Answered step by step

Verified Expert Solution

Question

1 Approved Answer

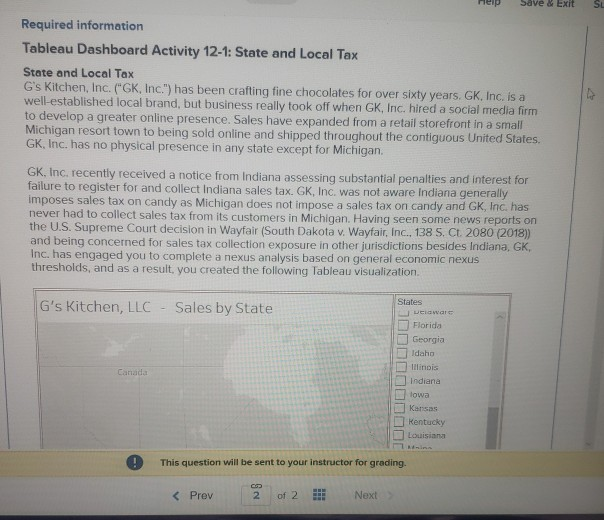

Required information Tableau Dashboard Activity 12-1: State and Local Tax State and Local Tax G's Kitchen, Inc. (GK, Inc.) has been crafting fine chocolates for

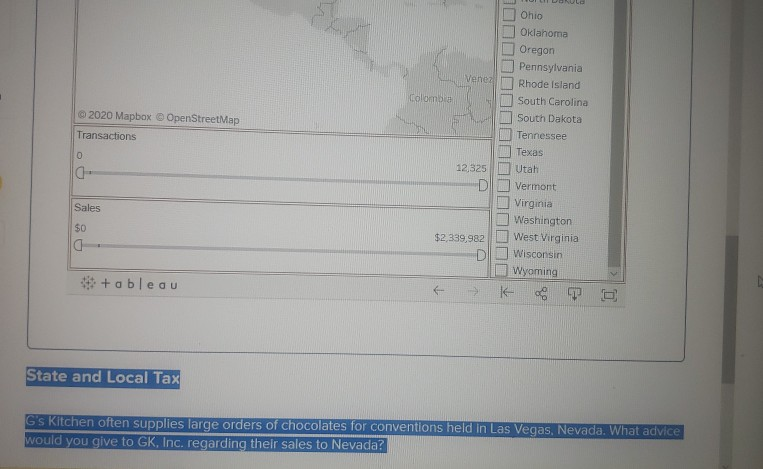

Required information Tableau Dashboard Activity 12-1: State and Local Tax State and Local Tax G's Kitchen, Inc. ("GK, Inc.") has been crafting fine chocolates for over sixty years. GK, Inc. is a well-established local brand, but business really took off when GK, Inc. hired a social media firm to develop a greater online presence. Sales have expanded from a retail storefront in a small Michigan resort town to being sold online and shipped throughout the contiguous United States. GK Inc. has no physical presence in any state except for Michigan. GK, Inc. recently received a notice from Indiana assessing substantial penalties and interest for failure to register for and collect Indiana sales tax. GK, Inc. was not aware Indiana generally imposes sales tax on candy as Michigan does not impose a sales tax on candy and GK, Inc. has never had to collect sales tax from its customers in Michigan. Having seen some news reports on the U.S. Supreme Court decision in Wayfair (South Dakota v. Wayfair, Inc., 138 5. Ct. 2080 (2018)) and being concerned for sales tax collection exposure in other jurisdictions besides Indiana, GK, Inc. has engaged you to complete a nexus analysis based on general economic nexus thresholds, and as a result, you created the following Tableau visualization G's Kitchen, LLC - Sales by State States WELC Wate Florida Georgia Idaho Illinois Indiana lowa Card Kentucky Louisiana This question will be sent to your instructor for grading. OpenStreetMap 2020 Mapbox Transactions Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin | Wyoming 12,325 -D Sales $2,339,982 tableau State and Local Tax G's Kitchen often supplies large orders of chocolates for conventions held in Las Vegas, Nevada, What advice would you give to GK, Inc. regarding their sales to Nevada? Required information Tableau Dashboard Activity 12-1: State and Local Tax State and Local Tax G's Kitchen, Inc. ("GK, Inc.") has been crafting fine chocolates for over sixty years. GK, Inc. is a well-established local brand, but business really took off when GK, Inc. hired a social media firm to develop a greater online presence. Sales have expanded from a retail storefront in a small Michigan resort town to being sold online and shipped throughout the contiguous United States. GK Inc. has no physical presence in any state except for Michigan. GK, Inc. recently received a notice from Indiana assessing substantial penalties and interest for failure to register for and collect Indiana sales tax. GK, Inc. was not aware Indiana generally imposes sales tax on candy as Michigan does not impose a sales tax on candy and GK, Inc. has never had to collect sales tax from its customers in Michigan. Having seen some news reports on the U.S. Supreme Court decision in Wayfair (South Dakota v. Wayfair, Inc., 138 5. Ct. 2080 (2018)) and being concerned for sales tax collection exposure in other jurisdictions besides Indiana, GK, Inc. has engaged you to complete a nexus analysis based on general economic nexus thresholds, and as a result, you created the following Tableau visualization G's Kitchen, LLC - Sales by State States WELC Wate Florida Georgia Idaho Illinois Indiana lowa Card Kentucky Louisiana This question will be sent to your instructor for grading. OpenStreetMap 2020 Mapbox Transactions Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin | Wyoming 12,325 -D Sales $2,339,982 tableau State and Local Tax G's Kitchen often supplies large orders of chocolates for conventions held in Las Vegas, Nevada, What advice would you give to GK, Inc. regarding their sales to Nevada

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started