Answered step by step

Verified Expert Solution

Question

1 Approved Answer

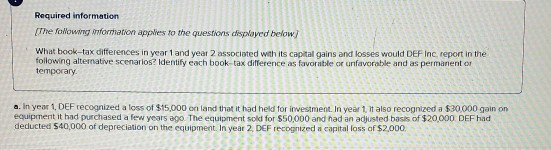

Required information The following formation applies to the questions displayed below What book-tax differences in year 1 and year 2 associated with its capital gains

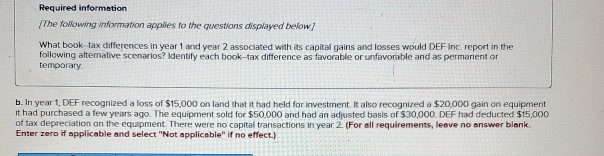

Required information The following formation applies to the questions displayed below What book-tax differences in year 1 and year 2 associated with its capital gains and losses would DEF Inc. report in the following alternative scenarios Identify each book tax difference as favorable o unfavorable and as permanent or temporary a. In year 1. DEF recognized a loss of $15,000 en land that it had held for investment. In year 1. It also recognized a $30,000 gain on equipment it had purchased a few years 00 The equipment sold for $50.000 and had an adjusted basis of $20.000 DEF had deducted 540,000 of depreciation on the equipment. In year 2. DEF recognized a capital loss of $2,000 Required information The following information applies to the questions displayed below] What book tax differences in vear 1 and year 2 associated with its capital gains and losses would DEF Inc. report in the following altemative scenarios? Identify each book-tax difference as favorable or unfavorable and as permanent or temporary b. In year 1. DEF recognized a loss of $15,000 on land that it had held for investment. It also recognized a $20,000 gain on equipment it had purchased a few years ago. The equipment sold for $50.000 and had an adjusted basis of $30,000 DEF had deducted $15,000 of tax depreciation on the equipment. There were no capital transactions in year 2 For all requirements, leave no answer blank Enter zero if applicable and select "Not applicable if no effect.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started