Answered step by step

Verified Expert Solution

Question

1 Approved Answer

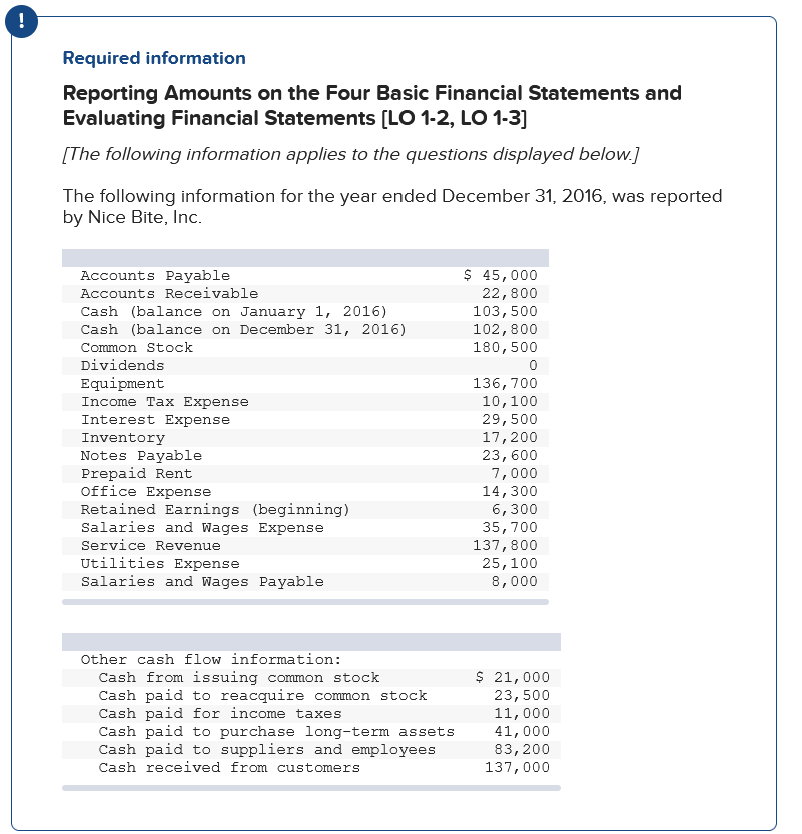

Required information Reporting Amounts on the Four Basic Financial Statements and Evaluating Financial Statements [LO 1-2, LO 1-3] [The following information applies to the questions

