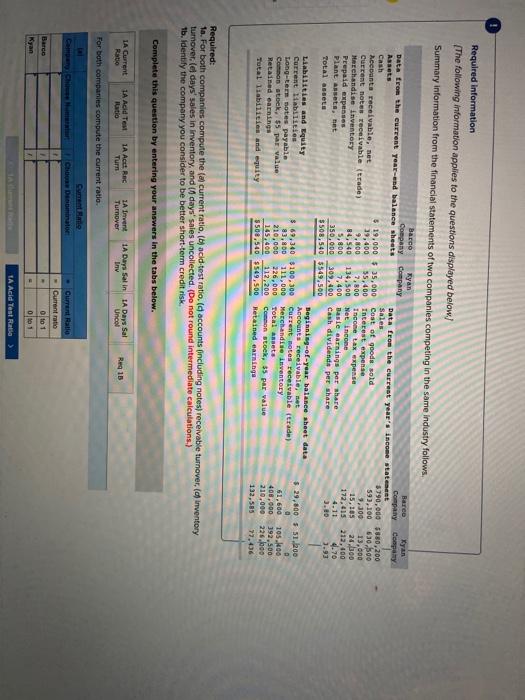

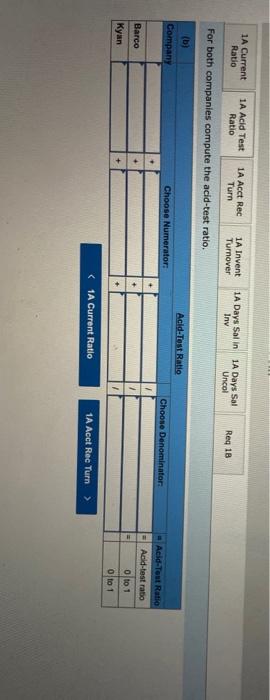

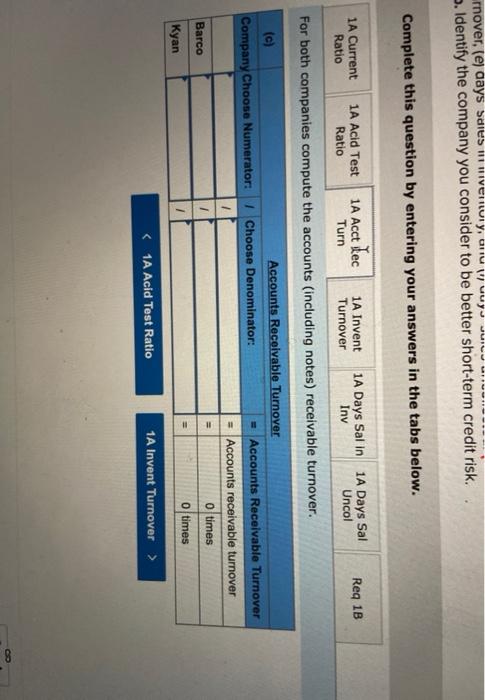

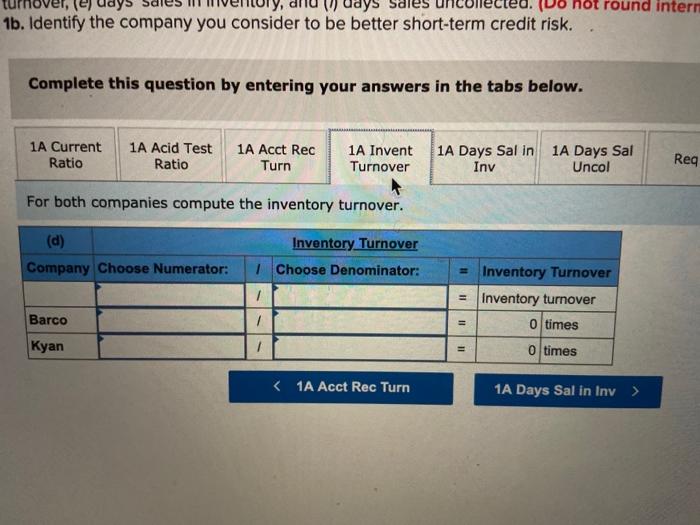

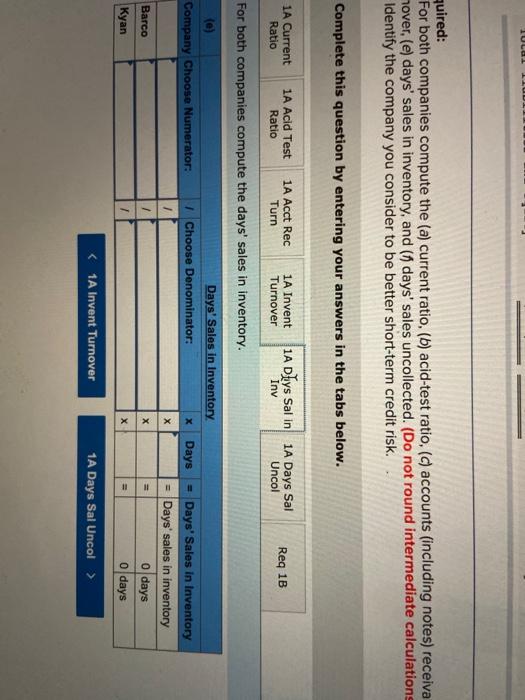

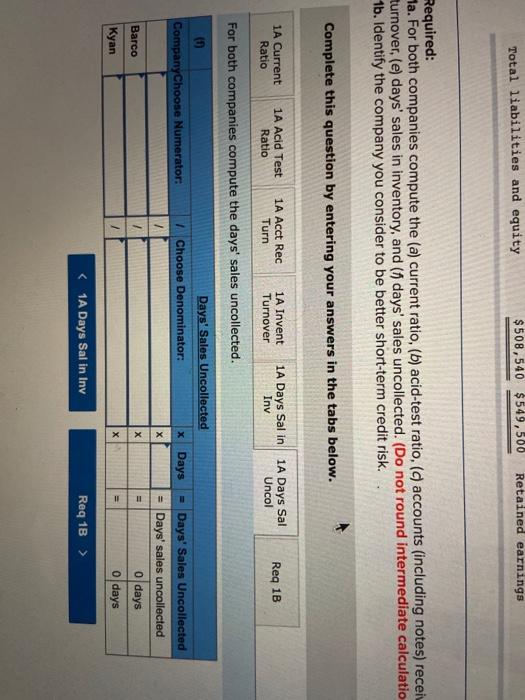

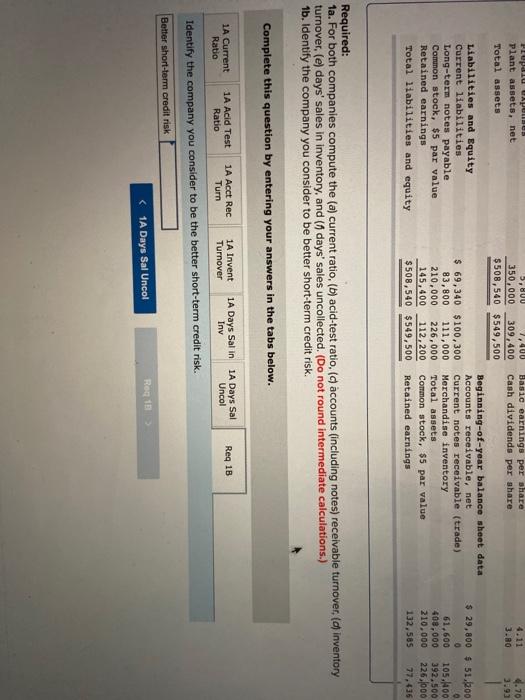

Required information The following information applies to the questions displayed below! Summary information from the financial statements of two companies competing in the same industry follows, Bacco Barco yan Company Company Data from the current year-end balance sheets Company Company Data from the current year's income statement Assets Cash Sales 5790,000 5880,200 $ 19,000 $ 35,000 Cost of goods sold Accounts receivable, net 593,100 630,00 39,400 55,400 Interest expense Current notes receivable (trade) 13,000 1,300 9.800 7,800 Income tax expense 15,185 Merchandise inventory 24,500 84,540 134.500 Net Income Prepaid expenses 172, 415 212,400 5,800 7.400 Daste earnings per share 4.70 Plant assets, het 350,000 309,400 Cash dividende per share Total assets $508,540 5549,500 Beginning-of-year balance sheet data Liabilities and Equity Accounts receivable, net $ 29,800 $ Sibe Current Stabilities $ 69,340 $100,300 Current notes receivable (trade) Long-term sotes payable 83,800 111,000 Merchandise inventory 61,600 105.00 Common stock, 55 par value 210,000 226,000 Total ants 408,000 192,500 Retained earnings 145.400 112,200 Common stock, 55 par value 210.000 225.000 Total liabilities and quity $508,540 $549.500 Retained earninga 132,585 77.436 3.93 Required: 1o. For both companies compute the current ratio, () acid-test ratio. ( accounts including notes) receivable turnover, (d) Inventory turnover. (d days' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk Complete this question by entering your answers in the tabs below. IA Current Ratio LA Acid Tom Ratio 1A Att Rec Turn IA Invent Turnover 1A Days Salin A Days Sal Inv Uncol Reg 16 For both companies compute the current ratio Cumente Che Dominato - Current Ratio - Current ratio Oto 1 001 Barce yan TA Acid Test Rate > 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Salin 1A Days Sal iny Uncol Reg 18 For both companies compute the acid-test ratio. (b) Company Acid-Test Ratio Choose Numerator: Choose Denominator Acid-Tout Ratio Acid-test ratio Oto 1 Barco 4 Kyan + 0 to 1 rnover, (e) days Sdies in divernuly, nu wuuy- JUICU Unud . Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current 1A Acid Test 1A Acct kec Ratio Ratio Turn 1A Invent Turnover 1A Days Sal in Inv 1A Days Sal Uncol Req 18 For both companies compute the accounts (including notes) receivable turnover. = Accounts Receivable Turnover Company Choose Numerator: 1 Choose Denominator: = Accounts Receivable Turnover Accounts receivable turnover Barco 0 times Kyan 0 times round intern days (Do 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol Req For both companies compute the inventory turnover. (d) Company Choose Numerator: Inventory Turnover 1 Choose Denominator: 1 1 = Inventory Turnover = Inventory turnover Barco 0 times Kyan 1 0 times TULUI quired: For both companies compute the (a) current ratio, (b) acid-test ratio, (c) accounts (including notes) receiva hover, (e) days' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Acct Rec 1A Current Ratio 1A Acid Test Ratio 1A Invent Turnover 1A Dys Salin 1A Days Sal Uncol Turn Inv Reg 1B For both companies compute the days' sales in inventory. Days' Sales In Inventory (e) Company Choose Numerator: Choose Denominator: Days 1 = Days' Sales In Inventory = Days' sales in inventory O days 0 days Barco / X Kyan Total liabilities