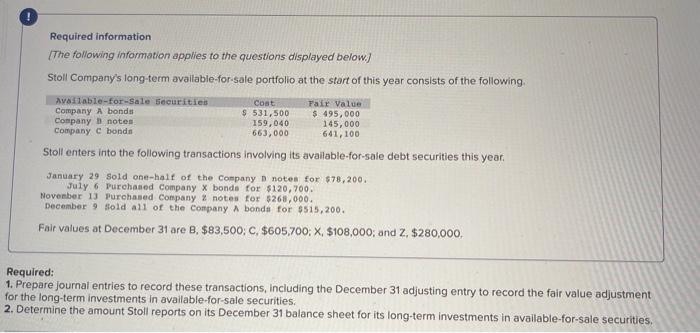

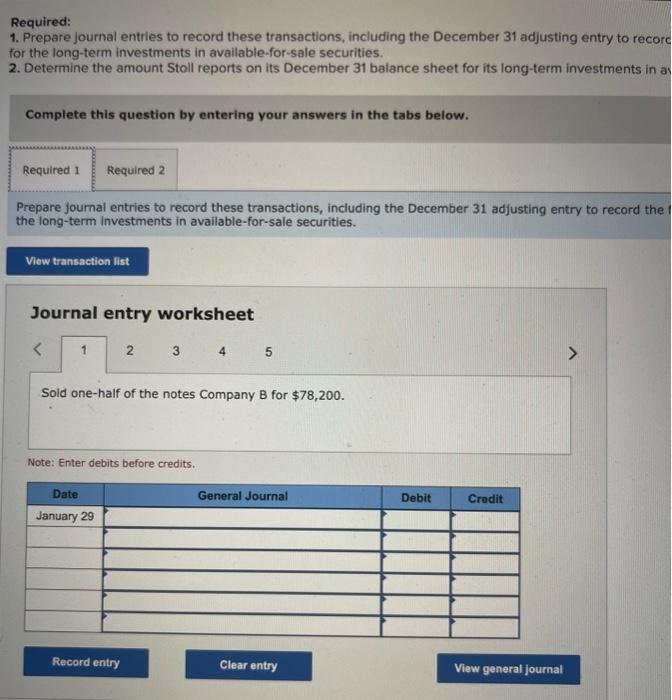

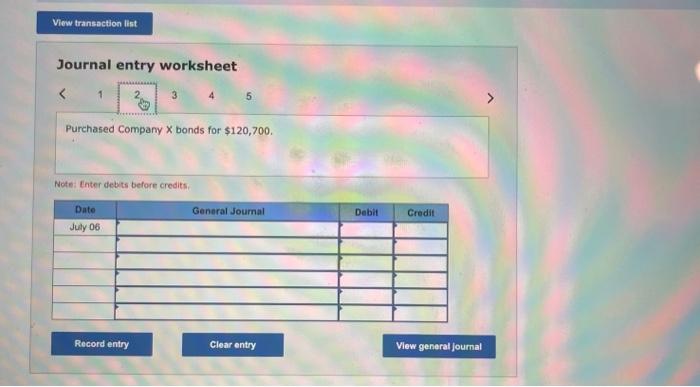

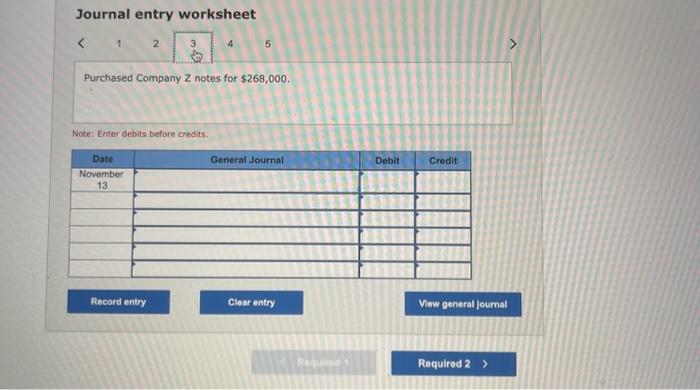

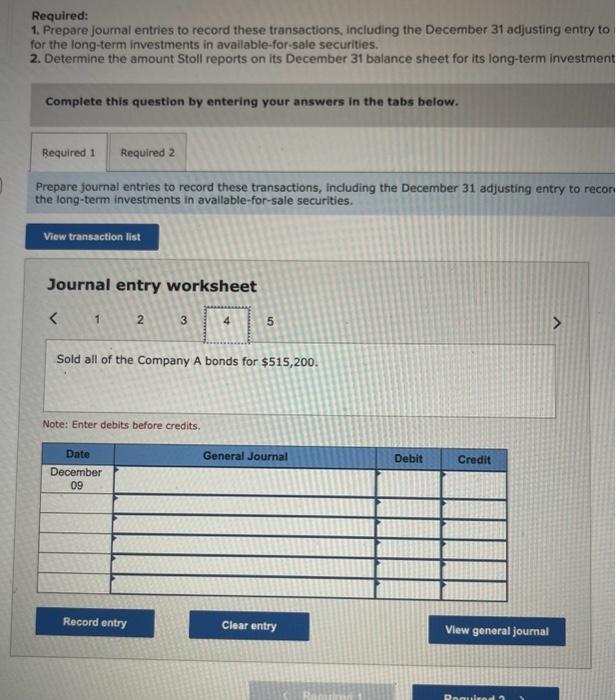

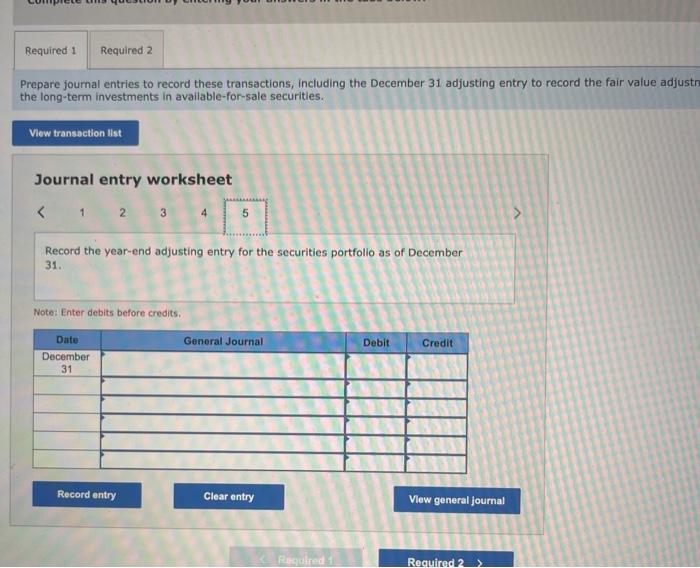

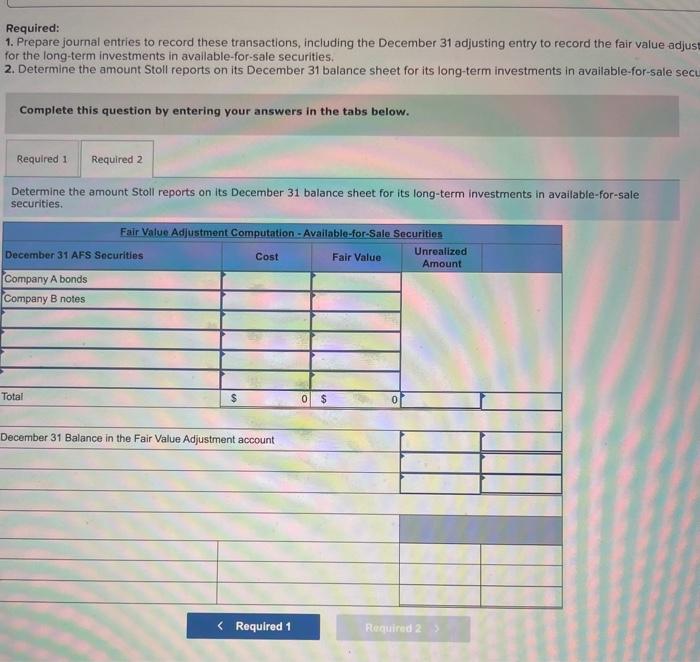

Required information [The following infomation applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company D note for $78,200. July 6 . Purchased company x bonde for 5120,700 . Noverber 13 Purohased Company z notes for 5268,000. December 9 ftold all of the Company A bondi for 5515,200 . Fair values at December 31 are B, $83,500;C,$605,700;,$108,000; and 2, $280,000. Required: Trepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment or the long-term investments in avallable-for-sale securities. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities. Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to recor for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in a Complete this question by entering your answers in the tabs below. Prepare joumal entries to record these transactions, including the December 31 adjusting entry to record the the long-term investments in available-for-sale securities. Journal entry worksheet 5 Sold one-half of the notes Company B for $78,200. Note: Enter debits before credits. Journal entry worksheet 45 Purchased Company X bonds for $120,700. Note: Enter debits before credits. Journal entry worksheet 5 Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to for the long-term investments in available-for-sale securities, 2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investmen Complete this question by entering your answers in the tabs below. Prepare joumal entries to record these transactions, including the December 31 adjusting entry to recor the long-term investments in avallable-for-sale securities. Journal entry worksheet Sold all of the Company A bonds for $515,200. Note: Enter debits before credits. Prepare joumal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjust the long-term investments in available-for-sale securities. Journal entry worksheet 1 Record the year-end adjusting entry for the securities portfolio as of December 31. Note: Enter debits before credits. Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adju: for the long-term investments in avallable-for-sale securities. 2. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale sec Complete this question by entering your answers in the tabs below. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities