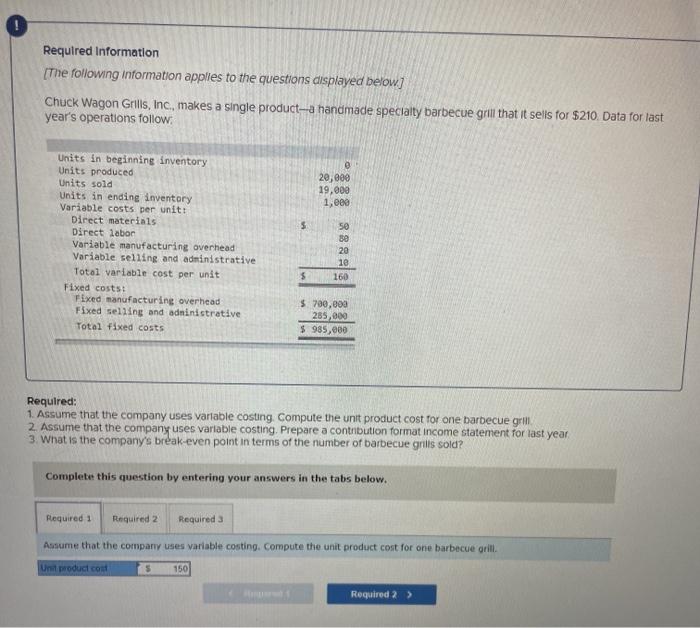

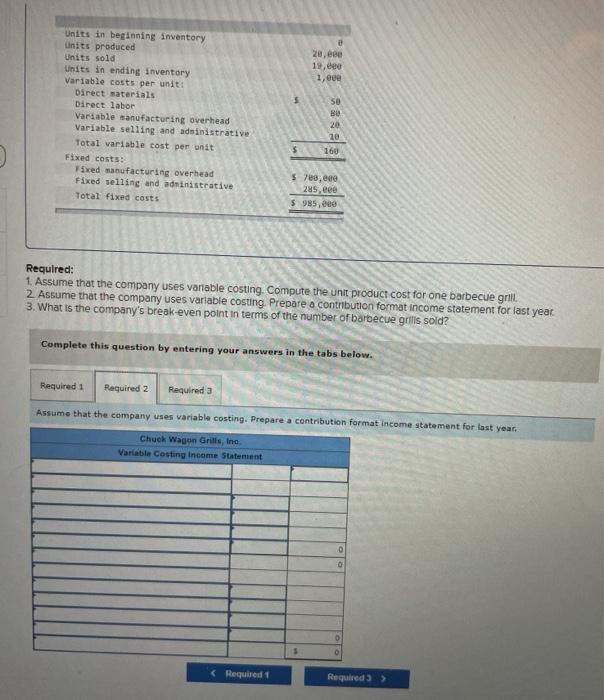

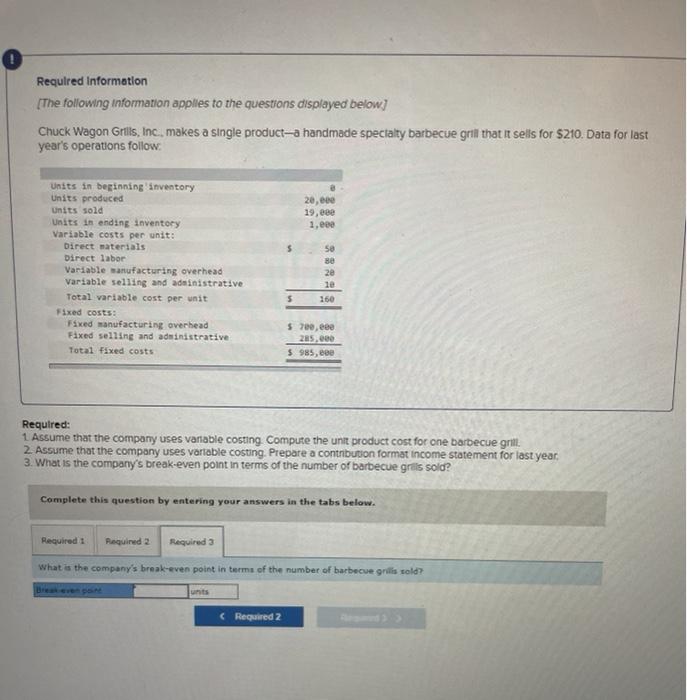

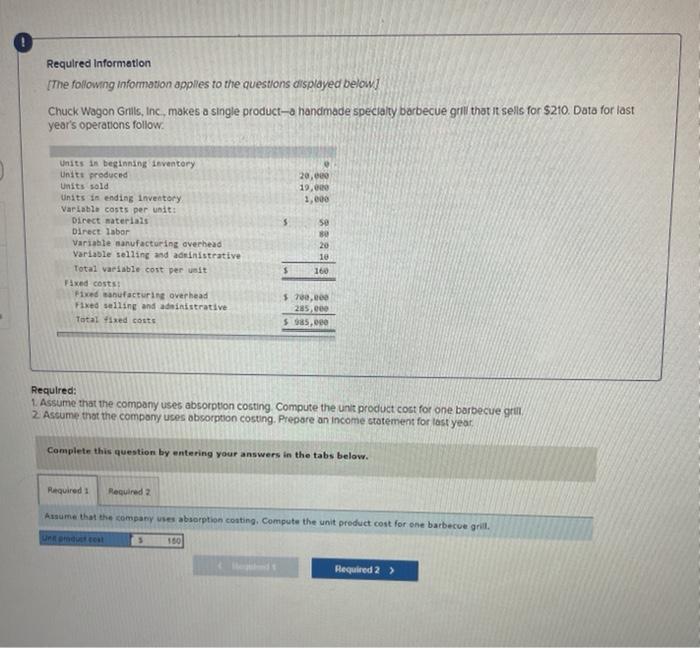

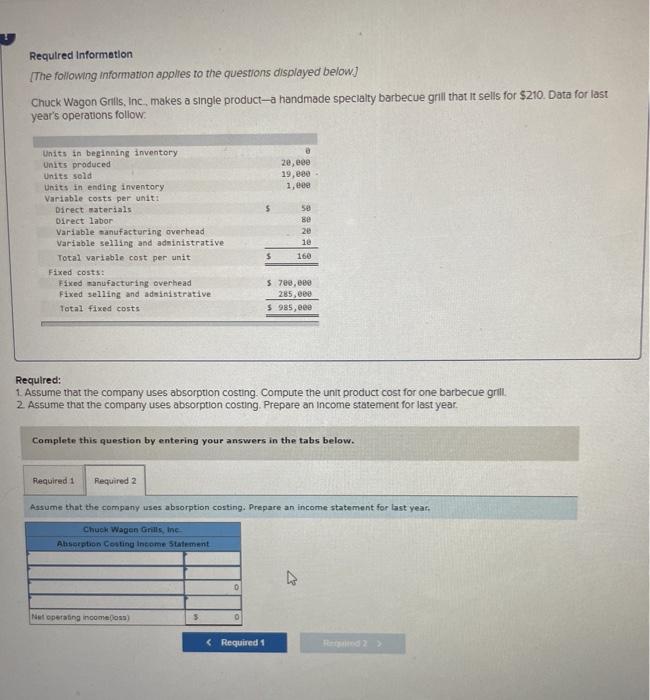

Required Information [The following information applies to the questions displayed below] Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow 20,000 19,000 1.ee 5 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs 888 20 10 160 $ $ 700,000 285,000 $ 985,000 Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill 2. Assume that the company uses variable costing Prepare a contribution format income statement for last year 3. What is the company's break-even point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. Unit product cout 5 150 Required 2 > 20.ece 19.de 1,eee se Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable sanufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs: Yixed manufacturing overhead Fixed selling and administrative Total fixed costs 20 10 160 $788, en 285.ee 5985,000 Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year 3. What is the company's break-even point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Assume that the company uses variable costing. Prepare a contribution format income statement for last year Chuck Wagon Grills, Ine Variable Costing Income Statement 0 0 5 Required Information [The following information applies to the questions displayed below) Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow 20,00 19, ese 1.000 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total Fixed costs 50 Be 2e le 160 5 $700, eee 285.000 $985, eee Required: 1 Assume that the company uses variable costing Compute the unit product cost for one barbecue grin. 2. Assume that the company uses vartable costing. Prepare a contribution format income statement for last year, 3. What is the company's break-even point in terms of the number of barbecue grils sold? