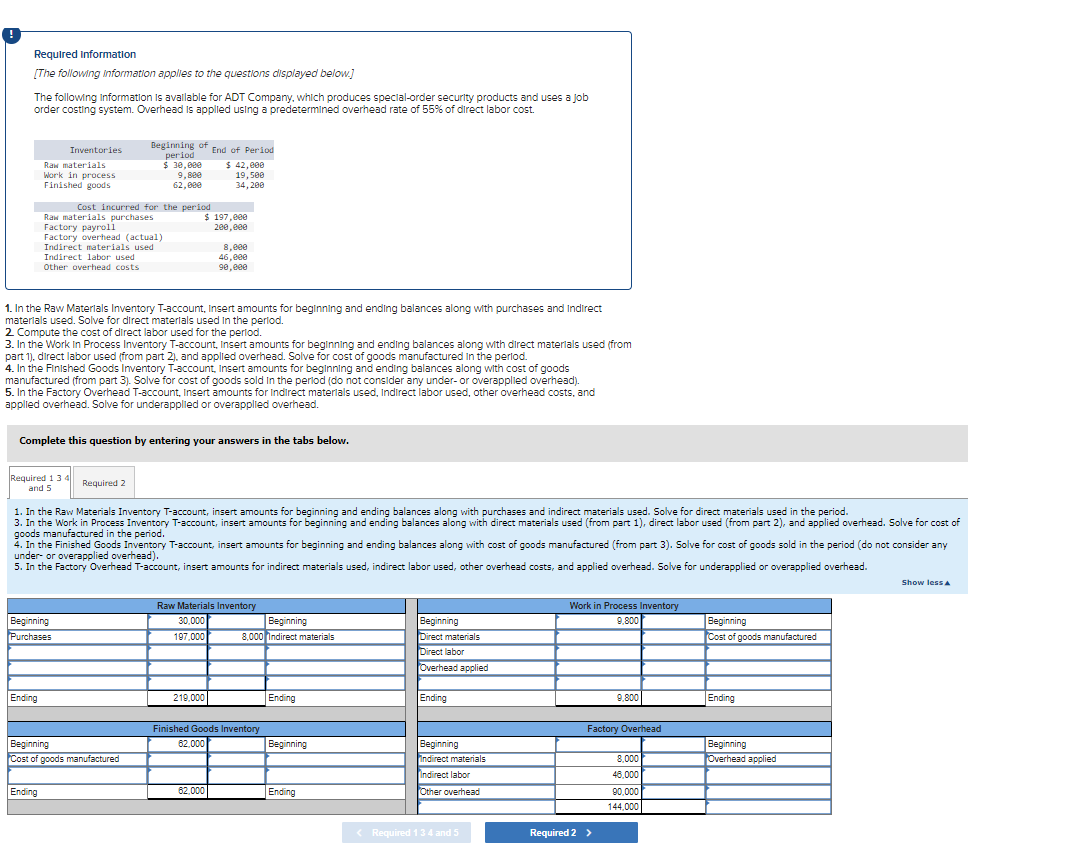

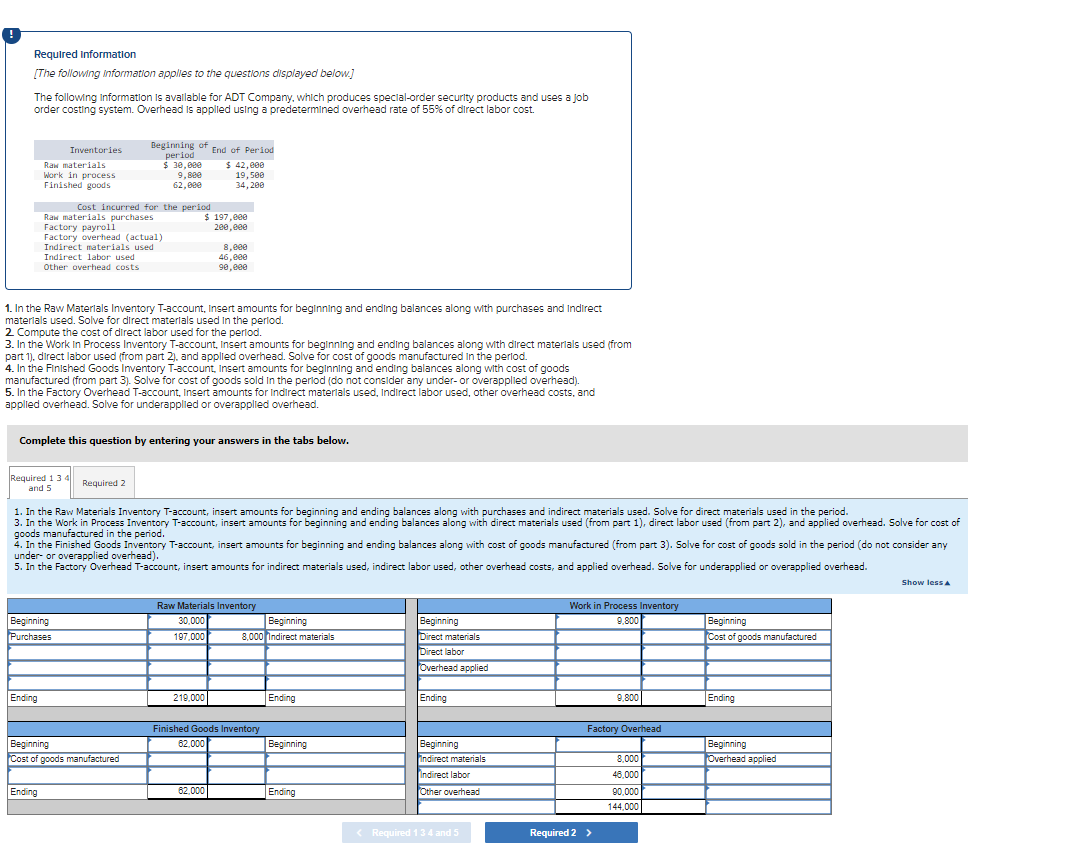

! Required information (The following information applies to the questions displayed below.] The following information is available for ADT Company, which produces special-order security products and uses a job order costing system. Overhead is applied using a predetermined overhead rate of 55% of direct labor cost. Inventories Raw materials Work in process Finished goods Beginning of End of Period period $ 30,eee $ 42,000 9,880 19,500 62,00 34,200 Cost incurred for the period Raw materials purchases $ 197,eee Factory payroll 2eeeee Factory overhead (actual) Indirect materials used 8,600 Indirect labor used 46,eee Other overhead costs 90.eee 1. In the Raw Materials Inventory T-account, Insert amounts for beginning and ending balances along with purchases and Indirect materials used. Solve for direct materials used in the period. 2 Compute the cost of direct labor used for the period. 3. In the Work In Process Inventory T-account, Insert amounts for beginning and ending balances along with direct materials used (from part 1), direct labor used (from part 2). and applied overhead. Solve for cost of goods manufactured in the period. 4. In the Finished Goods Inventory T-account Insert amounts for beginning and ending balances along with cost of goods manufactured (from part 3). Solve for cost of goods sold in the period (do not consider any under-or overapplied overhead). 