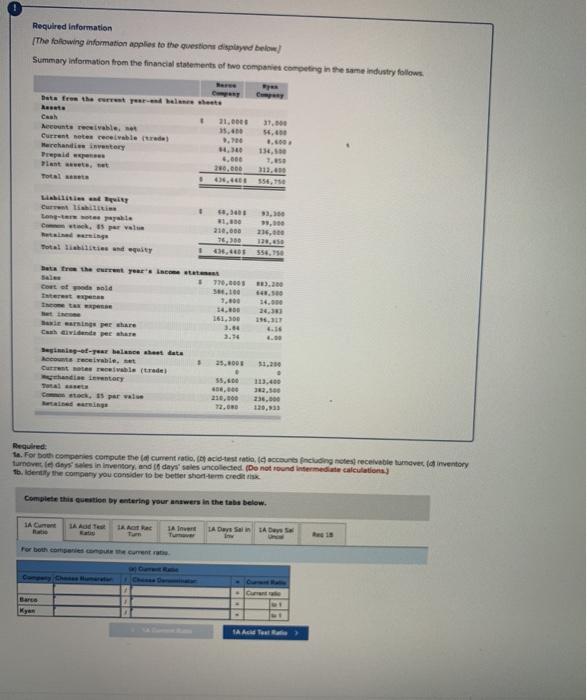

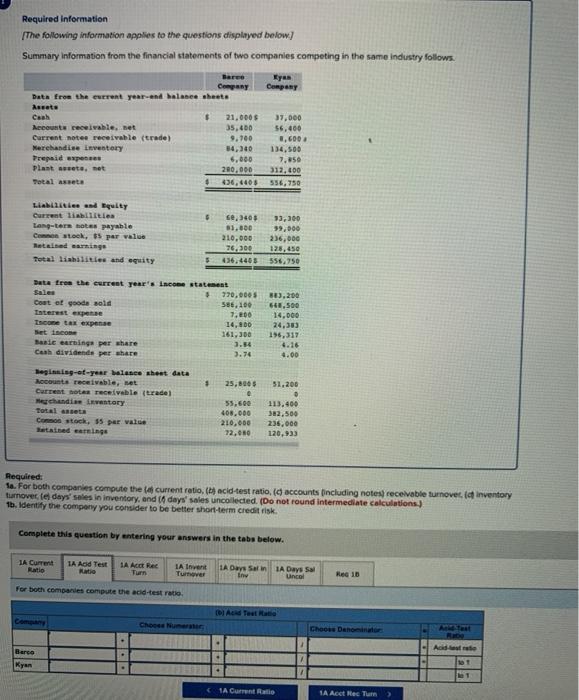

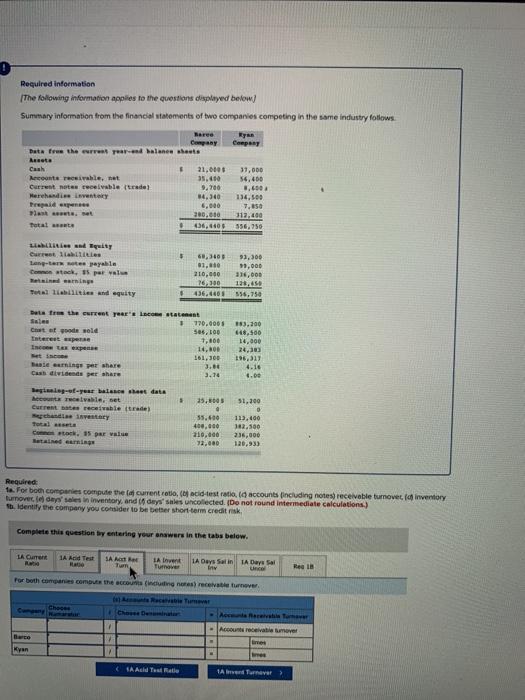

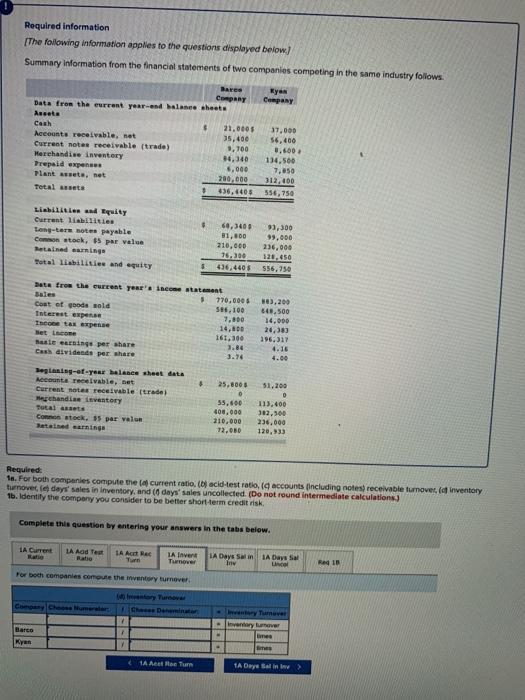

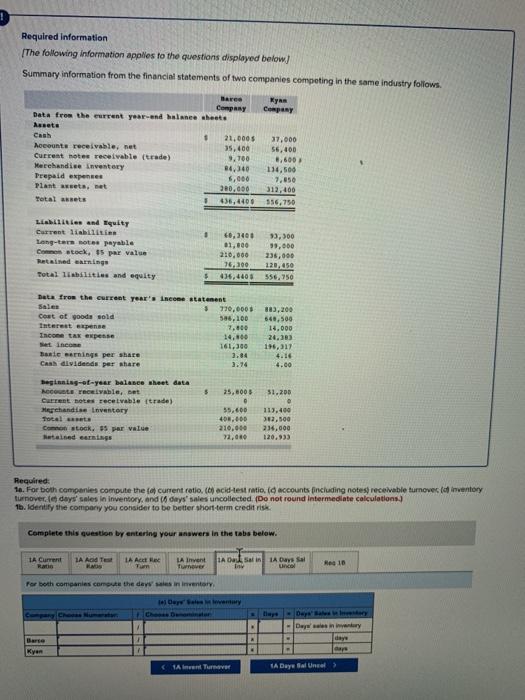

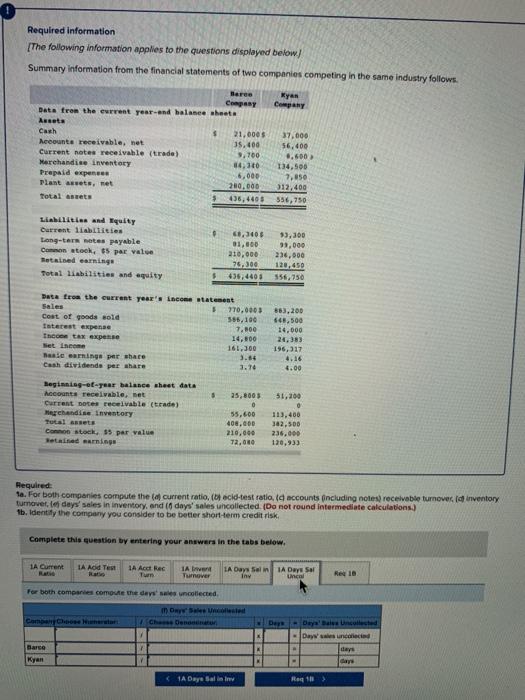

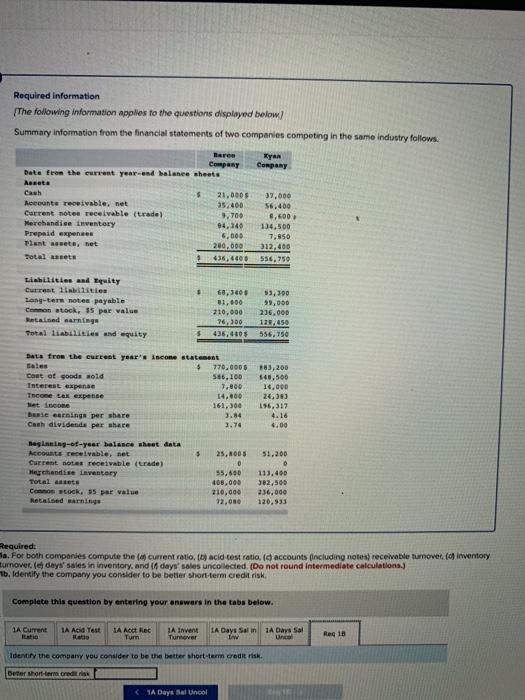

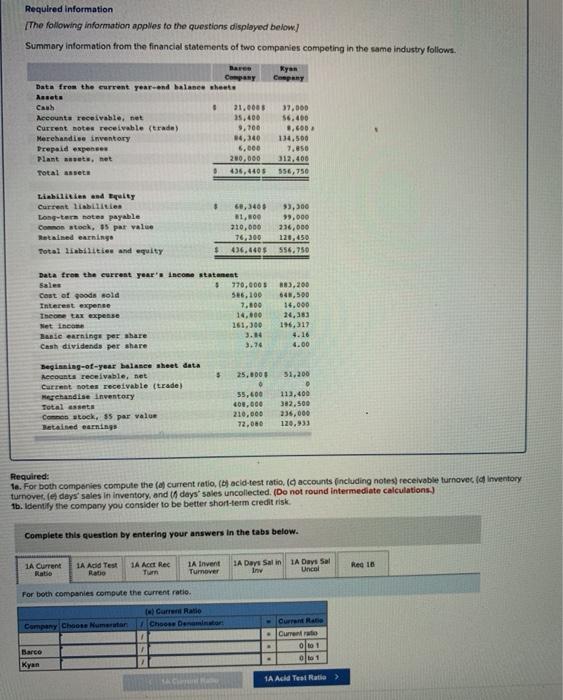

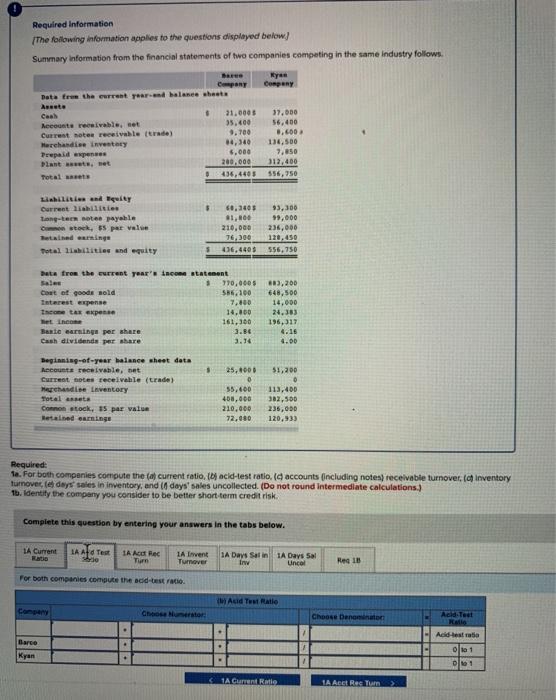

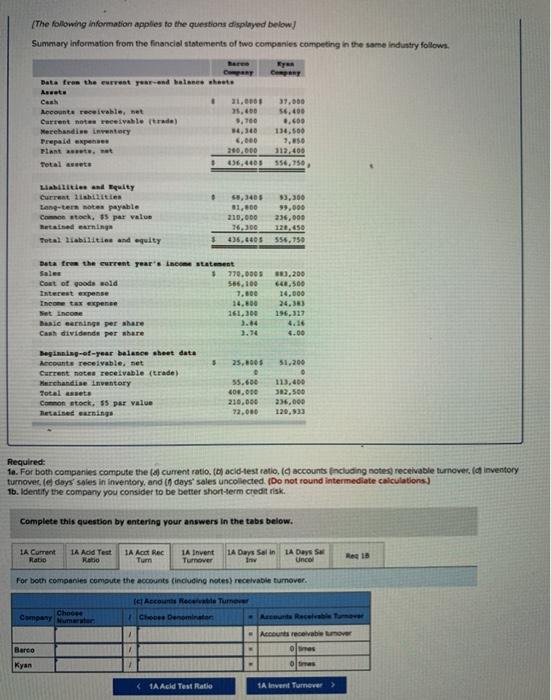

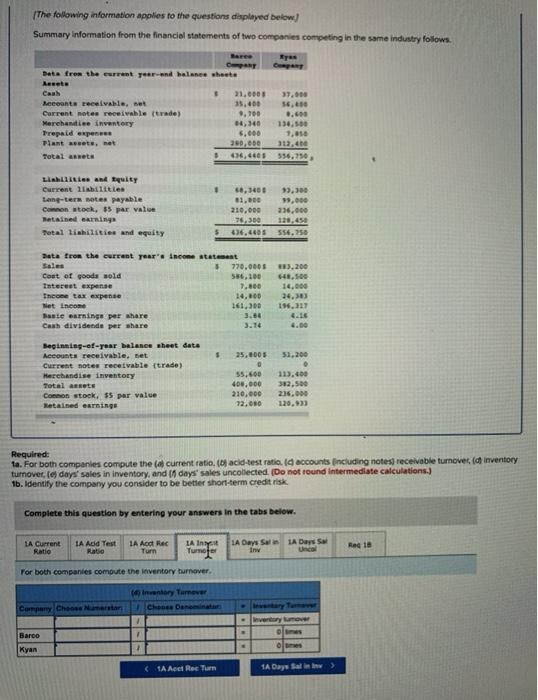

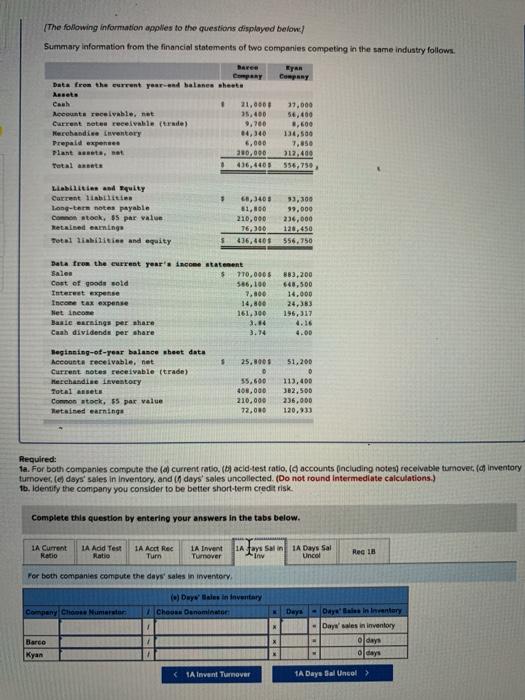

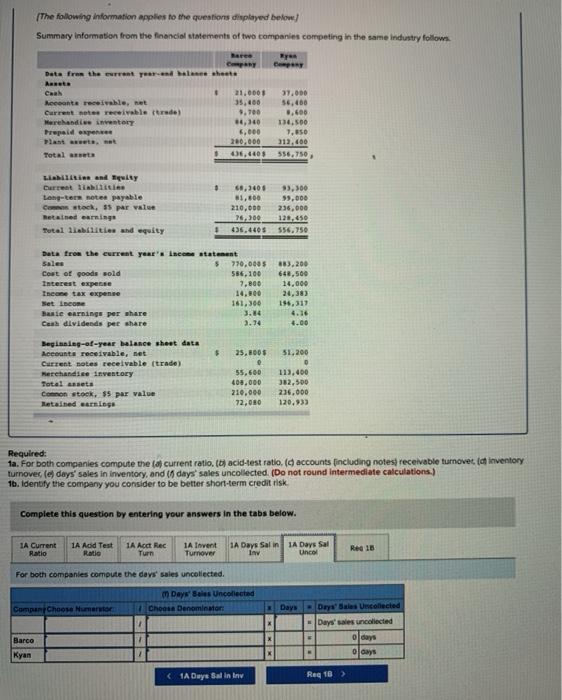

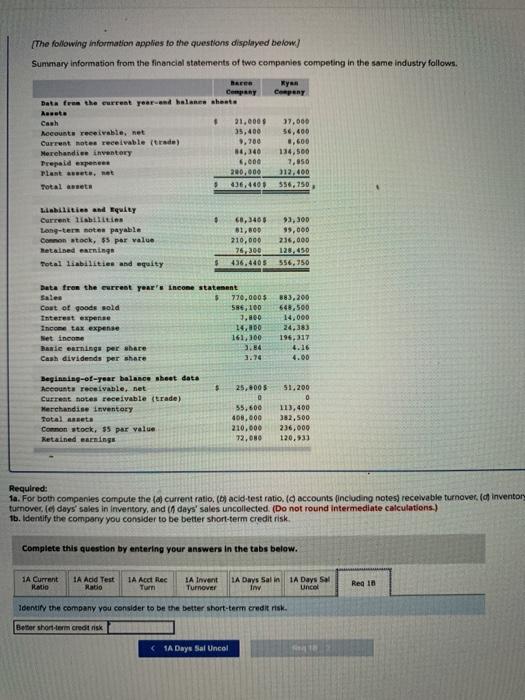

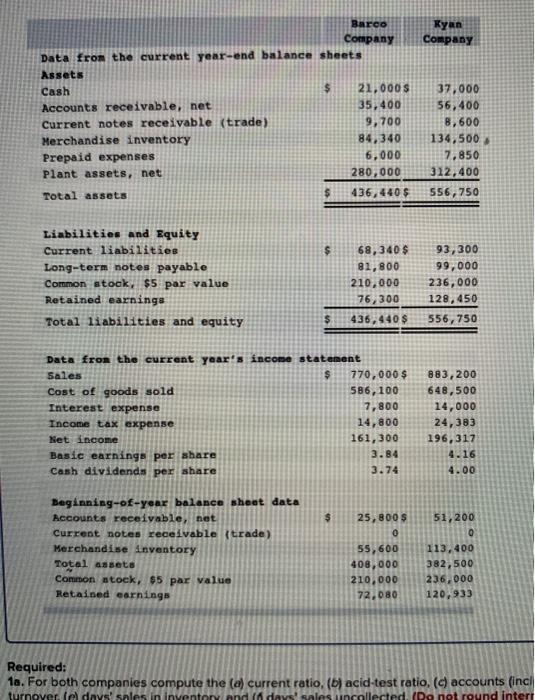

Required information The flowing information applies to the questions displayed below! Summary information from the financial statements of two companies competing in the same industry follows Data from the these shte Rente Cash 31.000 Account receivable, 15. Current netes receivable de . Merchandisinventory 14.30 Prepaid up 6.000 37.000 . 8.00 130,150 313.00 Total 6. Lindi Long-tele 85 purva 58.341 33,00 1,050 1,100 210.000 216,00 7620 180.00 31. 556,150 betare the year acestea 770.000 Como pode said 54.100 7.00 300 48.00 14.00 Bearings per share Chewinde pe share 261.300 3.64 2.14 190, 6.16 Beginning - balance shendete Rees receivable. Current materials (trade die Leventory 25.01 . 113.400 ac, 15 par wie 55,00 . 230,000 72.00 236,000 120.933 Required te. For both comper compute the current ratio, acid-testi (according test receivable turnover inventory turne day sales in inventory, and days' sales uncollected. (Do not found intermediate calculations) tb. Identity the company you consider to be better sondern credits Complete this question by entering your answers in the tabs below. 