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 what is the company's break-even point in terms of the number of barbecue grills told? units (Required 2 Required Information [The following Information applies to the questions displayed below! Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow 20.000 19.00 1,000 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per uniti Direct materiais Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs Fixed manufacturing overhead Fixed selling and administrative Total Fixed costs so 80 20 10 160 $70,000 285,000 $385,000 Required: 1. Assume that the company uses absorption costing Compute the unit product cost for one barbecue grill 2. Assume that the company uses absorption costing. Prepare an income statement for last year, Complete this question by entering your answers in the tabs below. Required: Required 2 Assume that the company uses absorption conting, Compute the unit product cost for one barbecue grill. 180 Required 2 > Required Information [The following information applies to the questions displayed below] Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that It sells for $210. Data for last year's operations follow 20, 19,800 1,00 Units in beginning inventory Units produced Units sold Units in ending inventory Variable costs per unit: Direct materials Direct labor Variable sanufacturing overhead Variable selling and administrative Total variable cost per unit Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs 50 BO 20 le $ 160 $ 700,000 285.000 $985,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill 2. Assume that the company uses absorption costing Prepare an income statement for last year. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company uses absorption costing. Prepare an income statement for last year. Chuck Wagen Grills, Inc Ansorption Costing Income Statement 0 Net operating income (0) 5