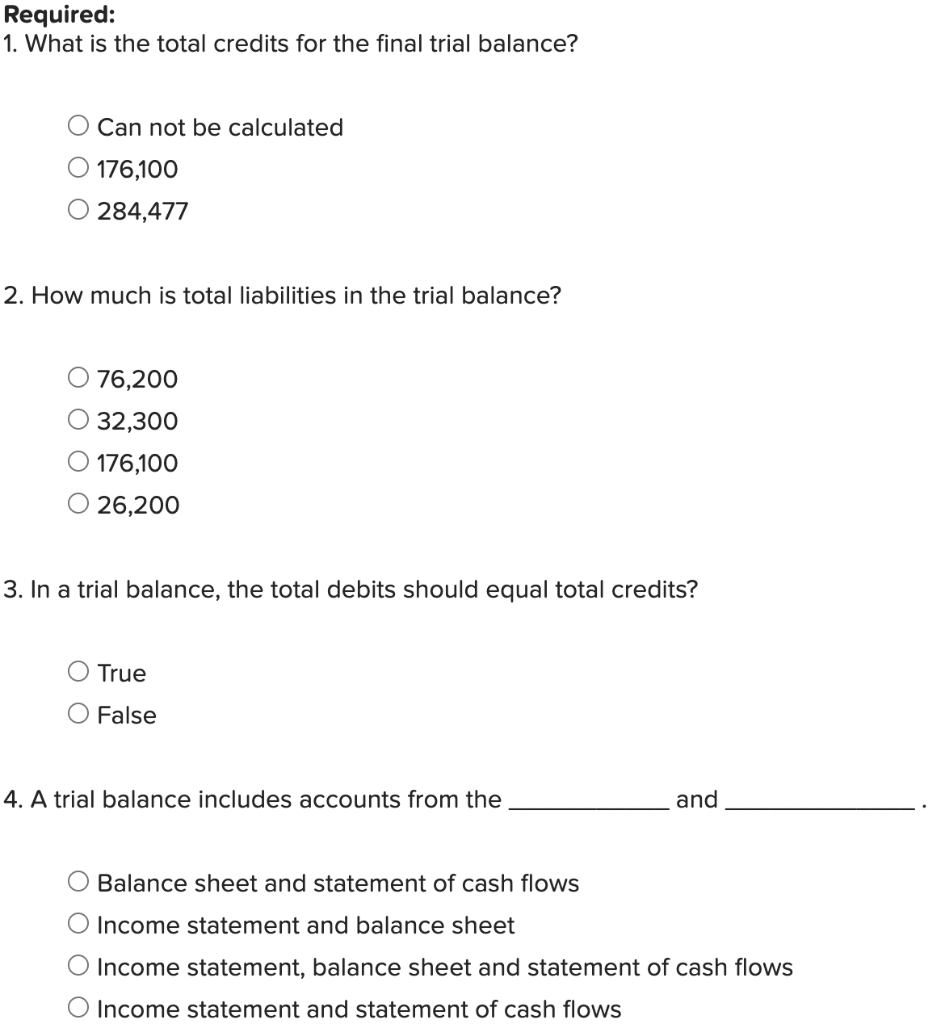

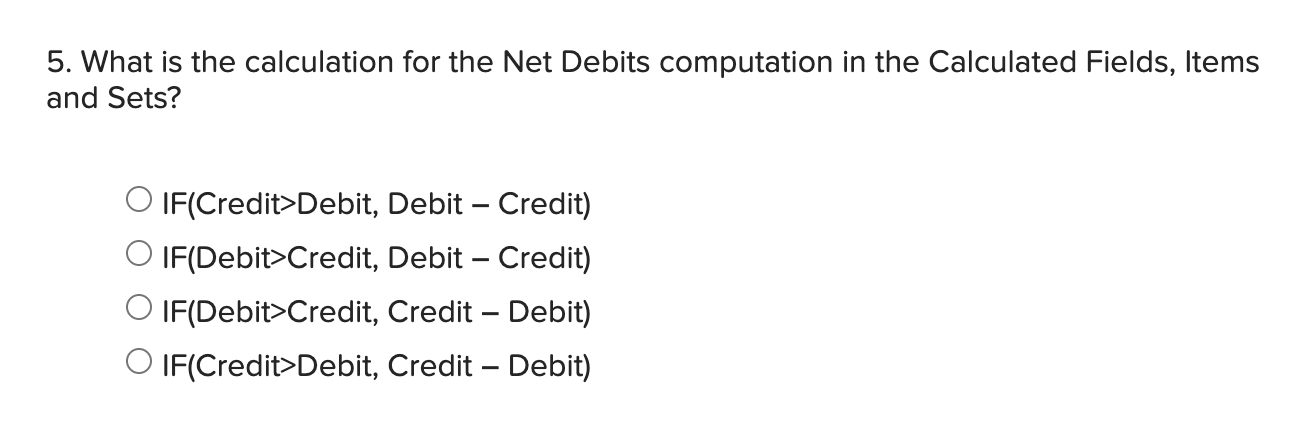

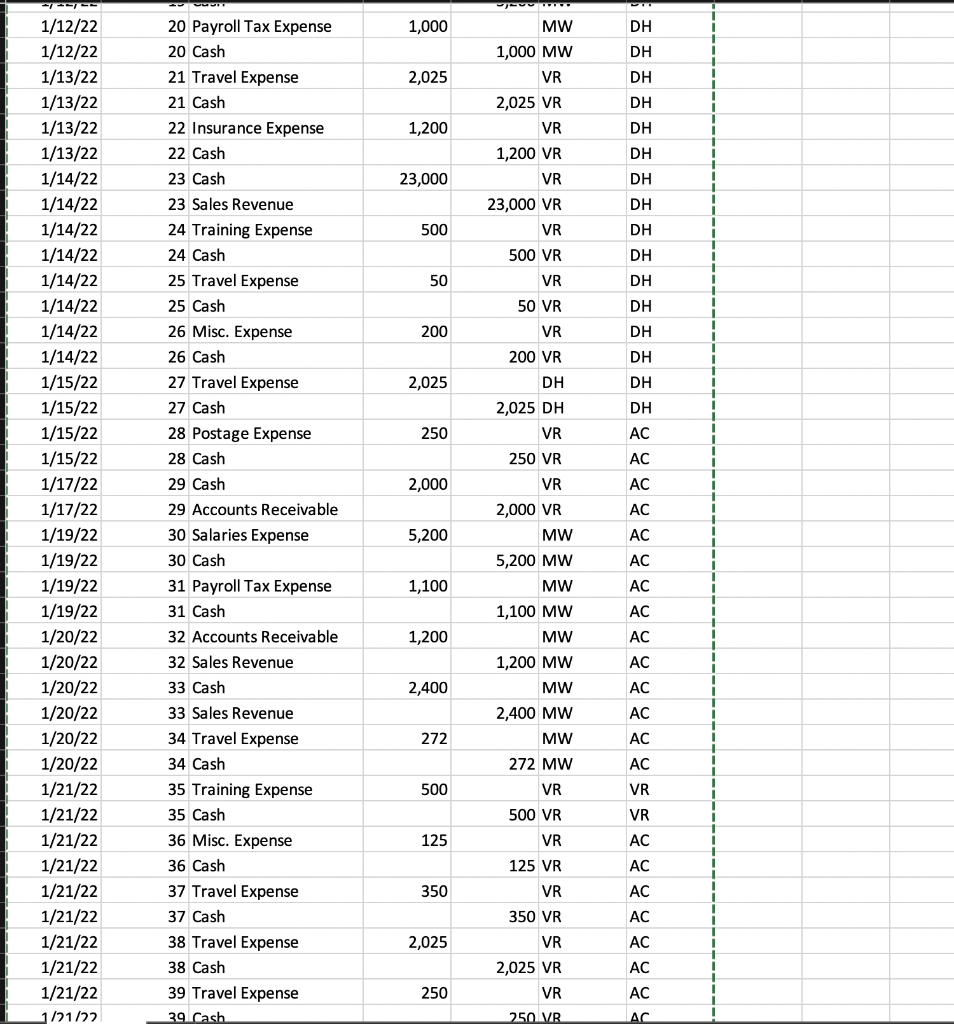

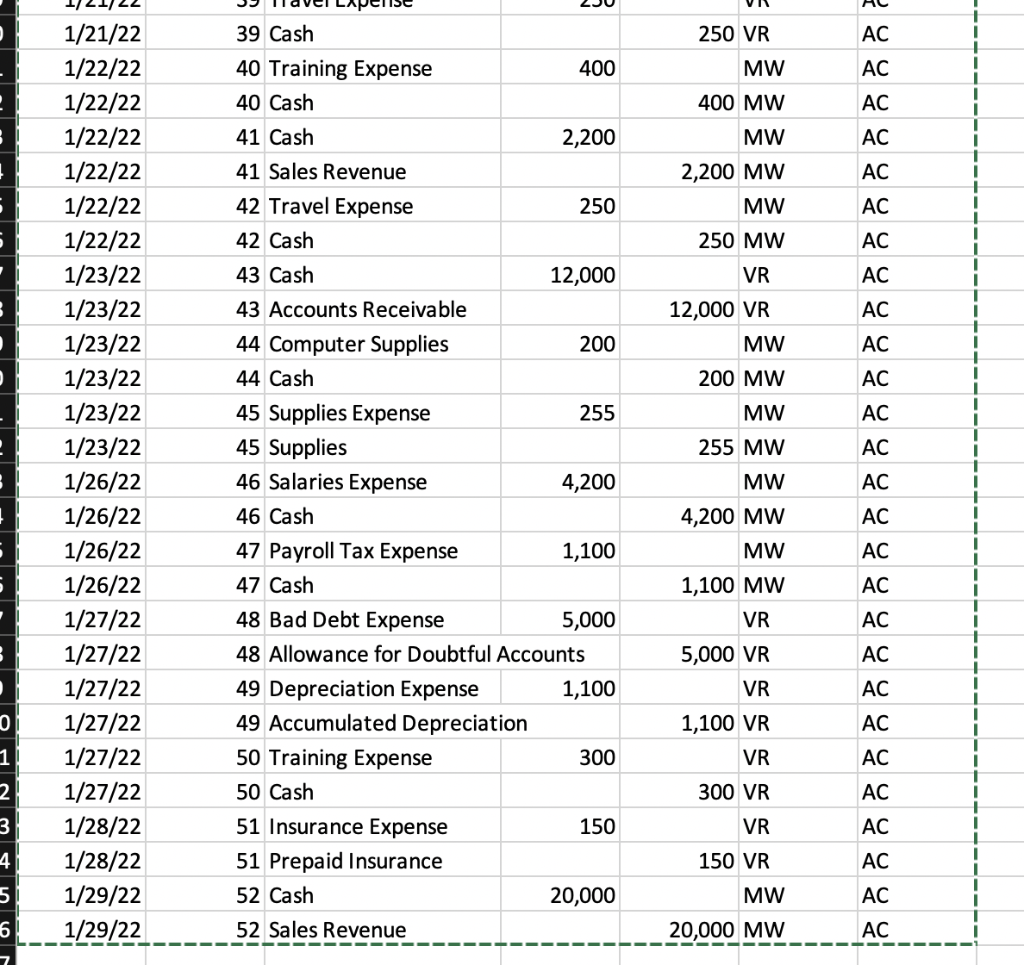

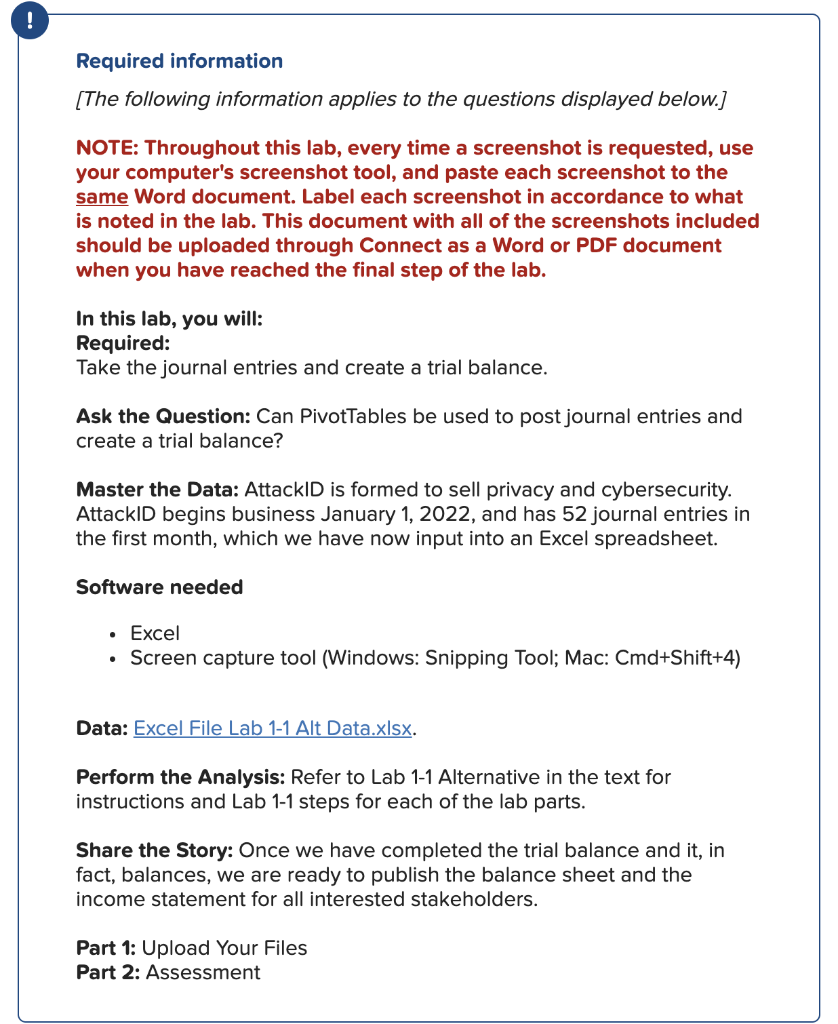

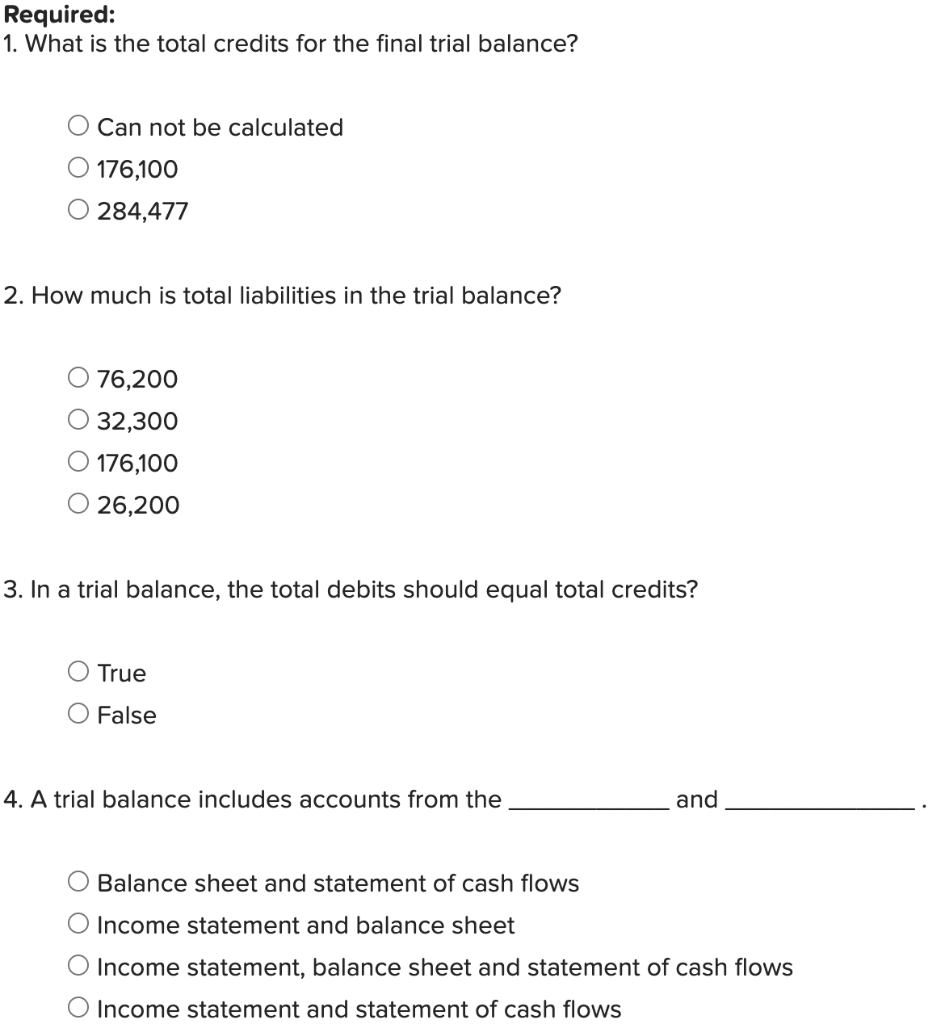

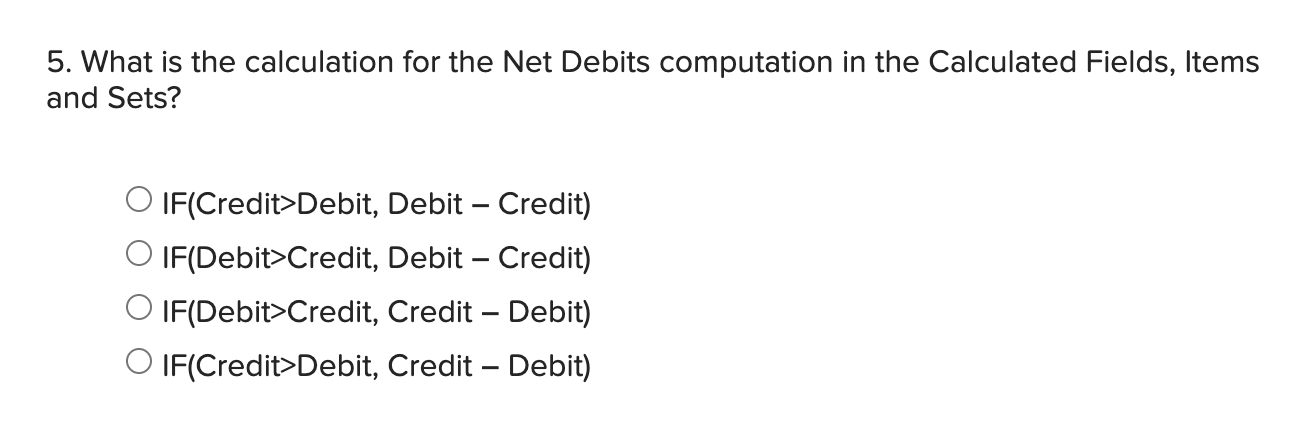

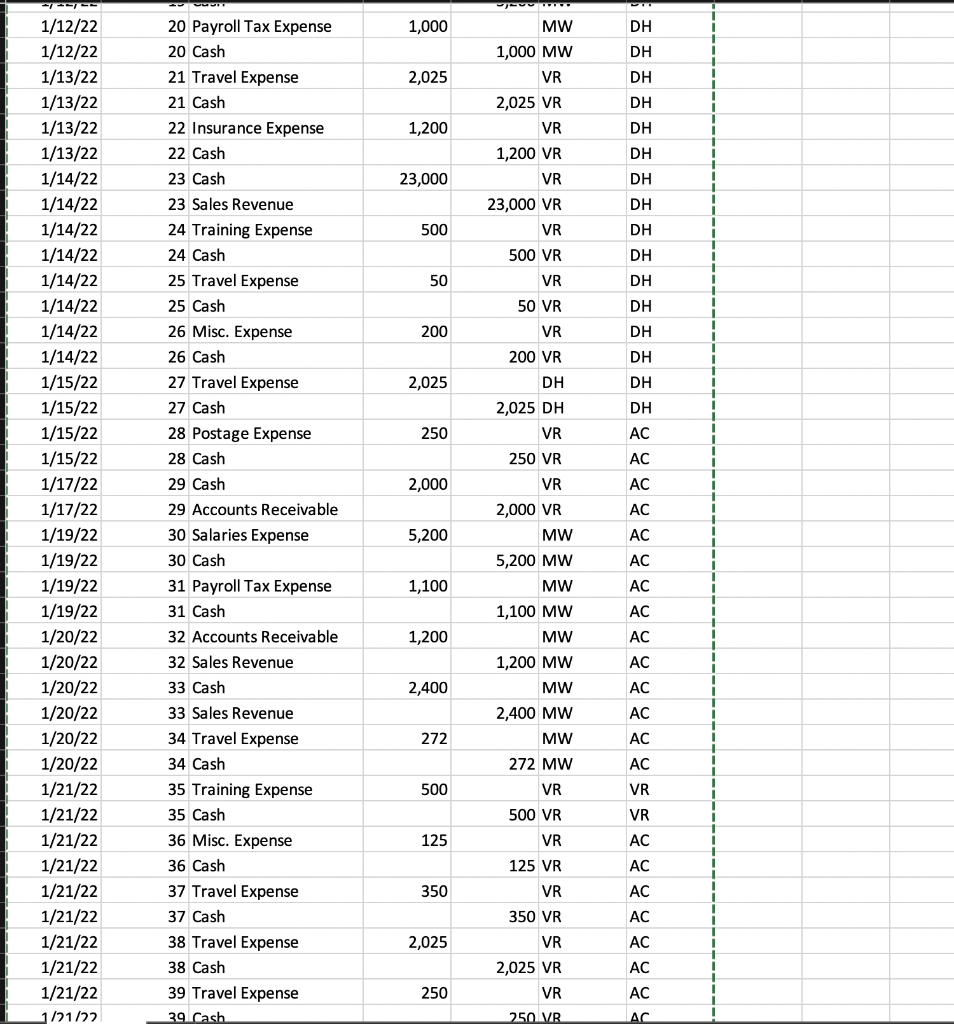

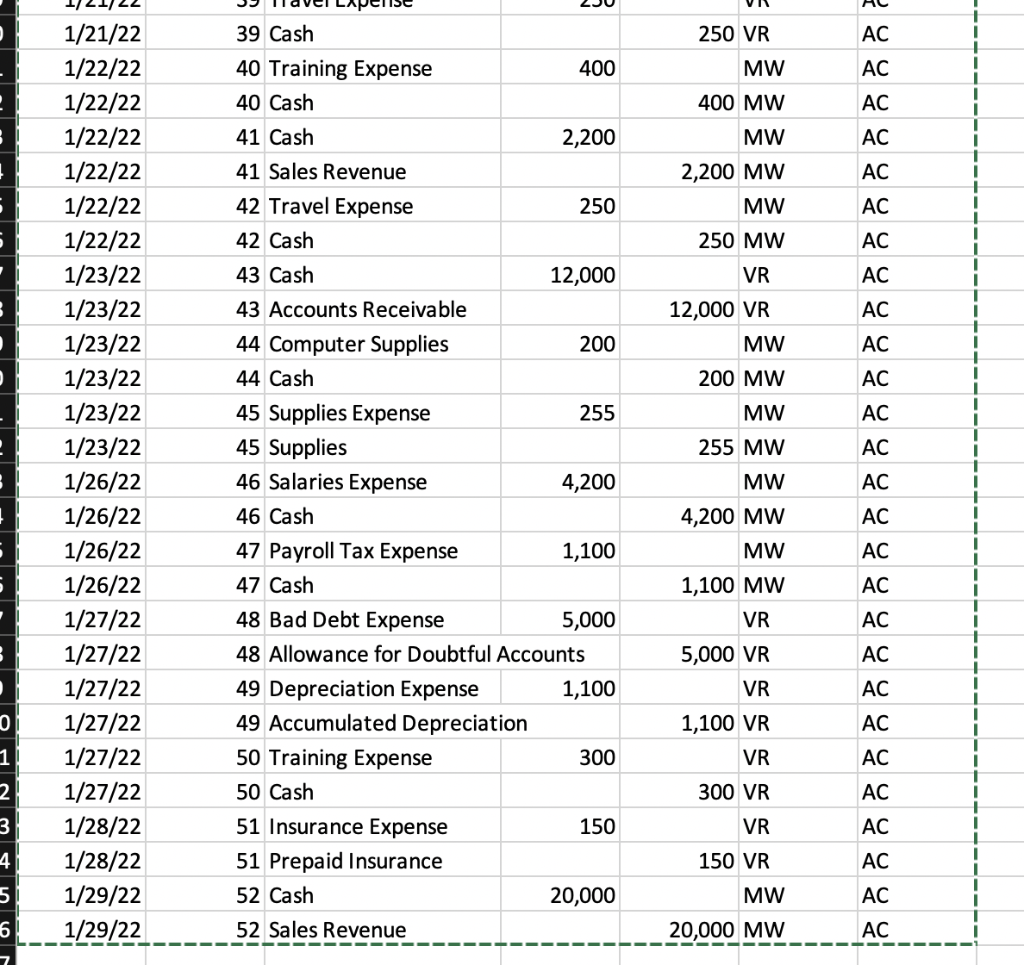

! Required information (The following information applies to the questions displayed below.) NOTE: Throughout this lab, every time a screenshot is requested, use your computer's screenshot tool, and paste each screenshot to the same Word document. Label each screenshot in accordance to what is noted in the lab. This document with all of the screenshots included should be uploaded through Connect