Question

Required information Skip to question [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases

Required information Skip to question [The following information applies to the questions displayed below.]

Littleton Books has the following transactions during May.

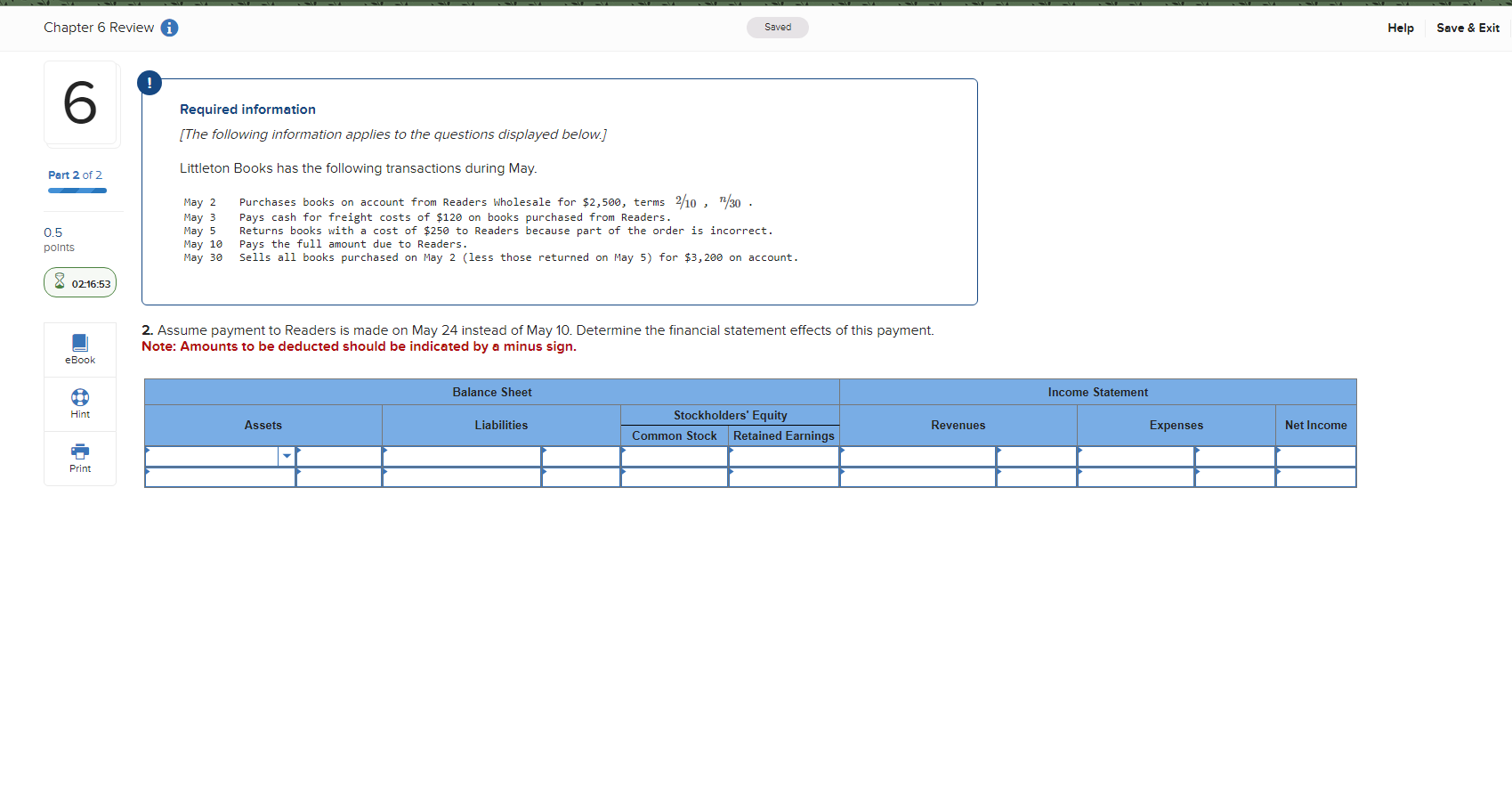

May 2 Purchases books on account from Readers Wholesale for $2,500, terms 210/ , n30/ . May 3 Pays cash for freight costs of $120 on books purchased from Readers. May 5 Returns books with a cost of $250 to Readers because part of the order is incorrect. May 10 Pays the full amount due to Readers. May 30 Sells all books purchased on May 2 (less those returned on May 5) for $3,200 on account. 2. Assume payment to Readers is made on May 24 instead of May 10. Determine the financial statement effects of this payment.

Note: Amounts to be deducted should be indicated by a minus sign.

Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,500, terms 2/10,n/30. May 3 Pays cash for freight costs of $120 on books purchased from Readers. May 5 Returns books with a cost of $250 to Readers because part of the order is incorrect. May 10 Pays the full amount due to Readers. May 30 Sells all books purchased on May 2 (less those returned on May 5) for $3,200 on account. 2. Assume payment to Readers is made on May 24 instead of May 10. Determine the financial statement effects of this payment. Note: Amounts to be deducted should be indicated by a minus sign

Required information [The following information applies to the questions displayed below.] Littleton Books has the following transactions during May. May 2 Purchases books on account from Readers Wholesale for $2,500, terms 2/10,n/30. May 3 Pays cash for freight costs of $120 on books purchased from Readers. May 5 Returns books with a cost of $250 to Readers because part of the order is incorrect. May 10 Pays the full amount due to Readers. May 30 Sells all books purchased on May 2 (less those returned on May 5) for $3,200 on account. 2. Assume payment to Readers is made on May 24 instead of May 10. Determine the financial statement effects of this payment. Note: Amounts to be deducted should be indicated by a minus sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started