1A Carton IR A Ras IAI LA Day Sa LA D For both compone come centro Barta Kya Required information The following information applies to the questions displayed below.) Summary Information from the financial statements of two companies competing in the same industry follows. yan Company Company Data from the current year and balance sheets Assets Cash 21,000$ 37,000 Accounts receivable, bet 35,400 Current notee receivable (trade) 9.700 3.600 Merchandise inventory 14,340 134,500 Prepaid expenses 5,000 Plant anneta, net 200.000 312,400 Total asseta 436,4405 556.750 6 Liabile and Equity Current liabilities Long-term holes payable Cemento, 95 per value Retained maringe Total liabilities and equity se,3405 $1,800 210,000 76,300 436.4403 33,300 99,000 236,000 125.450 556.750 Data free the current years in statement Sales 770,000 Coat of yoods sold 556,100 Interest expense 7.00 Tacone tax expense 14,900 Set Income 161,300 Basic earnings per where 3.34 cash dividende per where 3.74 03.200 64,500 14,000 24,303 196,317 4.00 3 Beginning-of-year balance sheet data Recente receivable, et Current stas receivable (trade Merchandise Leventory Total asset Costach, 95 per value 25,00 e 55,600 408.000 210,000 72,00 31,206 . 113.400 382,500 235,000 120.933 Required: 1. For both companies compute the current ratio. (acid-test ratio, ( accounts including notes receivable turnovet. I inventory turnover feldays' selesin inventory, and days' sales uncollected. (Do not found intermediate calculations) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. IA Current Ratio IA Add Test Ratio 1A Ace Rec IA Invent Turner LA w Satin th 1A Days Sol Res 10 For both companies compute the acid-test ratio DI ALTeet Rate Choose Denon Adobe Barco Kyan 1A Current Ratio IA Ace Hec. Turn Required information The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows Company Maree Company | Data from the era para balance sheets Art 21.01$ Recounts receivable, tet 35.600 Current netes receivable de Merchandie vente $4,340 Prepaid en 6.000 280.680 Total 436,4405 9.700 31,000 56.400 8.600 134,500 7.850 112.00 556.750 is 14 in 1 tk Crities Lanterne payable Comment, 15 perlu derings Total liabilities and equity 60,3401 91,80 210,000 16.360 436.00 93,300 1,000 110,000 133.650 356.750 Date free the current year's statement Sales 770.0001 Chat et de sold 506,00 terete 1,100 Incepe 14.NO ti 161,JOD Batering pet share Cash dividend per share 3.14 Begipof-year balance the data het recevable, et 5 25.00 Current was receivable (trade) chiae inventory 55.400 400.000 Con 15 Prane 20.000 Baalaat aar *83.200 48,500 14,000 24,30 195.311 4.16 6.00 51,200 113.400 102,500 236,000 120.93) Required 1. For both companies compute the current retio, acid-test ratio, accounts including notes) receivable turnover of inventory turnover de ses in inventory, and des sales collected. (Do not round Intermediate calculations.) Sh. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. LA CAT 1A And Test SAAB 1A en 1A Days Satin IA Day Sai RO Tun Turnover Inn Unco For both companies comes the account (luding nenes) receive turnever Real Choc Account receivablemeve Kyan A Asd Teuta 1Ad Tarnever Required information The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows. Company ) Bares Company Data from the current year-end balance sheets Austa Cash 21.0105 Accounts receivable, net 35,400 Current notes receivable (trade) 9,700 Merchandise inventory 10,340 Prepaid expenses 6,000 plant assete, et 200.000 Total assets 436, 4405 37.000 56,400 3.600 134.500 7.850 312,600 556,750 Liabilities and Equity Current liabilities Long-term hot payable Como to, 65 par valve tained earnings Total liabilities and equity 60,3401 93,300 81,000 99,000 210,000 236,000 10.450 436.440 $ 556.750 Data from the current year's income statement 770,000 $ Coat of goods sold 584,100 Interest expense 7.800 Iscotas expense 14,00 Bet come 161,300 Beste cernings per share 2.84 Cash dividend peshare 3.74 3,200 648,500 14.000 24,583 196.17 4.16 4.00 Legioning-of-year balance sheet data Accounts receivable, bet Current notes receivable (trade) Merchandise Leventory $ 25,800 O 55,600 400,000 210,000 72.000 51,200 0 113.400 302.300 236.000 120.933 Connes stock. 55 par valor Required: 10. For both companies compute the current ratio. (acid-test ratio, ( accounts (including notes receivable turnover. It inventory turnoveredeys' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations 1b. Identity the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. IA Current LA Add Test LA AGER LA Invent Turnover IA Days Salin Inv 1A Days Sal Linco Reg 10 For