as a Word or PDF document when you have reached the final step of the lab. In this lab, you will: Required: Take the journal entries and create a trial balance. Ask the Question: Can PivotTables be used to post journal entries and create a trial balance? Master the Data: AttackID is formed to sell privacy and cybersecurity. AttackId begins business January 1, 2022, and has 52 journal entries in the first month, which we have now input into an Excel spreadsheet. Software needed Excel Screen capture tool (Windows: Snipping Tool; Mac: Cmd+Shift+4) Data: Excel File Lab 1-1 Alt Data.xlsx. Perform the Analysis: Refer to Lab 1-1 Alternative in the text for instructions and Lab 1-1 steps for each of the lab parts. Share the Story: Once we have completed the trial balance and it, in fact, balances, we are ready to publish the balance sheet and the income statement for all interested stakeholders. Part 1: Upload Your Files Part 2: Assessment Required: 1. What is the total credits for the final trial balance? Can not be calculated O 176,100 284,477 2. How much is total liabilities in the trial balance? 76,200 O 32,300 O 176,100 O 26,200 3. In a trial balance, the total debits should equal total credits? O True O False 4. A trial balance includes accounts from the and Balance sheet and statement of cash flows O Income statement and balance sheet O Income statement, balance sheet and statement of cash flows O Income statement and statement of cash flows 5. What is the calculation for the Net Debits computation in the Calculated fields, Items and