Question

Required information Skip to question [The following information applies to the questions displayed below.] Lab Insight: An important internal control for cash is the reconciliation

Required informationSkip to question

[The following information applies to the questions displayed below.]

Lab Insight: An important internal control for cash is the reconciliation of the cash general ledger account to the bank statement on a regular basis. We call this a bank reconciliation and provide it here as an example of diagnostic analytics. In general, the expectation is that the company and the bank have recorded the same transactions, and any transactions not recorded by both are in need of reconciliation.

To perform a reconciliation, the company needs to reconcile the cash balance recorded in its general ledger (GL) with the cash that the bank collected or charged (disbursed) without the company's knowledge. At the same time, the company needs to reconcile the cash balance on the bank statement with the transactions recorded in the GL but not known at the bank. We also use reconciliations to find recording errors that either the bank or the company have made.

In this lab, we use conditional formatting to find items that need to be reconciled.

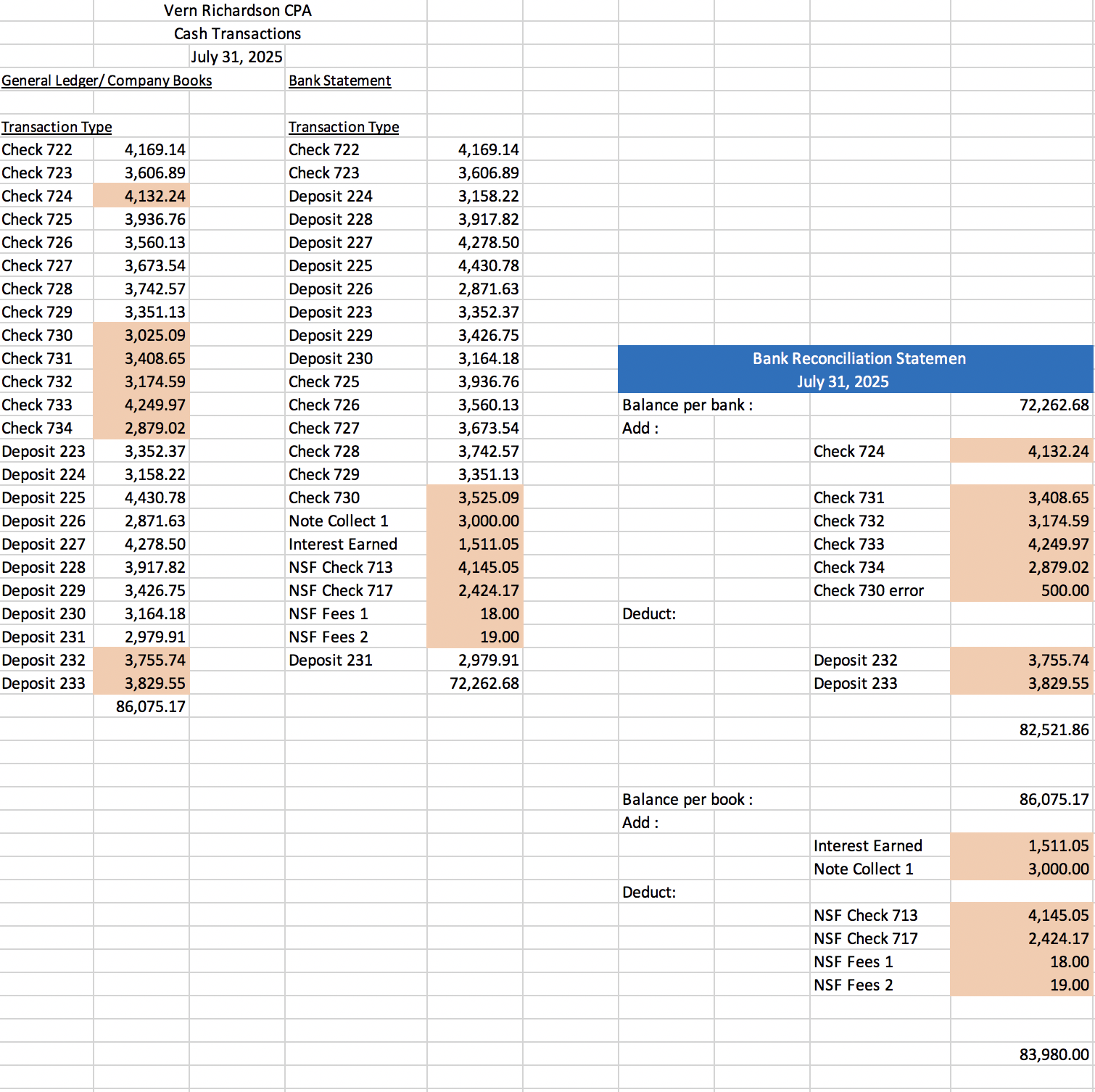

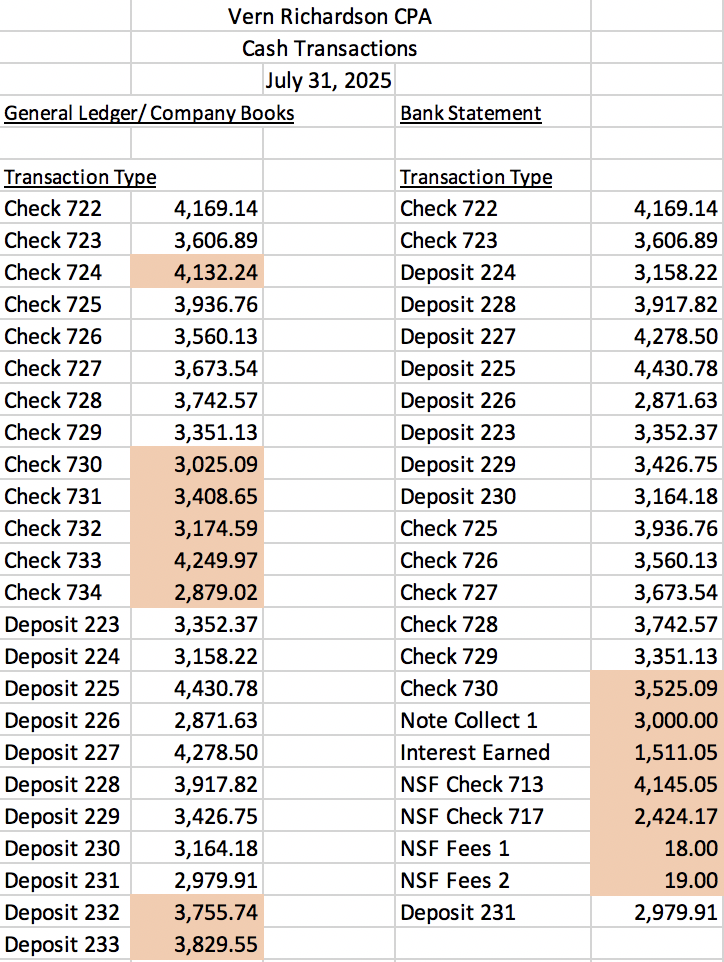

