Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [ The following information applies to the questions displayed below. ] Reese Castor, the owner of Castor Corporation, is located at 1 3

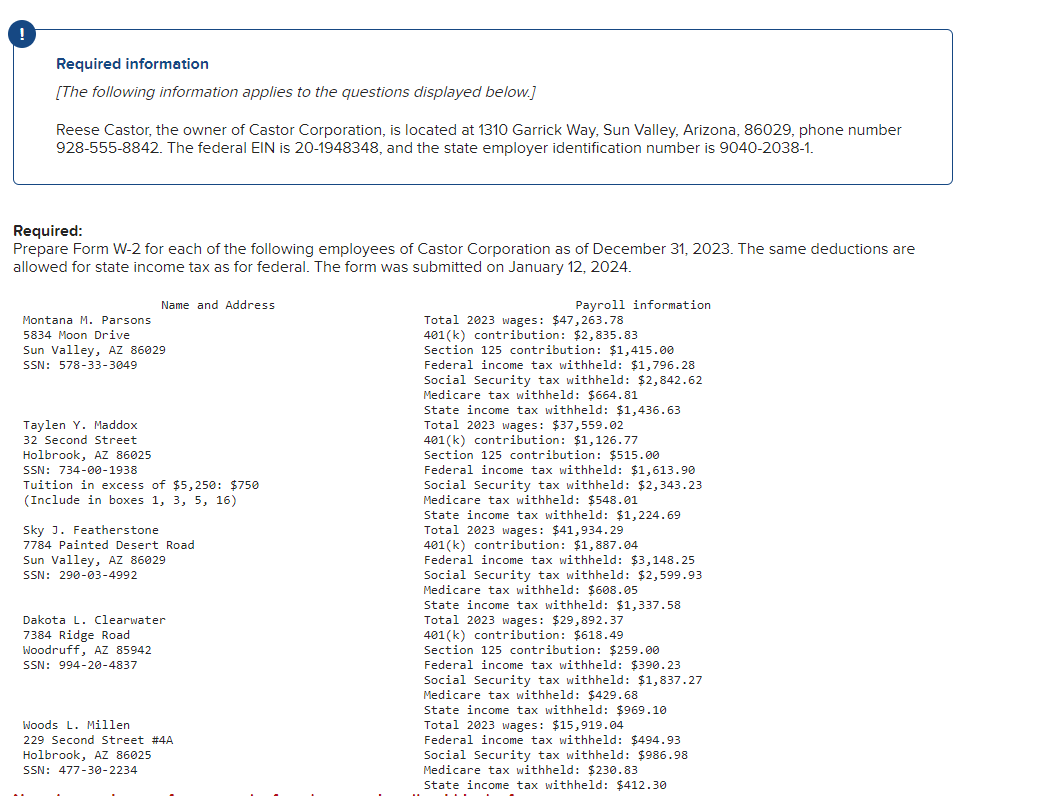

Required information

The following information applies to the questions displayed below.

Reese Castor, the owner of Castor Corporation, is located at Garrick Way, Sun Valley, Arizona, phone number

The federal EIN is and the state employer identification number is

Required:

Prepare Form W for each of the following employees of Castor Corporation as of December The same deductions are

allowed for state income tax as for federal. The form was submitted on January Montana M Parsons

Moon Drive

Sun Valley, AZ

SSN:

Taylen Y Maddox

Second Street

Holbrook, AZ

SSN:

Tuition in excess of $: $

Include in boxes

Sky J Featherstone

Sun Valley, AZ

SSN:

Dakota L Clearwater

Woodruff, AZ

SSN:

Woods L Millen

Second Street #A

Holbrook, AZ

SSN:

Total wages: $

k contribution: $

Section contribution: $

Federal income tax withheld: $

Social Security tax withheld: $

Medicare tax withheld: $

State income tax withheld: $

Total wages: $

k contribution: $

Section contribution: $

Federal income tax withheld: $

Social Security tax withheld: $

Medicare tax withheld: $

State income tax withheld: $

Total wages: $

k contribution: $

Federal income tax withheld: $

Social Security tax withheld: $

Medicare tax withheld: $

State income tax withheld: $

Total wages: $

k contribution: $

Section contribution: $

Federal income tax withheld: $

Social Security tax withheld: $

Medicare tax withheld: $

State income tax withheld: $

Total wages: $

Federal income tax withheld: $

Social Security tax withheld: $

Medicare tax withheld: $

State income tax withheld: $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started