5. In the Factory Overhead T-account, Insert amounts for indirect materials used, Indirect labor used, other overhead costs, and applied overhead. Solve for underapplied or overapplied overhead. Complete this question by entering your answers in the tabs below. Required 1 3 4 and 5 Required 2 1. In the Raw Materials Inventory T-account, insert amounts for beginning and ending balances along with purchases and indirect materials used. Solve for direct materials used in the period. 3. In the Work in Process Inventory T-account, insert amounts for beginning and ending balances along with direct materials used (from part 1), direct labor used (from part 2), and applied overhead. Solve for cost of goods manufactured in the period. 4. In the Finished Goods Inventory T-account, insert amounts for beginning and ending balances along with cost of goods manufactured (from part 3). Solve for cost of goods sold in the period (do not consider any under or overapplied overhead). 5. In the Factory Overhead T-account, insert amounts for indirect materials used, indirect labor used, other overhead costs, and applied overhead. Solve for underapplied or overapplied overhead. Show less Work in Process Inventory 9.800 Beginning Purchases Raw Materials Inventory 30,000 Beginning 197,000 8,000 Indirect materials Beginning Cost of goods manufactured Beginning Direct materials Direct labor Overhead applied Ending 219,000 Ending Ending 9.800 Ending Factory Overhead Finished Goods Inventory 62.000 Beginning Cost of goods manufactured Beginning Beginning Overhead applied Beginning indirect materials Indirect labor Other overhead 8,000 48,000 90,000 144,000 Ending 62.000 Ending Required 1 3 4 and 5 Required 2 >