Answered step by step

Verified Expert Solution

Question

1 Approved Answer

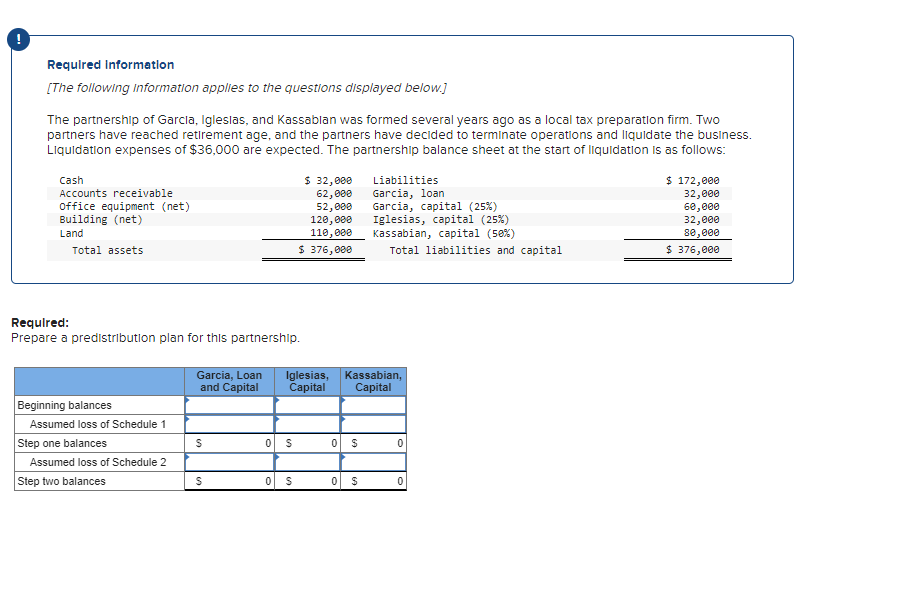

Required Information [ The following Information applies to the questions d / splayed below. ] The partnership of Garcla, Igleslas, and Kassablan was formed several

Required Information

The following Information applies to the questions dsplayed below.

The partnership of Garcla, Igleslas, and Kassablan was formed several years ago as a local tax preparation firm. Two

partners have reached retirement age, and the partners have decided to terminate operations and IIquidate the business.

Liquidation expenses of $ are expected. The partnership balance sheet at the start of Ilquidation is as follows:

Required:

Prepare a predistribution plan for this partnership.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started