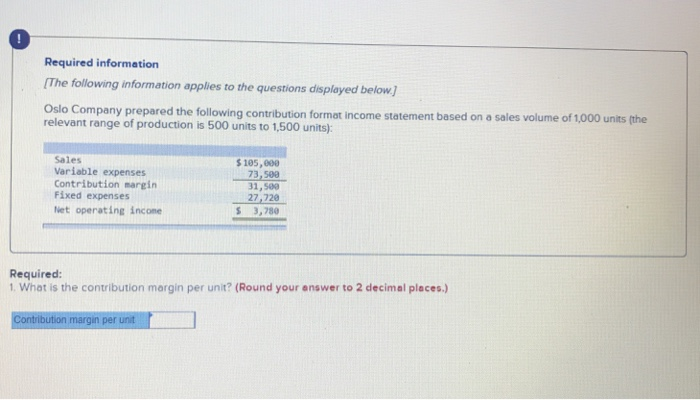

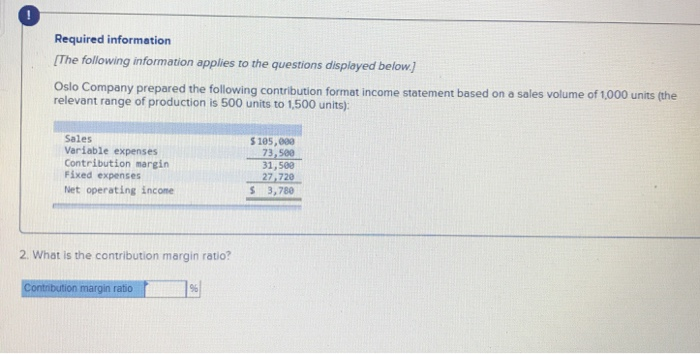

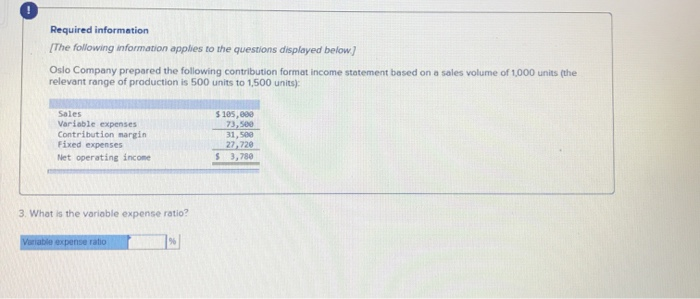

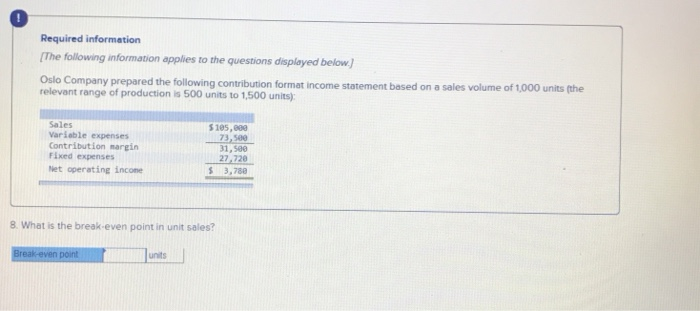

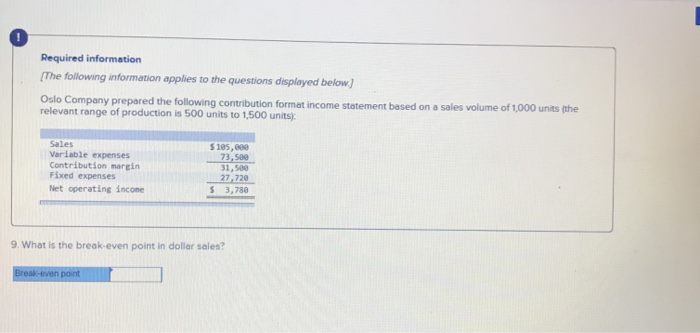

! Required information (The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales $105,000 73,500 31, 500 27,720 $ 3,780 Variable expenses Contribution margin Fixed expenses Net operating incone Required: 1 What is the contribution margin per unit? (Round your answer to 2 decimal places.) Contribution margin per unit - Required information The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales Veriable expenses Contribution margin Fixed expenses $ 105,000 73,500 31,500 27,720 $ 3,780 Net operating income 2. What is the contribution margin ratio? Contribution margin ratio 9% Required information (The following information applies to the questions displayed below Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of praduction is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 105,000 73,500 31, 500 27,720 S 3,780 3. What is the variable expense ratio? Variable expense ratio Required information The following information applies to the questions displayed below Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units) Sales Variable expenses Contribution margin Fixed expenses $105.000 73, 500 31, 5e0 27,720 3,780 Net operating incone 8. What is the break-even point in unit sales? units Break-even point Required information [The following information applies to the questions displayed below Oslo Company prepared the following contribution format income statement based on a sales relevant range of production is 500 units to 1,500 units): volume of 1,000 units (the Sales $105,000 Variable expenses Contribution margin Fixed expenses 73,500 31,500 27,720 S 3,788 Net operating income 9. What is the break-even point in dollar sales? Break-even point