and equity $ 508,540 $549,500 Retained earnings Required: a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( accounts (including notes) receiv turnover, (e) days' sales in inventory, and (1) days' sales uncollected. (Do not round intermediate calculatio 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in Inv 1A Days Sal Uncol Reg 1B For both companies compute the days' sales uncollected. (9 Company Choose Numerator: Days! Sales Uncollected Choose Denominator: x Days = Days' Sales Uncollected = Days' sales uncollected 0 days 0 days Barco 11 Kyan il PIUJIU . Plant assets, net Total assets 5,800 1,400 350.000 309,400 $508,540 $549,500 Basic earnings per share Canh dividends per share 3.RO 4.70 3.93 $ 29,800 $ 51,200 Liabilities and Equity Current liabilities Long-term notes payable Common stock, $5 par value Retained earnings Total liabilities and equity $ 69,340 $100,300 83,800 111,000 210,000 226,000 145,400 112,200 $ 508,540 $549,500 Beginning-of-year balance sheet data Accounts receivable, net Current notes receivable (trade) Merchandise inventory Total assets Common stock, $5 par value Retained earnings 61,600 408,000 210,000 132,585 105.1400 392,500 226,000 77,415 Required: 1a. For both companies compute the (a) current ratio, (b) acid-test ratio, ( accounts (including notes) receivable turnover (ch inventory turnover, (e) days' sales in inventory, and (days' sales uncollected. (Do not round intermediate calculations.) 1b. Identify the company you consider to be better short-term credit risk. Complete this question by entering your answers in the tabs below. 1A Current Ratio 1A Acid Test Ratio 1A Acct Rec Turn 1A Invent Turnover 1A Days Sal in 1A Days Sal Inv Uncol Reg 1B Identify the company you consider to be the better short-term credit risk. Better short-term credit risk