Required information

Skip to question

[The following information applies to the questions displayed below.]

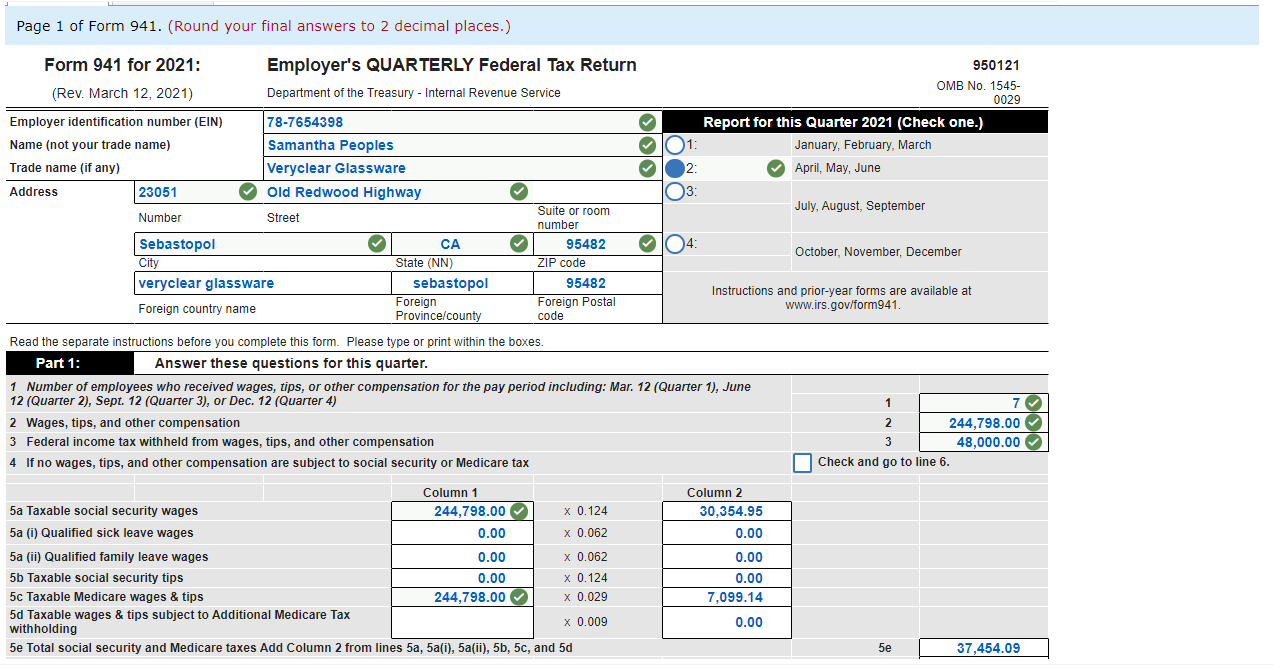

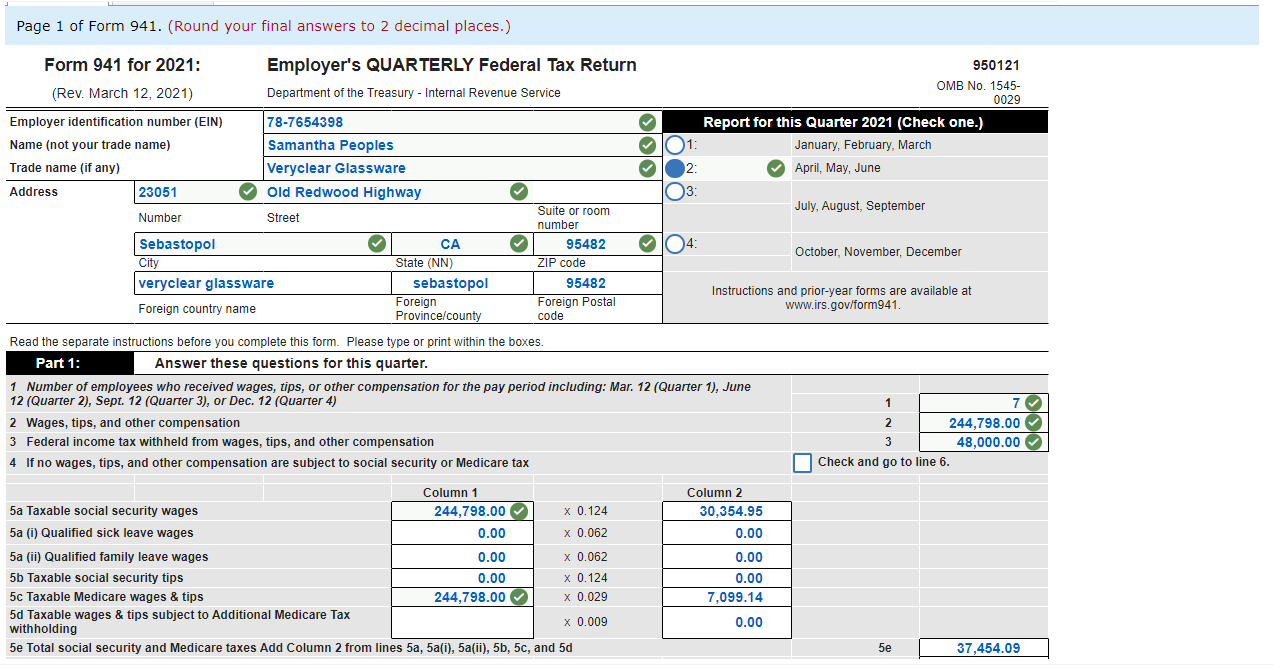

Veryclear Glassware is a new business owned by Samantha Peoples, the company president. Her first year of operation commenced on April 1, 2021.

EIN: 78-7654398

Address: 23051 Old Redwood Highway, Sebastopol, California 95482, phone 707-555-5555

Number of employees: 7