both companies commute the inventory turnever Barco 1 - Tumuver very unever - time res Kyan Required information [The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows. Kya Company Company Data from the current year and balance sheets Assets Cash 21.000$ Accounts receivable, net 35,400 Current notes receivable (trade) 9.100 Merchandise inventory 84.340 Prepaid expenses 6,000 Plant anseta, et 300.000 Total assets 435, 4400 37,000 56,400 8,600 114,500 312,400 356.750 Latities and quity Current liabilities Long-term not payable Common stock, 45 par value 1 40,2400 01,800 2:0.000 16,390 436,4405 93,500 99,000 235,000 120,450 556.750 Total libilities and equity Data from the current year'. Income statement Sales 3 730,000$ cost of goods sold 586.100 Interest pense 7,800 Incon tax expens 14.00 et Income 161.380 hanterings per share 3.84 Cash dividend per share 3.74 883,200 648,500 14.000 20.30 116,317 4.16 4.00 5 51.200 Beginning-of-year balance sheet data Necat receivable, et Current notes receivable (trade) Merchandise inventory 25, 8005 0 55,600 40.00 210.900 71,00 113,40 32,500 234.000 120.933 Como stock. 95 par value Required: 1o. For both companies compute the current ratio, acid-test ratio, (accounts including notes receivable turnovec (o inventory turnover.days' sales in inventory, and days' sales uncollected. (Do not round Intermediate calculations.) 15. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current 1A Adder KOS LA Acte LA invent Turnover IA DI Sal 1A Y Sal R 10 For both companies come the days in inventory Der een - Dwywany daye cape Kyen

