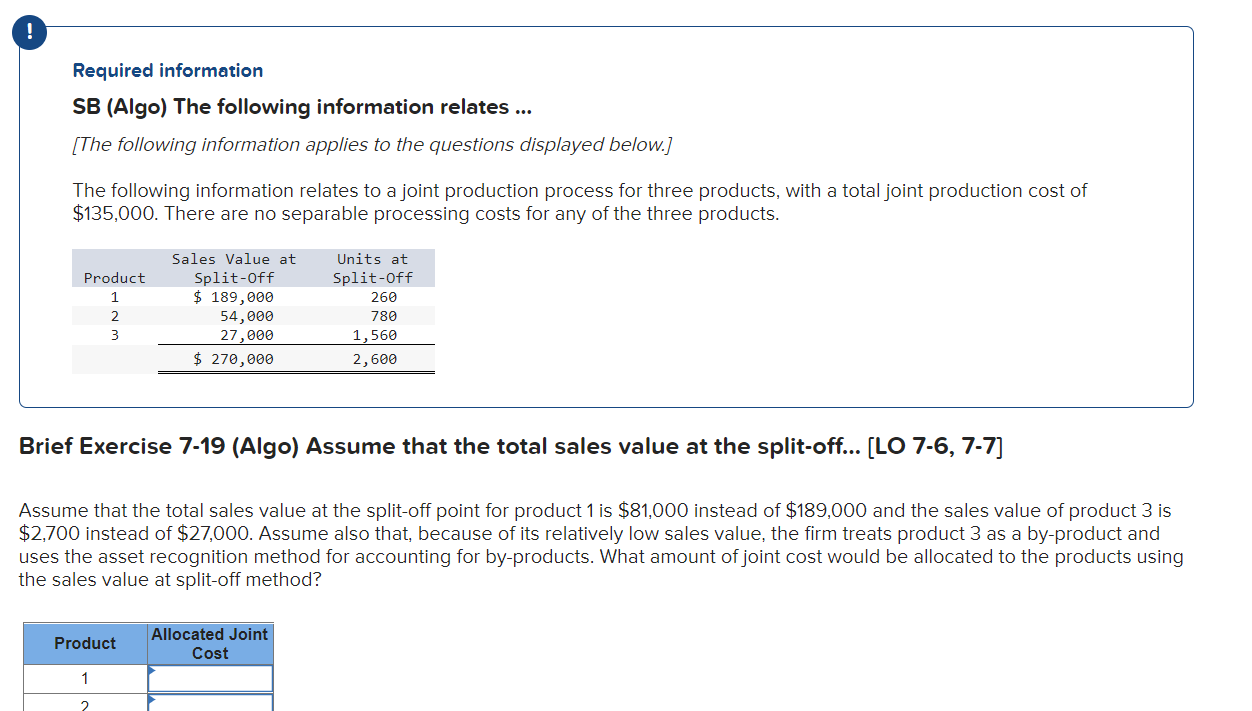

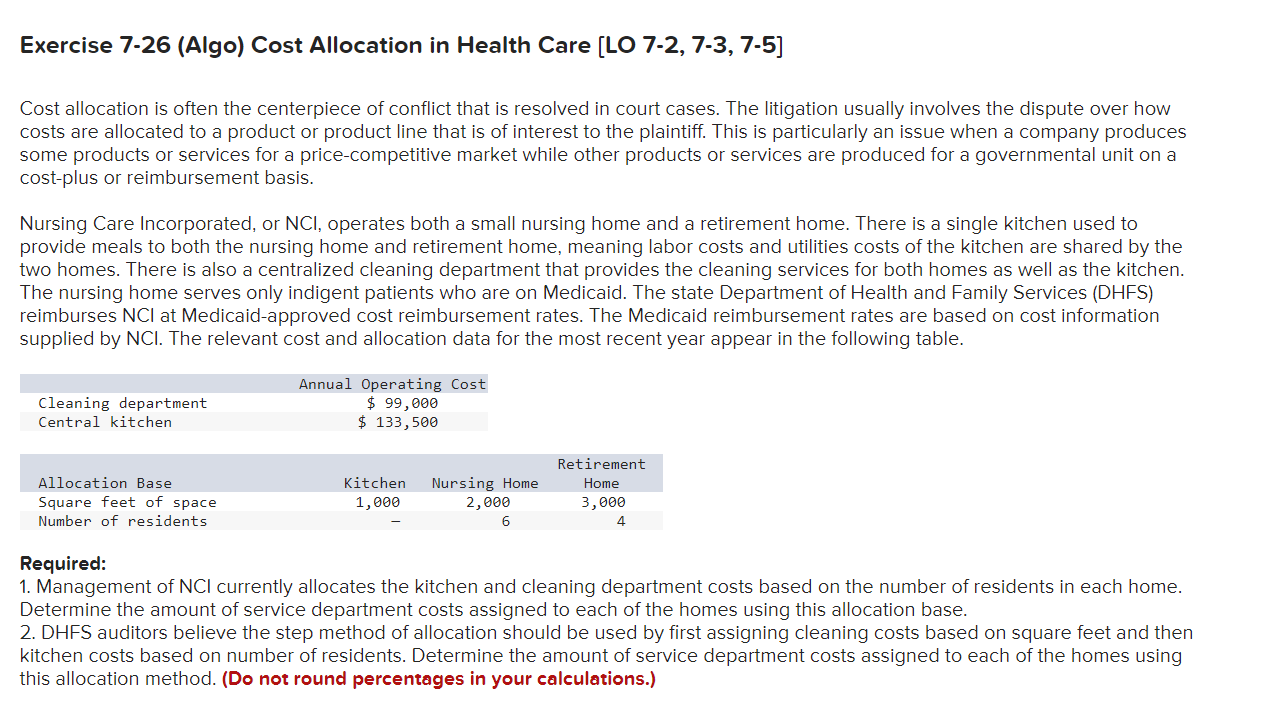

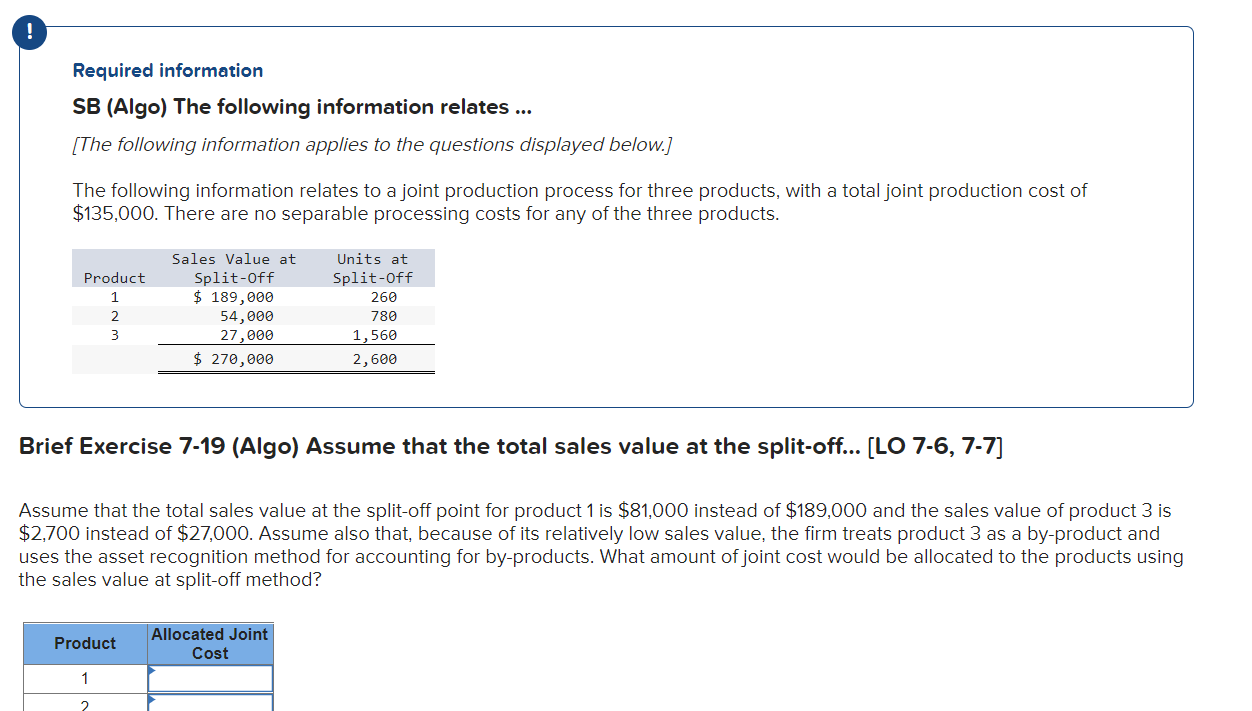

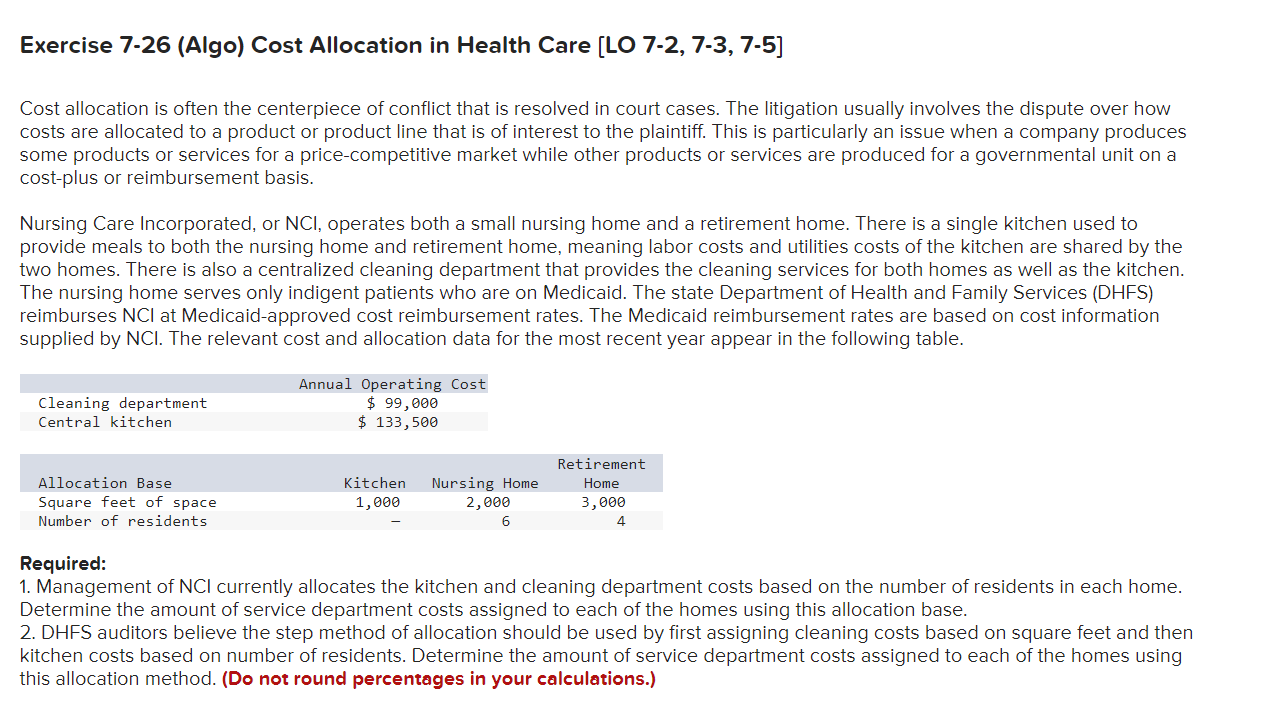

Required information SB (Algo) The following information relates ... [The following information applies to the questions displayed below.] The following information relates to a joint production process for three products, with a total joint production cost of $135,000. There are no separable processing costs for any of the three products. Brief Exercise 7-19 (Algo) Assume that the total sales value at the split-off... [LO 7-6, 7-7] Assume that the total sales value at the split-off point for product 1 is $81,000 instead of $189,000 and the sales value of product 3 is 2,700 instead of $27,000. Assume also that, because of its relatively low sales value, the firm treats product 3 as a by-product and Ises the asset recognition method for accounting for by-products. What amount of joint cost would be allocated to the products using he sales value at split-off method? Exercise 7-26 (Algo) Cost Allocation in Health Care [LO 7-2, 7-3, 7-5] Cost allocation is often the centerpiece of conflict that is resolved in court cases. The litigation usually involves the dispute over how costs are allocated to a product or product line that is of interest to the plaintiff. This is particularly an issue when a company produces some products or services for a price-competitive market while other products or services are produced for a governmental unit on a cost-plus or reimbursement basis. Nursing Care Incorporated, or NCl, operates both a small nursing home and a retirement home. There is a single kitchen used to provide meals to both the nursing home and retirement home, meaning labor costs and utilities costs of the kitchen are shared by the two homes. There is also a centralized cleaning department that provides the cleaning services for both homes as well as the kitchen. The nursing home serves only indigent patients who are on Medicaid. The state Department of Health and Family Services (DHFS) reimburses NCl at Medicaid-approved cost reimbursement rates. The Medicaid reimbursement rates are based on cost information supplied by NCl. The relevant cost and allocation data for the most recent year appear in the following table. Required: 1. Management of NCl currently allocates the kitchen and cleaning department costs based on the number of residents in each home. Determine the amount of service department costs assigned to each of the homes using this allocation base. 2. DHFS auditors believe the step method of allocation should be used by first assigning cleaning costs based on square feet and then kitchen costs based on number of residents. Determine the amount of service department costs assigned to each of the homes using this allocation method. (Do not round percentages in your calculations.)