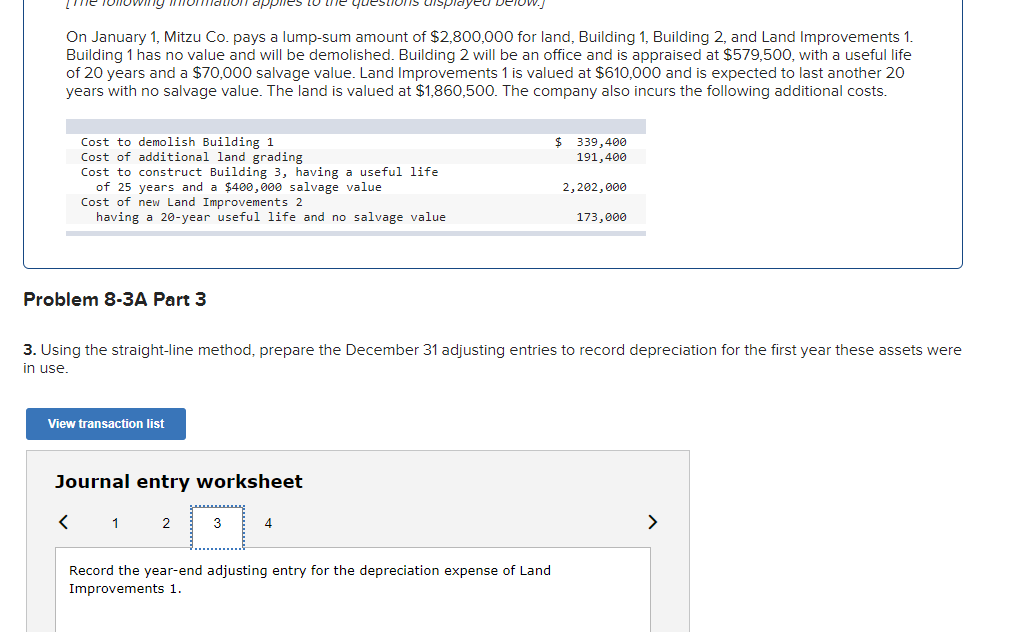

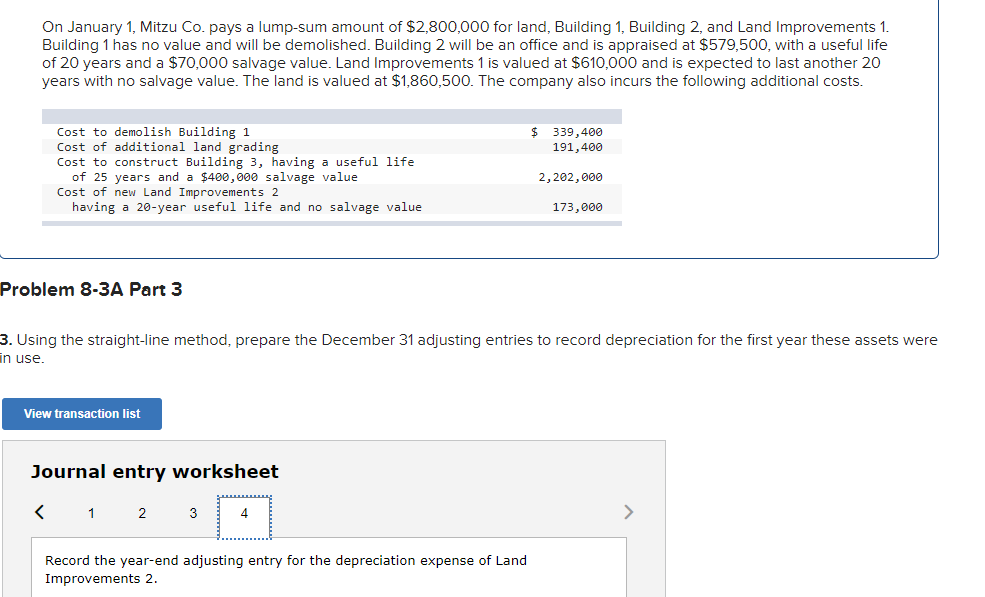

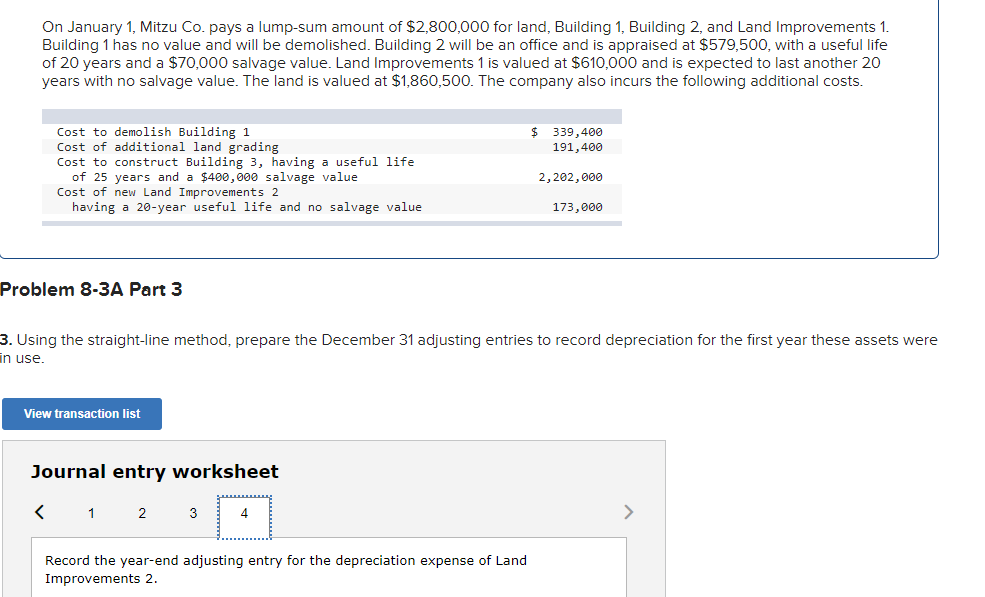

Required information Problem 8-3A Asset cost allocation; straight-line depreciation LO C1, P1 (The following information applies to the questions displayed below.) On January 1, Mitzu Co. pays a lump-sum amount of $2,800,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $579,500, with a useful life of 20 years and a $70,000 salvage value. Land Improvements 1 is valued at $610,000 and is expected to last another 20 years with no salvage value. The land is valued at $1,860,500. The company also incurs the following additional costs. $ 339,400 191,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2,202,000 173,000 Problem 8-3A Part 3 . Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were 7 use. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Building 2. On January 1, Mitzu Co. pays a lump-sum amount of $2,800,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $579,500, with a useful life of 20 years and a $70,000 salvage value. Land Improvements 1 is valued at $610,000 and is expected to last another 20 years with no salvage value. The land is valued at $1,860,500. The company also incurs the following additional costs. $ 339,400 191,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2,202,000 173,000 Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Building 3. my mon alloir app lo e questois unsplayeu Delow.] On January 1, Mitzu Co. pays a lump-sum amount of $2,800,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $579,500, with a useful life of 20 years and a $70,000 salvage value. Land Improvements 1 is valued at $610,000 and is expected to last another 20 years with no salvage value. The land is valued at $1,860,500. The company also incurs the following additional costs. $ 339,400 191,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2,202,000 173,000 Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Land Improvements 1. On January 1, Mitzu Co. pays a lump-sum amount of $2,800,000 for land, Building 1, Building 2, and Land Improvements 1. Building 1 has no value and will be demolished. Building 2 will be an office and is appraised at $579,500, with a useful life of 20 years and a $70,000 salvage value. Land Improvements 1 is valued at $610,000 and is expected to last another 20 years with no salvage value. The land is valued at $1,860,500. The company also incurs the following additional costs. $ 339,400 191,400 Cost to demolish Building 1 Cost of additional land grading Cost to construct Building 3, having a useful life of 25 years and a $400,000 salvage value Cost of new Land Improvements 2 having a 20-year useful life and no salvage value 2,202,000 173,000 Problem 8-3A Part 3 3. Using the straight-line method, prepare the December 31 adjusting entries to record depreciation for the first year these assets were in use. View transaction list Journal entry worksheet Record the year-end adjusting entry for the depreciation expense of Land Improvements 2