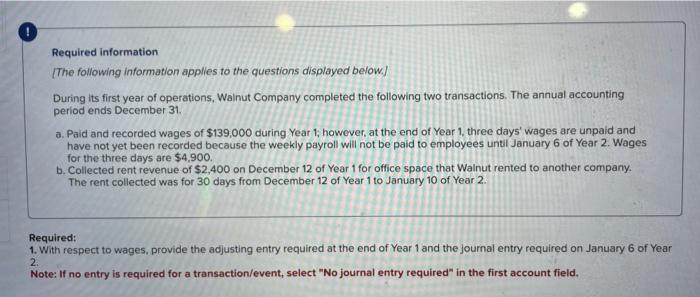

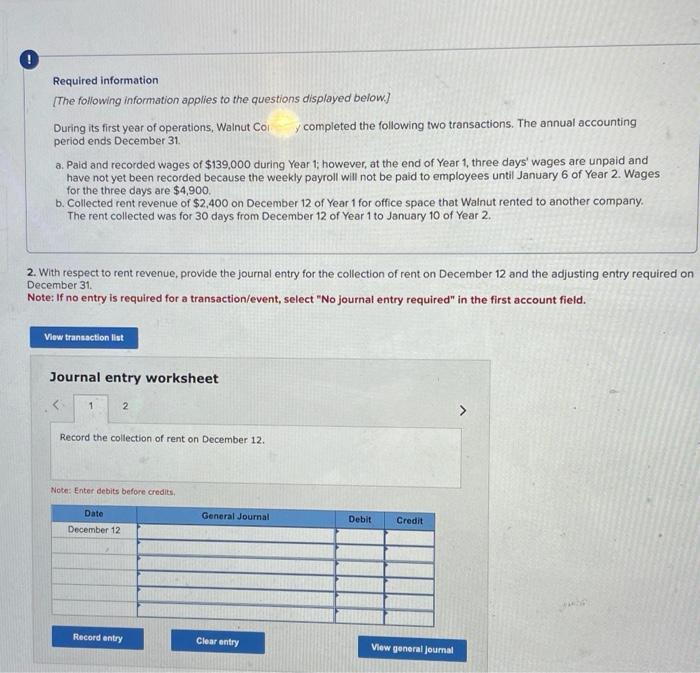

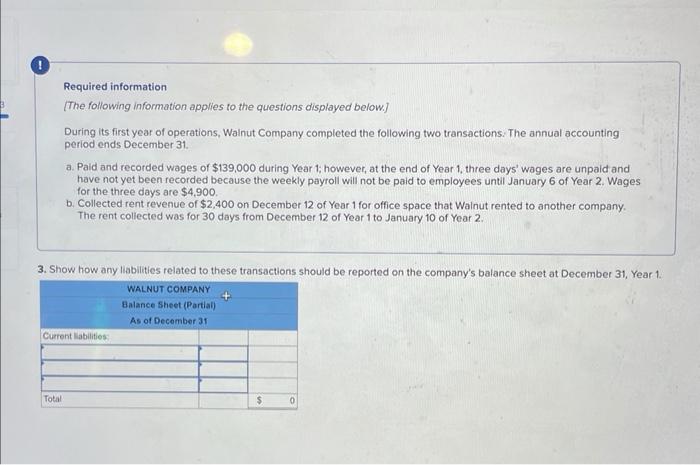

Required information [The following information applies to the questions displayed below.] During its first year of operations, Walnut Company completed the following two transactions. The annual accounting period ends December 31. a. Paid and recorded wages of $139,000 during Year 1; howover, at the end of Year 1, three days' wages are unpaid and have not yet been recorded because the weekly payroll will not be paid to employees until January 6 of Year 2 . Wages for the three days are $4,900. b. Collected rent revenue of $2,400 on December 12 of Year 1 for office space that Walnut rented to another company. The rent collected was for 30 days from December 12 of Year 1 to January 10 of Year 2. Required: 1. With respect to wages, provide the adjusting entry required at the end of Year 1 and the journal entry required on January 6 of Year 2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Required information [The following information applies to the questions displayed below] During its first year of operations, Wainut Col completed the following two transactions. The annual accounting period ends December 31. a. Paid and recorded wages of $139,000 during Year 1 ; however, at the end of Year 1 , three days' wages are unpaid and have not yet been recorded because the weekly payroll will not be paid to employees until January 6 of Year 2 . Wages for the three days are $4,900. b. Collected rent revenue of $2,400 on December 12 of Year 1 for office space that Walnut rented to another company. The rent collected was for 30 days from December 12 of Year 1 to January 10 of Year 2 . 2. With respect to rent revenue, provide the journal entry for the collection of rent on December 12 and the adjusting entry required on December 31 . Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the collection of rent on December 12. Nobe: Enter debits before credits, Required information [The following information applies to the questions displayed below.] During its first year of operations, Wainut Company completed the following two transactions: The annual accounting period ends December 31 . a. Paid and recorded wages of $139,000 during Year 1; however, at the end of Year 1, three days' wages are unpaid and have not yet been recorded because the weekly payroll will not be paid to employees until January 6 of Year 2 . Wages for the three days are $4,900. b. Collected rent revenue of $2,400 on December 12 of Year 1 for office space that Walnut rented to another company. The rent coliected was for 30 days from December 12 of Year 1 to January 10 of Year 2. 3. Show how any liabilities related to these transactions should be reported on the company's balance sheet at December 31 , Year 1