Answered step by step

Verified Expert Solution

Question

1 Approved Answer

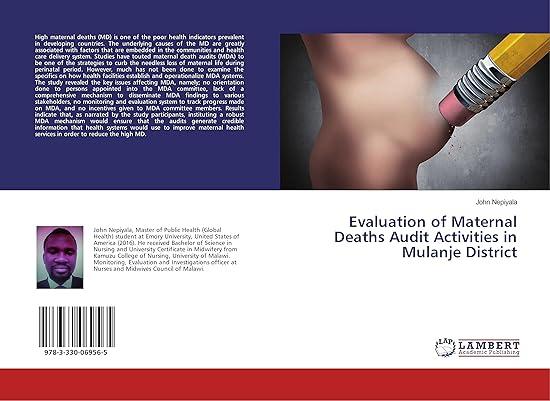

! Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. current Yr 1 Yr Ago 2 Yrs

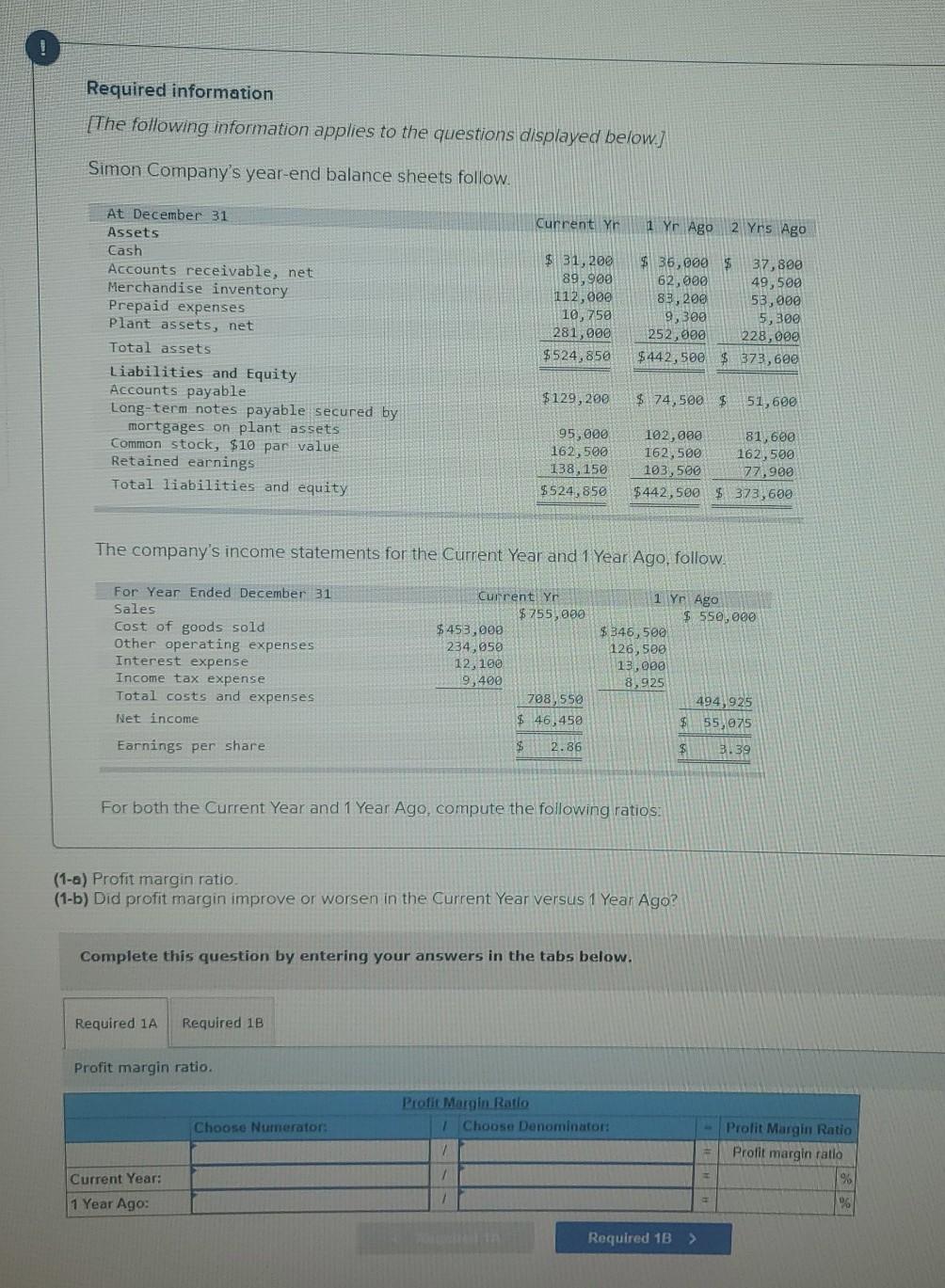

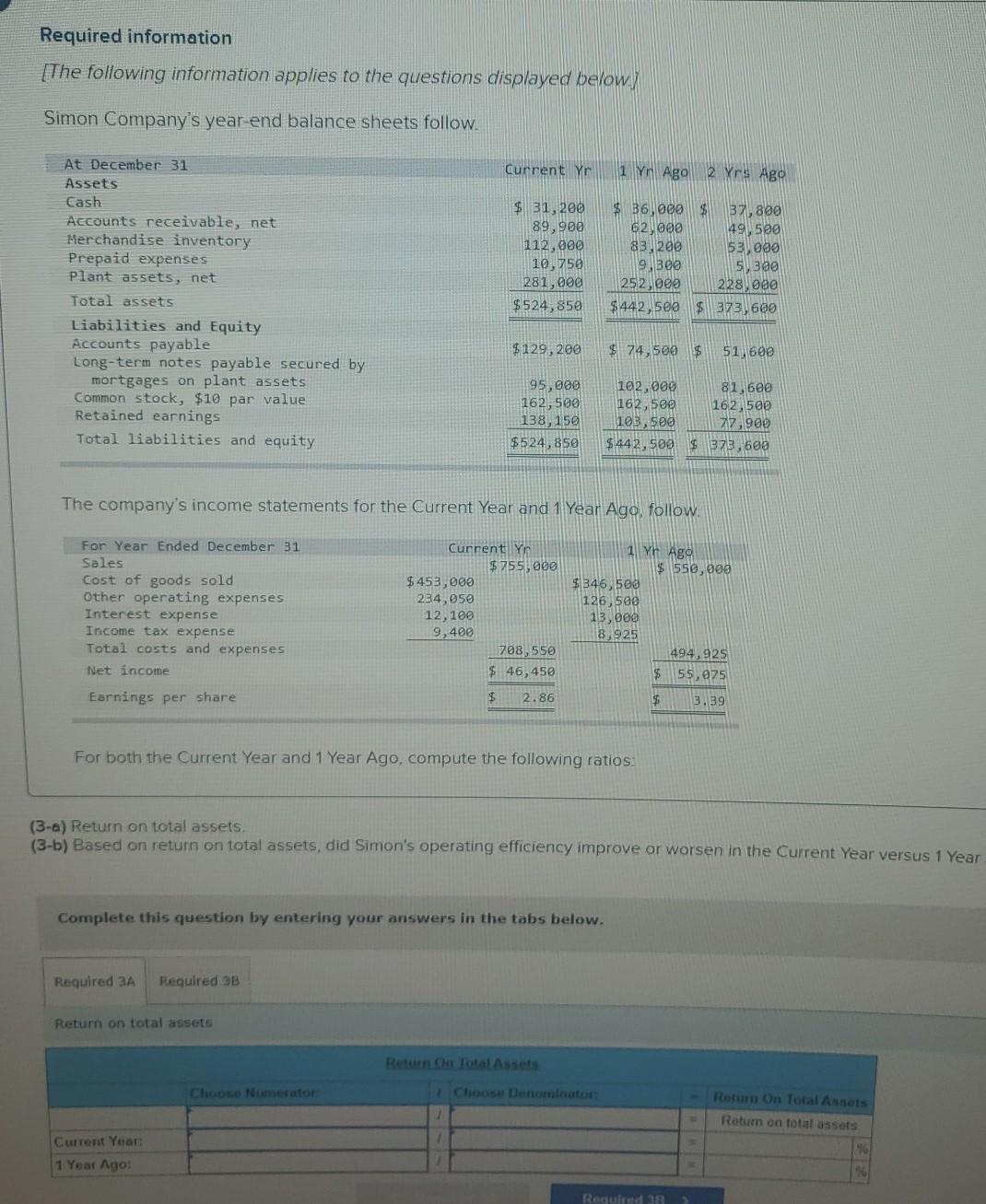

! Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,200 89,900 112,000 10,750 281,000 $524,850 $ 35,000 $ 37,800 62,000 49,500 83,200 53,000 9,300 5,30e 252,000 228,000 $442,500 $ 373,600 $129,200 $ 74,500 $ 51,600 95,000 162,500 138,150 $524,850 102,000 81,600 162,500 162,500 103,500 77.900 $442,500 $ 373,600 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Current Yr $755,000 $453,000 234,950 12,100 9,400 708,550 $ 46,459 1 Yr Ago $ 550,000 $ 346,500 126,500 13,000 8,925 494, 925 $ 55,075 $ 3.39 Earnings per share $ 2.86 For both the Current Year and 1 Year Ago, compute the following ratios: (1-0) Profit margin ratio. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Required 1A Required 1B Profit margin ratio. Profit Margin Ratio 7 Choose Denominator: Choose Numerator: - Prolit Margin Ratio Profit margin ratio 7 Current Year: 1 