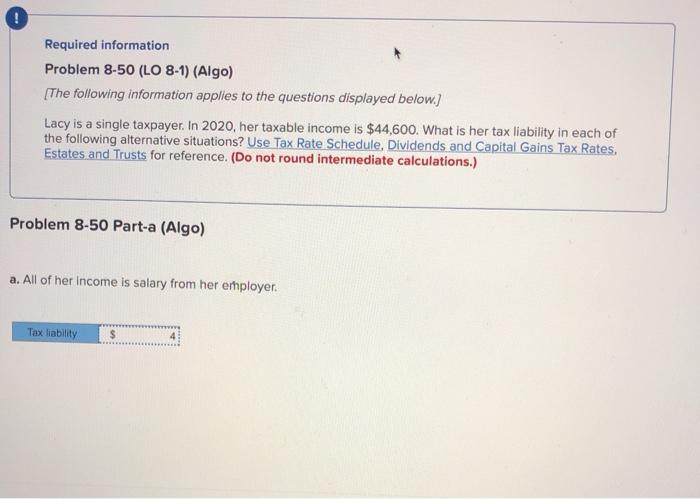

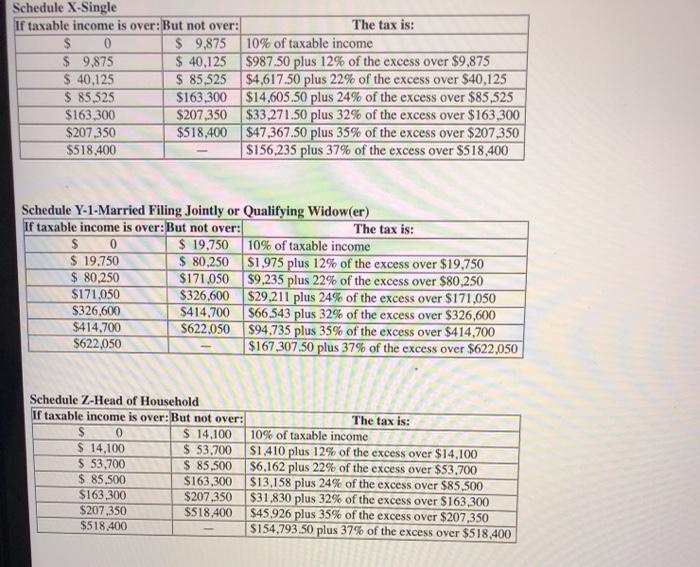

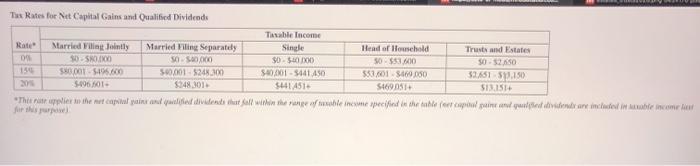

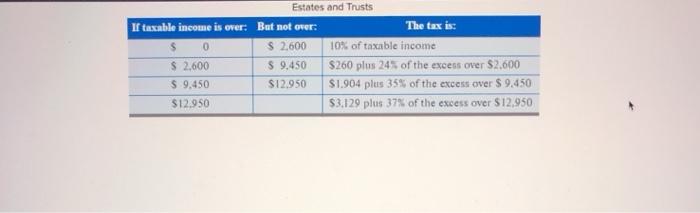

Required information Problem 8-50 (LO 8-1) (Algo) [The following information applies to the questions displayed below.) Lacy is a single taxpayer. In 2020, her taxable income is $44,600. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule. Dividends and Capital Gains Tax Rates, Estates and Trusts for reference. (Do not round intermediate calculations.) Problem 8-50 Part-a (Algo) a. All of her income is salary from her employer. Tax liability Schedule X-Single If taxable income is over: But not over: The tax is: $ 0 $ 9,875 10% of taxable income $ 9,875 $ 40,125 $987.50 plus 12% of the excess over $9.875 $ 40,125 $ 85,525 $4,617 50 plus 22% of the excess over $40,125 $ 85,525 $163,300 $14,605.50 plus 24% of the excess over $85,525 $163,300 $207,350 $33,271.50 plus 32% of the excess over $163,300 $207,350 $518,400 $47,367.50 plus 35% of the excess over $207 350 $518,400 $156,235 plus 37% of the excess over $518,400 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: But not over: The tax is: $ 0 $ 19,750 10% of taxable income $ 19.750 $ 80,250 $1,975 plus 12% of the excess over $19.750 $ 80,250 $171.050 $9,235 plus 22% of the excess over $80,250 $171,050 $326,600 $29.211 plus 24% of the excess over $171,050 $326,600 5414,700 566.543 plus 32% of the excess over $326,600 $414,700 $622.050 $94.735 plus 35% of the excess over $414,700 $622,050 $167,307 50 plus 37% of the excess over $622,050 Schedule Z-Head of Household If taxable income is over: But not over: The tax is: $ 0 $ 14,100 10% of taxable income $ 14,100 $ 53,700 $1.410 plus 12% of the excess over $14,100 $ 53,700 $ 85,500 $6,162 plus 22% of the excess over $53.700 $ 85,500 $163,300 $13,158 plus 24% of the excess over $85.500 $163,300 $207,350 $31,830 plus 32% of the excess over $163,300 $207,350 $518,400 $45 926 plus 35% of the excess over $207,350 $518,400 $154,793 50 plus 37% of the excess over $518,400 Tu Rates for Net Capital Gains and Qualified Dividende Table Income Rate Married Wilin Jointly Married Piling Separately Single Head of Household Trust and Estates SOSO 00 SOS $0 $40 100 SO3600 50 - $2.50 11 S015495.000 5.40,0015248.300 340201 - 5401.450 553/01 160.000 32,651 57.150 31 5096 101 $248 3011 $441451- 546905 513.151 "This wether capired divenhet all whole inceciind the table prevarende become Estates and Trusts If taxable income is over. But not over: The tax is: $ 0 $ 2.600 10% of taxable income $ 2,600 $ 9,450 $260 plus 245 of the excess over $2.600 $ 9,450 $12.950 $1.904 plus 35% of the excess over $ 9.450 $12.950 $3.129 plus 37% of the excess over $12,950