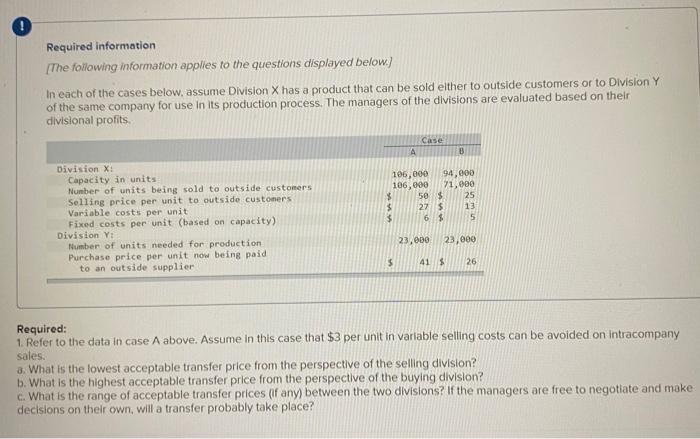

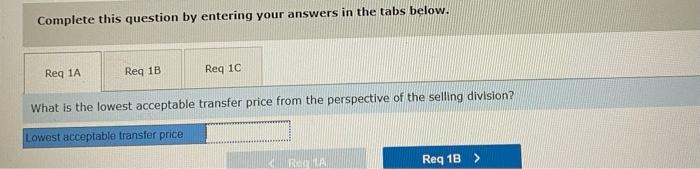

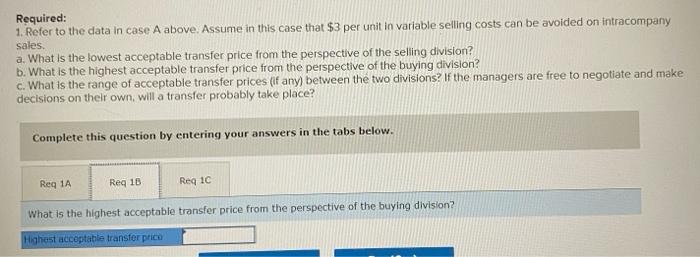

! Required information [The following information applies to the questions displayed below.) In each of the cases below, assume Division X has a product that can be sold either to outside customers or to Division Y of the same company for use in its production process. The managers of the divisions are evaluated based on their divisional profits Case A B Division X: Capacity in units Number of units being sold to outside customers Selling price per unit to outside customers Variable costs per unit Fixed costs per unit (based on capacity) Division Y: Number of units needed for production Purchase price per unit now being paid to an outside supplier 106,000 94,000 106,000 71,900 50 $ 25 27 5 13 $ 6 $ 5 23,000 23,000 5 41 26 Required: 1. Refer to the data in case A above. Assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. 3. What is the lowest acceptable transfer price from the perspective of the selling division? b. What is the highest acceptable transfer price from the perspective of the buying division? c. What is the range of acceptable transfer prices (if any) between the two divisions? If the managers are free to negotiate and make decisions on their own, will a transfer probably take place? Complete this question by entering your answers in the tabs below. Reg 1A Req 1B Reg 1C What is the lowest acceptable transfer price from the perspective of the selling division? Lowest acceptable transfer price RA Req 1B > Required: 1. Refer to the data in case A above. Assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. a. What is the lowest acceptable transfer price from the perspective of the selling division? b. What is the highest acceptable transfer price from the perspective of the buying division? c. What is the range of acceptable transfer prices (if any) between the two divisions? If the managers are free to negotiate and make decisions on their own, will a transfer probably take place? Complete this question by entering your answers in the tabs below. Req 1A Reg 13 Req 1C What is the highest acceptable transfer price from the perspective of the buying division? Highest acceptable transfer price Required information a. What is the lowest acceptable transfer price from the perspective of the selling division? b. What is the highest acceptable transfer price from the perspective of the buying division? c. What is the range of acceptable transfer prices (if any) between the two divisions? If the managers are free to negotiate and make decisions on thelr own, will a transfer probably take place? Complete this question by entering your answers in the tabs below. Reg LA Req 1B Reg 10 What is the range of acceptable transfer prices (if any) between the two divisions. If the managers are free to negotiate and make decisions on their own, will a transfer probably take place? Identify the range of acceptable transfer prices (if any) There is not a range of acceptable transfer prices There is a range of acceptable transfer prices as shown below Transfer price Are the managers likely to agree on a transfer price? Yes ONO 9 10