Wages, tips, and other compensation paid during the second quarter of 2021: $244,798

Income tax withheld from employees: $48,000

Social Security tax withheld from employees: $15,177.48

Medicare tax withheld from employees: $3,549.57

| Monthly tax liability: |

| April | $ 28,484.69 |

| May | 28,484.69 |

| June | 28,484.70 |

Required:

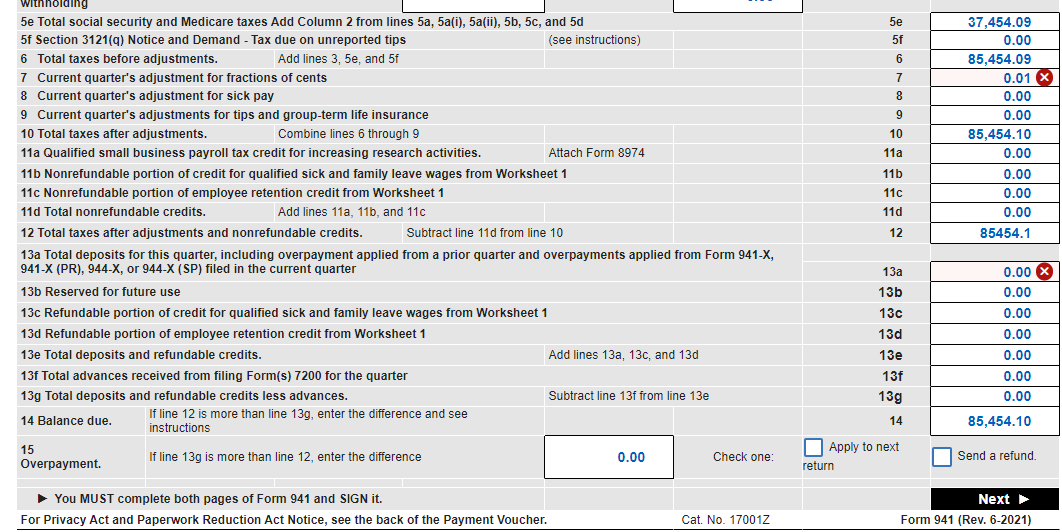

Complete the following Form 941 for the second quarter of 2021.