Required information The following information applies to the questions displayed below) Summary Information from the financial statements of two companies competing in the same industry follows Company Ceny Data from the current years balance sheet Anete Caah . 31.000 Recente receivable, wet 35,600 Current not receivable (trade) 9.00 Merchandise inventory 4,340 Prepaid expenses 5.000 plant te wet 200.000 Total met 436,4405 37.000 56,400 0.600 134,500 7.850 312,400 556,750 $ Lilities and guity Current liabilities long-term we payable Common stock, 65 per vel het enige Total liabilities and equity 60,2405 81,00 210,000 76.300 436,4405 93,300 99,000 236,000 120.450 556.750 5 Data from the current year' income statement Sales 770,000 Coat of goods sold 586.100 Interest expense 7.100 The tax expense 14.00 het in 161,300 Bante et per share 3.86 Cash dividende per share 3,200 648,500 14,000 24.383 196,317 4.16 4.00 . Depianis-of-year balance sheet data Accounts receivable, bet Current botes receivable (trade) Merchandise Laventory Total asset Common stock, 15 par value taned earnings 25,000 0 55.400 400,000 210,000 72,080 51,200 0 113,400 382,500 235,000 120.93) Required 1a. For both companies compute the current ratio, 1 acid-test ratio, ( accounts (including notes receivable turnover (chinventory turnover, ce days sales in inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identity the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current LA AT Test IA Act Rec Turn 1A Inwent Turnover 1A Days Salin Inw IA Days Sal Uncol Red 1 For both companies compute the acid-best ratio e Acid Test Rate Choose to Choose Denominator Acident Ratio Acid-test rate Barco Kyan olla 1 D1 (The following information applies to the questiones displayed below! Summary Information from the financial statements of two companies competing in the same industry follows Data from the event years there sheet . Recente receivable, et Current receivable (trade) Merchandisine Prepaid expen 21.000 35,000 9.700 4,140 6,000 200,000 06.440$ 37.000 56,460 8.600 14.500 1.450 312,400 556.750 Total art 0 Line and Equity arraalaalan Long-term stes payable Costach. 15 par value Retained earnings Tutal liabilities and equity 61,3405 $3,300 61.800 99,000 210.000 236,000 76.200 120, 450 436.4405556.750 1 Data from the current year'. Income statement Sales 770.0005 cost of goods sold 586,100 Interest expense 7.800 Income tax expense 14.00 Set Leon 161,300 Baie earnings per where 3.64 Ce dividends per share 3.34 883.200 648,500 14.000 24,383 196,317 4.00 $ 25.00 51,200 Beginning-of-year balance sheet data Accounts receivable, set Current notes receivable (trade) Merchandise inventory Total assets Connon stock, 55 par value Retained earnings 55,600 400,000 210,000 72,080 113,400 382,500 236,000 120.933 Required: 1a. For both companies compute the current ratio. c) acid-test ratio. ( accounts (including notes receivable turnover. It inventory turnover (e days' sales in inventory, and days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Add Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Salin 1A Days Sal Inv Uncol Red 16 For both companies compute the days sales uncollected. m Days Bees Uncollected Choose Denominator Company Choose Numeror Days Days Baies Uncollected Days' sales collected o days Olays x Barco Kyan 1A Dwye Salin Inv Reg 10 ) The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows. haree Cempany Data from the current year and balance sheets Aenet Cash 21.000 hceounts receivable, net 35,400 Current notes receivable (trade) 1,700 Merchandie Inventory 84,140 Prepaid expenses 6.000 200,000 Total annet 436,4001 07.000 56,400 8,600 134,500 7,850 312,400 356.750 abilities and Equity Current liabilities Long-ter hotes payable Connon stock, $5 per value Retained earnings Total liabilities and equity 68,3405 81,800 210,000 75.300 436.4405 9,300 99,000 236,000 120.450 556,150 Data from the current year's Income statement Sales $ 770,000 $ Coat of goods sold 586,100 Interest expense 3.800 Income tax expense 14.800 Net income 161,300 Basic earnings per sbare 3.84 Cash dividends per share 3.76 883.200 648,500 14,000 24,383 196, 317 4.16 4.00 $ Beginning-of-year balance sheet data Recounts receivable, net Current notes receivable (trade) Merchandise Inventory Total assets Common stock, $par value Retained warnings 25,00 0 55.600 408,000 210,000 72,080 51.200 0 113,400 382,500 236,000 120.931 Required: 1a. For both companies compute the current ratio, (b) acid-test ratio. (accounts (including notes) receivable turnover. (Inventor turnover (e days sales in Inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. A Current Ratio 1A Acid Test Ratio IA Acd Rec Turn 1A Invent Turnover LA Days Salin In 1A Days Sol Uncel Reg i loentify the company you consider to be the better short-term credit risk. Beter short-term credit risk 1A Days Sal Uncal kyan Company Barco Company Data from the current year-end balance sheets Assets Cash 21,000 $ Accounts receivable, net 35,400 Current notes receivable (trade) 9,700 Merchandise inventory 84,340 Prepaid expenses 6,000 Plant assets, net 280,000 Total assets 436,440 $ 37,000 56, 400 8,600 134,500 7,850 312,400 556, 750 $ Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity 68,340 $ 81,800 210,000 76,300 436, 440 $ 93,300 99,000 236,000 128, 450 556, 750 Data from the current year's income statement Sales $ 770,000 $ Cost of goods sold 586, 100 Interest expense 7,800 Income tax expense 14,800 Net income 161,300 Basic earnings per share 3.84 Cash dividends per share 3.74 883,200 648,500 14,000 24,383 196,317 4.16 4.00 $ Beginning-of-year balance sheet data Accounts receivable, net Current notes receivable (trade) Merchandise inventory Total assets Common stock, $5 par value Retained earnings 25,800 $ 0 55,600 408,000 210,000 72,080 51,200 0 113.400 382,500 236 000 120,933 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (incl turnover de days! sales in Inventor and 1 days' sales incollected. Do not round inter Required information The flowing information applies to the questions displayed below! Summary information from the financial statements of two companies competing in the same industry follows Data from the these shte Rente Cash 31.000 Account receivable, 15. Current netes receivable de . Merchandisinventory 14.30 Prepaid up 6.000 37.000 . 8.00 130,150 313.00 Total 6. Lindi Long-tele 85 purva 58.341 33,00 1,050 1,100 210.000 216,00 7620 180.00 31. 