Sets? O IF(Credit>Debit, Debit - Credit) O IF(Debit>Credit, Debit Credit) IF(Debit>Credit, Credit Debit) O IF(Credit>Debit, Credit Debit) Approved AC AC AC AC AC AC AC AC AC AC AC AC AC AC AC AC AC AC AC 1 Date JE# 2 1/2/22 3 1/2/22 4 1/2/22 5 1/2/22 6 1/2/22 7 1/2/22 8 1/4/22 1/4/22 LO 1/5/22 -1 1/5/22 _2 1/6/18 _3 1/6/18 4 1/5/22 _5 1/5/22 .6 1/6/22 -7 1/6/22 8 1/6/22 9 1/6/22 20 1/7/22 21 1/7/22 22 1/7/22 3 1/7/22 24 1/10/22 15 1/10/22 26 1/10/22 27 1/10/22 28 1/10/22 9 1/10/22 30 1/10/22 1 1/10/22 2 1/10/22 3 1/10/22 4 1/10/22 55 1/10/22 56 1/11/22 7 1/11/22 18 1/11/22 59 1/12/22 10 1/12/22 Account Name 1 Cash 1 Common Stock 2 Travel Expense 2 Cash 3 Building 3 Cash 4 Utilities Expense 4 Cash 5 Equipment 5 Notes Payable 6 Salaries Expense 6 Cash 7 Payroll Tax