Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information The Chapter 10 Form worksheet is to be used to create your own worksheet version of the main example in the text. Requirement

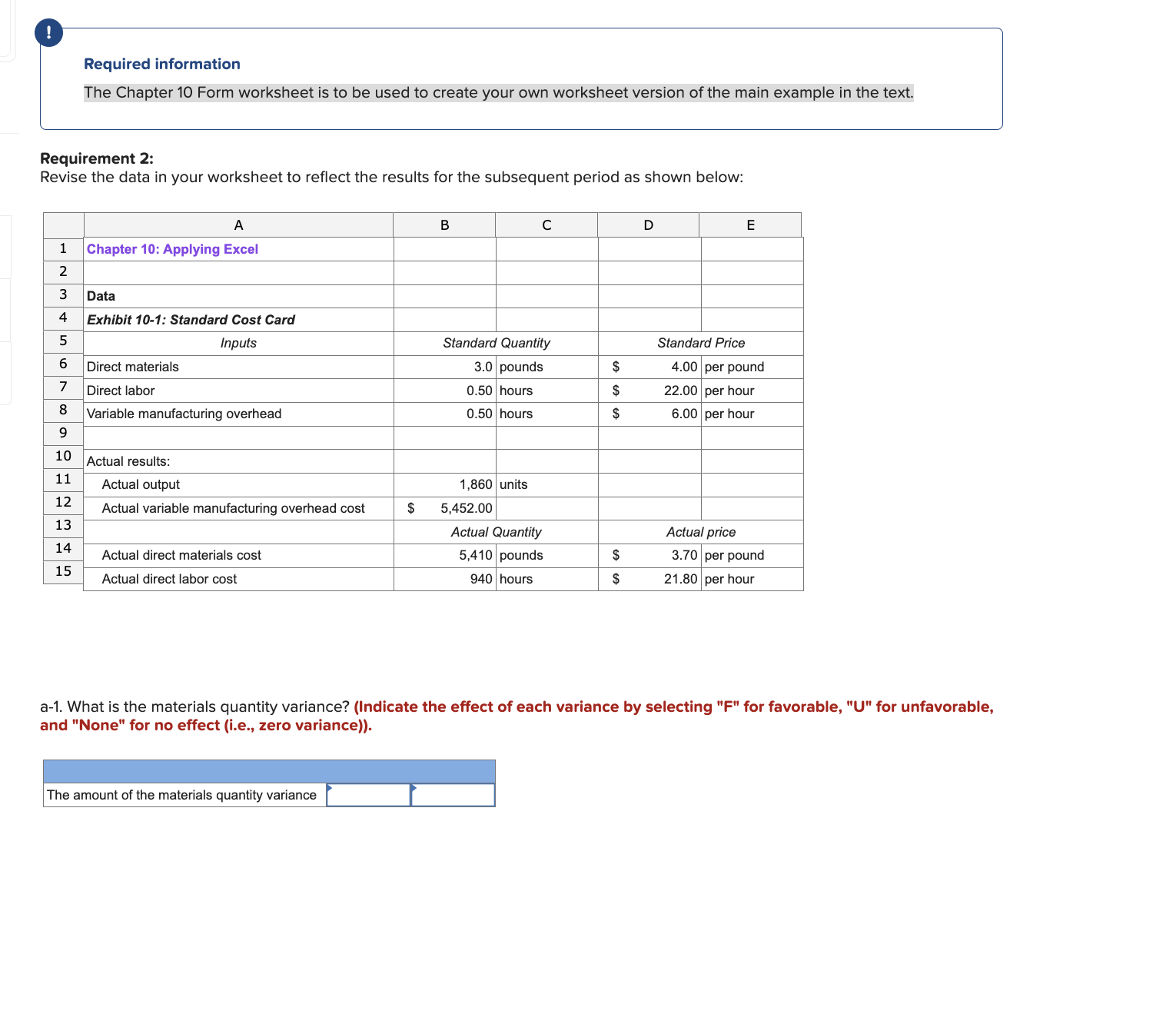

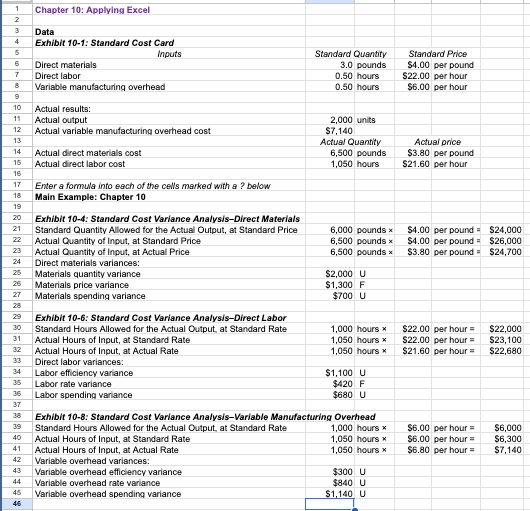

Required information The Chapter 10 Form worksheet is to be used to create your own worksheet version of the main example in the text. Requirement 2: Revise the data in your worksheet to reflect the results for the subsequent period as shown below: a-1. What is the materials quantity variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). a-1. What is the materials quantity variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). a-2. What is the materials price variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). b-1. What is the labor efficiency variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). b-2. What is the labor rate variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round your final answer to nearest whole dollar amount.) c-1. What is the variable overhead efficiency variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). c-2. What is the variable overhead rate variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \\ \hline 1 & Chapter 10: Applying Excel & & & & & \\ \hline \\ \hline \multicolumn{7}{|c|}{ Data } \\ \hline \multicolumn{7}{|c|}{ Exhibit 10-1: Standard Cost Card } \\ \hline 5 & Inputs & \multicolumn{2}{|c|}{ Standard Quantity } & \multicolumn{2}{|c|}{ Standard Price } & \\ \hline 6 & Direct materials & 3.0 & pounds & $4.00 & per pound & \\ \hline 7 & Direct labor & 0.50 & hours & $22.00 & per hour & \\ \hline 8 & Variable manufacturing overhead & 0.50 & hours & $6.00 & per hour & \\ \hline \\ \hline 10 & \multicolumn{6}{|l|}{ Actual results: } \\ \hline 11 & Actual output & 2,000 & \multicolumn{4}{|l|}{ units } \\ \hline 12 & \multirow[t]{2}{*}{ Actual variable manufacturing overhead cost } & \multicolumn{2}{|c|}{$7,140} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Actual price }} & \\ \hline 13 & & Actual Q & Quantity & & & \\ \hline 14 & Actual direct materials cost & 6,500 & pounds & $3.80 & per pound & \\ \hline 15 & Actual direct labor cost & 1,050 & hours & $21.60 & per hour & \\ \hline \multicolumn{7}{|c|}{ Fetual direct labor cost } \\ \hline 17 & \multicolumn{6}{|l|}{ Enter a formula into each of the cells marked with a ? below } \\ \hline 18 & \multicolumn{6}{|l|}{ Main Example: Chapter 10} \\ \hline \multicolumn{7}{|c|}{ Malin Exampie: Cnapuer to } \\ \hline 20 & \multicolumn{6}{|l|}{ Exhibit 10-4: Standard Cost Variance Analysis-Direct Materials } \\ \hline 21 & Standard Quantity Allowed for the Actual Output, at Standard Price & 6,000 & pounds x & $4.00 & per pound = & $24,000 \\ \hline 22 & Actual Quantity of Input, at Standard Price & 6,500 & pounds x & $4.00 & per pound = & $26,000 \\ \hline 23 & Actual Quantity of Input, at Actual Price & 6,500 & pounds x & $3.80 & per pound = & $24,700 \\ \hline 24 & \multicolumn{6}{|l|}{ Direct materials variances: } \\ \hline 25 & Materials quantity variance & $2,000 & u & & & \\ \hline 26 & Materials price variance & $1,300 & F & & & \\ \hline 27 & Materials spending variance & $700 & u & & & \\ \hline \\ \hline 29 & \multicolumn{6}{|l|}{ Exhibit 10-6: Standard Cost Variance Analysis-Direct Labor } \\ \hline 30 & Standard Hours Allowed for the Actual Output, at Standard Rate & 1,000 & hours x & $22.00 & per hour = & $22,000 \\ \hline 31 & Actual Hours of Input, at Standard Rate & 1,000 & hours x & $22.00 & per hour = & $23,100 \\ \hline 32 & Actual Hours of Input, at Actual Rate & 1,050 & hours x & $21.60 & per hour = & $22,680 \\ \hline 33 & \multicolumn{6}{|l|}{ Direct labor variances: } \\ \hline 34 & Labor efficiency varlance & $1,100 & U & & & \\ \hline 35 & Labor rate variance & $420 & F & & & \\ \hline 36 & Labor spending varlance & $680 & U & & & \\ \hline 37 & & & & & & \\ \hline 38 & Exhibit 10-8: Standard Cost Variance Analysis-Variable Manufac & turing Over & rhead & & & \\ \hline 39 & Standard Hours Allowed for the Actual Output, at Standard Rate & 1,000 & hours x & $6.00 & per hour = & $6,000 \\ \hline 40 & Actual Hours of Input, at Standard Rate & 1,050 & hours x & $6.00 & per hour = & $6,300 \\ \hline 41 & Actual Hours of Input, at Actual Rate & 1,050 & hours x & $6.80 & per hour = & $7,140 \\ \hline 42 & Variable overhead variances: & & & & & \\ \hline 43 & Variable overhead efficlency variance & $300 & u & & & \\ \hline 44 & Variable overhead rate varlance & $840 & U & & & \\ \hline 45 & Variable overhead spending variance & $1,140 & U & & & \\ \hline 45 & & & & & & \\ \hline \end{tabular}

Required information The Chapter 10 Form worksheet is to be used to create your own worksheet version of the main example in the text. Requirement 2: Revise the data in your worksheet to reflect the results for the subsequent period as shown below: a-1. What is the materials quantity variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). a-1. What is the materials quantity variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). a-2. What is the materials price variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). b-1. What is the labor efficiency variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). b-2. What is the labor rate variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Round your final answer to nearest whole dollar amount.) c-1. What is the variable overhead efficiency variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). c-2. What is the variable overhead rate variance? (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance)). \begin{tabular}{|c|c|c|c|c|c|c|} \hline & \\ \hline 1 & Chapter 10: Applying Excel & & & & & \\ \hline \\ \hline \multicolumn{7}{|c|}{ Data } \\ \hline \multicolumn{7}{|c|}{ Exhibit 10-1: Standard Cost Card } \\ \hline 5 & Inputs & \multicolumn{2}{|c|}{ Standard Quantity } & \multicolumn{2}{|c|}{ Standard Price } & \\ \hline 6 & Direct materials & 3.0 & pounds & $4.00 & per pound & \\ \hline 7 & Direct labor & 0.50 & hours & $22.00 & per hour & \\ \hline 8 & Variable manufacturing overhead & 0.50 & hours & $6.00 & per hour & \\ \hline \\ \hline 10 & \multicolumn{6}{|l|}{ Actual results: } \\ \hline 11 & Actual output & 2,000 & \multicolumn{4}{|l|}{ units } \\ \hline 12 & \multirow[t]{2}{*}{ Actual variable manufacturing overhead cost } & \multicolumn{2}{|c|}{$7,140} & \multirow{2}{*}{\multicolumn{2}{|c|}{ Actual price }} & \\ \hline 13 & & Actual Q & Quantity & & & \\ \hline 14 & Actual direct materials cost & 6,500 & pounds & $3.80 & per pound & \\ \hline 15 & Actual direct labor cost & 1,050 & hours & $21.60 & per hour & \\ \hline \multicolumn{7}{|c|}{ Fetual direct labor cost } \\ \hline 17 & \multicolumn{6}{|l|}{ Enter a formula into each of the cells marked with a ? below } \\ \hline 18 & \multicolumn{6}{|l|}{ Main Example: Chapter 10} \\ \hline \multicolumn{7}{|c|}{ Malin Exampie: Cnapuer to } \\ \hline 20 & \multicolumn{6}{|l|}{ Exhibit 10-4: Standard Cost Variance Analysis-Direct Materials } \\ \hline 21 & Standard Quantity Allowed for the Actual Output, at Standard Price & 6,000 & pounds x & $4.00 & per pound = & $24,000 \\ \hline 22 & Actual Quantity of Input, at Standard Price & 6,500 & pounds x & $4.00 & per pound = & $26,000 \\ \hline 23 & Actual Quantity of Input, at Actual Price & 6,500 & pounds x & $3.80 & per pound = & $24,700 \\ \hline 24 & \multicolumn{6}{|l|}{ Direct materials variances: } \\ \hline 25 & Materials quantity variance & $2,000 & u & & & \\ \hline 26 & Materials price variance & $1,300 & F & & & \\ \hline 27 & Materials spending variance & $700 & u & & & \\ \hline \\ \hline 29 & \multicolumn{6}{|l|}{ Exhibit 10-6: Standard Cost Variance Analysis-Direct Labor } \\ \hline 30 & Standard Hours Allowed for the Actual Output, at Standard Rate & 1,000 & hours x & $22.00 & per hour = & $22,000 \\ \hline 31 & Actual Hours of Input, at Standard Rate & 1,000 & hours x & $22.00 & per hour = & $23,100 \\ \hline 32 & Actual Hours of Input, at Actual Rate & 1,050 & hours x & $21.60 & per hour = & $22,680 \\ \hline 33 & \multicolumn{6}{|l|}{ Direct labor variances: } \\ \hline 34 & Labor efficiency varlance & $1,100 & U & & & \\ \hline 35 & Labor rate variance & $420 & F & & & \\ \hline 36 & Labor spending varlance & $680 & U & & & \\ \hline 37 & & & & & & \\ \hline 38 & Exhibit 10-8: Standard Cost Variance Analysis-Variable Manufac & turing Over & rhead & & & \\ \hline 39 & Standard Hours Allowed for the Actual Output, at Standard Rate & 1,000 & hours x & $6.00 & per hour = & $6,000 \\ \hline 40 & Actual Hours of Input, at Standard Rate & 1,050 & hours x & $6.00 & per hour = & $6,300 \\ \hline 41 & Actual Hours of Input, at Actual Rate & 1,050 & hours x & $6.80 & per hour = & $7,140 \\ \hline 42 & Variable overhead variances: & & & & & \\ \hline 43 & Variable overhead efficlency variance & $300 & u & & & \\ \hline 44 & Variable overhead rate varlance & $840 & U & & & \\ \hline 45 & Variable overhead spending variance & $1,140 & U & & & \\ \hline 45 & & & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started