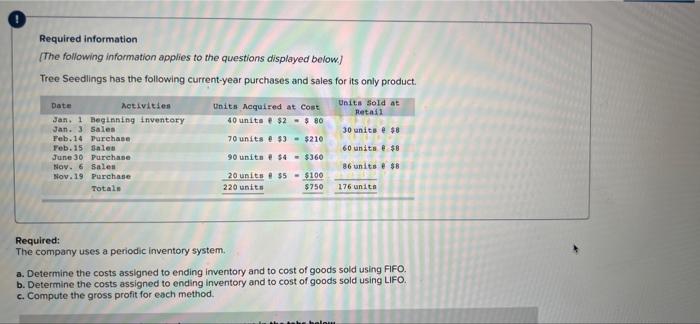

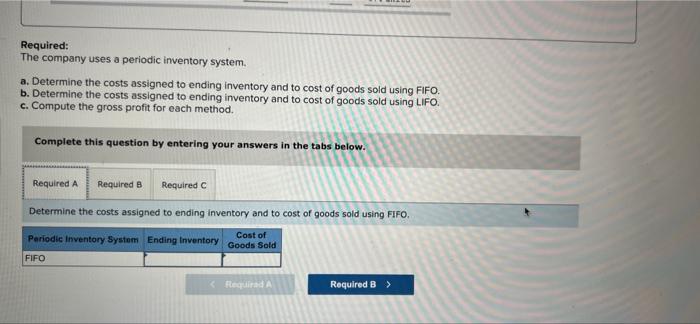

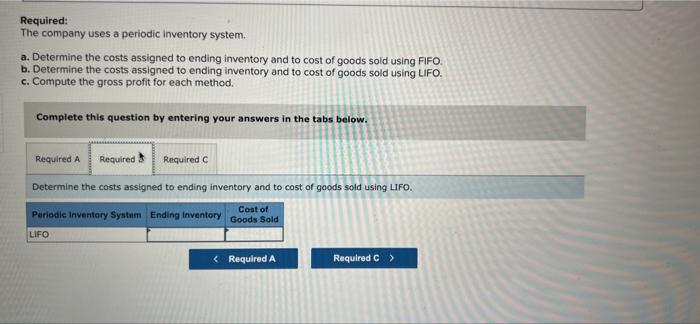

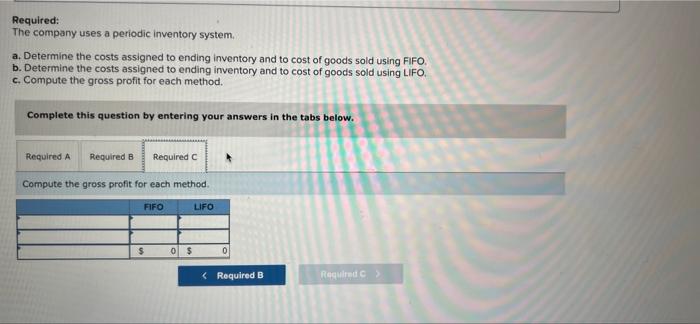

Required information The following information applies to the questions displayed below) Tree Seedlings has the following current-year purchases and sales for its only product Date Activities Units Acquired at cost Units Bold at Retas Jan. 1 Beginning inventory 40 units $2 - $ 80 Jan. 3 Sales 30 unita $8 Feb. 14 Purchase 70 units @ $3-$210 Teb. 15 Sales 60 units $8 June 30 Purchase 90 units $4 = $360 Nov. 6 Sales 86 units # $8 Nov. 19 Purchase 20 units 55 - $100 Totale 220 units $750 176 units Required: The company uses a periodic inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross profit for each method Required: The company uses a periodic inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross profit for each method. Complete this question by entering your answers in the tabs below. Required A Required B Required Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Periodic Inventory System Ending Inventory Goods Sold Cost of FIFO Required Required B > Required: The company uses a periodic inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross profit for each method. Complete this question by entering your answers in the tabs below. Required A Required Required Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. Periodic Inventary System Ending Inventory Cost of Goods Sold LIFO Required: The company uses a periodic inventory system a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO, b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross profit for each method. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the gross profit for each method. FIFO LIFO $ 0 $ 0