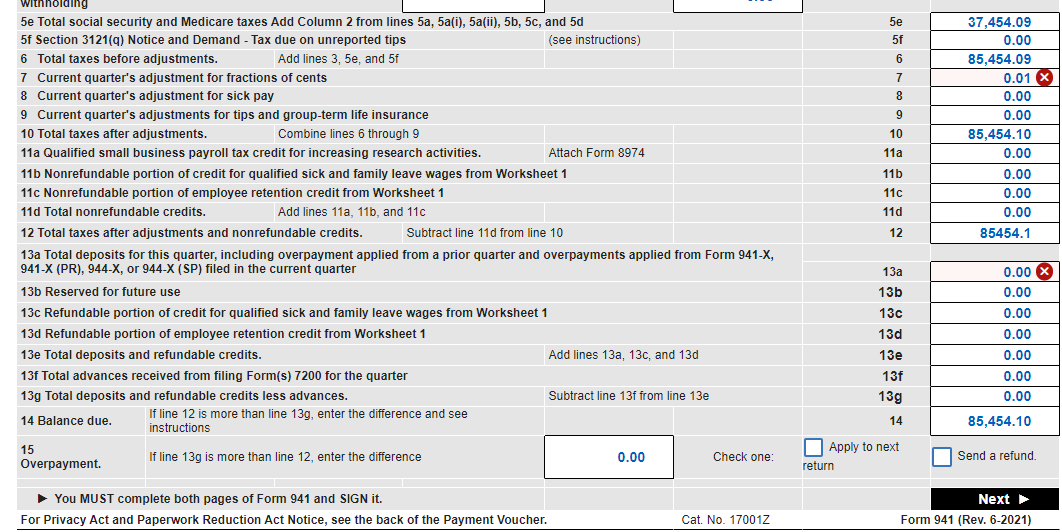

Cannot figure out the 5e and 7 and 17a !

-(NOTE): Instructions on format can be found on certain cells within the forms.

Page 1 of Form 941. (Round your final answers to 2 decimal places.) Read the separate instructions before you complete this form. Please type or print within the boxes. 5e Total social security and Medicare taxes Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d 5 f Section 3121(q) Notice and Demand - Tax due on unreported tips (see instructions) 6 Total taxes before adjustments. Add lines 3,5e, and 5f 7 Current quarter's adjustment for fractions of cents 8 Current quarter's adjustment for sick pay 9 Current quarter's adjustments for tips and group-term life insurance 10 Total taxes after adjustments. Combine lines 6 through 9 11a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11b Nonrefundable portion of credit for qualified sick and family leave wages from Worksheet 1 11c Nonrefundable portion of employee retention credit from Worksheet 1 11d Total nonrefundable credits. Add lines 11a, 11b, and 11c 12 Total taxes after adjustments and nonrefundable credits. Subtract line 11d from line 10 \begin{tabular}{|c|} \hline 37,454.09 \\ \hline 0.00 \\ \hline 85,454.09 \\ \hline 0.01x \\ \hline 0.00 \\ \hline 0.00 \\ \hline 85,454.10 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 85454.1 \\ \hline \end{tabular} 13a Total deposits for this quarter, including overpayment applied from a prior quarter and overpayments applied from Form 941-X, 941-X (PR), 944-X, or 944-X (SP) filed in the current quarter 13b Reserved for future use 13c Refundable portion of credit for qualified sick and family leave wages from Worksheet 1 13d Refundable portion of employee retention credit from Worksheet 1 13e Total deposits and refundable credits. 13f Total advances received from filing Form(s) 7200 for the quarter 13g Total deposits and refundable credits less advances. 14 Balance due. If line 12 is more than line 13g, enter the difference and see \begin{tabular}{|c|} \hline 0.00X \\ \hline 0.00 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 0.00 \\ \hline 85,454.10 \\ \hline \end{tabular} \begin{tabular}{l|l|c|} \hline 14 Balance due. & instructions \\ \hline 15 & If line 13g is more than line 12 , enter the difference & 0.00 \\ Overpayment. & Apply to next \\ return \end{tabular} You MUST complete both pages of Form 941 and SIGN it. Next For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Cat. No. 17001Z Form 941 (Rev. 6-2021)