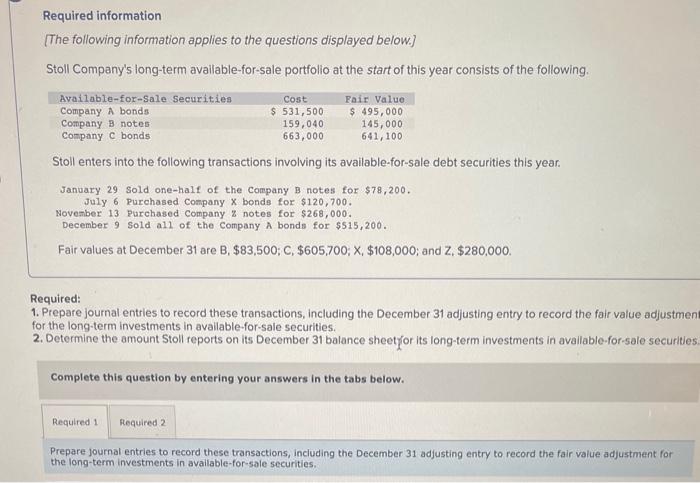

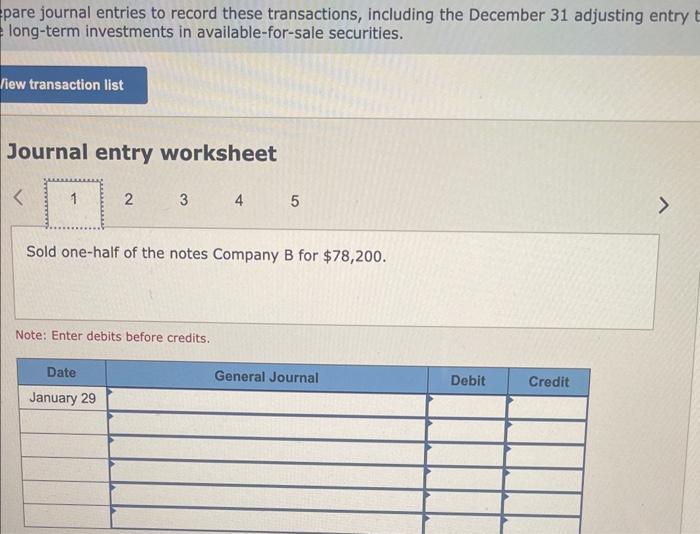

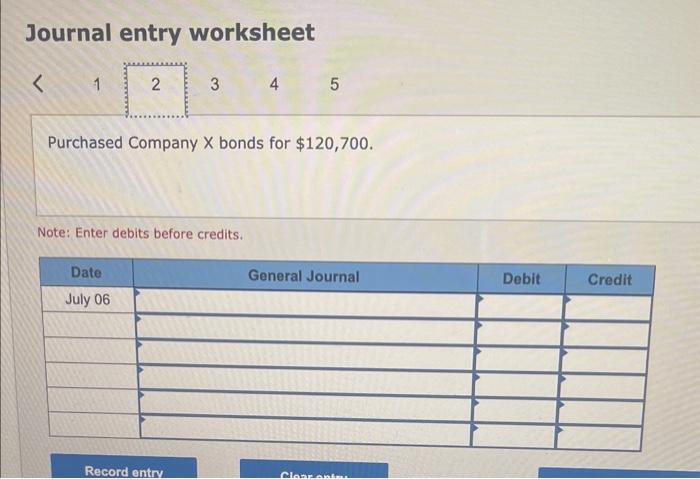

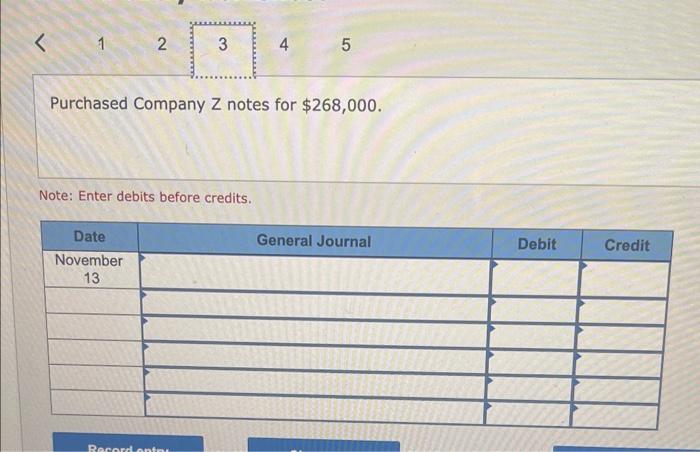

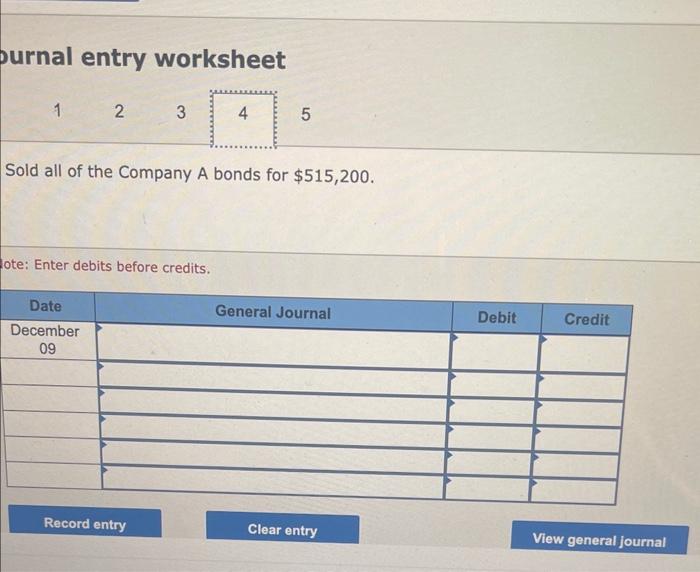

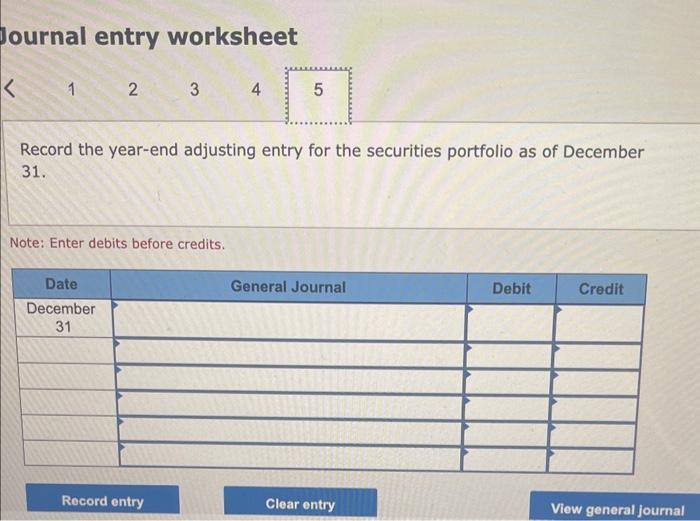

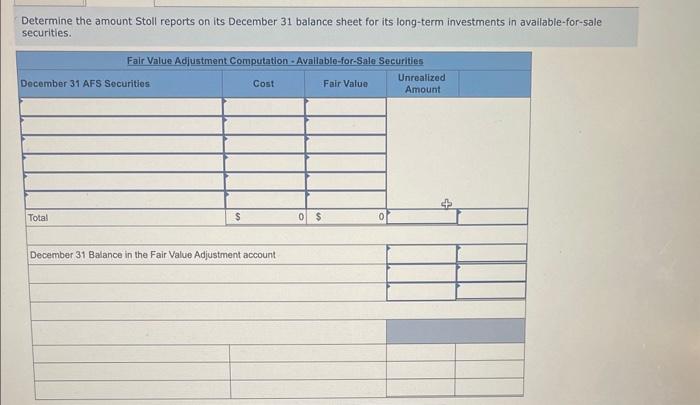

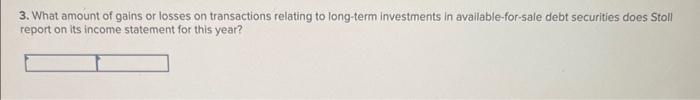

Required information [The following information applies to the questions displayed below.] Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 sold one-half of the Company B notes for $78,200. July 6 Purchased Company X bonds for $120,700. November 13 Purchased Company z notes for $268,000. December 9 sold all of the Company bonds for $15,200. Fair values at December 31 are B, $83,500;C,$605,700;X,$108,000; and Z, $280,000. Required: 1. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustmer for the long-term investments in available-for-sale securities. 2. Determine the amount Stoll reports on its December 31 balance sheetror its long-term investments in avallable-for-sale securities Complete this question by entering your answers in the tabs below. Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in avallable-for-sale securities. pare journal entries to record these transactions, including the December 31 adjusting entry long-term investments in available-for-sale securities. Journal entry worksheet 5 Sold one-half of the notes Company B for $78,200. Note: Enter debits before credits. Journal entry worksheet 5 Purchased Company X bonds for $120,700. Note: Enter debits before credits. Purchased Company Z notes for $268,000. Note: Enter debits before credits. burnal entry worksheet 1 Sold all of the Company A bonds for $515,200. lote: Enter debits before credits. lournal entry worksheet Record the year-end adjusting entry for the securities portfolio as of December 31. Note: Enter debits before credits. Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in avallable-for-5ale securities. 3. What amount of gains or losses on transactions relating to long-term investments in available-for-sale debt securities does Stoll report on its income statement for this year