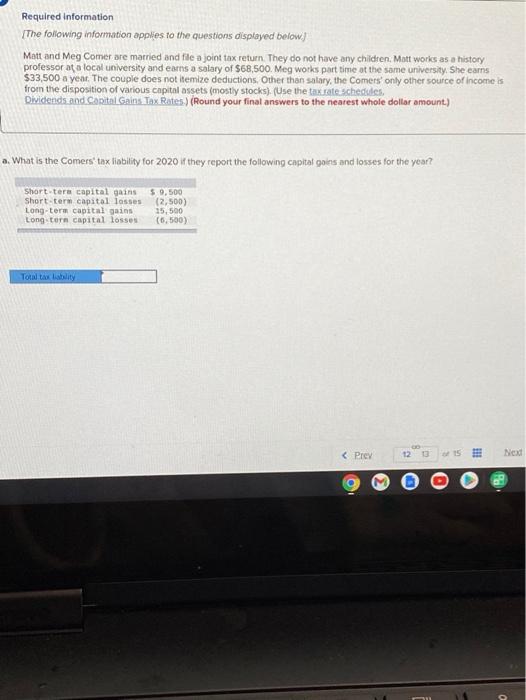

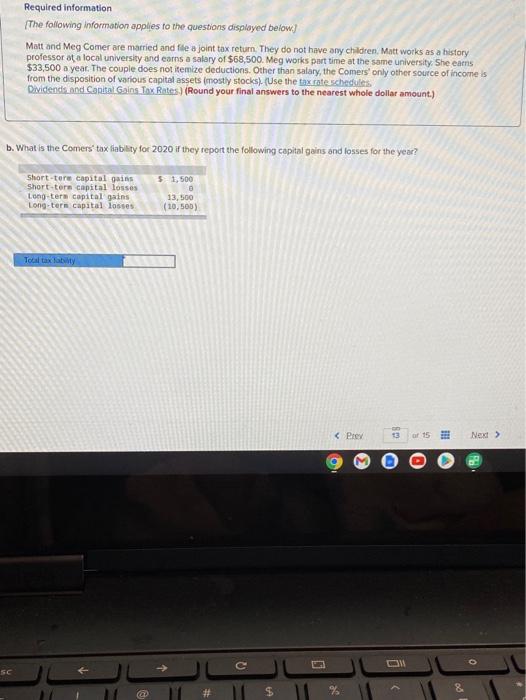

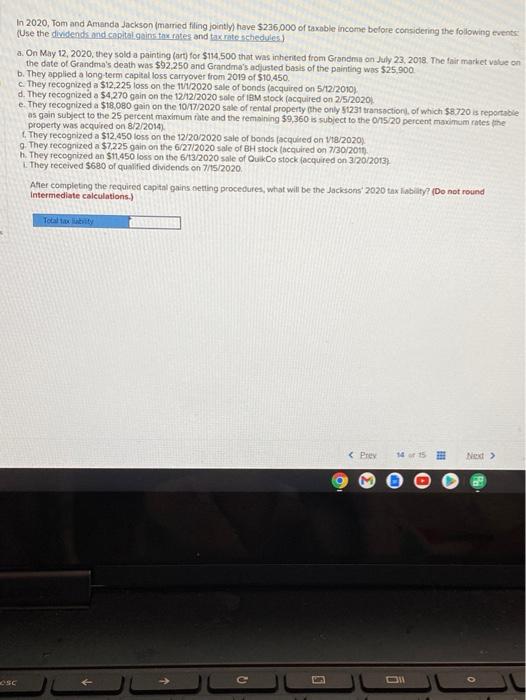

Required Information [The following information applies to the questions displayed below) Matt and Meg Comer are married and file a joint tax return. They do not have any children, Matt works as a history professor at a local university and earns a salary of $68,500. Meg works part time at the same university. She earns $33,500 a year. The couple does not itemize deductions. Other than salary, the Comers' only other source of income is from the disposition of various capital assets (mostly stocks) (Use the tax rate schedules Dividends and Capital Gains Tax Rates.) (Round your final answers to the nearest whole dollar amount) a. What is the Comers tax liability for 2020 if they report the following capital goles and losses for the year? Short tera capital gains Short-term capital losses Long-term capital gains Long term capital losses $ 9,500 (2,500) 15,500 (6.500) Total taxability M D i 50 11# $ 11 % In 2020, Tom and Amanda Jackson (mamed filing jointly have $236,000 of taxable income before considering the following events (Use the dividends and capital gains tax rates and tax rate schedules) a. On May 12, 2020, they sold a painting (art) for $114.500 that was inherited from Grandma on July 23, 2018. The fair market value on the date of Grandma's death was $92.250 and Grandma's adjusted basis of the painting was $25.900 b. They applied a long term capital loss carryover from 2019 of $10.450. c. They recognized a $12,225 loss on the 1/1/2020 sale of bonds (acquired on 5/12/2010), d. They recognized a $4270 gain on the 12/12/2020 sole of IBM stock (acquired on 2/5/2020) e. They recognized a $18.080 gain on the 10/17/2020 sale of rental property the only 51231 transaction of which $8.720 is reportable as goin subject to the 25 percent maximum rate and the remaining 59,360 is subject to the 0/15/20 percent maximum rates the property was acquired on 8/2/2014) t. They recognized a $12.450 loss on the 12/20/2020 sale of bonds acquired on 118/2020) They recognized a $7,225 gain on the 6/27/2020 sale of BH stock (acquired on 7/30/2011). h. They recognized an $11.450 loss on the 6/13/2020 sale of QulkCo stock facquired on 3/20/2013) L. They received $680 of qualified dividends on 7/15/2020 After completing the required capital gains cetting procedures, what will be the Jacksons 2020 tax liability? (Do not round Intermediate calculations.) Total tax bity Prey 145 Next > ON OSC Christopher sold 180 shares of Cisco stock for $12.780 in the current year. He purchased the shares several years ago for $5,400 Assuming his ordinary income tax rates 24 percent and he has no other capital gains or losses, how much tak wil he pay on this gain? (Use the dividends and capital gains tax rates and tax mit schedules Tas to be paid