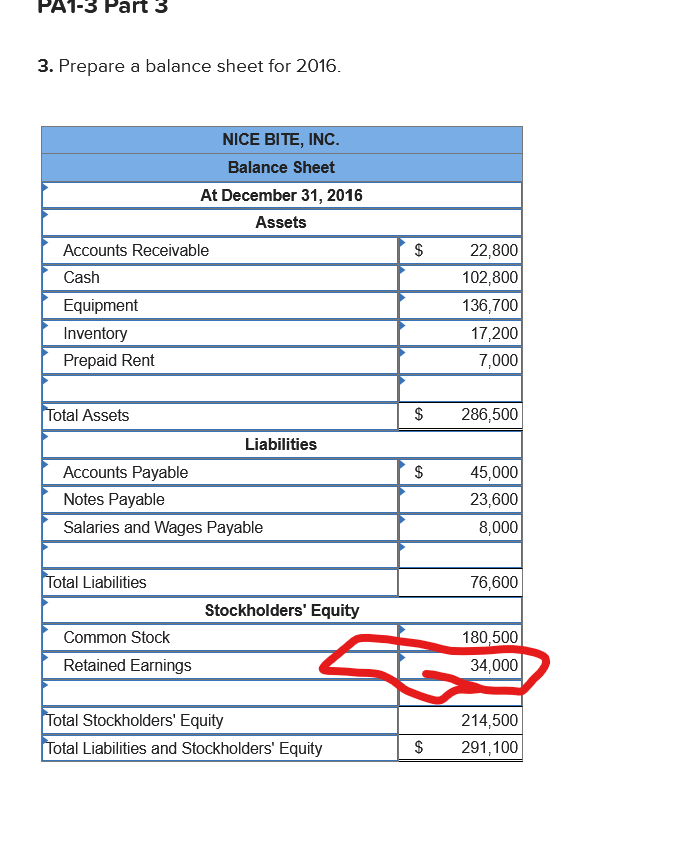

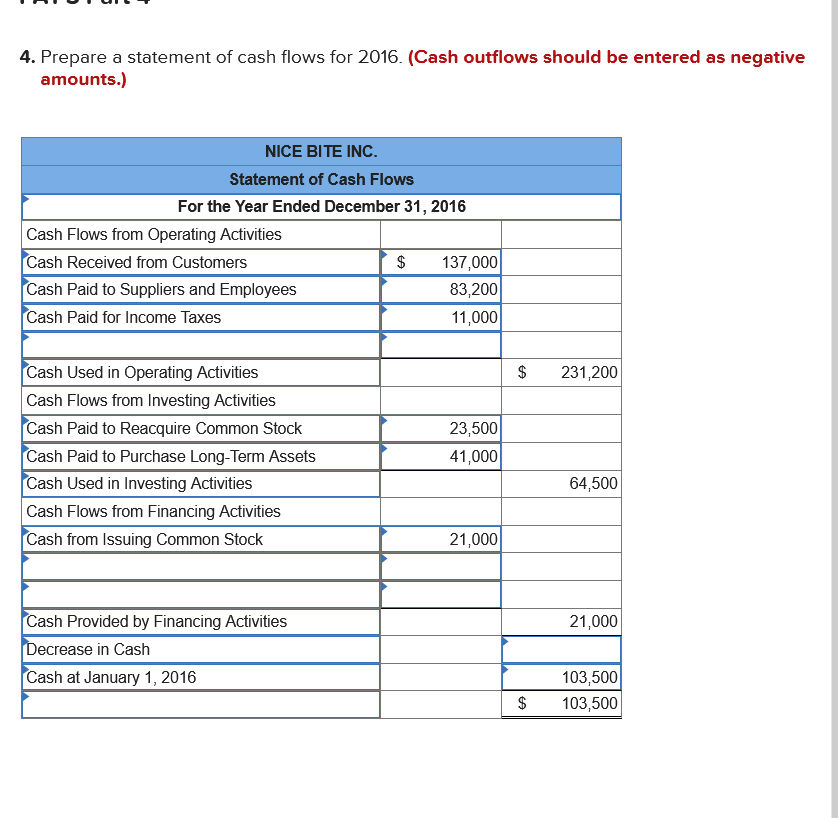

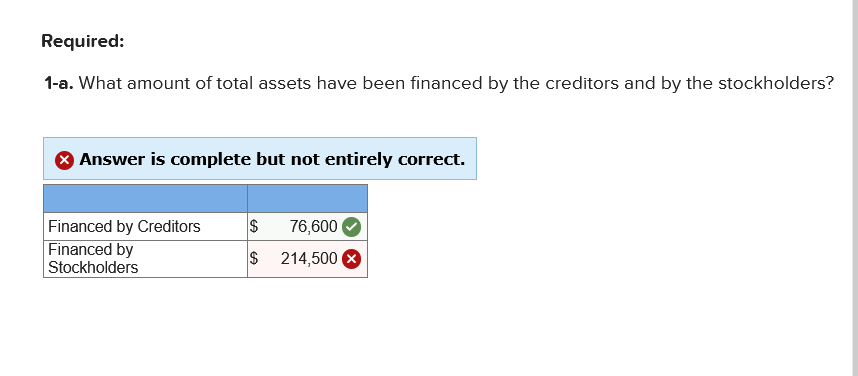

Required information Reporting Amounts on the Four Basic Financial Statements and Evaluating Financial Statements [LO 1-2, LO 1-3] [The following information applies to the questions displayed below.) The following information for the year ended December 31, 2016, was reported by Nice Bite, Inc. O O Accounts Payable Accounts Receivable Cash (balance on January 1, 2016) Cash (balance on December 31, 2016) Common Stock Dividends Equipment Income Tax Expense Interest Expense Inventory Notes Payable Prepaid Rent Office Expense Retained Earnings (beginning) Salaries and Wages Expense Service Revenue Utilities Expense Salaries and Wages Payable $ 45,000 22,800 103,500 102,800 180, 500 0 136, 700 10,100 29,500 17, 200 23, 600 7,000 14,300 6,300 35, 700 137,800 25,100 8,000 Other cash flow information: Cash from issuing common stock Cash paid to reacquire common stock Cash paid for income taxes Cash paid to purchase long-term assets Cash paid to suppliers and employees Cash received from customers $ 21,000 23,500 11,000 41,000 83,200 137,000 PA1-3 Part 3 3. Prepare a balance sheet for 2016. NICE BITE, INC. Balance Sheet At December 31, 2016 Assets Accounts Receivable Cash Equipment Inventory Prepaid Rent $ 22,800 102,800 136,700 17,200 7,000 $ 286,500 Total Assets Liabilities Accounts Payable Notes Payable Salaries and Wages Payable $ 45,000 23,600 8,000 Total Liabilities 76,600 Stockholders' Equity Common Stock Retained Earnings 180,500 34,000 Total Stockholders' Equity Total Liabilities and Stockholders' Equity 214,500 291,100 $ 4. Prepare a statement of cash flows for 2016. (Cash outflows should be entered as negative amounts.) NICE BITE INC. Statement of Cash Flows For the Year Ended December 31, 2016 Cash Flows from Operating Activities Cash Received from Customers $ 137,000 Cash Paid to Suppliers and Employees 83,200 Cash Paid for Income Taxes 11,000 $ 231,200 Cash Used in Operating Activities Cash Flows from Investing Activities Cash Paid to Reacquire Common Stock Cash Paid to Purchase Long-Term Assets Cash Used in Investing Activities Cash Flows from Financing Activities Cash from Issuing Common Stock 23,500 41,000 64,500 21,000 21,000 Cash Provided by Financing Activities Decrease in Cash Cash at January 1, 2016 103,500 103,500 $ Required: 1-a. What amount of total assets have been financed by the creditors and by the stockholders? Answer is complete but not entirely correct. Financed by Creditors Financed by Stockholders $ 76,600 $ 214,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started