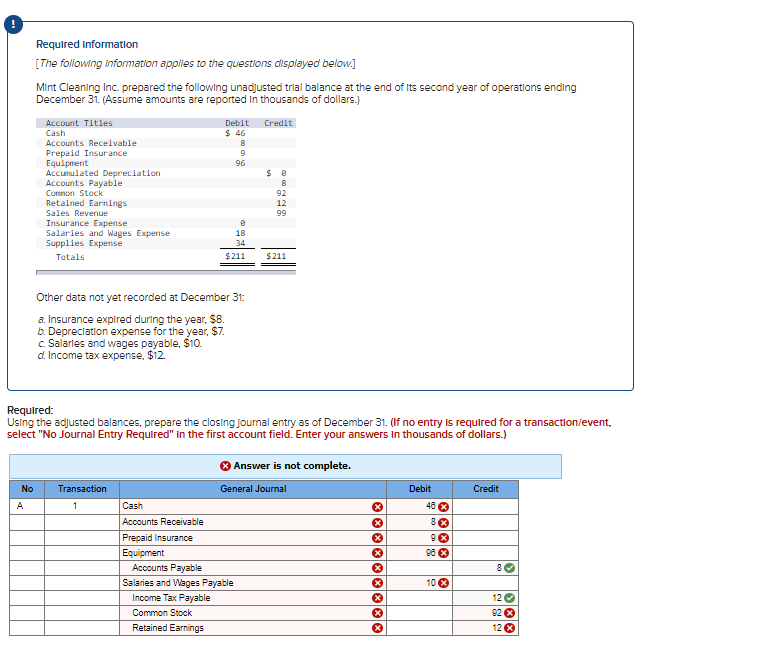

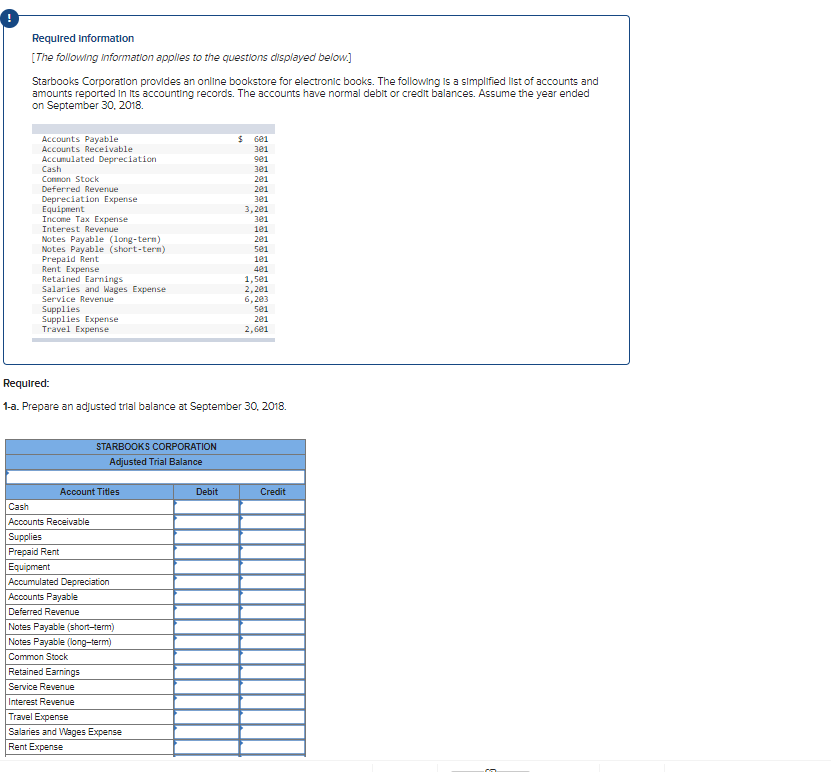

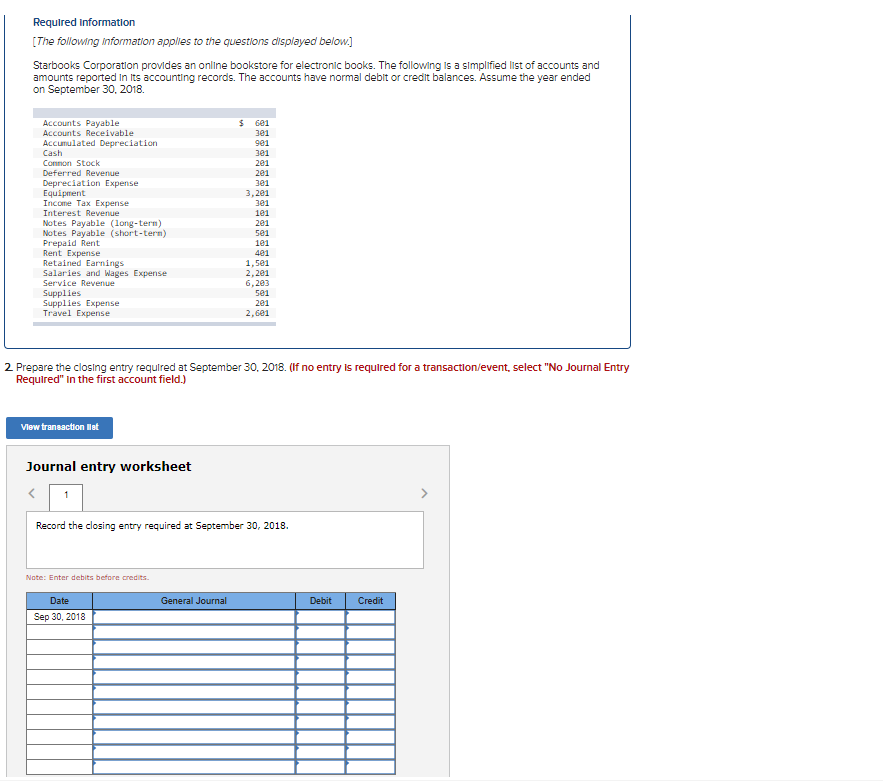

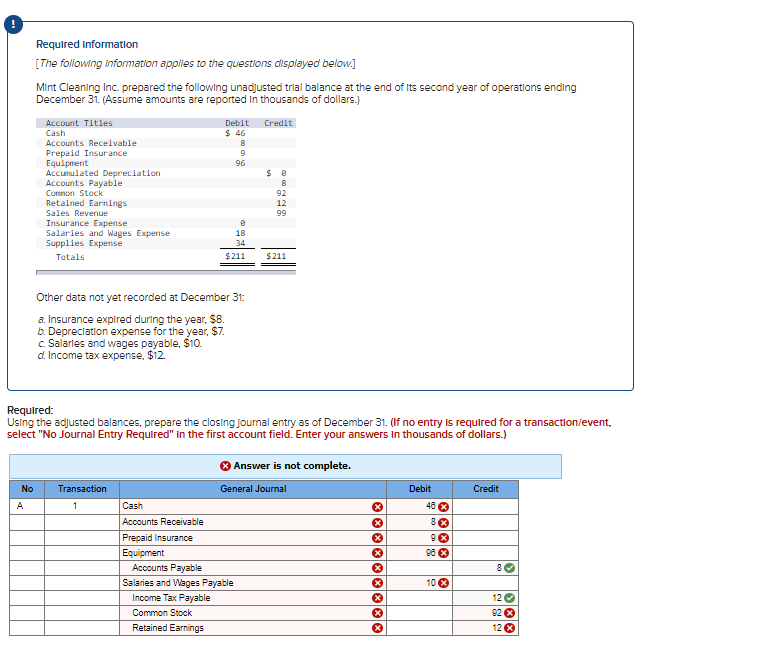

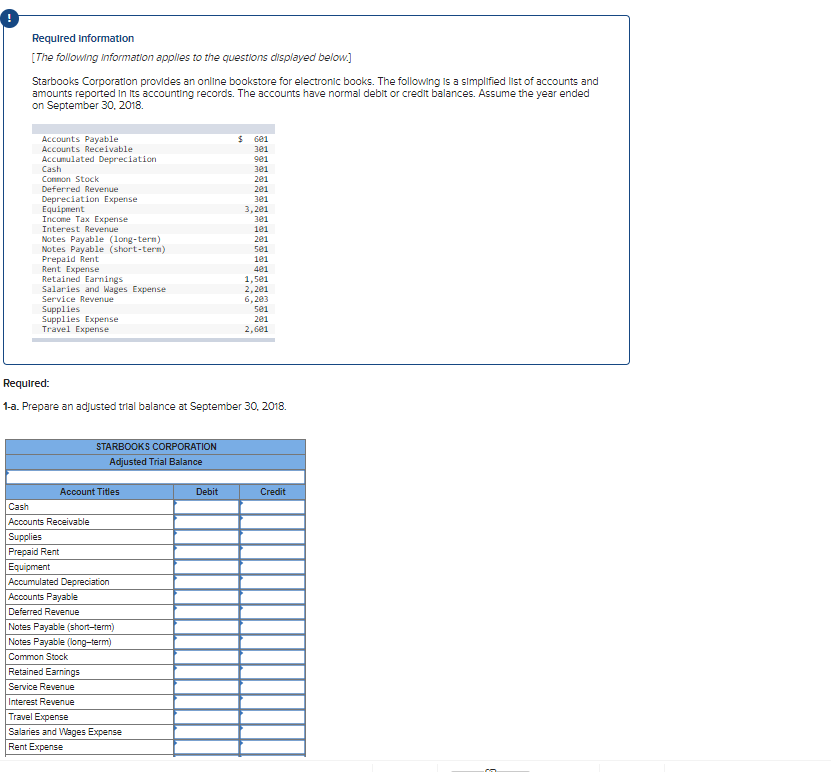

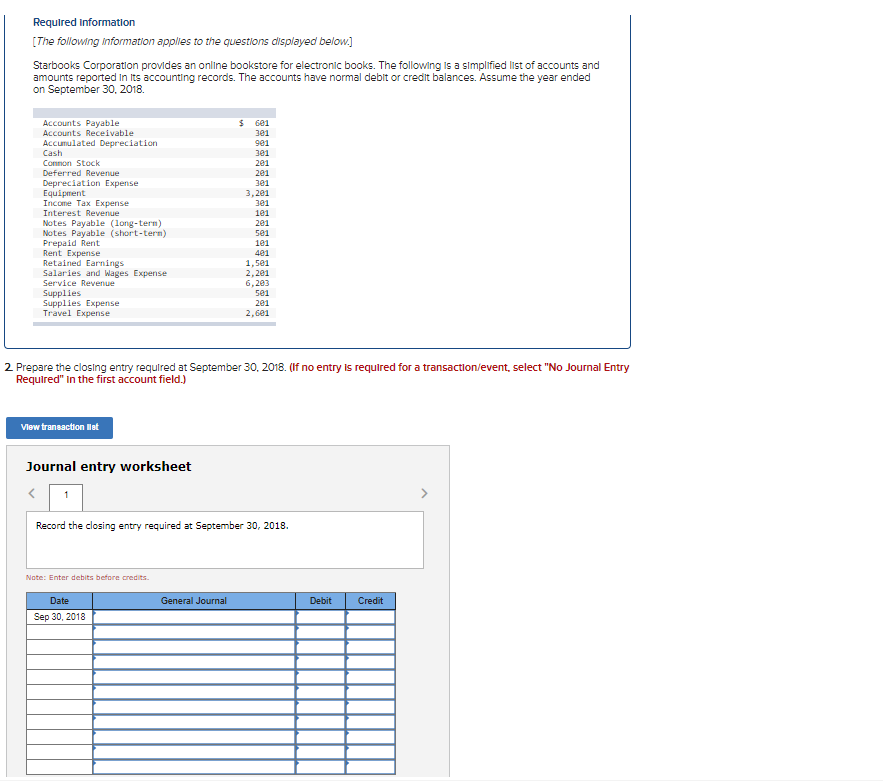

Required Information [The following information applies to the questions displayed below.] Mint Cleaning Inc. prepared the following unadjusted trial balance at the end of its second year of operations ending December 31. (Assume amounts are reported in thousands of dollars.) Account Titles Credit Cash Debit $ 46 B 96 $ Accounts Receivable Prepaid Insurance Equipment Accumulated Depreciation Accounts Payable Connon Stock Retained Earnings Sales Revenue Insurance Expense Salaries and Wages Expense Supplies Expense Totals 8 92 12 99 18 34 $211 $ 211 Other data not yet recorded at December 31 a. Insurance expired during the year. $8. b. Depreciation expense for the year, $7. c. Salaries and wages payable, $10. d Income tax expense. $12. Required: Using the adjusted balances, prepare the closing Joumal entry as of December 31. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in thousands of dollars.) No Transaction Credit A 1 Answer is not complete. General Journal Cash Accounts Receivable Prepaid Insurance Equipment Accounts Payable Salaries and Wages Payable Income Tax Payable Common Stock Retained Earnings Debit 46 8% 9 96 % 8 10% 12 92 12X Required information [The following information applies to the questions displayed below.] Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debitor credit balances. Assume the year ended on September 30, 2018. Accounts Payable Accounts Receivable Accumulated Depreciation Cash Connon Stock Deferred Revenue Depreciation Expense Equipment Income Tax Expense Interest Revenue Notes Payable (long-term) Notes Payable (short-term) Prepaid Rent Rent Expense Retained Earnings Salaries and Wages Expense Service Revenue Supplies Supplies Expense Travel Expense $ 601 3e1 901 3e1 2e1 2e1 3e1 3.201 3e1 1e1 2e1 sei 1e1 401 1,5e1 2,2e1 6,203 5e1 2e1 2,601 Required: 1-a. Prepare an adjusted trial balance at September 30, 2018. STARBOOKS CORPORATION Adjusted Trial Balance Debit Credit Account Titles Cash Accounts Receivable Supplies Prepaid Rent Equipment Accumulated Depreciation Accounts Payable Deferred Revenue Notes Payable (short-term) Notes Payable (long-term) Common Stock Retained Earnings Service Revenue Interest Revenue Travel Expense Salaries and Wages Expense Rent Expense Required information [The following information applies to the questions displayed below.] Starbooks Corporation provides an online bookstore for electronic books. The following is a simplified list of accounts and amounts reported in its accounting records. The accounts have normal debit or credit balances. Assume the year ended on September 30, 2018. Accounts Payable Accounts Receivable Accumulated Depreciation Cash Common Stock Deferred Revenue Depreciation Expense Equipment Income Tax Expense Interest Revenue Notes Payable (long-term) Notes Payable (short-tern) Prepaid Rent Rent Expense Retained Earnings Salaries and Wages Expense Service Revenue Supplies Supplies Expense Travel Expense $ 601 301 901 3e1 2e1 201 3e1 3, 2e1 3e1 1e1 2e1 se1 1e1 401 1,5e1 2,201 6,203 5e1 2e1 2,6e1 2 Prepare the closing entry required at September 30, 2018. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction Mat Journal entry worksheet 1 Record the closing entry required at September 30, 2018. Note: Enter debits before credits Date General Journal Debit Credit Sep 30, 2018