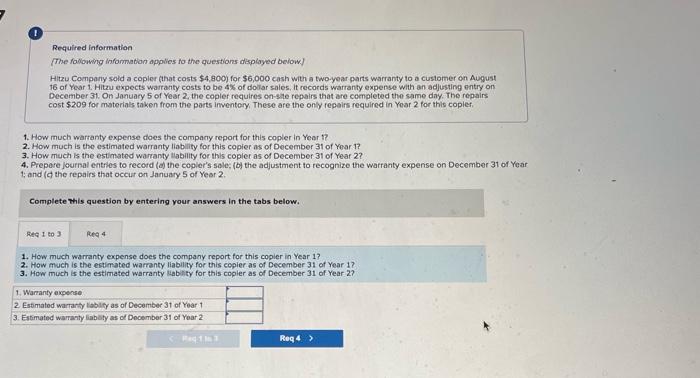

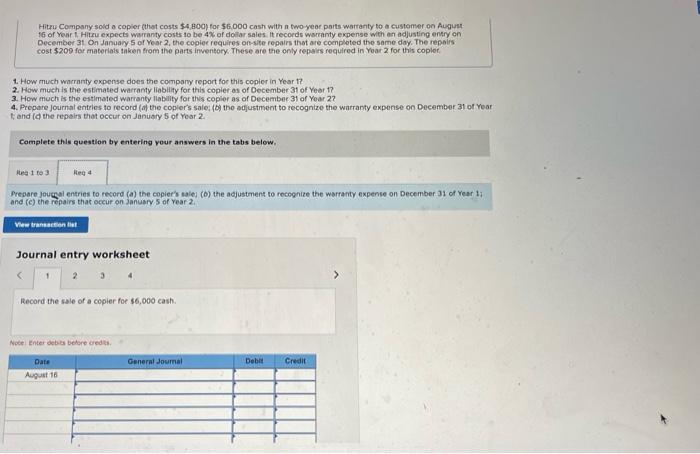

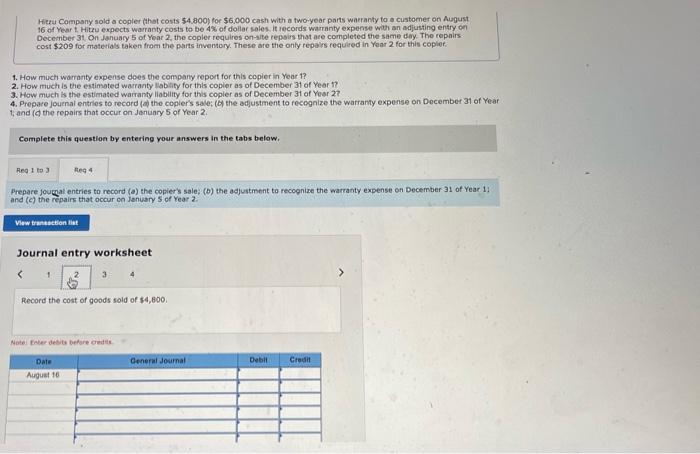

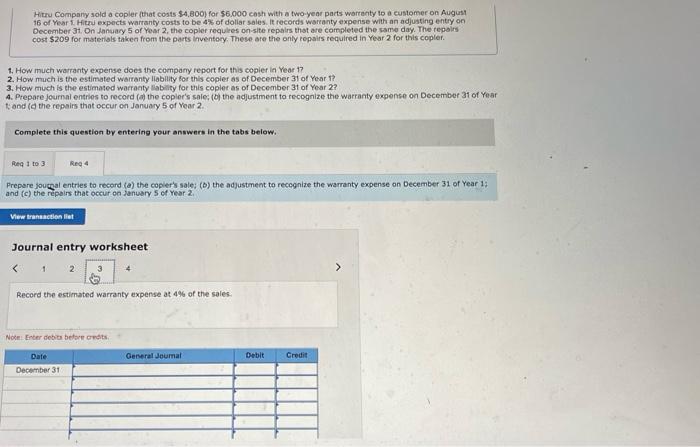

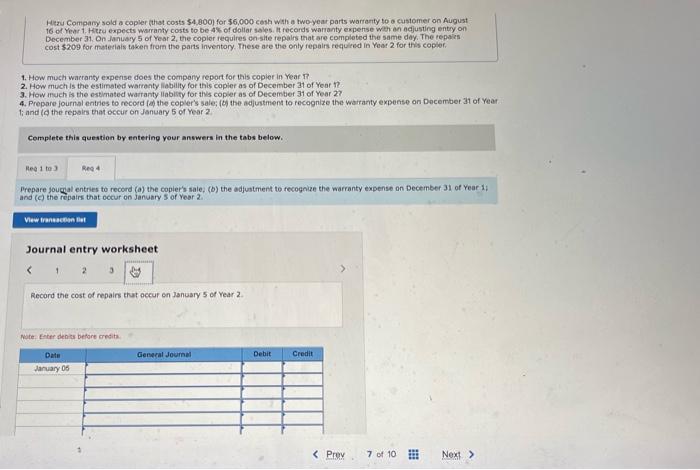

Required information (The following infamation applies to the questions displayed below.) Hitzu Company sold a copler (that costs $4,800) for $6,000 cash with a two-yoar parts warranty to a customer on August 16 of Year 1 . Hitzu expects warranty costs to be 4% of dodar sales, it records warranty expense with an adjusting entry on December 31. On January 5 of Year 2 , the copler requires on-ste repairs that are completed the same day. The repairs cost \$209 for materiats triken from the ports inventery. These are the onfy repairs required in Yoar 2 for this copier. 1. How much warranty expense does the company report for this copler in Year 1 ? 2. How much is the estimated warranty liability for this copier as of December 31 of Yoar 1 ? 3. How much is the estimated warranty tlability for this coplet as of December 31 of Year 2 ? 4. Prepore journal entries to record (d) the copler's sole; (b) the adjustment to recognize the warfanty expense on December 31 of Year 1; and (c) the repairs that occur on January 5 of year 2 . Complete this question by entering your answers in the tabs below. 1. How much warranty expense does the company report for this copier in Year 1 ? 2. How much is the estimated warranty liability for this copier as of December 31 of Year 17 ? 3. How much is the estimated warranty liablity for this copler as of December 31 of Year 2 ? Hitru Company sold a copier (thst costs $4, Boos for $6,000 cash with n two-yeor poits warranty to a customer on August: 16 of Your 1. Hitru expects warranty costs to be 4% of dolar sales. it records warranty expense with an adjusting entry on December 3t On January 5 of Year 2, the copier requires on-4te repairs that are coenploted the same day. The repelis cost $209 for materlats taken from the parts inventory. These are the only repais required in Yoar 2 for thils copler. 1. How much wacranty expense does the compary report foc this copler in Year t ? 2. How much is the estimated warranty liablity for this copler os of December 31 of Year t? 3. How much is the estimated warranty llability for this copier as of December 3 of Year 27 4. Propare journal entries to record (a) the copler's sale; (b) the adjustment to recognize the watranty expense on December 31 of Year fi; and (c) the repalts that occur on January 5 of Year 2 . Complete this question by entering your answers in the tabs below. Presare jougst entries to record (a) the copiers talel (b) the acjustment to recognize the warranty expense on December 31 of Year ti and (c) the repairs that occur on january 5 of year 2 . Journal entry worksheet Record the sale of a copier foe 36,000 cash. Noce: Enter aebes betare oredts. Hiera Compony sold a copler (that costs 54.800 ) for 56,000 cash with in two-year parts warranty to a customer on August 16 of Year L. Hitzu expects warranty costs to be 4% of dollar sales. it iecords warranty expense with an adjusting entry on December 31 On January 5 of Yoar 2, the copler requires on-site repsirs that are completed the same diny. The repairs. cost $209 for materials taken from the parts invemory. These are the only repairs cequited in Year 2 for this copief. 