Expense 7 Cash 8 Accounts Receivable 8 Sales Revenue 9 Cash 9 Notes Payable 10 Repairs Expense 10 Cash 11 Accounts Receivable 11 Sales Revenue 12 Cash 12 Accounts Receivable 13 Repairs Expense 13 Cash 14 Rent Expense 14 Cash 15 Prepaid Insurance 15 Cash 16 Accounts Receivable 16 Sales Revenue 17 Notes Payable 17 Cash 18 Supplies 18 Computer Supplies 18 Cash 19 Salaries Expense 19 Cash Debit Credit Entered 50,000 VR 50,000 VR 150 VR 150 VR 30,000 VR 30,000 VR 1,500 MW 1,500 MW 17,200 VR 17,200 VR 1,300 VR 1,300 VR 1,000 VR 1,000 VR 10,000 VR 10,000 VR 11,000 VR 11,000 VR 7,000 VR 7,000 VR 20,000 VR 20,000 VR 10,000 VR 10,000 VR 1,300 MW 1,300 MW 7,000 MW 7,000 MW 1,000 VR 1,000 VR 15,000 VR 15,000 VR MW 2,000 MW 500 MW 500 1,000 MW 5,200 MW 5,200 MW AC DH DH DH DH DH DH DH DH DH DH 2,000 DH DH DH DH DH MW DH DH DH DH 1,000 DH DH 2,025 DH DH 1,200 MW 1,000 MW VR 2,025 VR VR 1,200 VR VR 23,000 VR VR 500 VR VR 50 VR DH DH DH DH 23,000 500 DH DH DH 50 DH 200 VR DH 2,025 DH DH DH AC 250 AC 2,000 AC AC 1/12/22 1/12/22 1/13/22 1/13/22 1/13/22 1/13/22 1/14/22 1/14/22 1/14/22 1/14/22 1/14/22 1/14/22 1/14/22 1/14/22 1/15/22 1/15/22 1/15/22 1/15/22 1/17/22 1/17/22 1/19/22 1/19/22 1/19/22 1/19/22 1/20/22 1/20/22 1/20/22 1/20/22 1/20/22 1/20/22 1/21/22 1/21/22 1/21/22 1/21/22 1/21/22 1/21/22 1/21/22 1/21/22 1/21/22 1/21/22 20 Payroll Tax Expense 20 Cash 21 Travel Expense 21 Cash 22 Insurance Expense 22 Cash 23 Cash 23 Sales Revenue 24 Training Expense 24 Cash 25 Travel Expense 25 Cash 26 Misc. Expense 26 Cash 27 Travel Expense 27 Cash 28 Postage Expense 28 Cash 29 Cash 29 Accounts Receivable 30 Salaries Expense 30 Cash 31 Payroll Tax Expense 31 Cash 32 Accounts Receivable 32 Sales Revenue 33 Cash 33 Sales Revenue 34 Travel Expense 34 Cash 35 Training Expense 35 Cash 36 Misc. Expense 36 Cash 37 Travel Expense 37 Cash 38 Travel Expense 38 Cash 39 Travel Expense 39 Cash 200 VR DH 2,025 DH VR 250 VR VR 2,000 VR MW 5,200 MW MW 1,100 MW MW 1,200 MW MW 5,200 AC AC 1,100 AC AC 1,200 AC AC AC 2,400 AC 272 2,400 MW MW 272 MW VR 500 VR AC 500 VR VR 125 VR AC AC 125 VR 350 VR AC AC AC 2,025 350 VR VR 2,025 VR VR 250 VR 250 AC AC AC 230 250 VR AC MW AC AC AC AC AC 400 MW MW 2,200 MW MW 250 MW VR 12,000 VR MW 200 MW AC AC AC AC MW AC 255 MW AC 1/21/22 1/22/22 1/22/22 1/22/22 1/22/22 1/22/22 1/22/22 1/23/22 1/23/22 1/23/22 1/23/22 1/23/22 1/23/22 1/26/22 1/26/22 1/26/22 1/26/22 1/27/22 1/27/22 1/27/22 1/27/22 1/27/22 1/27/22 1/28/22 1/28/22 1/29/22 1/29/22 39 Cash 40 Training Expense 400 40 Cash 41 Cash 2,200 41 Sales Revenue 42 Travel Expense 250 42 Cash 43 Cash 12,000 43 Accounts Receivable 44 Computer Supplies 200 44 Cash 45 Supplies Expense 255 45 Supplies 46 Salaries Expense 4,200 46 Cash 47 Payroll Tax Expense 1,100 47 Cash 48 Bad Debt Expense 5,000 48 Allowance for Doubtful Accounts 49 Depreciation Expense 1,100 49 Accumulated Depreciation 50 Training Expense 300 50 Cash 51 Insurance Expense 150 51 Prepaid Insurance 52 Cash 20,000 52 Sales Revenue AC AC AC AC MW 4,200 MW MW 1,100 MW VR 5,000 VR VR 1,100 VR VR AC AC AC 0 AC 1 AC 2 300 VR AC 3 VR AC 4 150 VR AC 5 MW AC 6 20,000 MW AC 7