Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Required information [ The following information applies to the questions displayed below. ] Kayla works for LeFlore Inc. and earns a monthly salary of $

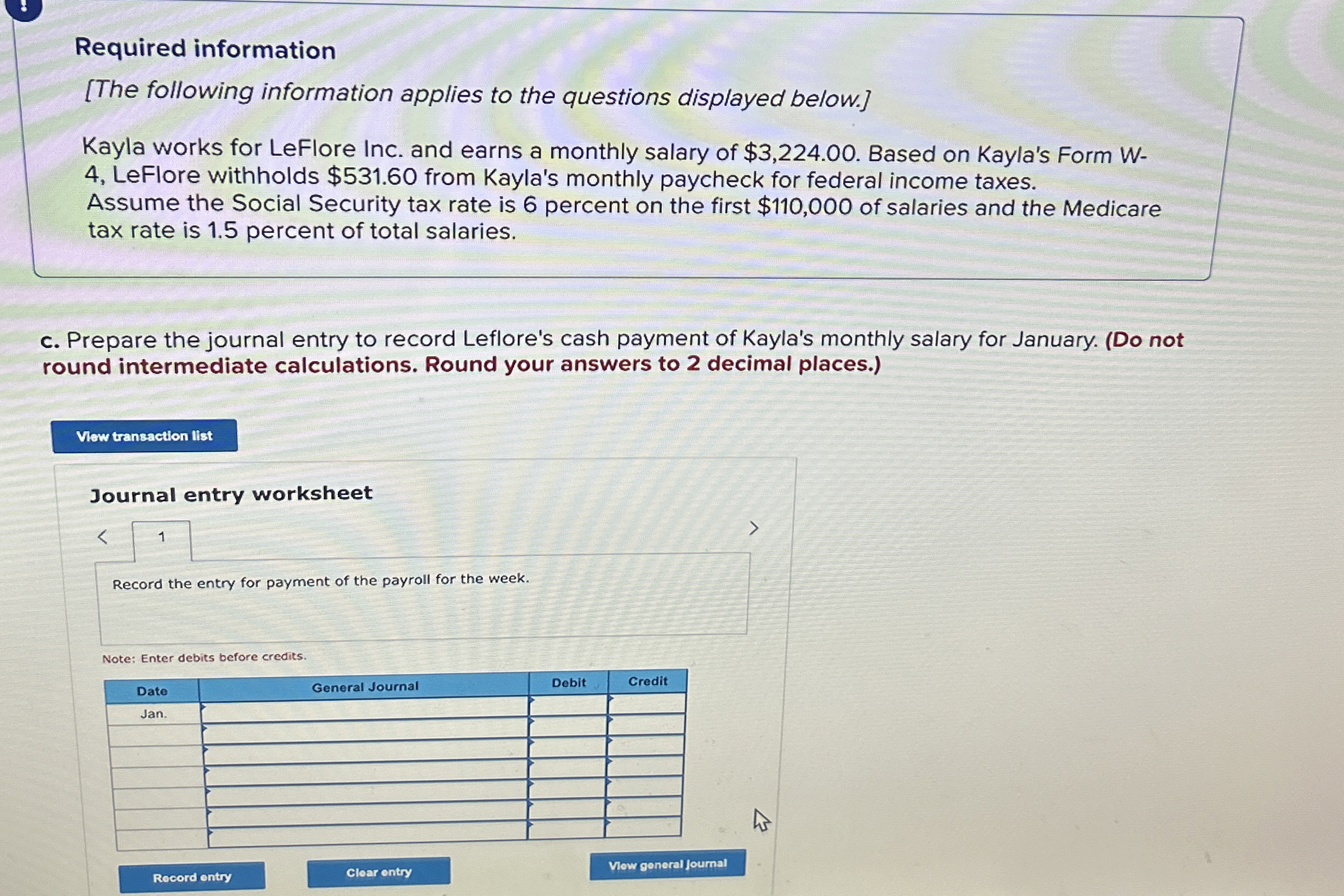

Required information

The following information applies to the questions displayed below.

Kayla works for LeFlore Inc. and earns a monthly salary of $ Based on Kayla's Form W LeFlore withholds $ from Kayla's monthly paycheck for federal income taxes. Assume the Social Security tax rate is percent on the first $ of salaries and the Medicare tax rate is percent of total salaries.

c Prepare the journal entry to record Leflore's cash payment of Kayla's monthly salary for January. Do not round intermediate calculations. Round your answers to decimal places.

Journal entry worksheet

Record the entry for payment of the payroll for the week.

Note: Enter debits before credits.

tableDateDebit,CreditJan

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started