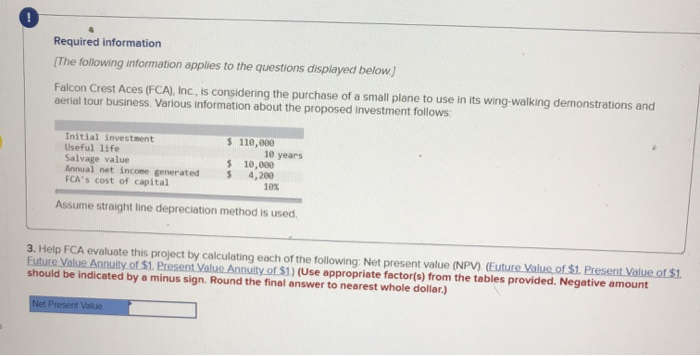

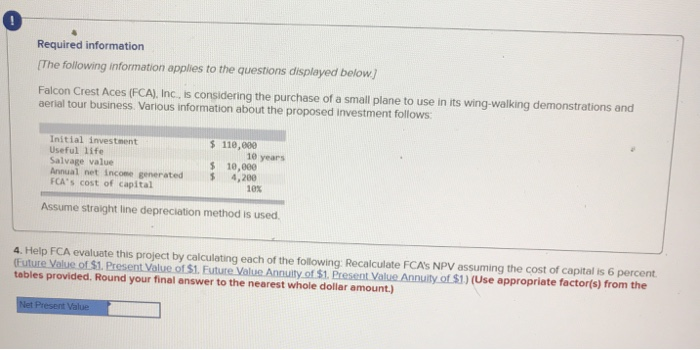

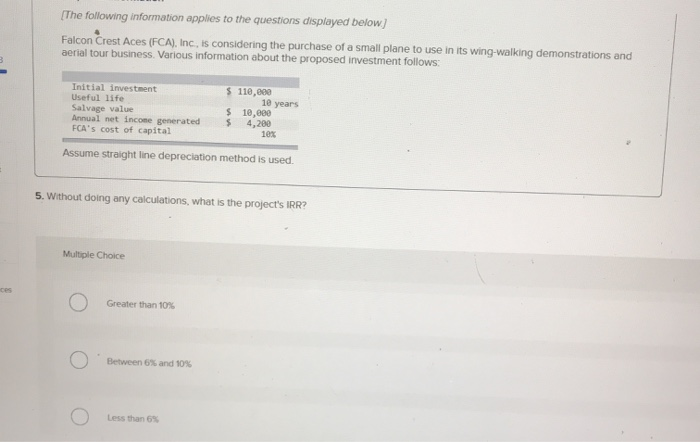

Required information The following information applies to the questions displayed below) Falcon Crest Aces (FCA), Inc., is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investent Useful life Salvage value Annual net income generated FCA'S cost of capital $ 110,000 10 years $ 10,000 $ 4,200 103 Assume straight line depreciation method is used. 3. Help FCA evaluate this project by calculating each of the following: Net present value (NPV) (Euture Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) (Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar) Net Present Value Required information The following information applies to the questions displayed below.) Falcon Crest Aces (FCA), Inc. is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated FCA's cost of capital $ 110,000 10 years $ 10,000 $ 4,200 10% Assume straight line depreciation method is used. 4. Help FCA evaluate this project by calculating each of the following: Recalculate FCA'S NPV assuming the cost of capital is 6 percent (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) (Use appropriate factor(s) from the tables provided. Round your final answer to the nearest whole dollar amount.) Net Present Value [The following information applies to the questions displayed below) Falcon Crest Aces (FCA), Inc. is considering the purchase of a small plane to use in its wing-walking demonstrations and aerial tour business. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated FCA'S cost of capital $ 110,000 10 years $ 10,000 $ 4,200 10% Assume straight line depreciation method is used. 5. Without doing any calculations, what is the project's IRR? Multiple Choice Greater than 10% O Between 6% and 10% Less than 6%