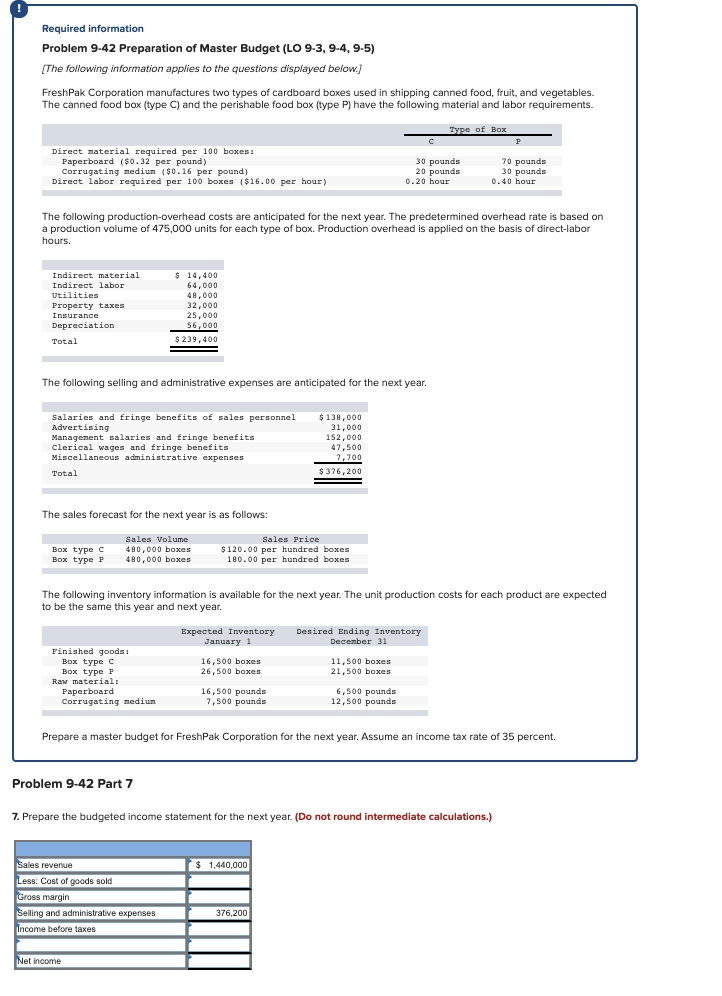

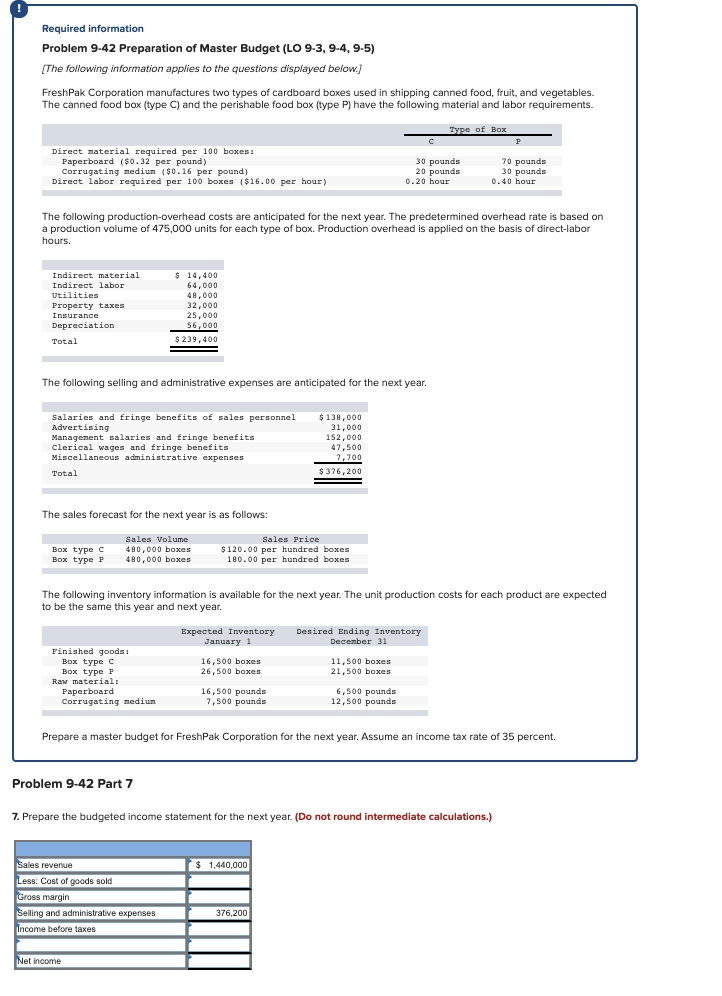

Required information Problem 9-42 Preparation of Master Budget (LO 9-3, 9-4, 9-5) (The following information applies to the questions displayed below.) Fresh Pak Corporation manufactures two types of cardboard boxes used in shipping canned food, fruit and vegetables. The canned food box (type C) and the perishable food box (type P) have the following material and labor requirements. Bype of Box c F Direct material required per 100 boxes: Paperboard ($0.32 per pound) Corrugating medium ($0.16 per pound) Direct labor required per 100 boxes ($16.00 per hour) 30 pounds 20 pounds 0.20 hour 70 pounds 30 pounds 0.40 hour The following production-overhead costs are anticipated for the next year. The predetermined overhead rate is based on a production volume of 475,000 units for each type of box. Production overhead is applied on the basis of direct-labor hours. Indirect material Indirect labor Utilities Property taxes Insurance Depreciation Total $ 14,400 64,000 48,000 32,000 25,000 56,000 $ 239,400 The following selling and administrative expenses are anticipated for the next year. Salaries and fringe benefits of sales personnel Advertising Management salaries and fringe benefits clerical wages and fringe benefits Miscellaneous administrative expenses Total $ 138,000 31,000 152,000 47,500 7,700 $376,200 The sales forecast for the next year is as follows: Box type C Box type P Sales Volume 480,000 boxes 480,000 boxes Sales Price $120.00 per hundred boxes 180.00 per hundred boxes The following inventory information is available for the next year. The unit production costs for each product are expected to be the same this year and next year. . Expected Inventory January 1 Desired Ending Inventory December 31 Finished goods : Box type C Box type P Raw material: Paperboard Corrugating medium 16,500 boxes 26,500 boxes 11,500 boxes 21,500 boxes 16,500 pounds 7,500 pounds 6,500 pounds 12,500 pounds Prepare a master budget for FreshPak Corporation for the next year. Assume an income tax rate of 35 percent. Problem 9-42 Part 7 7. Prepare the budgeted income statement for the next year. (Do not round intermediate calculations.) . ) $ 1,440,000 Sales revenue Less: Cost of goods sold Gross margin Selling and administrative expenses Income before taxes 376,200 Net Income