Vern Richardson CPA Cash Transactions July 31, 2025 General Ledger/Company Books Bank Statement Transaction Type Transaction Type Check 722 4,169.14 Check 722 4,169.14 Check 723 3,606.89 Check 723 3,606.89 Check 724 4,132.24 Deposit 224 3,158.22 Check 725 3,936.76 Deposit 228 3,917.82 Check 726 3,560.13 Deposit 227 4,278.50 Check 727 3,673.54 Deposit 225 4,430.78 Check 728 3,742.57 Deposit 226 2,871.63 Check 729 3,351.13 Deposit 223 3,352.37 Check 730 3,025.09 Deposit 229 3,426.75 Check 731 3,408.65 Deposit 230 3,164.18 Bank Reconciliation Statemen Check 732 3,174.59 Check 725 3,936.76 July 31, 2025 Check 733 4,249.97 Check 726 3,560.13 Balance per bank : 72,262.68 Check 734 2,879.02 Check 727 3,673.54 Add: Deposit 223 3,352.37 Check 728 3,742.57 Check 724 4,132.24 Deposit 224 3,158.22 Check 729 3,351.13 Deposit 225 4,430.78 Check 730 3,525.09 Check 731 3,408.65 Deposit 226 2,871.63 Note Collect 1 3,000.00 Check 732 3,174.59 Deposit 227 4,278.50 Interest Earned 1,511.05 Check 733 4,249.97 Deposit 228 3,917.82 NSF Check 713 4,145.05 Check 734 2,879.02 Deposit 229 3,426.75 NSF Check 717 2,424.17 Check 730 error 500.00 Deposit 230 3,164.18 NSF Fees 1 18.00 Deduct: Deposit 231 2,979.91 NSF Fees 2 19.00 Deposit 232 3,755.74 Deposit 231 2,979.91 Deposit 232 3,755.74 Deposit 233 3,829.55 72,262.68 Deposit 233 3,829.55 86,075.17 82,521.86 Balance per book: Add: 86,075.17 Interest Earned 1,511.05 Note Collect 1 3,000.00 Deduct: NSF Check 713 4,145.05 NSF Check 717 2,424.17 NSF Fees 1 18.00 NSF Fees 2 19.00 83,980.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started