556,150 betare the year acestea 770.000 Como pode said 54.100 7.00 300 48.00 14.00 Bearings per share Chewinde pe share 261.300 3.64 2.14 190, 6.16 Beginning - balance shendete Rees receivable. Current materials (trade die Leventory 25.01 . 113.400 ac, 15 par wie 55,00 . 230,000 72.00 236,000 120.933 Required te. For both comper compute the current ratio, acid-testi (according test receivable turnover inventory turne day sales in inventory, and days' sales uncollected. (Do not found intermediate calculations) tb. Identity the company you consider to be better sondern credits Complete this question by entering your answers in the tabs below. 1A Carton IR A Ras IAI LA Day Sa LA D For both compone come centro Barta Kya Required information The following information applies to the questions displayed below.) Summary Information from the financial statements of two companies competing in the same industry follows. yan Company Company Data from the current year and balance sheets Assets Cash 21,000$ 37,000 Accounts receivable, bet 35,400 Current notee receivable (trade) 9.700 3.600 Merchandise inventory 14,340 134,500 Prepaid expenses 5,000 Plant anneta, net 200.000 312,400 Total asseta 436,4405 556.750 6 Liabile and Equity Current liabilities Long-term holes payable Cemento, 95 per value Retained maringe Total liabilities and equity se,3405 $1,800 210,000 76,300 436.4403 33,300 99,000 236,000 125.450 556.750 Data free the current years in statement Sales 770,000 Coat of yoods sold 556,100 Interest expense 7.00 Tacone tax expense 14,900 Set Income 161,300 Basic earnings per where 3.34 cash dividende per where 3.74 03.200 64,500 14,000 24,303 196,317 4.00 3 Beginning-of-year balance sheet data Recente receivable, et Current stas receivable (trade Merchandise Leventory Total asset Costach, 95 per value 25,00 e 55,600 408.000 210,000 72,00 31,206 . 113.400 382,500 235,000 120.933 Required: 1. For both companies compute the current ratio. (acid-test ratio, ( accounts including notes receivable turnovet. I inventory turnover feldays' selesin inventory, and days' sales uncollected. (Do not found intermediate calculations) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. IA Current Ratio IA Add Test Ratio 1A Ace Rec IA Invent Turner LA w Satin th 1A Days Sol Res 10 For both companies compute the acid-test ratio DI ALTeet Rate Choose Denon Adobe Barco Kyan 1A Current Ratio IA Ace Hec. Turn Required information The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows Company Maree Company | Data from the era para balance sheets Art 21.01$ Recounts receivable, tet 35.600 Current netes receivable de Merchandie vente $4,340 Prepaid en 6.000 280.680 Total 436,4405 9.700 31,000 56.400 8.600 134,500 7.850 112.00 556.750 is 14 in 1 tk Crities Lanterne payable Comment, 15 perlu derings Total liabilities and equity 60,3401 91,80 210,000 16.360 436.00 93,300 1,000 110,000 133.650 356.750 Date free the current year's statement Sales 770.0001 Chat et de sold 506,00 terete 1,100 Incepe 14.NO ti 161,JOD Batering pet share Cash dividend per share 3.14 Begipof-year balance the data het recevable, et 5 25.00 Current was receivable (trade) chiae inventory 55.400 400.000 Con 15 Prane 20.000 Baalaat aar *83.200 48,500 14,000 24,30 195.311 4.16 6.00 51,200 113.400 102,500 236,000 120.93) Required 1. For both companies compute the current retio, acid-test ratio, accounts including notes) receivable turnover of inventory turnover de ses in inventory, and des sales collected. (Do not round Intermediate calculations.) Sh. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. LA CAT 1A And Test SAAB 1A en 1A Days Satin IA Day Sai RO Tun Turnover Inn Unco For both companies comes the account (luding nenes) receive turnever Real Choc Account receivablemeve Kyan A Asd Teuta 1Ad Tarnever Required information The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows. Company ) Bares Company Data from the current year-end balance sheets Austa Cash 21.0105 Accounts receivable, net 35,400 Current notes receivable (trade) 9,700 Merchandise inventory 10,340 Prepaid expenses 6,000 plant assete, et 200.000 Total assets 436, 4405 37.000 56,400 3.600 134.500 7.850 312,600 556,750 Liabilities and Equity Current liabilities Long-term hot payable Como to, 65 par valve tained earnings Total liabilities and equity 60,3401 93,300 81,000 99,000 210,000 236,000 10.450 436.440 $ 556.750 Data from the current year's income statement 770,000 $ Coat of goods sold 584,100 Interest expense 7.800 Iscotas expense 14,00 Bet come 161,300 Beste cernings per share 2.84 Cash dividend peshare 3.74 3,200 648,500 14.000 24,583 196.17 4.16 4.00 Legioning-of-year balance sheet data Accounts receivable, bet Current notes receivable (trade) Merchandise Leventory $ 25,800 O 55,600 400,000 210,000 72.000 51,200 0 113.400 302.300 236.000 120.933 Connes stock. 55 par valor Required: 10. For both companies compute the current ratio. (acid-test ratio, ( accounts (including notes receivable turnover. It inventory turnoveredeys' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations 1b. Identity the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. IA Current LA Add Test LA AGER LA Invent Turnover IA Days Salin Inv 1A Days Sal Linco Reg 10 For both companies commute the inventory turnever Barco 1 - Tumuver very unever - time res Kyan Required information [The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows. Kya Company Company Data from the current year and balance sheets Assets Cash 21.000$ Accounts receivable, net 35,400 Current notes receivable (trade) 9.100 Merchandise inventory 84.340 Prepaid expenses 6,000 Plant anseta, et 300.000 Total assets 435, 4400 37,000 56,400 8,600 114,500 312,400 356.750 Latities and quity Current liabilities Long-term not payable Common stock, 45 par value 1 40,2400 01,800 2:0.000 16,390 436,4405 93,500 99,000 235,000 120,450 556.750 Total libilities and equity Data from the current year'. Income statement Sales 3 730,000$ cost of goods sold 586.100 Interest pense 7,800 Incon tax expens 14.00 et Income 161.380 hanterings per share 3.84 Cash dividend per share 3.74 883,200 648,500 14.000 20.30 116,317 4.16 4.00 5 51.200 Beginning-of-year balance sheet data Necat receivable, et Current notes receivable (trade) Merchandise inventory 25, 8005 0 55,600 40.00 210.900 71,00 113,40 32,500 234.000 120.933 Como stock. 95 par value Required: 1o. For both companies compute the current ratio, acid-test ratio, (accounts including notes receivable turnovec (o inventory turnover.days' sales in inventory, and days' sales uncollected. (Do not round Intermediate calculations.) 15. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current 1A Adder KOS LA Acte LA invent Turnover IA DI Sal 1A Y Sal R 10 For both companies come the days in inventory Der een - Dwywany daye cape Kyen Required information The following information applies to the questions displayed below) Summary Information from the financial statements of two companies competing in the same industry follows Company Ceny Data from the current years balance sheet Anete Caah . 31.000 Recente receivable, wet 35,600 Current not receivable (trade) 9.00 Merchandise inventory 4,340 Prepaid expenses 5.000 plant te wet 200.000 Total met 436,4405 37.000 56,400 0.600 134,500 7.850 312,400 556,750 $ Lilities and guity Current liabilities long-term we payable Common stock, 65 per vel het enige Total liabilities and equity 60,2405 81,00 210,000 76.300 436,4405 93,300 99,000 236,000 120.450 556.750 5 Data from the current year' income statement Sales 770,000 Coat of goods sold 586.100 Interest expense 7.100 The tax expense 14.00 het in 161,300 Bante et per share 3.86 Cash dividende per share 3,200 648,500 14,000 24.383 196,317 4.16 4.00 . Depianis-of-year balance sheet data Accounts receivable, bet Current botes receivable (trade) Merchandise Laventory Total asset Common stock, 15 par value taned earnings 25,000 0 55.400 400,000 210,000 72,080 51,200 0 113,400 382,500 235,000 120.93) Required 1a. For both companies compute the current ratio, 1 acid-test ratio, ( accounts (including notes receivable turnover (chinventory turnover, ce days sales in inventory, and (days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identity the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current LA AT Test IA Act Rec Turn 1A Inwent Turnover 1A Days Salin Inw IA Days Sal Uncol Red 1 For both companies compute the acid-best ratio e Acid Test Rate Choose to Choose Denominator Acident Ratio Acid-test rate Barco Kyan olla 1 D1 (The following information applies to the questiones displayed below! Summary Information from the financial statements of two companies competing in the same industry follows Data from the event years there sheet . Recente receivable, et Current receivable (trade) Merchandisine Prepaid expen 21.000 35,000 9.700 4,140 6,000 200,000 06.440$ 37.000 56,460 8.600 14.500 1.450 312,400 556.750 Total art 0 Line and Equity arraalaalan Long-term stes payable Costach. 15 par value Retained earnings Tutal liabilities and equity 61,3405 $3,300 61.800 99,000 210.000 236,000 76.200 120, 450 436.4405556.750 1 Data from the current year'. Income statement Sales 770.0005 cost of goods sold 586,100 Interest expense 7.800 Income tax expense 14.00 Set Leon 161,300 Baie earnings per where 3.64 Ce dividends per share 3.34 883.200 648,500 14.000 24,383 196,317 4.00 $ 25.00 51,200 Beginning-of-year balance sheet data Accounts receivable, set Current notes receivable (trade) Merchandise inventory Total assets Connon stock, 55 par value Retained earnings 55,600 400,000 210,000 72,080 113,400 382,500 236,000 120.933 Required: 1a. For both companies compute the current ratio. c) acid-test ratio. ( accounts (including notes receivable turnover. It inventory turnover (e days' sales in inventory, and days' sales uncollected. (Do not round Intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Add Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Salin 1A Days Sal Inv Uncol Red 16 For both companies compute the days sales uncollected. m Days Bees Uncollected Choose Denominator Company Choose Numeror Days Days Baies Uncollected Days' sales collected o days Olays x Barco Kyan 1A Dwye Salin Inv Reg 10 ) The following information applies to the questions displayed below) Summary information from the financial statements of two companies competing in the same industry follows. haree Cempany Data from the current year and balance sheets Aenet Cash 21.000 hceounts receivable, net 35,400 Current notes receivable (trade) 1,700 Merchandie Inventory 84,140 Prepaid expenses 6.000 200,000 Total annet 436,4001 07.000 56,400 8,600 134,500 7,850 312,400 356.750 abilities and Equity Current liabilities Long-ter hotes payable Connon stock, $5 per value Retained earnings Total liabilities and equity 68,3405 81,800 210,000 75.300 436.4405 9,300 99,000 236,000 120.450 556,150 Data from the current year's Income statement Sales $ 770,000 $ Coat of goods sold 586,100 Interest expense 3.800 Income tax expense 14.800 Net income 161,300 Basic earnings per sbare 3.84 Cash dividends per share 3.76 883.200 648,500 14,000 24,383 196, 317 4.16 4.00 $ Beginning-of-year balance sheet data Recounts receivable, net Current notes receivable (trade) Merchandise Inventory Total assets Common stock, $par value Retained warnings 25,00 0 55.600 408,000 210,000 72,080 51.200 0 113,400 382,500 236,000 120.931 Required: 1a. For both companies compute the current ratio, (b) acid-test ratio. (accounts (including notes) receivable turnover. (Inventor turnover (e days sales in Inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. A Current Ratio 1A Acid Test Ratio IA Acd Rec Turn 1A Invent Turnover LA Days Salin In 1A Days Sol Uncel Reg i loentify the company you consider to be the better short-term credit risk. Beter short-term credit risk 1A Days Sal Uncal kyan Company Barco Company Data from the current year-end balance sheets Assets Cash 21,000 $ Accounts receivable, net 35,400 Current notes receivable (trade) 9,700 Merchandise inventory 84,340 Prepaid expenses 6,000 Plant assets, net 280,000 Total assets 436,440 $ 37,000 56, 400 8,600 134,500 7,850 312,400 556, 750 $ Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity 68,340 $ 81,800 210,000 76,300 436, 440 $ 93,300 99,000 236,000 128, 450 556, 750 Data from the current year's income statement Sales $ 770,000 $ Cost of goods sold 586, 100 Interest expense 7,800 Income tax expense 14,800 Net income 161,300 Basic earnings per share 3.84 Cash dividends per share 3.74 883,200 648,500 14,000 24,383 196,317 4.16 4.00 $ Beginning-of-year balance sheet data Accounts receivable, net Current notes receivable (trade) Merchandise inventory Total assets Common stock, $5 par value Retained earnings 25,800 $ 0 55,600 408,000 210,000 72,080 51,200 0 113.400 382,500 236 000 120,933 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (incl turnover de days! sales in Inventor and 1 days' sales incollected. Do not round inter