1. How much wamanty expense does the company report for this copier in Year t? 2. How much is the estimated warranty labity for this copier as of December 31 of Yeer 17 ? 3. How much is the estimated warranty liability for this copler as of December 3t of Year 27 4. Prepare jouenal entries to record (a) the copler's sale; (C) the adfustment to recognize the warranty expense on December 31 of Year 1 , and (c) the repairs that occur on Jantiary 5 of Year 2 . Complete this question by entering your answers in the tabs below. Prepare joumat entries to record (a) the copier's sale; (b) the acjustment to recognize the warranty expense on December 31 of Year 11 and (c) the repairs that occur on Jenuary 5 of Year 2 . Journal entry worksheet Motel faler dests befare eredts. Hitru Company sold a copler (that costs $4,800 for 5.6.000 cosh with a two-year parts warrenty to a customer on August 16 of Year f. Hitwi expects warranty costs to be 4% of doliar sales. It recorts wareanty expense with an adjusting entry on December 31. On danuacy 5 of Year 2 , the copler requlees on-site repalis that are corcpleted the wame day. The repalis cost $209 for materlak takea from the parts inventory. These are the only repairs required in Year 2 for thits copler. 1. How much warranty expense does the compary report for this copier in Year 17 2. How much is the estimated warranty liability Bor this copler as of December 3t of Year T? 3. How much is the estimated warracty liability for this coplet as of December 31 of Yoar 2 ? 4. Prepare jeurnal entries to record (a) the coplor's sales (b) the adjustment to recognize the warranty exgense on December 31 of Yeaf fiand (d) the repairs that occur on January 5 of Vear 2 . Complete this question by entering your answers in the tabs below. Prepare jougeal entries to rocord (a) the copler's sale; (b) the adjustment to recognize the warranty expense on December 31 of Year 17 and (c) the repairs that occur oa January 5 of Year 2 , Journal entry worksheet Record the estimated warranty expense at 4% of the sales. Noke: Enter dobit belare onsts. Hizu Company sold a copler (that costs $4,800 for $6,000 cest wat a two-year parts warranty to a customer on August 16 or Yent 1 . Hitru expects wairanty costs to be 4% of doliar sales. it records warranty expense were an adjusting entry on December 31. On January 5 of Year 2, the copler requires on-ste repalrs trat are comploted the same dey. The iepaics cost $209 for materlais taken from the parts inventory. These are the only fepalis requiced in Yoar 2 for this copief. 1. How much wacranty expense does the compony report tor this copier in Year T 2. How much is the estimsted warrenty liability for this copier as of December 31 of Yeat 12 ? 3. How much is the estimated warranty llablity for this copier as of December 31 of Year 27 4. Prepare journal entries to record (a) the copler's sale; (b) the adjustment to recognize the watranty expense on Docember it of Year 1i and (a) the repairs that occur on January 5 of Year 2 . Compiete this question by entering your anwwers in the tabs below. Prepare joumal entries to record (a) the copler's sale, (b) the adjustment to fecognize the warranty expense an December 31 of Year it and (c) the repairs that occur on Janusry 5 of year 2 . Journal entry worksheet Record the cost of repairs that occur on January 5 of Year 2. Note. Eeter denics betore eredita