Year Ago: Required 18 > ! Required information [The following information applies to the questions displayed below Simon Company's year-end balance sheets follow. Current Yr 1 Yr Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,200 89,900 112,000 10,750 281,000 $524,850 $ 36,000 $ 37,800 62,000 49,500 83,290 53,000 9,300 5,300 252,000 228,000 $442,500 $ 373,600 $129,200 $ 74,500 $ 51,600 95,000 162,500 138,150 $524,850 102,000 81,600 162,500 162,500 103,500 77,990 $442,500 $373,600 The company's income statements for the Current Year and 1 Year Ago, follow. 1 Yr Ago $ 550,000 For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current Yr $755,000 $ 453,000 234,050 12,100 9,400 708,550 $ 46,450 $ 346,500 126,500 13,000 8,925 494,925 $ 55,075 $ 2.86 $ 3.39 For both the Current Year and 1 Year Ago, compute the following ratios. (2) Total asset tumover. Total Asset Turnover Choose Denominator: Choose Numerator: Total Asset Turnover Total asset turnover times Current Year: 1 1 Year Ago: times Required information [The following information applies to the questions displayed below/ Simon Company's year-end balance sheets follow. Current Yn 1 Yn Ago 2 Yrs Ago At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,200 89, 900 112,000 10,750 281,000 $524,850 $ 6,000 $ 37,800 62, oee 49,500 83,280 53,000 9,300 5300 252,080 228 000 $442,500 $373) 600 $129,200 $ 74,500 $ 51, 600 95,000 162,500 138,150 $524,850 102,000 81,600 162,500 162,500 103,500 27.900 $442,500$ 373,600 The company's income statements for the Current Year and 1 Year Ago follow For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earnings per share Current YA $ 755,000 $453,000 234,050 12,100 9,400 708,550 $ 46,450 1 Yr Ago $ 550,000 $346,500 126,500 13,000 8.925 494,925 $ 55,075 $ 3.39 $ 2.86 For both the Current Year and 1 Year Ago, compute the following ratios. (3-6) Return on total assets. (3-5) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus 1 Year Complete this question by entering your answers in the tabs below. Required 3A Required 3B Return on total assets Return On Total Assets Choose Numerator 1 ChoosDenominator Return On Total Assets Rotum on total assets Current Year 1 Year Ago: Required 32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started