Question

Required information Skip to question [The following information applies to the questions displayed below.] EagleEye Limited, a manufacturer of digital cameras, is considering entry into

Required information

Skip to question

[The following information applies to the questions displayed below.]

EagleEye Limited, a manufacturer of digital cameras, is considering entry into the digital binocular market. EagleEye currently does not produce binoculars of any style, so this venture would require a careful analysis of relevant manufacturing costs to correctly assess its ability to compete. The market price for this binocular style is well established at $133 per unit. EagleEye has enough square footage in its plant to accommodate the new production line, although several pieces of new equipment would be required; their estimated cost is $4,850,000. EagleEye requires a minimum ROI of 11% on any product line investment and estimates that if it enters this market with its digital binocular product at the prevailing market price, it is confident of its ability to sell 30,000 units each year.

Required:

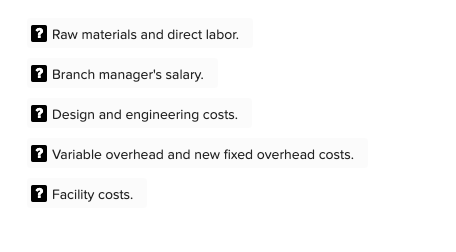

a. Identify the costs that EagleEye Limited, would consider for decision of entering the digital binocular market.

Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.

Circuit Masters Incorporated (CMI) is presently operating at 80% of capacity and manufacturing 128,000 units of a patented electronic component. The cost structure of the component is as follows:

Raw materials$ 6.80per unitDirect labor6.80per unitVariable overhead8.80per unitFixed overhead$ 473,600per yearAn Italian firm has offered to purchase 20,800 of the components at a price of $28.00 per unit, FOB CMI's plant. The normal selling price is $34.40 per component. This special order will not affect any of CMI's "normal" business. Management calculated that the cost per component is $26.10, so it is reluctant to accept this special order.

Required:

- Calculate the fixed overhead per unit.

- Is the cost calculation appropriate?

- Should the offer from the Italian firm be accepted?

? Branch manager's salary. ? Design and engineering costs. Variable overhead and new fixed overhead costs. b. Calculate the target cost per unit for entry into the digital binocular market. Note: Round your answer to \\( \\mathbf{2} \\) decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started